Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

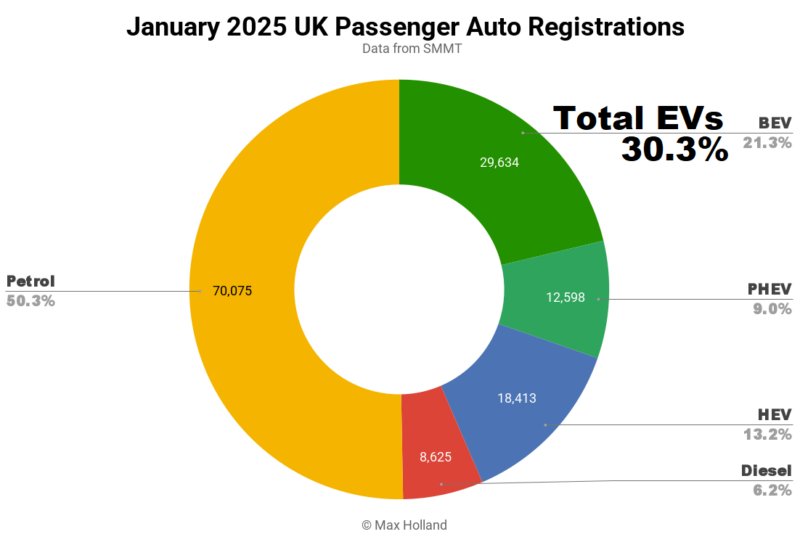

January saw plugin EVs take 30.3% share of the UK auto market, up from 23.0% year-on-year. BEVs grew volume by 42% YoY, while PHEVs grew 5.5%. Plugin growth comes despite overall auto volume down 2.5% year-on-year, at 139,345 units. Volkswagen was the leading BEV brand in January.

January’s sales figures saw combined plugin EVs take 30.3% share of the UK auto market, with full electrics (BEVs) taking 21.3%, and plugin hybrids (PHEVs) taking 9.0%. These compare with YoY shares of 23.0% combined, 14.7% BEV, and 8.4% PHEV.

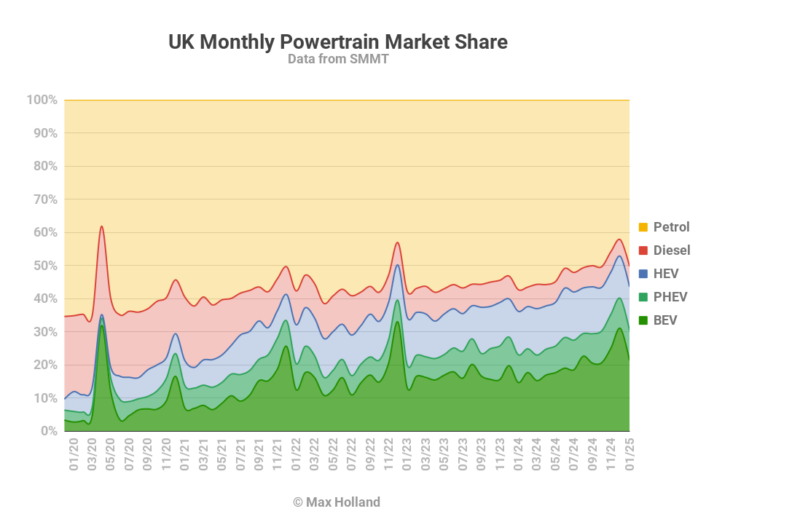

This is a good start to the year for BEVs. Recall that the UK started implementing a ZEV mandate in 2024, aimed at setting gradually rising targets for the proportion of “Zero Emission” vehicles that manufacturers must sell. In reality this isn’t simply about BEVs – although these play the largest part – but lowering emissions (however that is achieved). 2024 set a headline target of “22% ZEV”, with a small amount of credit given for PHEV, and a fraction given for the lowest emission plugless cars (e.g. HEVs). In practice, the “22%” translated into a market-wide 19.6% share for BEVs in 2024, which – along with 8.6% PHEVs and 13.6% HEVs – just about met the aggregate target.

2025 sees the headline ZEV target ratchet up to “28%”. Again, with some wiggle room this will translate into a BEV share target of somewhere around 24–25%. This being the case, January’s result of 21.3% is already a good result and suggests that the ZEV mandate “is working”. Despite this, unsurprisingly the industry lobby, the SMMT is claiming that manufacturers will “struggle” to meet the target this year, and asking for more carrots for their pockets. We can ignore most of that.

One valid point that the SMMT raises is questioning the logic of applying an additional £410 annual road tax on BEVs priced above 40,000 – called the “expensive car supplement”. ICE cars have to pay this, but shouldn’t BEVs get a better deal (since they still cost more than their ICE peers)? This extra £410 is due to apply from the start of April under current plans.

Regular readers know that I’m all for more affordable BEVs, but that doesn’t mean that what is currently a mid-market price family BEV costing £40,995 should reasonably be taxed an extra £410 per year more than a BEV priced at £39,995. Not only should BEVs arguably get a softer touch, but this “cliff” tax approach – only applying the extra tax, in full, for BEVs priced above £40,000 – seems brainless. The tax rate should surely be proportional (% based) and should slide in, starting at whatever the MSRP is in excess of £40,000 (or e.g. starting at £38,000 or whatever point makes sense). This is the type of calculation that Norway uses for VAT tax on “luxury” BEVs, for example. Most countries use a threshold-plus-percentage (or even progressive percentage) rate for income tax, so is this more subtle approach really so “hard to understand” as is often claimed?

Just as an illustrative example, if the road tax were set at 4% for the portion of the MSRP price above £40,000, then the £40,995 vehicle would only pay around £20 per year in extra tax. However a £45,000 would pay £200 extra, and that original tax target (of around ~£400 per year) would only be paid by BEVs costing around £50,000. Since this feels roughly the right price point for where “premium” (or luxury, if you prefer) begins, given where European BEV pricing is at currently, something along these lines might be considered to be fair. Actual premium / luxury BEVs costing £60,000+ would pay around £800+ per year (though this is still less than similar ICE vehicles that might be paying £1100 to 1500 per year or more). The thresholds and % could be tweaked over time if necessary.

If one wanted to be fairer still, since this is ostensibly a “road tax” used for road costs and maintenance, why not have a tax which progresses by vehicle weight? Again this tax could start above a certain threshold, to incentivize cars which are as light as is realistically feasible for a simple economy car. With today’s safety structures, vehicle weight starts at around 1,000 kg to 1,100 kg (for example, the Dacia Sandero, the Toyota Yaris, or the Dacia Spring BEV). Then give an additional “weight allowance” to BEVs, since batteries and power electronics are still fairly heavy at this stage of the BEV technology curve. Please discuss in the comments if a sliding weight-based tax (perhaps supplemented by annual mileage driven) would be a fairer way to pay for roads.

Back to January’s market shares, combustion-only powertrains were both down in volume YoY. Petrol-only volume was down 14.4% to 70,035 units, and diesel-only was down 7.7% to 8,625 units.

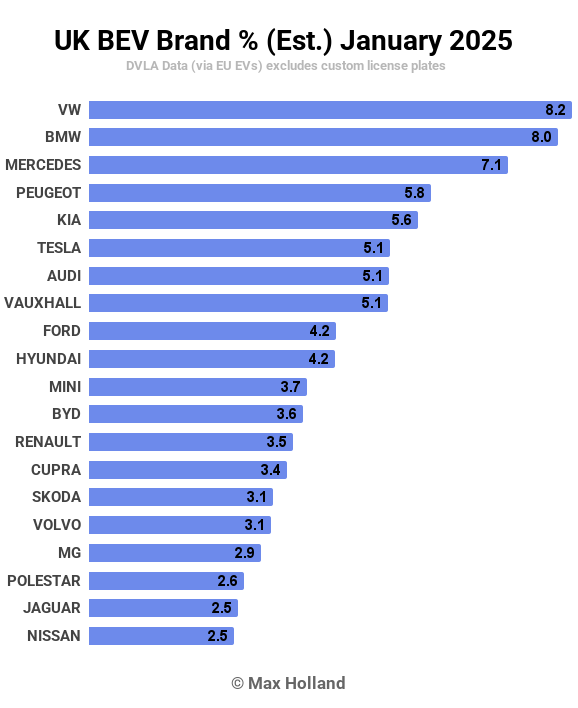

Best-Selling BEV Brands

According to UK vehicle licensing data (the DVLA via EU EVs), the Volkswagen brand had the lead in the UK’s BEV market in January, with 8.2% share, just ahead of BMW (8.0%), and Mercedes (7.1%).

The UK’s long-term leading BEV brand, Tesla, was back in 6th spot in January with a little over 5.1% of the market, after one of its biggest ever pushes in December 2024 (20.9% of the market).

As I’ve mentioned elsewhere, there’s a narrative being circulated around European (including UK) mainstream media that Tesla sales are “crashing because of Musk”. Whatever one may think of Musk, there’s well over 100,000 other people working at Tesla. Cool-headed analysis of the auto market and the normal pattern of sales is typically absent in such narratives, and the notion of “Tesla sales crashing” in the UK (e.g. this mainstream account) leaves out much of the key context. It leaves out Tesla’s huge December BEV share in the UK, Tesla’s habitual quarterly unevenness, and that many potential buyers are waiting for the new Model Y to arrive (in May, in the case of the UK’s RHD market).

It’s true that Tesla’s two best-selling models now have much more competition than a few years ago, including from decently competent, albeit simpler vehicles, at lower price points. The Tesla brand’s market share (and volume) may indeed see another dip in full year 2025 in Europe as a whole (following 2024’s dip versus 2023), but the Model Y will almost certainly be Europe’s best-selling BEV model again. After all, it had close to 3x the volume of the highest non-Tesla in 2024, as Jose has recently reported with hard data.

Recall that after January 2024’s UK results, when some of our CT community were ignoring Tesla’s habitual quarterly pattern, ignoring the wait for the refreshed Model 3, and boldly forecasting that the BMW brand would overtake Tesla in the UK in 2024? How did that work out? Not great. Yes, the lead of the Model Y will gradually shrink over time, but don’t expect it to be outcompeted this year (unless Tesla disrupts itself with a cheaper model). Of course, here we are talking about brands. In terms of combining all brands under their respective manufacturing group, Volkswagen Group has the lead in the UK, as well as in Europe.

In the January brand rankings, Peugeot (5.8%) stepped up from 2024’s average share (4.7%), as did Kia (5.6% from 2024’s 3.9%). Meanwhile, beyond Tesla, MG (2.9%) also lost share in January compared to 2024 (5.5%), but no one is seriously arguing that “MG is crashing”. Due to the UK’s right-hand drive system, production and shipping is often in batches, so monthly variability like this is pretty normal.

Beyond this monthly variability, there are some hints at moves by new models, though our data for this is always patchy, unfortunately. The Kia EV3 seems to have had its best month yet, with around 900 units in January. The Ford Explorer also had a decent month with around 650 units (though down from its December meet-the-ZEV-target push). The Dacia Spring maintained a decent volume of around 350 units. At the premium end, the new Volvo EX90 continued to ramp up, to around 60 units, and the new Audi S6 e-tron saw around 140 units (including RS6 variants).

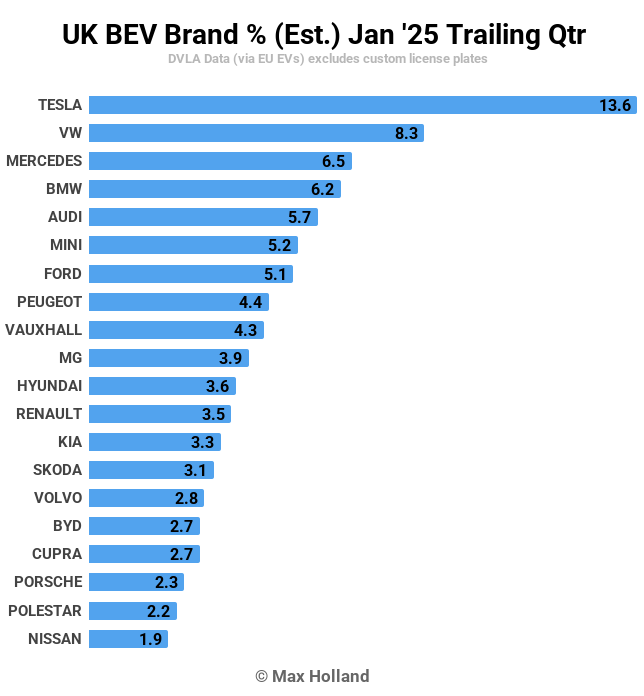

Let’s check in on the 3-month rankings:

Given what we said above about quarterly patterns and the additional monthly variability in the UK RHD market, this chart gives a better picture of the ground reality (though even here, the late 2024 push to meet the ZEV mandate distorts things – see the 2024 full year ranking for a longer average).

Here, the top five brands are all the same ones as in full year 2024, though slightly reshuffled and with an extra push (notably in December) having come from Volkswagen to meet the ZEV mandate deadline. Mini is higher than its average, again thanks to a big December push, and that’s even more the case for Ford. Most of the others are not too far off their longer term averages, but again – check that 2024 ranking for more context.

When we have the full Q1 data, and can compare it to the 2024 Q4 data, we will be able to see more clearly which brands were in the biggest rush to meet the 2024 ZEV mandate.

Outlook

January’s 2.5% YoY drop in auto market volume is within normal variation. The broader UK economy is just lukewarm, though better than some neighbours, with latest Q3 2024 GDP data showing 0.9% YoY growth, and Q4’s result currently expected to be 1.0%. Inflation shaved to 2.5% in December (latest), and interest rates have just reduced from 4.75% to 4.5% over the past week or so. Manufacturing PMI remained negative in January, at 48.3 points, though was up from December’s 47.0 points.

The ZEV mandate introduced in 2024, amidst much grumbling from intransigent legacy auto, did in the end result in a decent bump in BEV share, and accelerated the transition compared to many neighbouring European countries. With 2025’s tightening mandate, we have to guess that it will also be effective again this year, and no doubt amidst even more grumbling.

What are your thoughts on the UK transition to EVs? Are you planning to get an EV in 2025 or are you still waiting for “future” specs? Please jump into the discussion below to share your perspective.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy