Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

March’s auto market saw plugin EVs take a 27.9% share in France, growing from a 25.4% share year-on-year. Full electric volume was up by some 11% YoY, while plugin hybrid volume grew 4%. Overall auto volume was 180,024 units, marginally down YoY, though well below 2017–2019 seasonal norms (~230,000). The Peugeot e-208 remained the bestselling full electric vehicle for the third consecutive month.

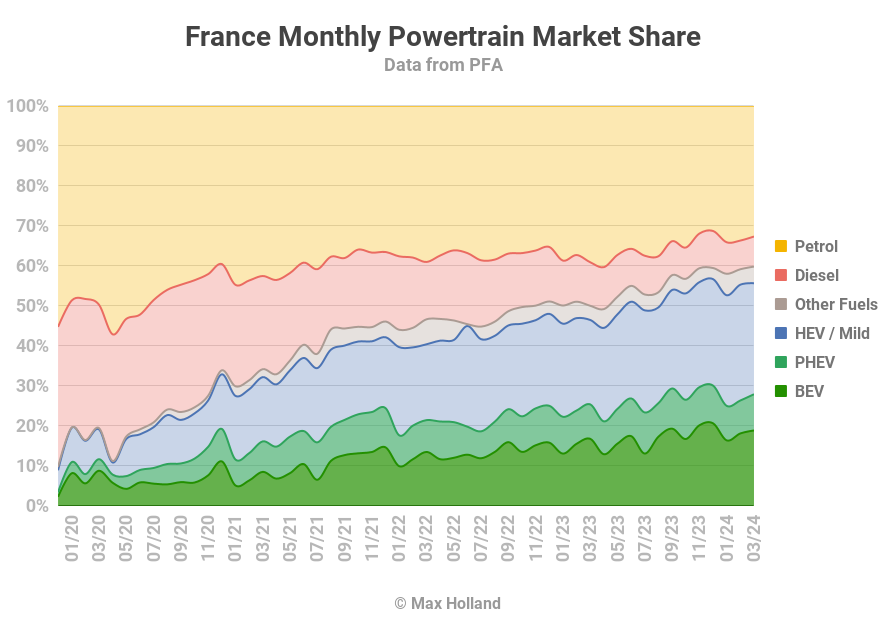

March’s data tally saw combined plugin EVs take a 27.9% share in France, comprising 18.9% full battery-electrics (BEVs), with 9.0% plugin hybrids (PHEVs). These compare with YoY figures of 25.4% combined, 16.8% BEV, and 8.6% PHEV.

Due to the earlier incidence of Easter, and of weekends, the month of March had 2 fewer working days than last year, so the volumes of BEVs (up 10.8%), PHEVs (up 3.7%), and hybrid EVs (up 29.6%) actually represent decent growth on a daily pro rata basis.

Some of the BEV registration volume reflects the recent government “social leasing” program which encourages less well-off households to switch to a BEV. The 2024 scheme opened on January 1st, and the doors closed 6 weeks later with 50,000 leases arranged (twice the anticipated number). Stellantis and Renault Group were the biggest players in this round of the social leasing scheme.

This scheme has juiced the BEV numbers so far this year, and will continue to do so over the next month or two, as the remaining leased units actually get delivered and appear in the data as registered vehicles. After that, BEV volume might show signs of a mild hangover.

Another pull forward for the past 3 months has come from those BEVs which have been approaching the end of their purchase incentive eligibility — put simply, most BEVs made outside of Europe. With March 15th as the cutoff date, we will likely see a major hangover in all of these models. Models affected include the Dacia Spring, Tesla Model 3, Kia Niro, Kia EV6, BYD Atto 3, Volvo EX30, MG4 (plus all other MGs), Ford Mustang Mach-e, Fisker Ocean, Nissan Ariya, and Toyota BZ4X (amongst several others).

Combustion-only petrol and diesel volumes were down YoY, and their market share fell to 40% from 50% YoY.

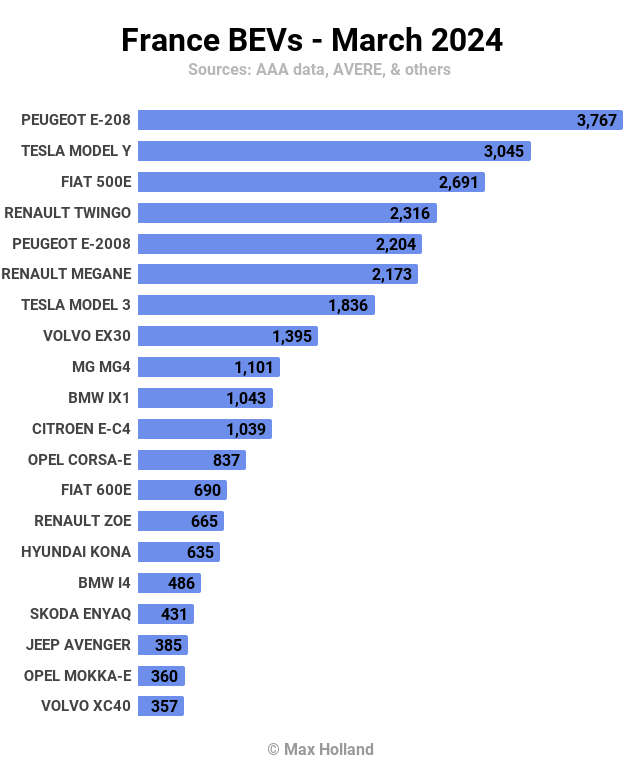

Bestselling BEVs

For the third consecutive month, the Peugeot e-208 was France’s bestselling BEV, with 3,767 units.

In second place was the Tesla Model Y, and in third was the Fiat 500e — a swap of their positions from last month.

The Renault Twingo had a strong climb to 4th, from 9th last month. This rise may be a result of the social leasing program. Likewise with the Peugeot e-208, which climbed from 15th to 5th.

Even the Renault Zoe, now in its final month of production, saw a fairly strong climb, from 20th to 14th. The Zoe was a truly pioneering car when it first went on sale in December 2012. With close to 450,000 lifetime sales, and Europe’s annual bestseller for a couple of years, it made a huge early contribution to the EV transition. RIP Zoe, you will be missed.

In 8th position and a new record of 1,395 units, the new Volvo EX30 has done well since its January launch. This will be its high water mark for the medium term, as the EX30 is among those models whose access to the purchase incentive was cut after March 15th, as mentioned above. We can also expect the MG4, which took 9th position in March, to see a big hangover in the coming months, for the same reason.

There were no debutants in March, but the new BMW iX2 climbed to 277 units, from 99 units in its debut, last month.

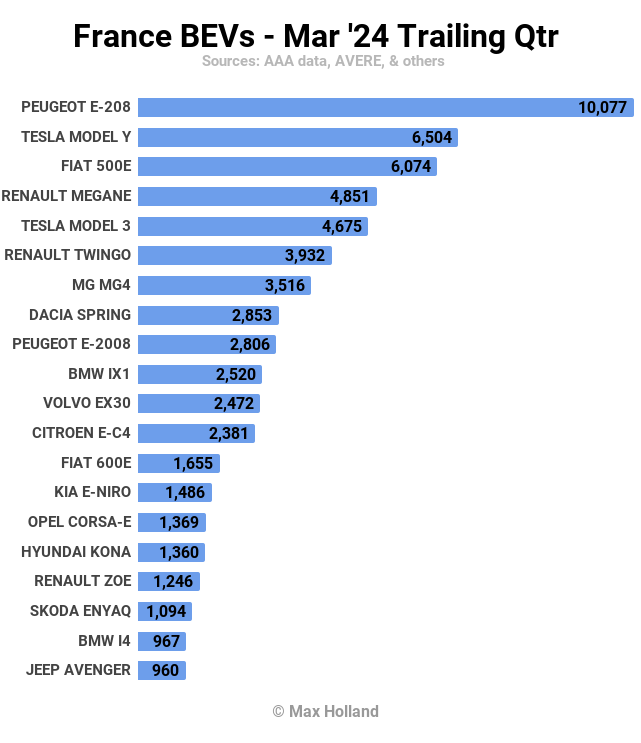

Let’s look at the Q1 rankings:

The Peugeot e-208 is showing its strong lead, over 50% more volume than the runner up, Tesla Model Y, and a big climb from its 2023 Q4 rank of 7th place. The Fiat 500 comes in third, just behind the Model Y.

The Tesla Model 3 and the Dacia Spring are already sliding down the rankings, losing 4 and 5 spots respectively, since both are victims of the March 15th incentive cut-off. We can also expect the Volvo EX30 and Kia e-Niro to quickly disappear from the top 20 over the next two months, both also now left out in the cold.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Outlook

Although not as weak as neighboring Germany, the French economy is not in great shape. We don’t yet have updated GDP figures beyond those for Q4 2023, which showed YoY growth of 0.7%. Headline inflation moderated to 2.3% in March. Interest rates have been sitting at 4.5% since mid-September. Manufacturing PMI fell to 46.2 points in March from 47.1 points in February.

The economic environment does not look good for auto market health, nor for the speed of the EV transition. We also know that in April, some of the most popular BEVs — those made outside Europe — will see a crash in sales due to being cut off from incentives. The temporary boost from the social leasing scheme will also cool off in the next couple of months.

Meanwhile, even though BEV batteries and cells are at record low costs, there are still no great value and truly affordable BEVs offered on the European market. I recently documented how “Europe’s most affordable BEV,” the Dacia Spring, is still way overpriced in Europe compared to what it costs to produce. Other BEV models see MSRP pricing which is even more elevated.

Social leasing schemes are obviously a way of trying to temporarily compensate for this underlying lack-of-affordability. Meanwhile, European car makers are nevertheless making record profits? And now good value BEVs from outside Europe are effectively demoted in France… What’s wrong with this picture?

What are your thoughts on the French EV market? Please join in the conversation below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.