Support CleanTechnica’s work through a Substack subscription or on Stripe.

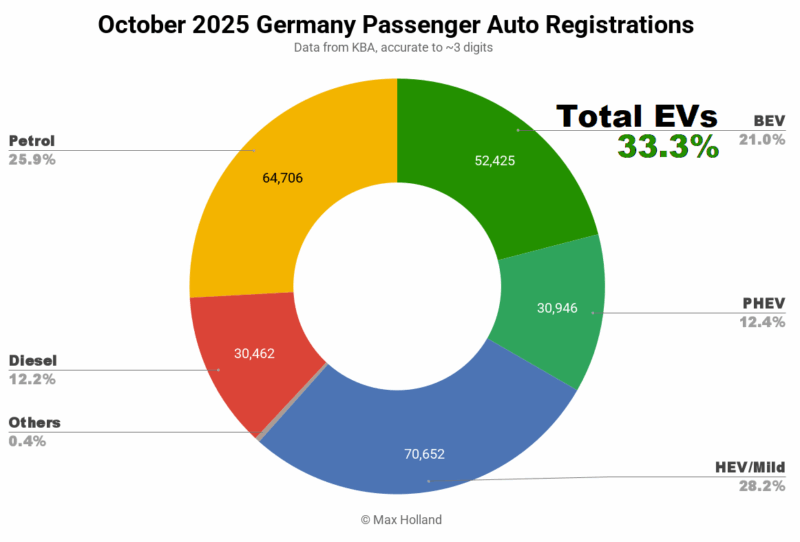

October saw plugin EVs take 33.3% share in Germany, up from 23.6% year on year. BEV volumes were up 48%, while PHEVs increased by 60%. Overall auto volume was 250,133 units, up some 8% YoY. The best-selling BEV was the Skoda Elroq.

The October auto market saw combined EVs take 33.3% share in Germany, with full electric vehicles (BEVs) at 21.0% share and plugin hybrids (PHEVs) at 12.4%. These compare with YoY figures of 23.6% combined, 15.3% BEV and 8.3% PHEV.

The October auto market saw combined EVs take 33.3% share in Germany, with full electric vehicles (BEVs) at 21.0% share and plugin hybrids (PHEVs) at 12.4%. These compare with YoY figures of 23.6% combined, 15.3% BEV and 8.3% PHEV.

The transition is continuing, albeit at a glacial pace. The government is considering re-introducing some targeted BEV purchase incentives in January 2026, for lower income households and with a vehicle MSRP ceiling of €45,000. The incentive amount will be up to €4,000 per vehicle (with a total funding pot of €3.5 billion).

Personally I’d prefer to see the price ceiling at €30,000 and a more modest €2,500 per vehicle, stretching the finite pot for longer, and causing less hang-over when it inevitably phases out at some point. Another concern is that the eligibility will be designed to “primarily benefit the German and European automotive industries” according to one of the politicians involved.

This molly-coddling approach will make European manufacturers less competitive in global markets in the long run. It will also be used for C-suite pay rises and shareholder profit-stuffing by inefficient legacy auto companies, rather than encouraging them to tighten their belts and be more dynamic and innovative.

If this new policy goes through, we can expect a hold-back of purchases on eligible vehicles in December, and a boost to their respective sales in H1 2026. Let’s keep an eye on it.

Combined ICE-only vehicle share in October fell to 38.0%, down from 47.6% YoY.

Best-Selling Models

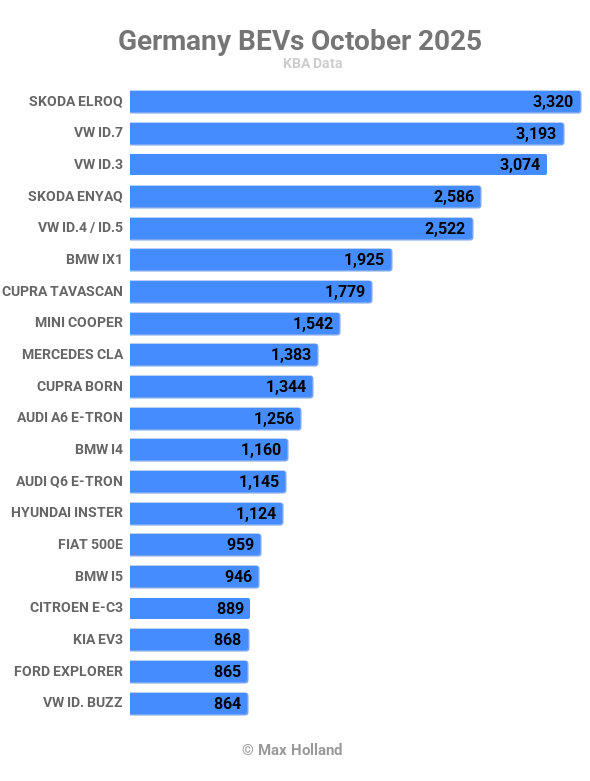

Having been steadily climbing since its first decent volumes in March, the Skoda Elroq took its first pole position in October, with 3,320 units sold.

The Volkswagen ID.7 came second, with 3,193 units, and its sibling the ID.3 came third with 3,074 units.

Most of the top 10 ranking is fairly stable. The Cupra Tavascan scored its highest ever volume (1,779 units) and rose to 7th place. The Mercedes CLA also continued to grow volume, with a new high of 1,383 units, and gained 9th place.

Further back, the Citroen e-C3 made a significant new record volume of 889 units (from 553 previously), and gained 17th place. Its close competitor, the Renault 5, has averaged 667 monthly units recently, and ranked 25th in October.

The new MG S5 outperformed, registering 626 units (up from 125 just last month), and ranking 27th. In 28th, the Leapmotor T03 is also doing very well, having sold over 600 units for each of the past three months.

The Renault 4, which launched in June and is still ramping, also scored record volume in October (353 units) and rose to 38th.

Checking up on recent debutants, the Kia EV4 had seen 228 units in its September launch, and stepped up to 285 in October. The Leapmotor B10 had seen 22 units in September, and grew to 99 in October.

There were a couple of newcomers in October, though neither yet making customer deliveries. The new BMW iX3 saw some showroom units delivered (customer deliveries only start in November, according to the BMW.de website). This is one of the first of BMW’s new generation of BEV with 800V and 400 kW charging, so should prove popular.

Likewise, the Kia EV 5 registered a single unit in October, ahead of a future customer launch. This shares much of its underlying platform and powertrain with the EV4, though is somewhat larger at 4,610mm in length (vs. 4,430) and is a boxy SUV design, rather than a hatchback. Its styling is essentially like a smaller version of the EV9 SUV.

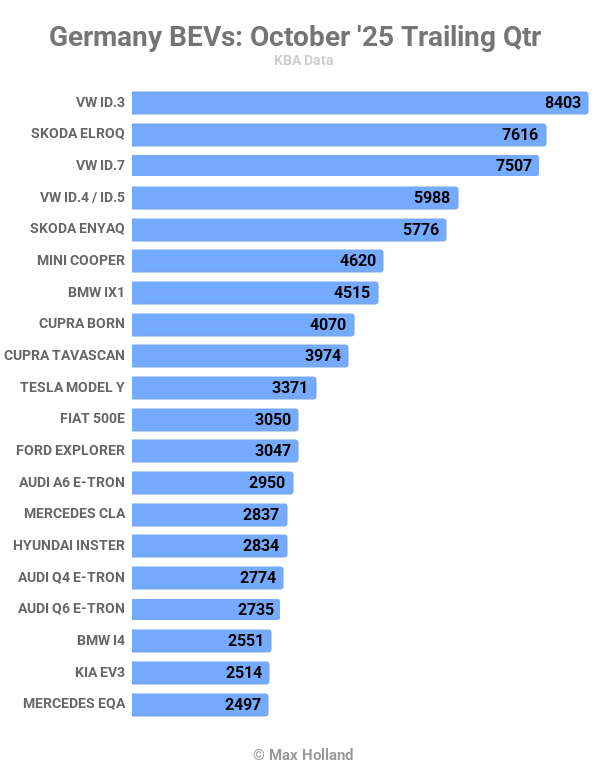

Let’s now turn to the 3-month ranking:

Leading the monthly sales in both August and September, the Volkswagen ID.3 still holds on to the lead in the 3-month chart. The Skoda Elroq has caught up considerably, and has now overtaken the ID.7, thanks to its big October.

I would guess that the Elroq will now mostly dominate the sales charts in the months ahead, since it’s a more popular format (compact SUV) than either the ID.3 (hatchback) or the ID.7 (sedan, tourer). And it’s considerably better value than either.

Further back, the new Mercedes CLA has climbed rapidly since its first decent customer volume back in July, and is now already up to 14th place, a great result, given its premium pricing.

Further back, the Leapmotor T03 and Citroen e-C3 have both recently climbed steeply, to 25th and 26th spots, respectively. The Renault 5 is also right there, just behind them in 27th spot.

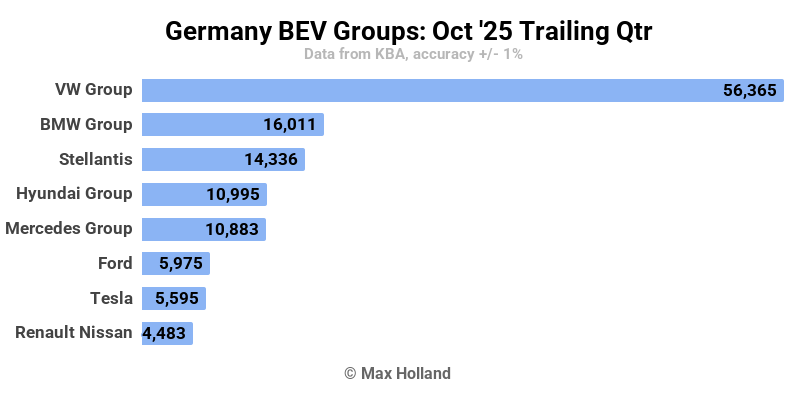

Here’s a quick look at the manufacturing group chart:

Volkswagen Group still has a commanding lead, but it lost 2.3% share from three months prior, and is now down to 41.6%.

BMW also lost 1% share, now at 11.8%. Stellantic gained 2.0% share (now 10.6%), and Hyundai Group was essentially flat. Mercedes grabbed an additional 1.6% share, now at 8.0%. All these top 5 positions are unchanged since 3 months prior.

Renault Group lost 0.4% of share, whilst both Ford and Tesla gained around 1.0% share, leading to Renault tumbling two spots.

Outlook

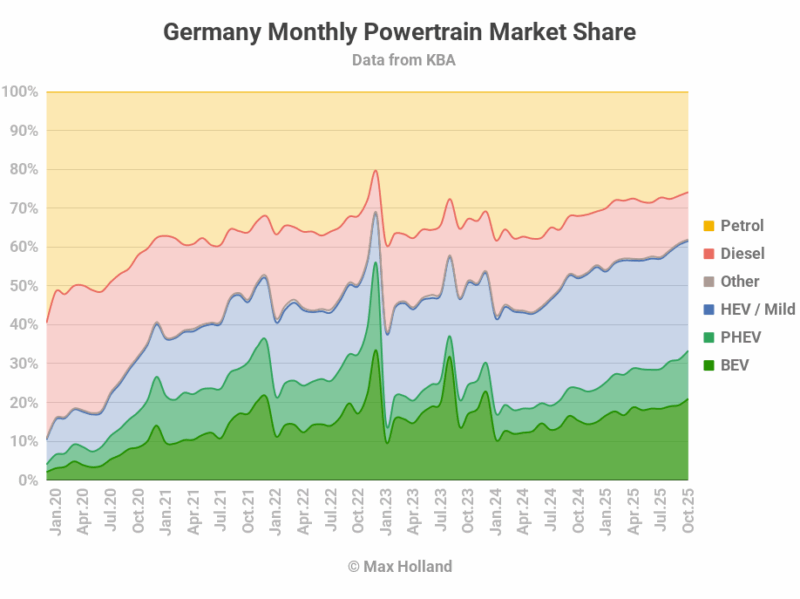

Germany auto sales so far in 2025 are effectively flat from last year. The main change has been a mild growth in BEV share, especially over the last two months, and a more notable growth in PHEVs.

The German economy remains stagnant, with every quarter of 2023 showing just 0.3% YoY GDP growth, including the latest Q3 data. The underlying reason for the stagnation is the extreme increase in energy prices across Europe, which especially impacts Germany with its significant industrial sector. The energy prices in turn relate to the war in Ukraine, as well as the sabotage of the Nord Stream pipeline. Inflation was fairly flat at 2.3% in October, from 2.4% in September. ECB interest rates have been flat at 2.15% since early June. Manufacturing PMI was essentially unchanged at 49.6 points in October, from 49.5 points in September.

What are your thoughts on Germany’s EV market? What are the prospects of the new BEV incentives going into effect in January? Please share your insights and perspectives in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy