Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

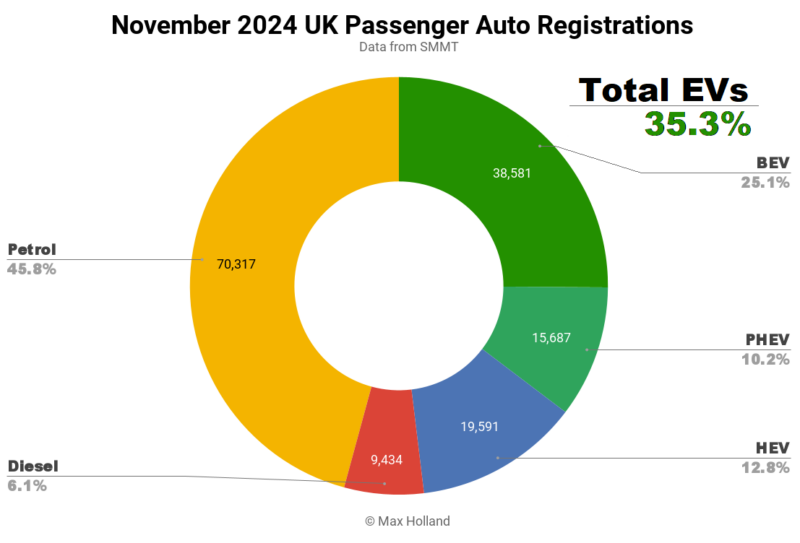

November saw plugin EVs take 35.3% share of the UK auto market, up from 25.7% year on year. BEVs grew volume by 58% YoY, and took a quarter of the market, while PHEV volume was flat. Overall auto volume was 153,610 units, down 2% YoY. Tesla was the leading BEV brand in November.

November’s sales figures saw combined plugin EVs take 35.3% share of the UK auto market, with full electrics (BEVs) taking 25.1%, and plugin hybrids (PHEVs) taking 10.2%. These compare with YoY shares of 25.7% combined, 15.6% BEV, and 10.1% PHEV.

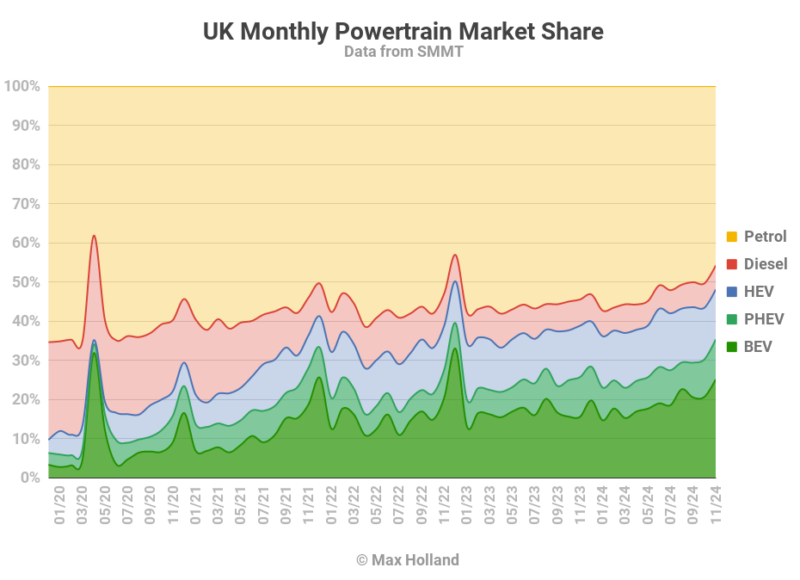

The usually strong growth in BEV share comes as the end of year deadline for the 2024 ZEV mandate looms large. Every manufacturer must sell a certain minimum proportion of BEVs (and other low emissions vehicles), or trade ZEV credits, to avoid fines.

While there’s a headline 22% target, some wiggle-room for the first year of the system (with e.g. bonuses for improving emissions on non-BEV models sold), the effective minimum target for each manufacturer’s BEV proportion of sales is in fact more like ~19%.

This 19% is still a substantial raising of the bar from 2023’s 16.5% full year UK BEV share, because this time it is not simply an industry average target, instead even the worst laggards have to meet this minimum bar (although some credits trading between manufacturers is allowed).

Under the scheme, legacy auto can no longer leave all the heavy lifting to the likes of Tesla and MG, unless they are willing to pay out good money to those competitors for ZEV credits. The wiggle room and work-arounds will steadily tighten in the coming years, even as the headline % targets themselves tighten – to 28% in 2025, 33% in 2026, then 38%, 52%, 66%, and 80% by 2030.

The legacy auto manufacturers are currently lobbying the UK government hard to try to soften the ZEV targets, just as they are lobbying policymakers in the EU zone to loosen the emissions tightening rules for 2025 and beyond. Perhaps they are arguing that having “only” shown their demonstration BEVs in the mid to late 1990s, almost 30 years has not been enough time for these companies to learn how to transition to cleaner technology?

The position voiced by the UK industry representative, the SMMT, makes no mention of the almost 30 years of BEV foot dragging, squandered opportunities, and ICE rent-seeking, by legacy auto. The SMMT simply claims that: “Manufacturers are investing at unprecedented levels to bring new zero emission models to market and spending billions on compelling offers. Such incentives are unsustainable – industry cannot deliver the UK’s world-leading ambitions alone.” (SMMT statement).

Is anyone buying their spin?

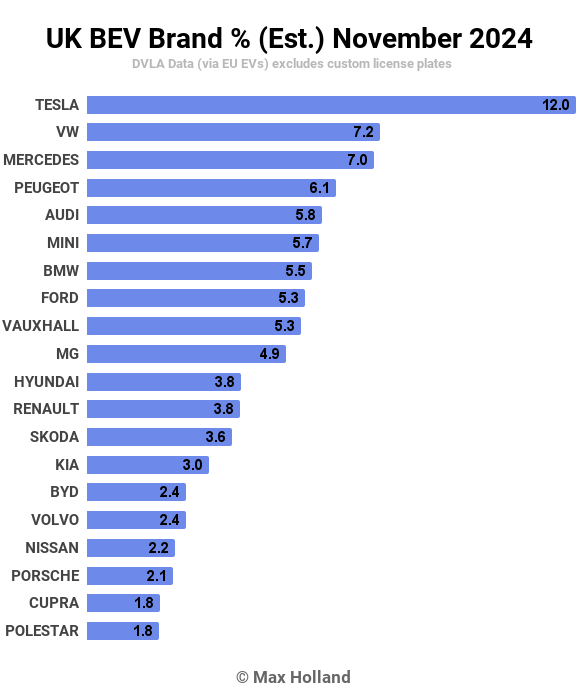

Best Selling BEV Brands

Thanks largely to the continuing popularity of the Model Y, Tesla was once again the best selling brand for BEVs in the UK, with 12% of the overall BEV market in November. This comes after a relatively quiet month in October, when Tesla was taking a break following the usual September push.

In second place was Volkswagen brand, with 7.2% of the BEV market, a big step up from their share of just 3.7% back in Q1 this year. Just behind, with 7.0% share, Mercedes took third spot.

The Volkswagen brand has had to step up in recent months – and will do so again in December – because that weak start to 2024 means it is the brand with the biggest unit shortfall in BEV sales, relative to the mandate (for more see New Automotive’s analysis).

This large unit shortfall is partly because Volkswagen is typically the biggest selling car brand in the UK (and thus all its unit numbers are big), and partly because it is still quite some % below the ZEV target. Volkswagen, however, is not nearly as far adrift in % terms as much smaller brands like Mazda and Suzuki, or medium-large brands like Nissan and Ford.

Mini had a big step up in BEV volume in November, with over 2,000 units (around 4x its normal monthly volume), taking 5.7% of the market. It seems that production of Mini’s new range of BEV is now ramping up well.

Ford is another brand which is still adrift of the 2024 ZEV target and having to step up its BEV sales. November saw it selling over 2,000 units (1.6x its recent monthly average volume), still mostly the new Explorer, and now supplemented by the just-launched Ford Capri, which sold over 250 units in the month.

The affordable Dacia Spring continues to sell decently, adding another ~265 units in November.

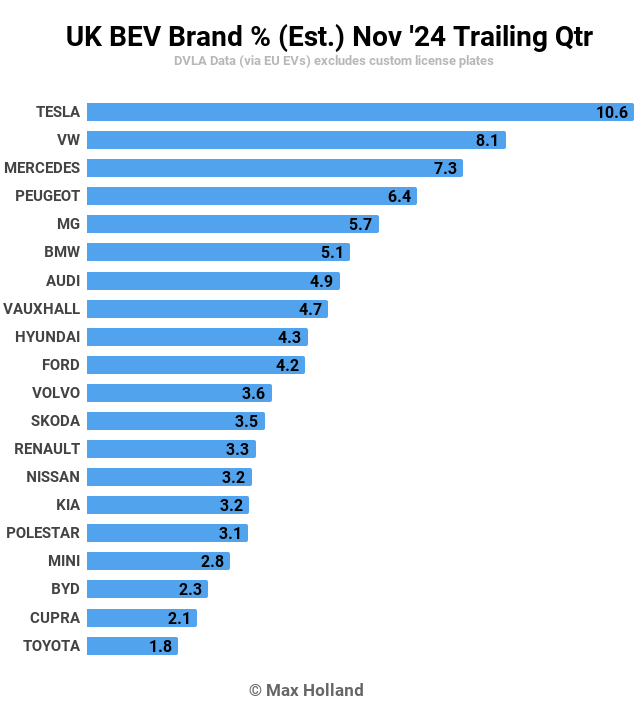

Let’s check up on the 3-month rankings.

Tesla maintains its strong lead over the three month period, with 10.6% of the UK BEV market, and over 13,000 sales.

Volkswagen has jumped up from third in the prior period, to second by the end of November, thanks to increasing volumes dramatically over the past three months. Prior to September its monthly average volume was just around 1,300 units, but since September its average has been over 3,300 units – some 2.5x higher.

Further down the rankings we find Ford now in 10th place, a good rise from its prior 18th place, and rushing to get close to the ZEV mandate and avoid paying out too much money for ZEV credits from its competitors!

While the overall UK auto market will likely meet the ZEV requirement for 2024 – and brands will avoid paying large fines to the UK government – some brand and manufacturing groups will exceed the targets and thus collect excess credits, and some will miss and have to buy those excess credits held by others, to make up for their own shortfall. We will know how things work out — which brands were the winners and which were the losers — by the time the dust settles in early 2025.

Meanwhile, if you have been waiting to get into a new BEV in the UK, this is a great time to find a discount offer as some brands (in volume terms, Volkswagen, Ford, Nissan, Renault) rush to get their BEVs out of the door. Don’t pay MSRP for any of the BEVs from these brands in December.

Outlook

For November and December, the UK auto market is being steered by ZEV regulations as much as by the broader economic climate. The latest GDP figures show YoY growth of 1% in Q3 2024, an improvement over the 0.7% of Q2. Inflation rose to 2.3 in October (latest data), and interest rates reduced to 4.75% in early November. Manufacturing PMI fell back to 48 points in November, from 49.9 points in October.

The ZEV mandate means we will see higher BEV share again in December, possibly getting near 30%, as the aforementioned brands rush to push out more volume — even if they have to give big discounts — to avoid paying big transfers to their competition (which is surely more painful than giving discounts to customers).

If you’ve spotted great bargains on new BEVs for UK consumers, please do share them in the comments so that our readers can potentially benefit from some great deals! What are your thoughts on the UK auto market as we move towards 2025? Will the legacy brands succeed in pressuring the government to soften the mandate? Please jump in to the comments below and share your perspective.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy