Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

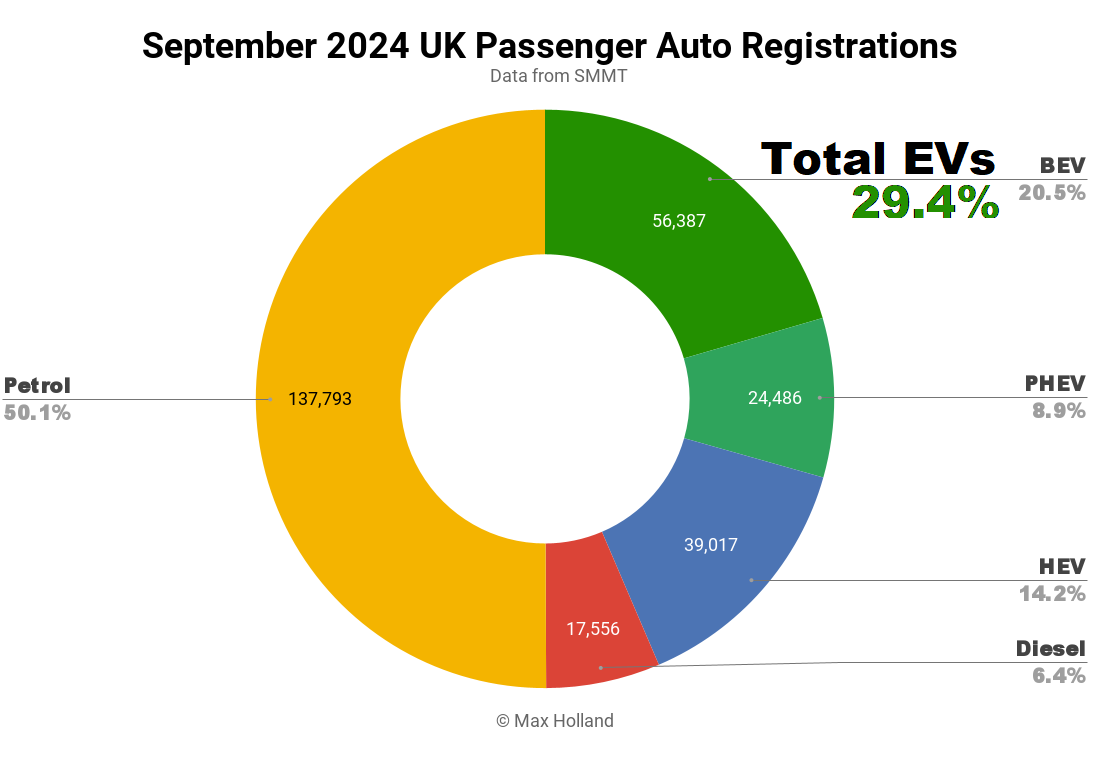

September saw plugin EVs take 29.4% share of the UK auto market, up from 23.4% year on year. Both BEVs and PHEVs grew volume YoY, by 24% and 32% respectively. Overall auto volume was 275,239 units, up 1% YoY, but still far below pre-2020 seasonal norms (350,000+). Tesla was the leading BEV brand in September.

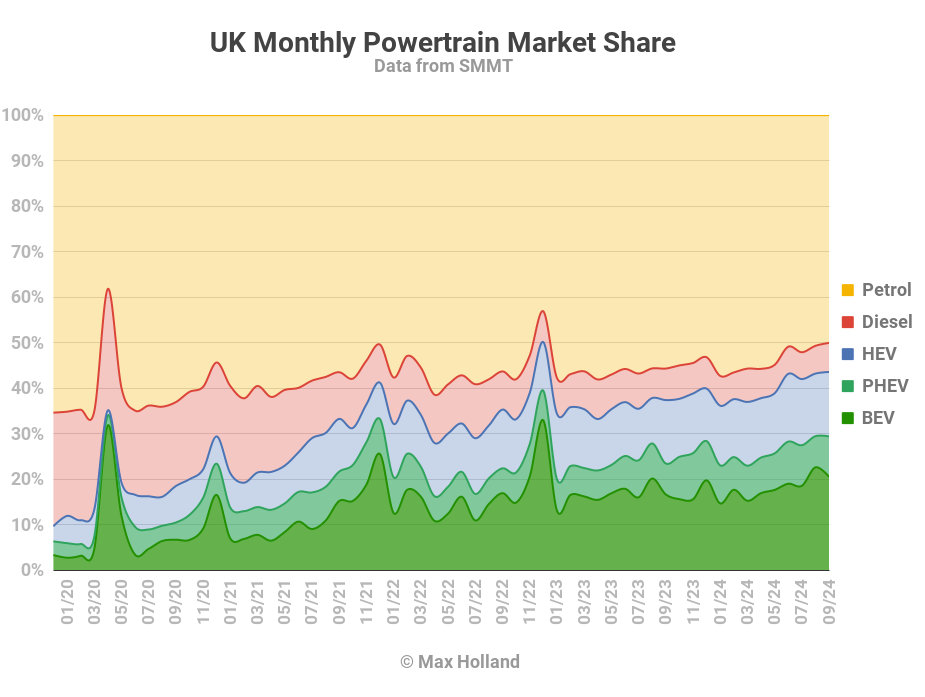

September’s sales tally saw combined plugin EVs take 29.4% share of the UK auto market, with full electrics (BEVs) taking 20.5%, and plugin hybrids (PHEVs) taking 8.9%. These compare with YoY shares of 23.4% combined, 16.6% BEV and 6.8% PHEV.

Against broader auto volumes which were barely flat YoY, both BEVs and PHEVs grew volume at a healthy clip. BEVs grew 24.4% to a new record high of 56,387 units, whilst PHEVs grew 32.1% to 24,468 units.

Meanwhile, HEVs were essentially flat YoY, diesels saw a 7% volume decline, and petrol-only vehicles lost substantial volume of 9.3%, dropping share from 55.7% to 50.1% YoY.

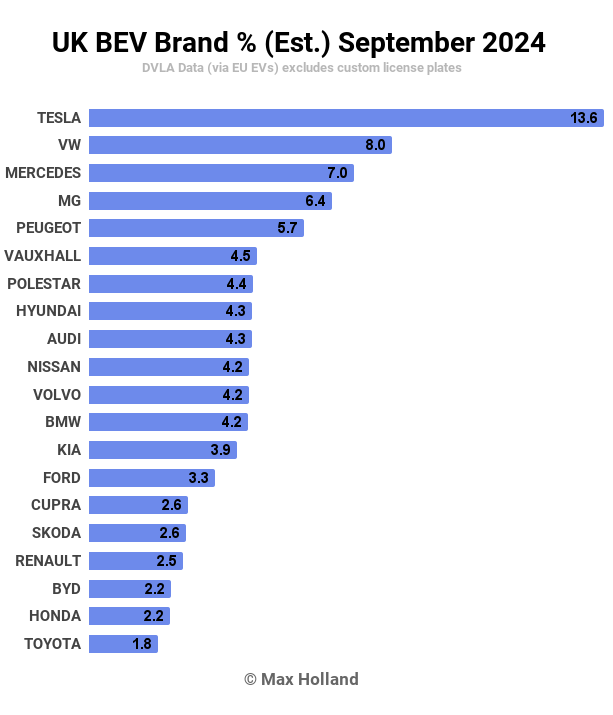

Best Selling BEV Brands

Tesla was yet again the best selling BEV brand in September, with the Model Y leading with 5,799 units, enough to put it in joint 4th place in the overall auto market. Year to date, the Model Y is the 9th best selling automobile overall (and by far the best selling BEV), with 23,485 units registered.

Volkswagen took a surprise 2nd place in the September BEV rankings, a much stronger performance than typical (the brand is only in the 6th spot year to date). BMW, conversely, slipped back to the 12th spot, despite being 2nd in the year-to-date rankings. In both cases, these volume swings are likely more to do with irregular shipments of right–hand-drive units arriving in the UK than fundamental changes in demand.

Mercedes took the third spot in September, unchanged from its position in August.

We don’t have enough resolution in UK BEV model sales data to definitively identify every newly launching model, but can identify a few.

The most significant debuts in volume terms are the new Polestar 3 and Polestar 4, which registered 93 units and 744 units in September, respectively. Polestar looks like it may have a big hit on its hands with the 4. These are remarkable launch volumes for a vehicle which starts from £59,995. Let’s see what the sustainable volume is going forwards.

The new Porsche Macan sold its first ~113 units into the UK in September, and will surely grow from here, with the UK market having outsized weighting for the Porsche brand (the Taycan sold 288 UK units in September).

The MG Cyberster Roadster made its first UK customer deliveries in September, with a healthy 70 units registered — very strong for a vehicle like this, in not-the-most-practical segment. The new MG is the only open-top BEV two-seat sports car on the market. Quid de te, Tesla?

With striking design, good tech, GT levels of comfort and performance, and priced from £54,995, the Cyberster will surely grow its monthly UK volumes further from here. Like all other MGs, it comes with a 7-year, 80,000-mile whole-vehicle warranty in the UK. This, or a Tesla Model 3 Performance for ~10% more money?

The new Peugeot e-5008 also launched in the UK in September, with an initial 213 units. Check the Norway report for some basic info on this new 7-seat mid-large SUV.

The new Ford Explorer, which debuted in August with a strong 366 units, immediately shot up in September, registering a further 1,177 units. That put it not far off the UK’s top 10 in only its second month on sale — a very impressive performance.

Another UK debutant from August, the Alfa Romeo Junior Elettrica, delivered an altogether more modest 20 units in September — not yet notable, but let’s see how far it can grow. Its platform-sharing cousin, the Fiat 600, sells around 45 units per month on average in the UK, which should be easily achievable for the more charismatic Alfa.

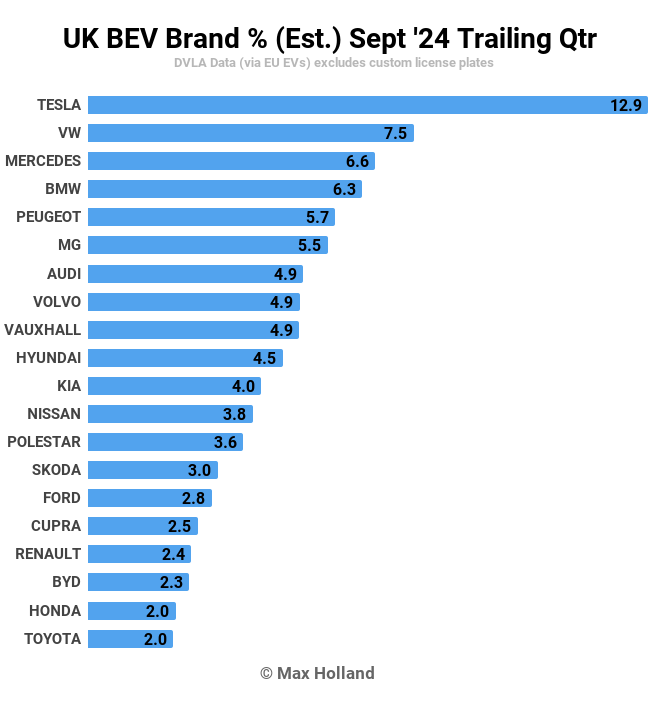

Let’s check up on the trailing 3-month brand rankings:

Unsurprisingly, Tesla still has a very strong lead in the UK, with 12.9% of the BEV market in Q3, far ahead of runner-up Volkswagen’s 7.5% share. Volkswagen nevertheless saw a good improvement over Q2’s 5.2% share, which had placed it in 8th spot.

Stepping back to look at the year-to-date figures, Tesla leads decisively, with a share of 13.6%. BMW is in second at 8.9%, and Mercedes in third at 6.7%. Despite a good result in Q3, the Volkswagen brand is still back in 6th position YTD, with 5.6% share.

With increasing UK volumes of its new Explorer model, Ford is finally starting to make decent BEV sales (the Mach-e was never the right market position for significant volume). On the basis of decent September deliveries, Ford’s Q3 overall volume almost doubled over Q2, going from 1,537 units to 2,875 units. Market share grew from 1.9% to 2.8%, and should reach close to 4% by the end of Q4, thanks to the Explorer.

Toyota’s BEV Weighting Still Lagging

This improvement in Ford’s BEV figures was a big turn around from a few months ago, when Ford was amongst the worst laggards in the UK EV transition, with only a tiny percentage of its auto sales being BEVs (despite being typically the ~5th largest auto brand in the UK). In September, Ford’s BEV share of overall sales (“BEV weighting”) was slightly over 11%, not great for a volume manufacturer, but by no means the worst of the big players.

That badge of dishonour still goes to Toyota (the UK’s 3rd largest auto brand in September), which sold 15,602 autos overall, of which just 6% were BEVs. Other big players, Kia (2nd largest UK brand) and Audi (4th largest), saw September BEV weightings of 13% and 16%, respectively. The month’s top volume auto brand, Volkswagen, had a relatively decent weighting of 19% (though, notably, still below the UK average BEV share of 20.5%).

Of the other medium-to-large brands (those with over 5,000 UK auto sales in September), above-average BEV weightings were seen for Mercedes-Benz (24%), BMW (21%), Vauxhall (25%), Volvo (26%), MG Motor (44%), and Peugeot (31%). Obviously Tesla, Polestar, BYD, and the other plugin-only brands remain the exemplars.

Outlook

With the UK’s 2024 ZEV mandate requiring brands to have BEV weightings of 22% (with some wiggle room), or buy credits or pay fines, it looks like Toyota is going to be spending money for ZEV credits from the likes of Tesla or Polestar. What a fall from grace for the automaker that was the first volume seller of (then-innovative) hybrids like the Prius in the late 1990s.

The overall UK auto market is historically weak, and the broader economy is not in much better shape, with YoY GDP growth of 0.7% in Q2 (latest figures). Inflation is at 2.2%, and interest rates are high at 5%. Manufacturing PMI is weak at 51.5 points in September, down from 52.5 points in August.

Overall, by the end of this year, the UK market will obviously have to get close to the 22% BEV target (such is the design of the ZEV mandate). The BEV share year to date stands at just 17.8%, so expect some brands to be offering BEV discounts to improve their position before the end of December.

If you’re in the UK and have had your eye on a certain BEV for a while, especially from the likes of Ford, Kia, Nissan, or Toyota (surely not?), but have been sitting on the fence — this situation could present an opportunity to jump in. Other brands which are currently well below the mandate target are Skoda, Renault, Mazda, Mini, Citroen, Dacia, and Fiat. See NewAutomotive’s September data for more brand BEV weightings.

Obviously, many of these brands are part of larger auto groups which will tackle the mandate as a team, so it’s hard to predict exactly what kinds of deals might be offered, by which brands. Either way, it’s worth keeping an eye out for special offers, and especially leasing deals, as these are a low-risk way to get into a BEV.

What are your thoughts on the UK’s auto market, state of transition, and prospects for the coming few years? Please join in the conversation in the comments section below. If you have tips and tricks for tracking special offers and leasing deals in the UK, please share them with the community!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy