Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

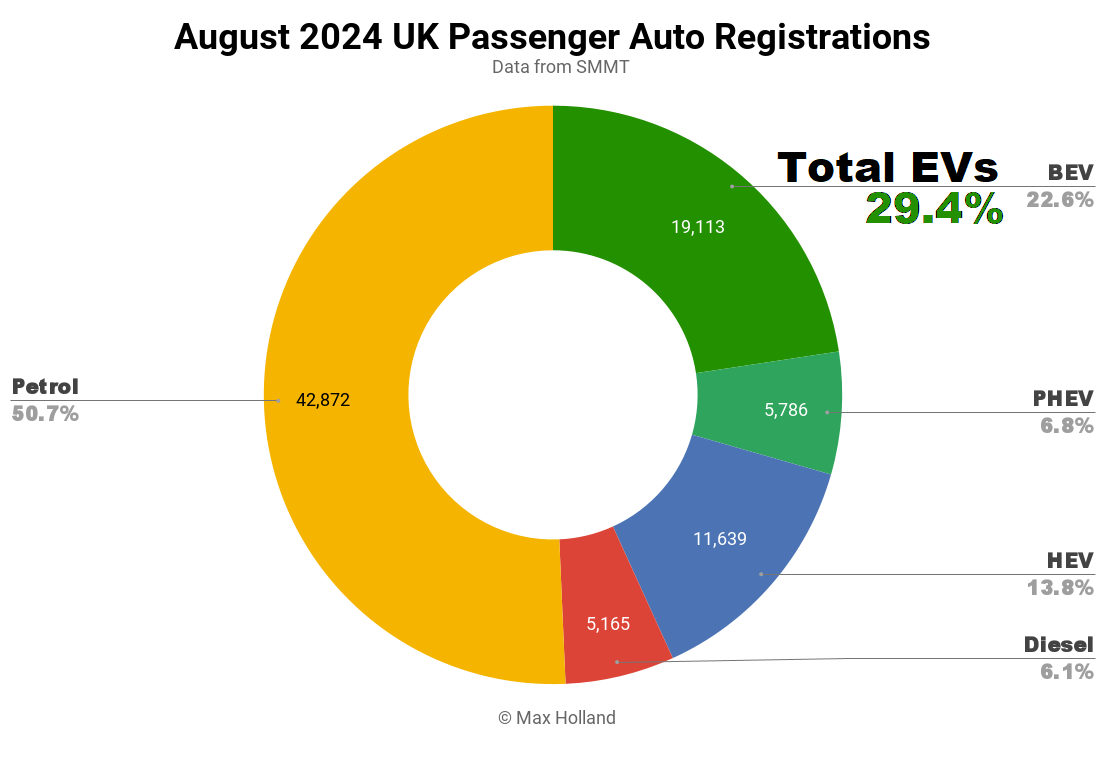

August’s auto market saw plugin EVs take 29.4% share in the UK, up from 27.8% year on year. BEVs grew in volume, whilst PHEVs shrank. Overall auto volume was 84,575 units, down 1% YoY and in line with pre-2020 norms. The UK’s leading BEV brand in August was Tesla, with 16% share of the BEV market.

August’s auto sales saw plugin EVs take 29.4% share in the UK, with full electrics (BEVs) taking 22.6% and plugin hybrids (PHEVs) taking 6.8%. These compare with YoY shares of 27.8% combined, 20.1% BEV and 7.7% PHEV.

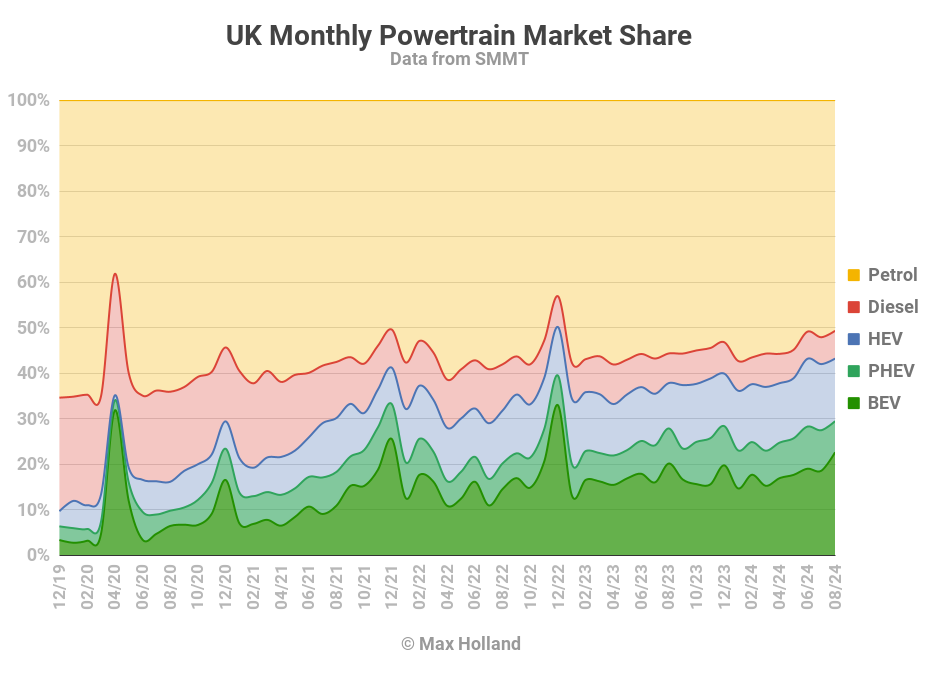

August is usually a relatively quiet month for UK auto sales, and this year was no different. In terms of share, BEVs’ 22.6% was the UK’s highest ever for a non-December month, though only 11% up in volume YoY. PHEV sales have been more erratic, with the YoY growth trend seen over recent months now giving way to a modest decline. This is likely temporary, though — expect to see PHEVs back to health in September.

HEVs (traditional plugless hybrids) also grew YoY, but against the backdrop of the world quickly moving towards plugins, this technology has no long-term future. It is more of a quick-fix — for slight emissions improvement — that some laggards (Toyota, for example) are still strongly pushing in an attempt to keep their underlying ICE investments alive.

Combustion-only vehicles, and mild hybrids, continued to lose volume, with petrol vehicles down in volume by 10% YoY and diesels by 7.3%. Their combined share reduced to 56.8% of the market, down from 62.2% a year ago.

Top Selling BEV Brands

Tesla again was the UK’s most popular BEV brand in August, with 16.1% of the BEV market, and saw the refreshed Tesla Model 3 just ahead of the Model Y in sales (unusually). The Model 3 was also the UK’s third placed overall best seller (all powertrains) in August, while the Model Y came in 5th.

In the BEV race, BMW brand was in second place, with 6.7% share. The BMW i4 was their strongest single model.

Mercedes brand came in third, with 6.0% of the market, just fractionally ahead of Peugeot and Volkswagen.

There weren’t many great surprises in the monthly rankings. Although, Ford was given a big boost from launching its new Ford Explorer model, with around 370 debut units (already more than its older sibling, the Mustang Mach-e). The Explorer is Ford’s take on the Volkswagen ID.4, using the same underlying VW Group MEB platform. This gives Ford a quick-start to selling its own branded BEVs, without having to develop the entire underlying platform and systems-integration from scratch.

Stellantis’ Alfa Romeo brand introduced their first BEV model to the UK market, the Alfa Romeo Junior Elettrica. This is a cousin of the Jeep Avenger and the Fiat 600e, using mostly the same mechanicals underneath but priced, at £33,895, halfway between the Fiat (from £32,995) and the Jeep (from £34,999).

Unlike the cousins, however, the Alfa offers the option of a much higher-trim, sporty variant, the Veloce. This comes with the same battery (54 kWh gross), though a more powerful 207 kW motor (80% up on the standard car’s 115 kW), with upgraded brakes, suspension, and other components. The Veloce costs £42,295 and will likely attract some driving enthusiasts who are fans of Alfa’s notable sports car history.

There were 3 UK units of the Junior Elettrica registered in August. Let’s see how the Alfa-badged vehicle gets on, especially relative to the (more vanilla?) Jeep- and Fiat-badged cousins.

Let’s now check up on the 3-month brand ranking:

Some claimed early in 2024 that BMW would overtake Tesla in UK BEV sales this year. Evidence suggests it won’t happen, certainly not this year.

Tesla still has a strong advantage in tech-image, efficiency, some aspects of practicality (e.g., interior space efficiency), perceived value, and — most of all — a huge advantage over all other brands in the Supercharger network and its ease of use.

BMW is, however, obviously doing very well in its own right — a remarkable turnaround for a brand I castigated back in 2019 for their foot-dragging — especially in terms of offering a very broad range of models. But Tesla is still king for now.

The slowdown in Tesla Model 3 sales at the start of the year (prior to the Highland refresh) perhaps gave BMW fans some false hope — that has now evaporated with the success of the refresh. Even if we add MINI brand sales to BMW Group’s namesake brand, the larger entity will still struggle to match Tesla for BEV sales over full year 2024.

Towards the bottom of the brand rankings, Japanese legacy brands Toyota (in 20th) and Honda (22nd) are still dragging their feet and underperforming. Shame, shame, shame.

Outlook

Whilst August’s UK auto market was roughly flat in volume, with plugins steadily increasing share, the broader economy remains weak. Q2 2024 GDP increased by 0.9% YoY, an improvement over the 0.3% of Q1 but still lacklustre. It is better, however, than many European neighbours.

The UK inflation rate went into reverse in July (latest date), at negative 0.2%, and interest rates reduced from 5.25% to 5.0% at the start of August. Manufacturing PMI was 52.5 points in August, from 52.1 in July.

The UK’s Zero Emission Vehicle (ZEV) mandate is set at “22%” for this first year of implementation (with some wiggle-room and fudging allowed). Next year’s target will increase to 28%, then 33% in 2026. This much is set in stone, so we can expect the overall auto market to necessarily follow this trajectory. PHEVs will add a bit more to plugin sales over the coming few years — before eventually fading out in the long run when BEVs will almost entirely take over.

What are your thoughts on the UK’s transition to EVs? Will BMW (at either the brand level or at the group level) overtake Tesla in UK BEV sales in 2025? Let us know your predictions and predilections in the comments below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy