Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

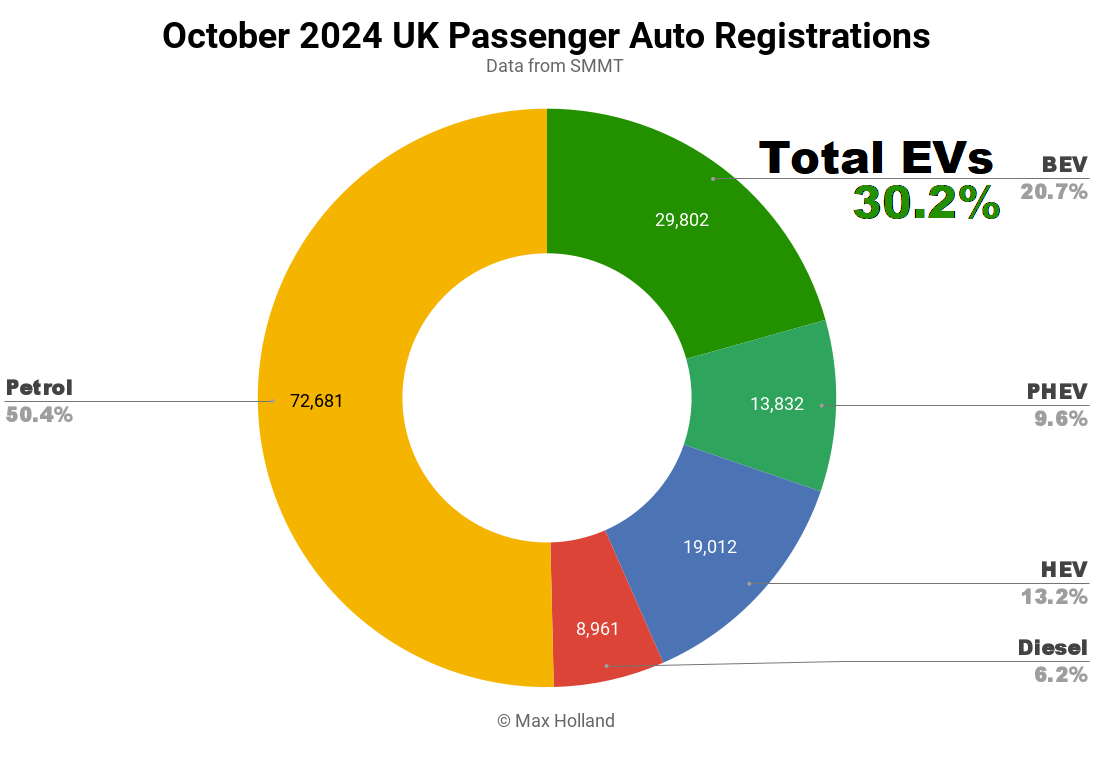

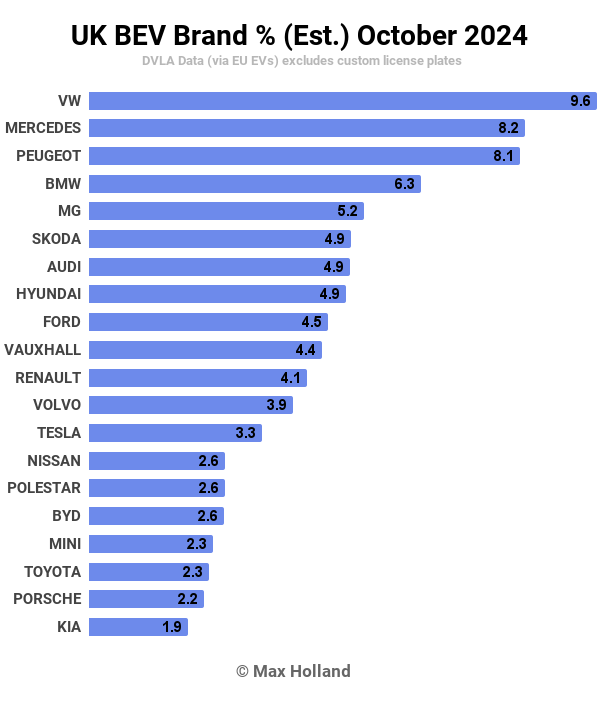

October’s auto market saw plugin EVs take 30.2% share in the UK, up from 24.9% year on year. Both BEVs and PHEVs grew in volume, whilst the overall auto market shrank. Overall auto volume was 144,288 units, down 6% YoY, and slightly below pre-2020 norms. The UK’s leading BEV brand in August was Volkswagen, with 9.6% share of the BEV market.

October’s sales totals saw combined plugin EVs take 30.2% share in the UK, with full electrics (BEVs) taking 20.7%, and plugin hybrids (PHEVs) taking 9.6%. These compare with YoY shares of 24.9% combined, 15.6% BEV, and 9.3% PHEV.

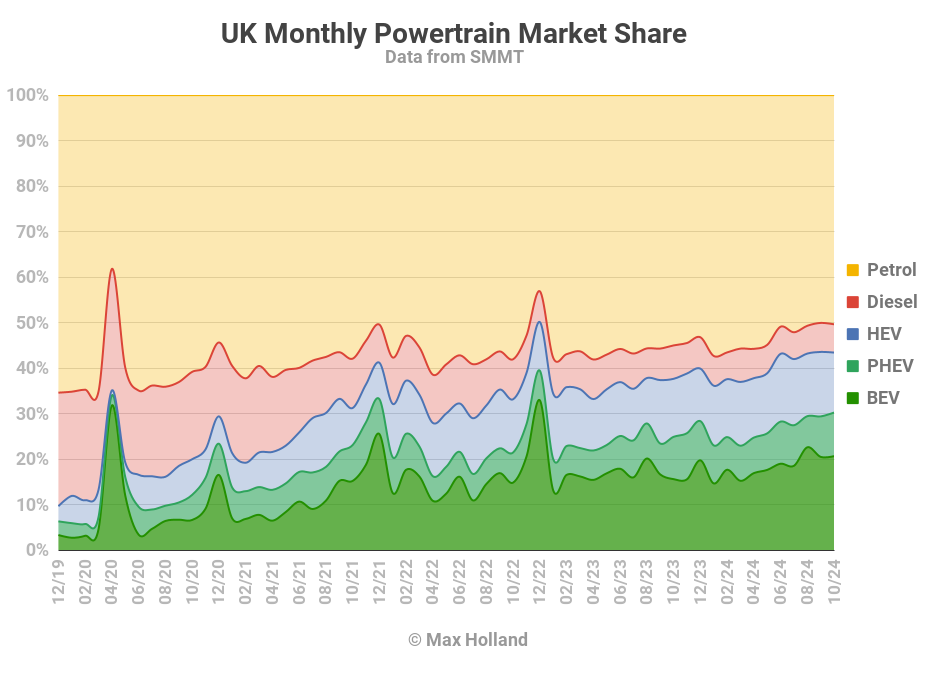

With healthy BEV share, and decent performance of PHEVs, the UK’s combined plugin share hit the highest level seen since December 2022 (when Tesla made an unprecedentedly massive push). This is good news and bodes well for even higher ground in November and December (especially as the deadline to meet the 22% ZEV mandate draws near).

Diesel share (including MHEVs) has been weak, hovering just over 6% (on average) for the past 7 months, with only diminishing prospects for the future. Year to date diesel share is at 6.4%, compared to 7.6% at this point last year. Share is trending to hit 3% around 4 years from now.

Unlike Norway, where diesel sales continue to persist at a very low level, due concerns about the harsh northern conditions, the UK has no extreme use cases that point to diesel as the habitual answer. With battery technology further advancing over the next few years, BEVs — or at least PHEVs and EREVs — will likely reliably handle any practical driving task in the UK.

Petrol share (including MHEVs) is coming perilously close to dipping under the 50% mark on a permanent basis. The past 5 months have seen an average of 50.7% share, and slowly trending down. We can expect this to dip below 50% in the next two months, perhaps temporarily recover in H1 2025, and stay below 50% thereafter.

By this point next year, combined petrol and diesel will likely be dipping below 50% for the first time.

Leading BEV Brands

After Tesla’s big push in September, the brand took a back seat in October, allowing Volkswagen to take the top spot, with 9.6% share of the UK BEV market.

In second place was Mercedes, with 8.2% share, just ahead of Peugeot, with 8.1% share.

This is a record performance for Peugeot, its first ever time in the UK’s top 3 spots. Obviously Tesla’s October absence helps, but Peugeot has anyway recently been performing strongly, taking 7th in July, 4th in August, and 5th in September. Let’s see if this can be sustained over a longer period.

Skoda also had a relatively strong month, with the Skoda Enyaq reportedly taking the top BEV model spot with somewhere over 1450 units. With still only one BEV model on sale, Skoda must now bring their next BEV to market, and the company plans to do so with the Elroq (a Niro-sized SUV) sometime early in 2025. It is already being fanfared on Skoda’s UK website.

We can’t read too much into any one month’s results in the UK, due to being a batch-supplied right-hand-drive market, with necessarily erratic monthly model and brand volumes.

One or two data points stand out as worth highlighting. The Dacia Spring finally saw decent volume in the UK, with over 328 units registered, from just 4 initial units in September. This comes 4 years after the Spring went on sale in neighbouring France!

The Spring’s UK MSRP starts from £14,995, but deals can be found closer to £14,000. The Spring comes with a 3 year 60,000 miles standard vehicle warranty, which can be inexpensively extended to 7 years if official servicing intervals are adhered to. For those wanting to own a fresh new BEV, with a long warranty, and don’t need to do regular long journeys in the vehicle, the Spring is as affordable as it gets in the UK.

The MG Cyberster, which debuted last month with around 70 units, added another ~90 units in October. This is great volume for a niche 2 seat sports car, let’s see how it continues.

Talking about strong volumes, the new Porsche Macan grew quickly from its September debut (~113 units), adding at least ~460 more units in October. This likely puts it in or close to the top 20 best selling BEVs in the UK (though we don’t have robust enough model data to know for sure).

Chery launched the Omoda E5 SUV (the BEV version of the C5) in September with 187 units, and added another ~220 units in October. Without a dedicated dealer network, the Omoda is being distributed and serviced though independent UK retail network, Arnold Clark.

The Omoda E5 is Kia Niro sized (4,424 mm), with a fairly decent WLTP range of 257 miles, and okay (not great) DC fast charging (10% to 80% in around 40 minutes). It is priced from £33,000 MSRP, and comes with a long 7 year warranty. Pre-registered deals can be found for around £30,000. The challenge is that Kia Niro deals can be found from £32,000, with longer range (285 miles WLTP), from a better-known brand. On the other hand, the Omoda battery is LFP chemistry from BYD, which should be considered a huge plus point, with over 3,000 cycles, for 20+ year longevity.

The new Ford Capri debuted in the UK in October, with around 44 units. For an overview of this new model from Ford, check my recent Norway report. Finally, the Xpeng G6 also broke the ice in the UK in October, though with just 5 initial units, which may be for test drives (and feedback) rather than customer deliveries. Let’s keep an eye on it.

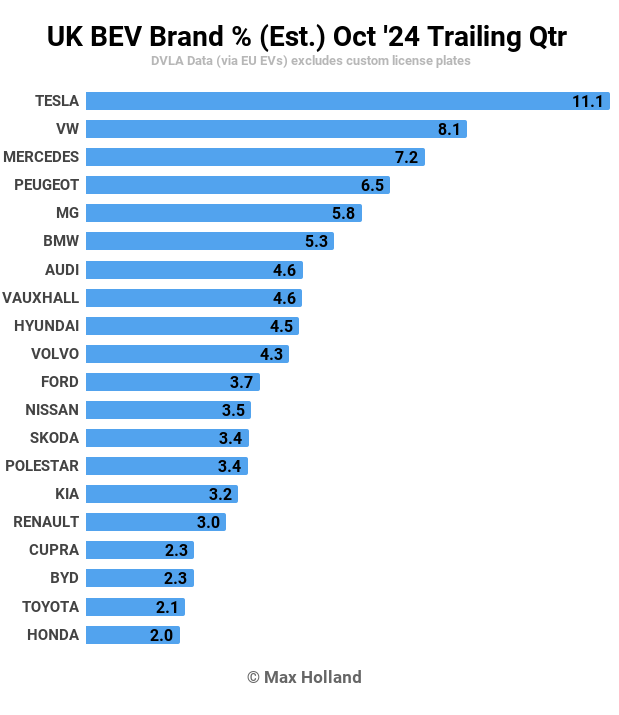

Here’s the trailing-Q chart:

As usual, Tesla is very dominant, with a decent gap separating it from runner-up Volkswagen brand (8.1%). Mercedes is in third with 7.2%.

Most of the moves since the prior period are modest, with the most notable slides being from BMW, Audi, Volvo, Kia, and BYD, each stepping back 3 or 4 spots.

The biggest climbers are Peugeot and Ford. In the DVLA data that we have access to, Peugeot’s light vans (Partner and Expert, typically for last mile deliveries, or minicabs) are included in the brand totals. Since these vans are relatively popular, this juices Peugeot’s UK numbers considerably, much moreso than other brands, so just be aware of that twist in the data source. Nevertheless, even without the vans Peugeot would still be doing fairly well, though perhaps in 7th or 8th, rather than 3rd or 4th. Either way you look at it, Peugeot has climbed 5 or 6 spots since the prior period, a good improvement.

Ford has climbed an impressive 11 spots, from 18th to 7th, mostly thanks to the success of the new Explorer, which is now being joined by the new Capri. This is a big turn around from their previous lacklustre BEV image of just a few months ago. Ford’s totals are also slightly juiced by the inclusion of their Transit van, but to a much lesser degree than Peugeot’s. Once the Capri gets rocking, how far will Ford climb – can it get near the top 5?

Despite providing welcome new additions to the BEV models available, there’s little prospect of Dacia or Omoda entering the top 20 anytime soon (but I would be very happy for Dacia to prove me wrong)! By contrast, with the rising popularity of the new Macan, there is every prospect of Porsche entering the chart next month, so let’s look out for that.

Outlook

Although October saw overall auto volume slightly down from a year ago, the UK’s year-to-date auto market has grown 3.3% from this point in 2023, and will end up close to 2 million units. This is a bit down from the 2.3 million seen in some of the good years of the two decades pre-2020, but still slightly above the 1.94 million units of 2011 (the weakest year of that period).

With the pandemic no longer being a decent explanation for the continuing weakness (if anything we should be seeing a rebound), we have to look to the wider economy. Although better than some neighbouring countries, and gradually alleviating, the UK’s latest data on the trailing 12 months of quarterly YoY GDP figures aren’t great (+0.3%, – 0.3%, +0.3%, +0.7%). Q3 2024 is not yet in, but is expected to be roughly +0.6%, before further modest improvements next year. Inflation shifted lower (1.7%), as did interest rates (4.75%), though manufacturing PMI declined to 49.9 points in October, from 51.1 points prior.

Obviously a weak-ish auto market could be regarded as a positive whilst ICE powertrains are still dominating sales. On the other hand, a stronger UK economy would likely boost the speed of the EV transition – with more public funds for infrastructure, and more consumer spending power to stretch to still-relatively-expensive BEVs.

The one solid signpost is the UK’s ZEV mandate which is now set in stone, and requires manufacturers to make 22% BEV sales this year (with some wiggle-room), 28% next year, and increasing thereafter. There’s no prospect of a re-negotiation of this, and so the (mostly legacy) industry lobby, the SMMT is still looking for financial support to achieve it, saying:

“Moving the market rapidly towards these ambitious targets needs bold and compelling incentives for consumers. Manufacturers are currently shoring up demand with historic levels of support, but this is unsustainable in the long term as it threatens [profits] viability. Without the government support to match the manufacturers’ commitment, there must be an urgent review of the market’s performance and the regulatory mechanisms driving the transition.” (SMMT statement)

What the statement conceals are the record profits, management bonuses, CEO salaries, and shareholder payouts that many legacy manufacturers paid to themselves in 2022 and 2023. Knowing that we are in the middle of a challenging technology transition (though one full of opportunities), why didn’t these manufacturers instead plough revenues back into investments in cost reductions and scale-ups for BEV technologies? Now they come asking for incentives? The same old attitude of entitlement seems to be in effect.

What are your thoughts on the UK’s auto market and transition to EVs? Which of the new models are you excited about, or perhaps planning to try out? Please join in the conversation in the comments below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy