Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

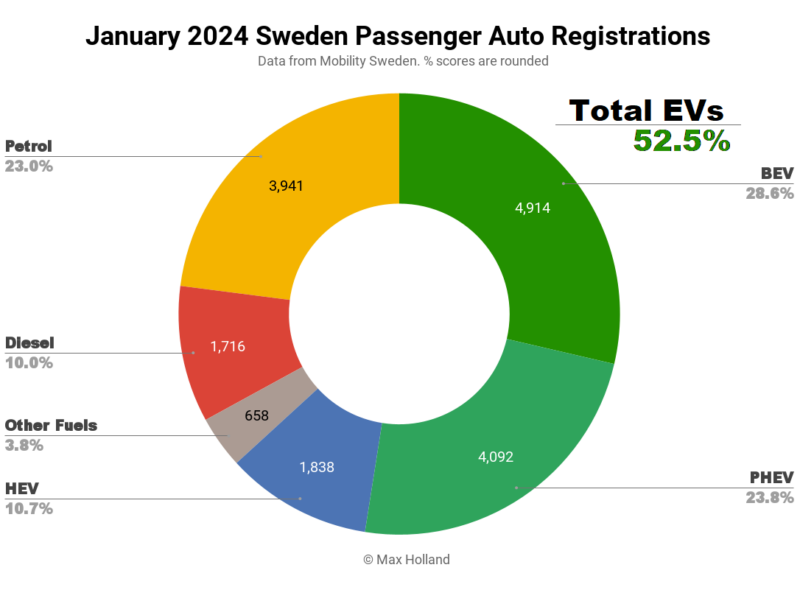

January’s market saw plugin EVs take 52.5% share in Sweden, flat YoY from 52.4%. Plugin volumes were up YoY for both full electrics and plugin hybrids. January’s overall auto volume was 17,159 units, up some 18% YoY. The Tesla Model Y was the month’s bestseller.

January saw combined EVs take 52.5% share in Sweden, with full battery electrics (BEVs) at 28.6%, and plugin hybrids (PHEVs) at 23.8%. These figures compare with 52.4% combined, with 28.9% BEV, and 23.5% PHEV, year on year.

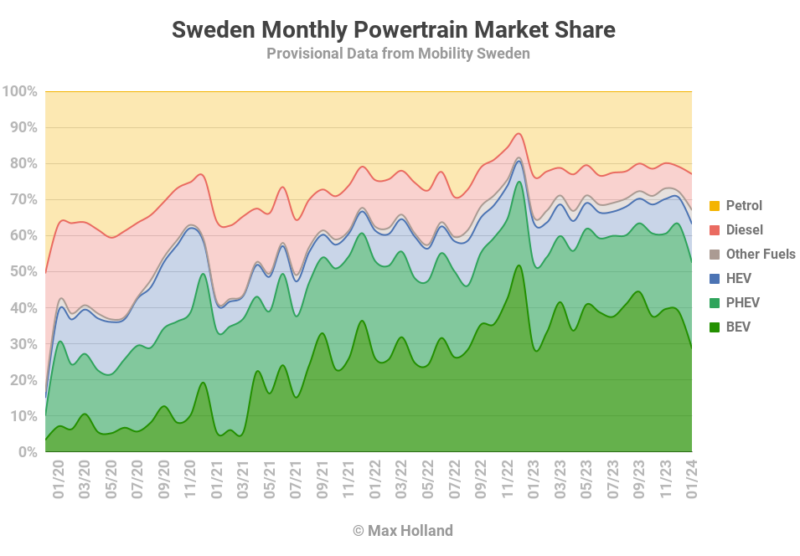

That plugin share barely increased from a year ago is disappointing, but may be a consequence of shipping allocations rather than demand-side cooling. Having said that, the demand side is in a squeeze as the Swedish economy has contracted over the past 12 months. Added to that, most plugins on sale in Europe are still significantly more expensive up front compared to ICE alternatives, unlike in China, where sticker prices are close to parity.

The long term cost of ownership in Sweden still strongly favours plugins, but when belts are forced to be tightened in the present, short term cost shaving may gain more prominence. Let’s see whether this is a demand-side symptom, or simply mainly a supply allocation dip, by keeping an eye on it in the coming few months.

Diesel-only powertrains continue to lose share, down to 10.0% in January 2024, from 11.3% YoY.

BEV Best Sellers

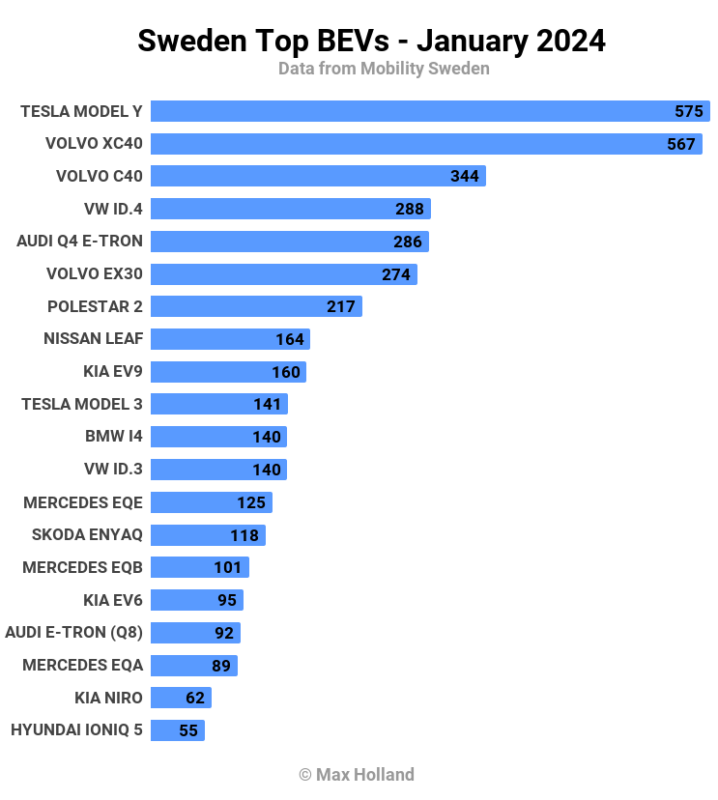

Sweden’s 2023 overall leader, The Tesla Model Y, won a close competition with the Volvo XC40 to take the top spot again in January, with 575 units delivered. The Volvo C40 took third spot, a strong climb from 7th in December.

The big news in the January model rankings was the rapid ascent of the new Volvo EX30 compact SUV, which took 6th spot, having only debuted in December! For a quick refresher on the price and specs of the EX30, take a look at my report from last month. We can expect it to keep climbing from here.

A potential EX30 competitor, in the form of the Kia EV3, may arrive later this year, though no dates have been confirmed. Don’t forget that the Kia Niro was typically in the top three spots for several years, from 2019 until around Q3 2022, and has typically remained within the top 10 since then. When launched, the Kia EV3 will effectively take over market position from the Niro, and we can expect it to be very popular in Sweden.

Talking of Kia, the EV9, which debuted at volume in November, is still doing well, with 160 units and 9th spot in January.

No other vehicle in the top 20 saw increased volume compared to recent monthly averages. The BYD Seal, another December debutant, hasn’t yet seen a jump to big volumes, delivering a modest 7 units in January.

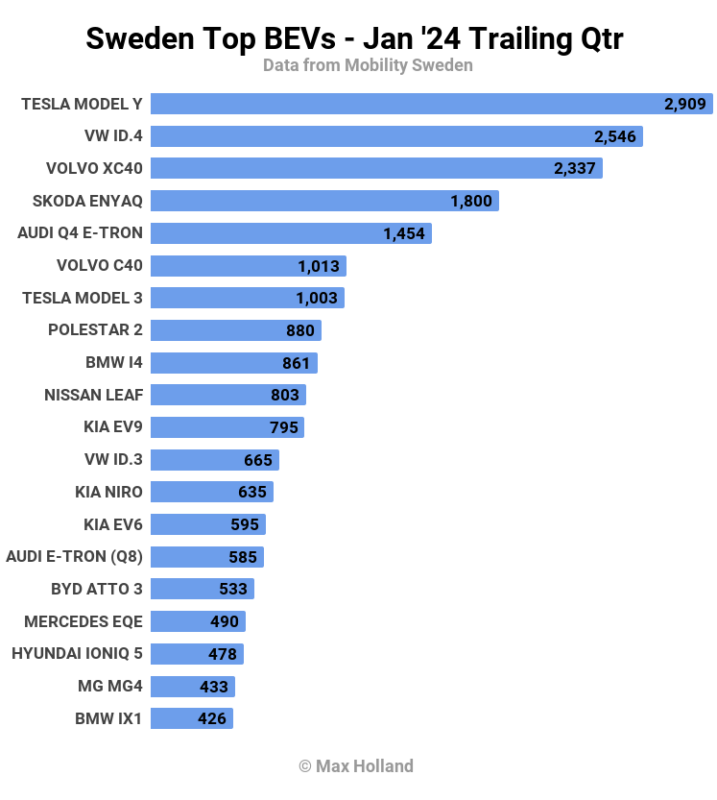

Looking at the trailing quarter rankings, the top 5 slots are exactly the same as they were in the prior period (August to October). The Volvo C40 came in 6th, and the Tesla Model 3 in 7th, both returning to the top 10 from a prior period of lower volumes. Most other moves were small.

Having had three good initial months, the Kia EV9 earned a well deserved 11th spot in the trailing-Q chart. I expect it to stay in this neighbourhood for a while.

On climbing debutants, the Volvo EX30 is just outside the top 20 (in 21st) from just two months of sales. If it remains on trend, it should jump to near the 10th spot next month and higher from there.

Somewhat affordable models (around €25,000 or less) that should be debuting in Sweden this year, include the Citroën e-C3 (“sometime in the spring”), the Fiat Panda, and the Renault 5 (both “timing unknown”).

Although the Swedish market has a preference for SUVs (see the top 5 ranks above), smaller cars like the Ora Funky Cat (22nd rank), and the Mini Cooper (26th) have seen respectable sales in the country. This suggests that size is not a fundamental obstacle to potential success, if the specs and value proposition are attractive (as they appear to be with these incoming affordable debutants). Let’s see what happens.

Outlook

Sweden’s GDP annual growth rate trajectory improved to 0% in Q4 2023, from -1.4% in Q3. Interest rates remained flat at 4%, while inflation lowered to 4.4%. Manufacturing PMI worsened to 47.1 points in January, from 48.6 in December.

In such a weak consumer economy Mobility Sweden remains concerned about the growing dependence of auto sales (and especially BEVs) on company buyers, rather than private consumers: “The share of electric cars amounted to nearly 29 percent, which is a slowdown compared to the 2023 full-year outcome of 39 percent. It is still the companies that keep the passenger car market and electrification going. Business customers account for seven out of ten new registrations and eight out of ten electric cars during the month.” (Sofia Linder, chief economist at Mobility Sweden, machine translation).

We will have to see how this year plays out — will the climbing trend continue, or slow to a snail’s pace? Please share your thoughts on Sweden’s EV transition in the comments section below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.