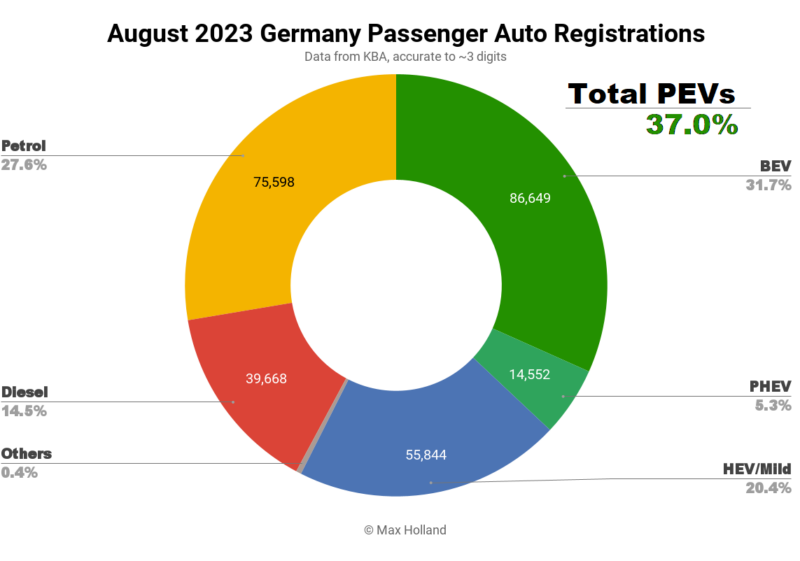

August saw plugin EVs take 37% share of Germany’s auto market, up from 28.5% year on year. Full electrics had significant pull-forward sales, ahead of the tightening in incentives from September 1st. Overall auto volume was 273,417 units, up some 37% YoY mainly thanks to the pull-forward. The best selling full electric was again the ID.4/5.

With combined EVs taking 37% share in August, full electrics (BEVs) contributed 31.7%, with plugin hybrids (PHEVs) at 5.3%. These compare with YoY figures of 28.5%, with 16.1% BEV and 12.4% PHEV.

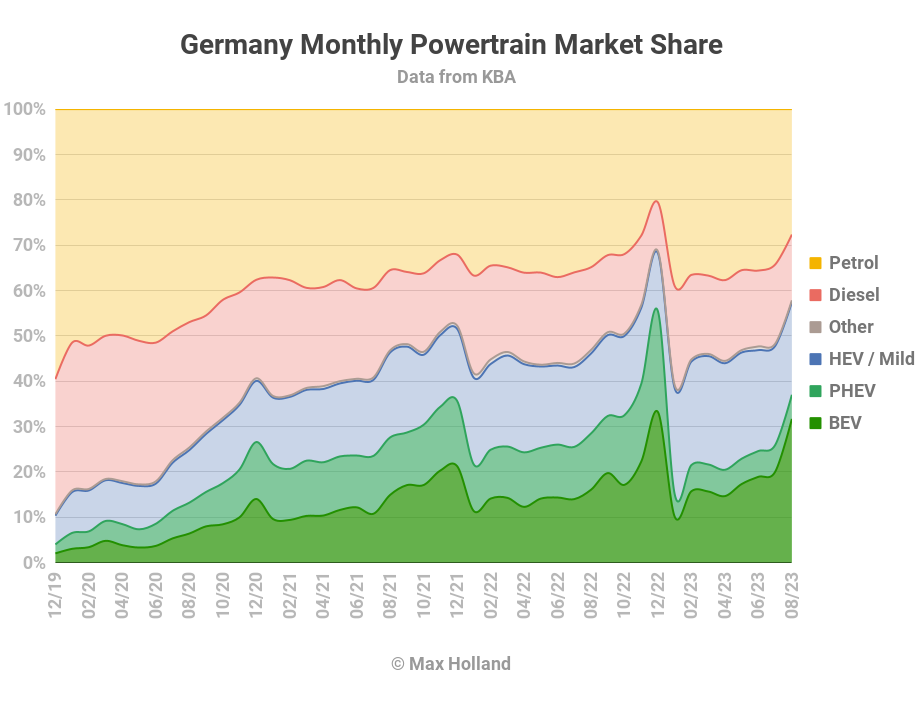

BEVs saw sales volumes increase by 2.7x over August 2022. This huge boost was due to the looming change of ecobonus incentives which occurred on September 1st. As of this date, only private consumers are eligible for the ecobonus — businesses, fleets, or other organisations, are no longer able to apply. Since the bonus can be up to €4,500 in some cases, companies and fleets jumped in strongly in August to make purchases ahead of the cut.

We will see a corresponding hangover in BEV sales in the next couple of months. Even after that, there won’t be any chance for the market to settle — there will be another change introduced from January 1st 2024. This will lower the BEV eligibility price ceiling from €65,000 to €45,000, and will reduce the bonus amount from €4,500 to €3,000.

So we can expect another surge of pull-forward sales in November and December, especially in that €45,000 to €65,000 price bracket, and another subsequent hangover.

Eventually, Germany will likely phase out the incentives entirely, as the UK did a couple of years ago. The incentives are mainly a prop to support domestic automakers to make attractive margins on BEVs, to encourage investment in their production.

BEVs are already profitable for those manufacturers which take their production seriously, and extending incentives for too long will only cause the laggards a more painful exposure to global market competition later on.

Best Selling BEVs

The Volkswagen ID.4/ID.5 was the best selling BEV model in August, with 5,683 units. In second spot was the Tesla Model Y, at 4,795 units, with the Volkswagen ID.3 coming in third (3,636 units).

Due to the looming incentive change discussed above, obviously all the major models saw volume growth in August compared to recent months. Apparently though, some planned for the demand surge better than others. Some of the Stellantis models — e.g. the Opel Corsa — saw almost 4x their typical monthly volumes.

Great Wall Motors made a special effort to bring in decent volumes of their Ora Funky Cat, which saw 2,207 unit sales in August. This is almost 12x its more lacklustre average sales volume (188 units) over each of the previous 3 months. It gained 12th spot as a result.

BYD also saw a large sales jump for the recently debuted Atto 3, with 1,985 units, but that’s more in line with their normal launch-ramp curve (albeit helped by the August pull-froward).

Talking of newer models, August saw two BEV model debuts on the German market. One was the Peugeot 308 (an initial 5 units registered), which is almost a twin of the Opel Astra that launched in decent volume in June.

The 308 is yet another well judged C-Segment BEV from Stellantis with a right-sized battery, and decent efficiency. It gets 410 km WLTP-rated range, and is able to charge from 10% to 80% in 28 minutes — almost the same specs as the Opel Astra. I suspect that the latter will be favoured in the German market, and its Gallic sibling will be favoured in its home market.

The other BEV model debuting in August was the Volkswagen ID.7, an E-Segment sedan. This is a large vehicle, almost as long as the Tesla Model S (4,961 mm vs 5,021 mm), and as such, it becomes the flagship vehicle of the Volkswagen brand, replacing the Arteon.

The ID.7 has an impressive WLTP range of up to 621 km (700 km variant coming later), and is able to recharge 10% to 80% in just 28 minutes. It is priced from €57,000, significantly undercutting the Tesla Model S (from €95,000), though not offering the same extreme performance as the Tesla.

The ID.7 registered an initial 28 units in August, no doubt most initially going to Volkswagen managers and showrooms/demonstrators. It will be interesting to see how it gets on in volume, relative to peers.

Let’s now look at the longer term perspective:

Here, the Volkswagen ID.4/ID.5 is still top, displacing the Tesla Model Y which had led the previous period (March-to-May). The Tesla drops to second place, with the Fiat 500 taking 3rd (from 6th previously).

There was considerable movement in the rankings, mainly because of some brands being better prepared for the August pull-forward than others. The Cupra Born climbed (from 10th to 6th), as did the Dacia Spring (23rd to 7th), Hyundai Kona (14th to 9th), Opel Corsa (20th to 12th), Opel Mokka (25th to 13th), Renault Megane (38th to 19th), and Kia Niro (30th to 20th).

Just outside the top 20, some newer models had good growth, including the Smart “#1”, the Jeep Avenger, and the BYD Atto 3. Note that these are all competitively priced small or compact SUVs, with decent range and charging – exactly what the market is looking for, reflected in their fast increase in sales. All in the top 30 already, we can expect to see them challenging for the top 20 soon.

Finally, let’s take a quick look at the performance of the auto manufacturing groups:

Volkswagen Group remains firmly in the lead, far ahead of any rival, as we would expect of the home country’s largest auto maker. Its share of the BEV market stands at 27.4%, a slight dip from 29.3% previously.

Stellantis has climbed 2 spots from 4th to 2nd, gaining an impressive 4.5% share (to 15.1%) in the process. Hyundai group also climbed strongly, from 6th to 3rd, increasing share by 2.5% (to 10.5%). Tesla, Mercedes, and BMW all lost rank and lost share.

Keep in mind that much of this change in rankings is due to the one-off August pull-forward, which some auto makers focussed on capturing more than others did.

Outlook

Germany’s economy remains at a negative 0.2% year on year growth rate as of the latest July figures. The auto market’s 37% YoY volume boost in August should help that month’s figures slightly when they arrive, but that was a one off.

Interest rates are flat at 4.25%, the highest level since 2008–2009. Inflation fell slightly in August to 6.1%, from 6.2% in July, but consumer price inflation didn’t improve. Manufacturing PMI remained very weak at 39.1%, slightly improved over July, but still at the lowest level since 2009.

All of this looks miserable for the German economy in the months ahead. Car sales may help prop things up, since there is still somewhat of a backlog of latent demand built up during the supply chain problems of 2020 onwards. We will have to see how things play out. As usual, for those who are in a position to buy a new vehicle, the long term savings from BEVs are widely known about, so we can expect to see their share continue to stay on a growth track over the medium term.

The next couple of months will certainly see the BEV hang-over mentioned earlier.

What are your thoughts on Germany’s auto market transition to EV? Please jump in below to join the discussion.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …