Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

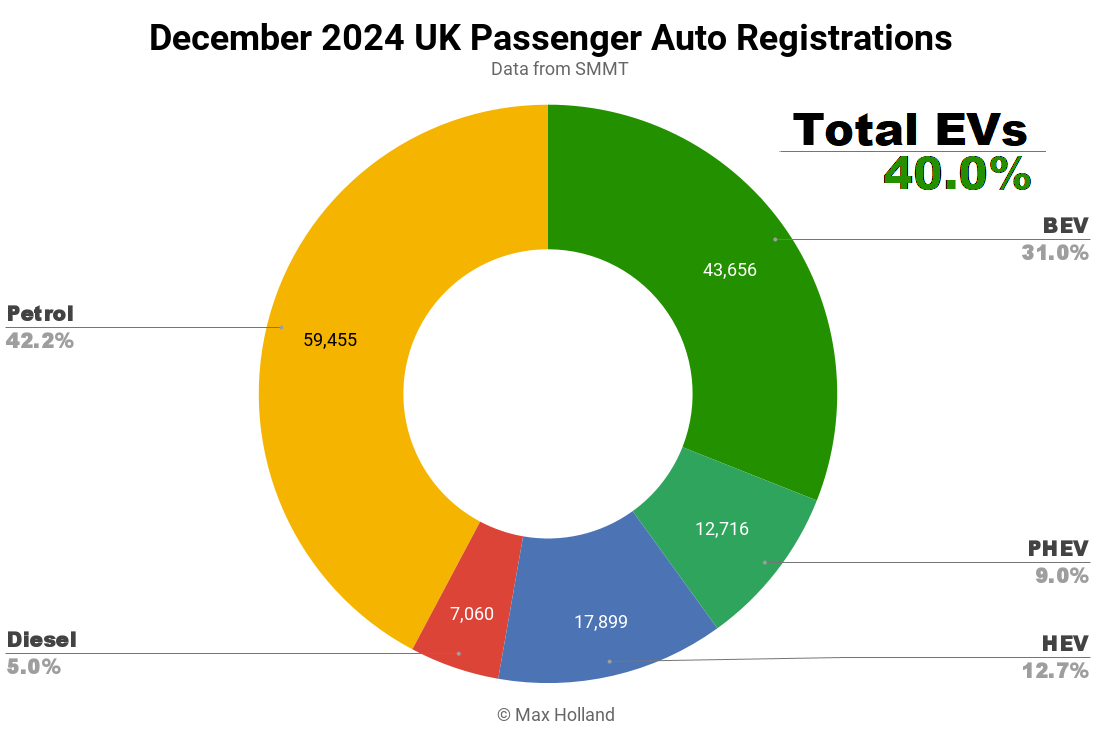

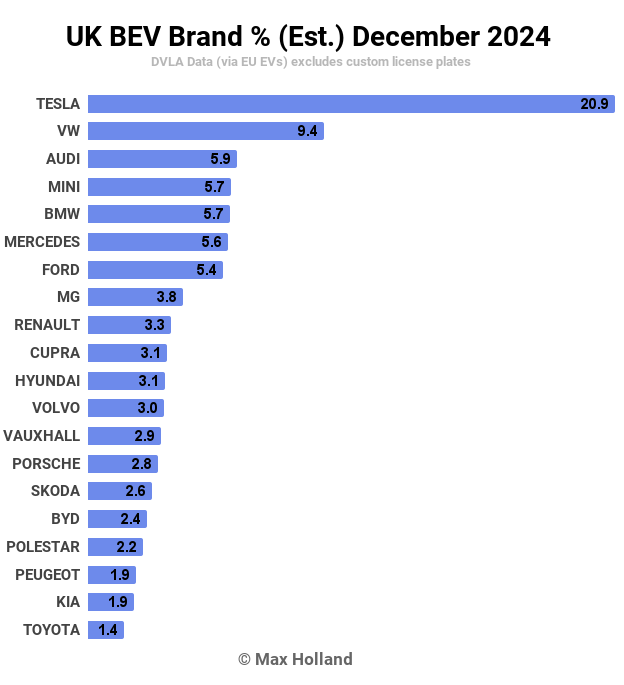

December’s auto market saw plugin EVs take 40.0% share in the UK, up from 28.7% year on year. BEVs grew strongly to meet the 2024 ZEV mandate before the year closed out. Overall auto volume was 140,786 units, flat YoY and well below pre-2020 norms. The UK’s leading BEV brand in December was Tesla, with 20.9% share of the BEV market.

December’s sales totals saw combined plugin EVs take 40.0% share in the UK, with full electrics (BEVs) taking a near record 31.0%, and plugin hybrids (PHEVs) taking 9.0%. These compare with YoY shares of 28.4% combined, 19.7% BEV, and 8.6% PHEV.

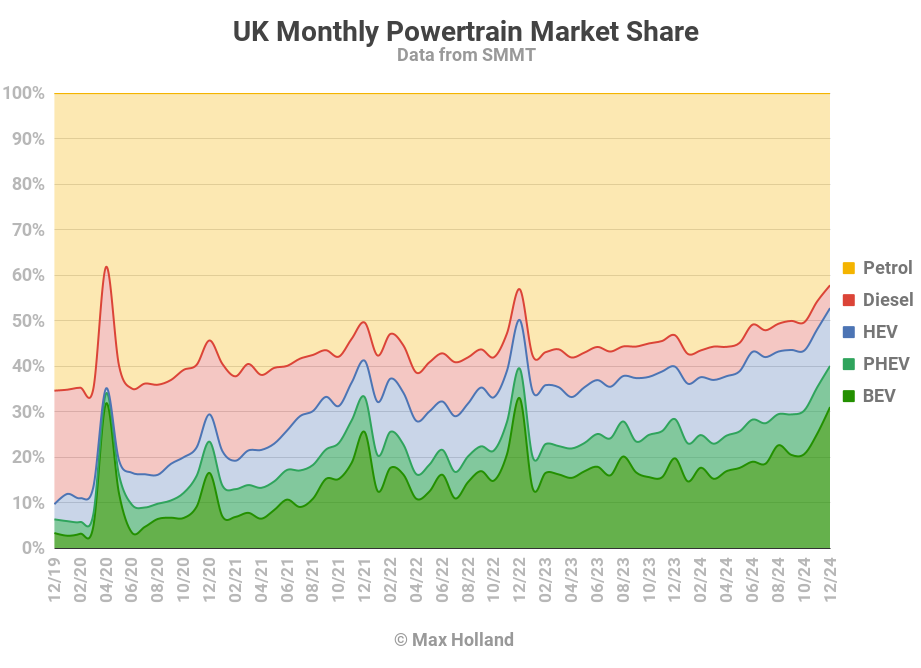

The year on year comparison superficially looks highly favourable, though there are some caveats. The 2024 Zero Emissions Vehicles (ZEV) mandate — more on this below — started in January, so that December 2023 saw a hold-back of BEV deliveries until early 2024 to get a head-start on the mandate. Conversely, December 2024 was the final chance to meet the mandate, and to avoid fines and penalties, and thus saw an extra push of BEV volumes. So, the YoY comparison of the two Decembers is not exactly apples-to-apples.

2024 Full Year Analysis

Overall, 2024 saw the UK’s full year BEV share at 19.6% and 381,970 units (with PHEVs at 8.6% and 167,178 units). 2023 had seen full year figures of 16.5% BEV (314,684 units) and 7.5% PHEV (141,311).

The UK introduced the ZEV mandate for the first time in 2024, requiring automakers to sell a headline target of “22% ZEVs” over the full year. The 22% goes in quotes because it is somewhat mythical — there’s quite a lot of fudging allowed, to help the medicine go down, especially in this first year of the scheme. One of the fudges comes from giving extra points for improved emissions from non-BEV vehicles sold (PHEVs, HEVs, and even ICE-only), and another major fudge is ZEV credit trading between manufacturers to make up for shortfalls.

The 2024 full year 19.6% BEV share, with the fudges mentioned, effectively means that the overall auto industry passed the “22%” ZEV mandate’s 2024 target. Because of this, there were plenty of ZEV credits able to be bought and sold between manufacturers, and it seems that none had to pay the government fines of up to £15,000 per vehicle.

Instead, the excess of credits means that the relative laggards like Toyota, Mazda, Ford, and Renault could simply purchase ZEV credits from the likes of Tesla and Polestar to make up their own shortfalls.

New Automotive estimates that as of the end of December, the summed ZEV credit surplus is about twice the combined shortfall that the laggards need to make up. This suggests that the credit’s “market price” is likely only at most a few thousand pounds per unit. Still, that’s a decent motivation for these manufacturers to improve their future performance.

In 2025 and ahead, the ZEV scheme tightens further. The “side bonus” for PHEVs and HEVs is less significant, and the headline target of “28% ZEV” is obviously a good step higher.

Given that batteries and other related BEV-powertrain component costs are getting cheaper all the time, we should expect that many of the slower-to-transition automakers may again back-load their BEV deliveries towards the end of 2025.

January 2025’s market will certainly see BEVs in a (temporary) hangover from the big December push.

Best Selling BEV Brands

With their usual end-of-year push, Tesla was the UK’s best selling BEV brand in December, grabbing an estimated 20.9% share of the country’s overall BEV market. The Tesla Model Y was in fact the best selling vehicle of any kind in December, and the Model 3 was the second best!

In a repeat of recent months, the Volkswagen brand took second place behind Tesla. Audi also made a push in December, with the Audi Q4 e-tron being the UK’s 9th best selling vehicle of any kind (and the 3rd best BEV model), helping Audi take 3rd spot in the BEV brands ranking (from 5th in November).

Volkswagen needed to make this push because it was still lagging on the ZEV mandate entering the last few months of the year. Mercedes, on the other hand, was already comfortably ahead of the ZEV target, so could take its foot off the pedal a bit, and slid down from 3rd to 6th in December.

The same appears to have been the case for Stellantis’ two big brands in the UK, Peugeot and Vauxhall/Opel, with Peugeot shedding 70% of its sales volume compared to November. If the 2024 target was already in the bag, the logic goes, better for Stellantis to hold back additional deliveries till January, to help meet the 2025 target.

Of course, if Stellantis was really far out in front, it wouldn’t be having to strategize about how to meet the 2025 target.

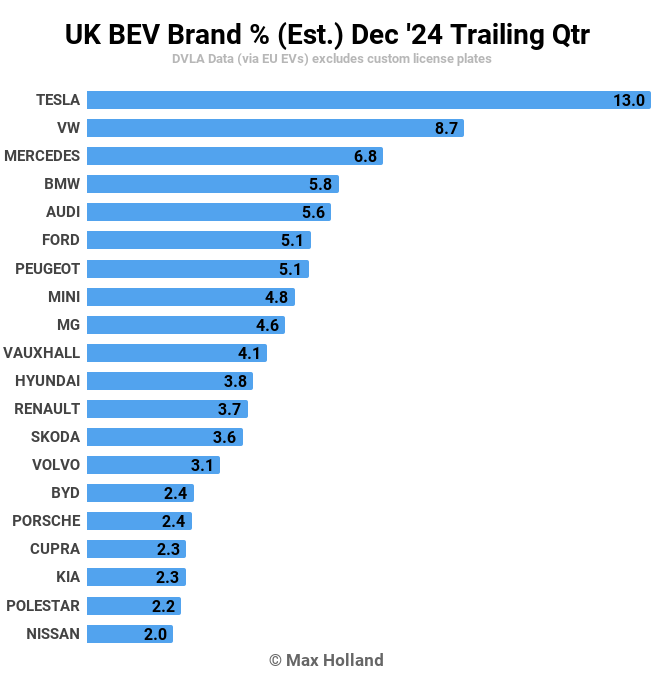

Let’s look at the trailing 3 months market shares:

Here the brand shares have a more normal distribution, though with Tesla still notably overweight and a good margin ahead of the Volkswagen brand in second and Mercedes in third.

The top 4 brands are unchanged from Q3. Although, the Volkswagen brand has grown its share a bit and BMW has lost a fraction.

The biggest changes come from Ford (in 6th), which almost doubled its share from Q3; Mini (in 8th), which tripled its share; and Porsche (in 16th), which quadrupled its share! It’s worth mentioning that Porsche’s Q3 share of 0.7% was uncharacteristically low, it’s more usually around 2%, and the Q4 quadrupling was obviously helped by the new Porsche Macan BEV.

Ford had to make a big push in Q4 because — as a large volume auto brand in the UK — it had to sell plenty of BEVs to meet the mandate, and it was a long way behind entering the final months of the year, as I mentioned in last month’s report. Even after a decent December push, with the new Explorer and Capri models contributing, Ford likely still needed to buy a large number of credits from other manufacturers, according to New Automotive’s calculations.

Minor slides in share came for Kia and Nissan. Though, Kia (as part of Hyundai Motor Group) was never in danger of missing the 2024 ZEV mandate. Nissan was further adrift, and likely had to buy credits from others — not great given the company’s overall difficulties globally.

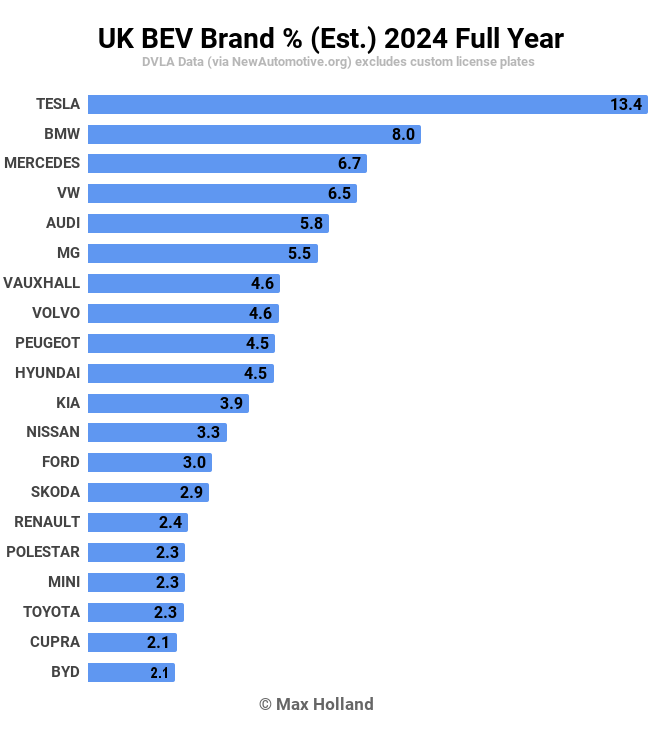

Now that we’re into 2025, let’s have a look back at full year 2024:

This is the big picture for popular BEV brands in the UK, and there are no great surprises, with Tesla still out in front and BMW in second place.

The rankings will have to change in 2025, as the big brands have to start improving their BEV game to keep pace (percentage-wise) with their overall UK auto market share. Volkswagen, Ford, and Toyota are in the top 5 overall brands in the UK, but the latter two are hardly noticeable in the BEV market.

So Ford and Toyota in particular have a lot of ground to make up over the next couple of years to keep pace with the tightening ZEV mandate. Let’s see if they can make it, or risk going the way of the Dodo in the UK market.

Outlook

Obviously the UK’s ZEV mandate now sets a minimum bar on the rate of the EV transition going forwards. 2025’s target tightens further, with a headline of “28% ZEVs” and less room for fudging.

In the broader economy, the Q3 figures have been revised slightly down to 0.9% GDP growth YoY (from the earlier estimate of 1.0%). Inflation crept back up to 2.6% in November (latest) from 2.3% in October. Interest rates are at 4.75%. Manufacturing PMI fell to 47 points in December, from 48 points in November.

The 2024 ZEV scheme put the UK’s EV transition on a different rhythm compared to continental neighbours, where vehicle emissions targets remained fairly lax in 2024 before tightening significantly in the year 2025. Thus, December 2024 on the continent saw an expected hold-back of BEV deliveries, with France at 16.1% BEV share and Germany at just 14.9% (reports coming soon), less than half the share of the UK.

Nevertheless these apparent large differences are just the (policy-led) specific timings, and the bigger picture is that 2025 should see all these neighbouring countries with BEV share in the range of roughly 23%–28% share (or more in some cases).

What are your thoughts on the UK’s evolving auto market? Will 2025 see the traditional big legacy brands like Volkswagen, Ford, and Toyota manage to keep pace in the UK? Or will they be on a slippery slope of having to buy substantial credits from the EV specialist brands like Tesla, Polestar, and MG? Please share your perspective in the comments below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy