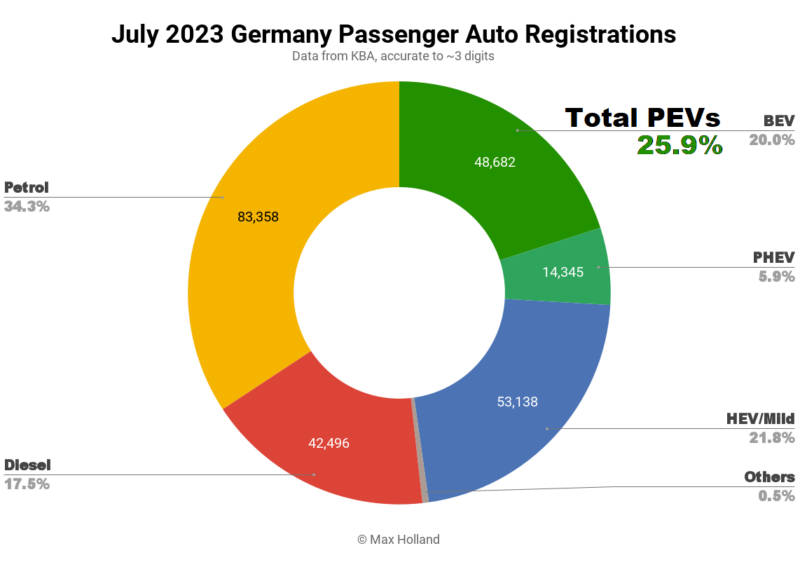

July saw plugin EVs take 26% share in Germany, up from 25.5% year on year. Behind the apparently scant growth, full electrics grew share by 1.43x to 20.0%, whereas plugin hybrids lost share. Overall auto volume was 243,277 units, up by 18% year on year, though still below long term seasonal norms (over 300,000). The Volkswagen ID.4/5 was the bestselling full electric, and the BMW i5 made its market debut.

With July’s combined result seeing plugin EVs take 25.9% share in Germany, full electrics (BEVs) contributed 20.0%, and plugin hybrids (PHEVs), 5.9%. The respective figures a year ago were 25.5%, 14.0%, and 11.5%. We can see that the weighting has shifted strongly to BEVs, with PHEVs losing half their share YoY, just like they did last month.

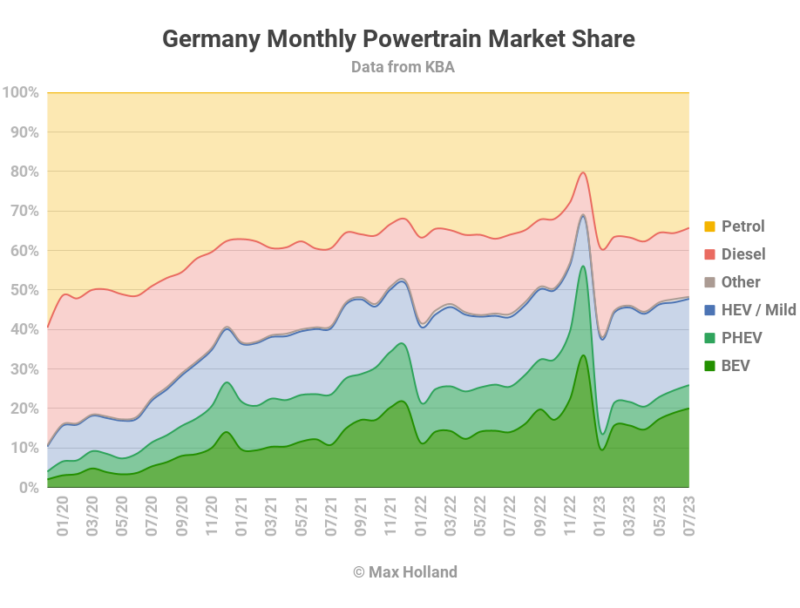

This same shift in weighting towards BEVs has characterised every month of 2023 to date, coming off the back of the cancellation of ecobonus incentives for PHEVs from January 1st.

In terms of volumes, BEVs are up a significant 69% YoY in July, making up for the slow start to the year after also being subjected to trims to their incentives from January 1st.

The January incentive cut caused a disjunction at the time, with Q1 seeing just 13.2% YoY BEV volume growth. The market has now largely normalised, with the trailing 3 months seeing 60% YoY volume growth, a very healthy rate.

Combined combustion-only powertrains saw their share fall YoY, from 56.1% to 51.7%. Next up, we can expect to see them at under 50% in August, and close to 45% at the end of September.

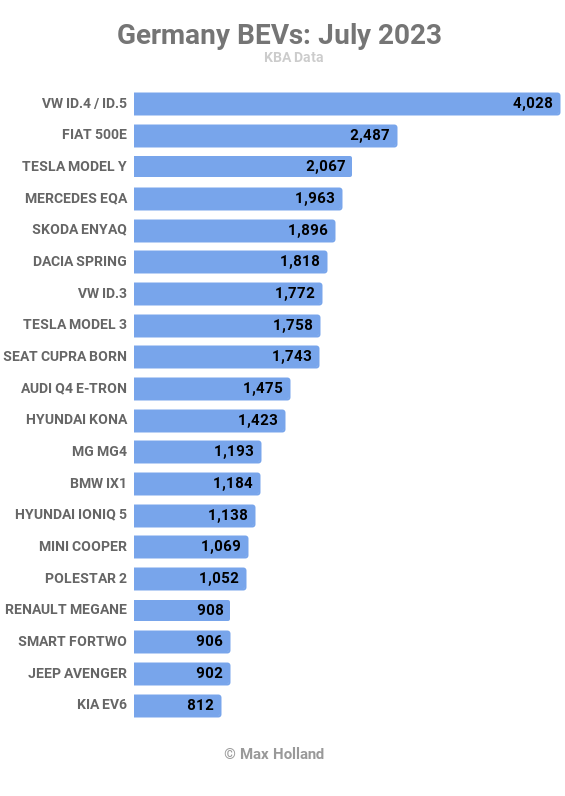

July’s BEV Bestsellers

With Tesla in a slower month for logistics, the Volkswagen ID.4/ ID.5 comfortably took the bestseller spot for July. The Fiat 500 took second, with the Tesla Model Y in third.

The Mercedes EQA had yet another record volume month, with 1,963 units, taking fourth. The Dacia Spring was back to good volumes in July (1,818 units), after a slow first half of the year, and took 6th spot.

Another notable result in the above chart was the new Jeep Avenger, which has already climbed into 19th position, having only just launched in the German market in May. Let’s see how far this B-segment SUV can climb.

Outside the top 20, the Opel Astra continued to grow sales since its March launch, to 342 units in July. The problem is that — starting from €45,000 — it is priced €3,000 more than the entry Tesla Model 3, which by most measures is a more competent all round vehicle. Unless the Astra’s pricing changes, it probably won’t reach near the top 20.

The BYD Atto 3 saw its first month of decent volumes in Germany (367 units, from a previous high of 53 last month). Although listing for over €40,000, deals can be had for well under.

Finally, and perhaps most ionically, BMW has now started selling an electric 5-series, the BMW i5, in its home market. The 5 series has been on the market since 1972, and has been a benchmark (the benchmark?) E-segment executive car in Europe for much of the past half century.

Now that the BMW i5 is being delivered to customers (first 252 units in July), it will be interesting to see how it gets on relative to its ICE siblings. It will never be a high volume vehicle overall, priced starting from €70,000, but will help to transition its segment to BEV. It has a WLTP range of 582 km, 10% to 80% charging in 28 minutes, and is able to recover 100km rated range, from near empty, in just 5 minutes.

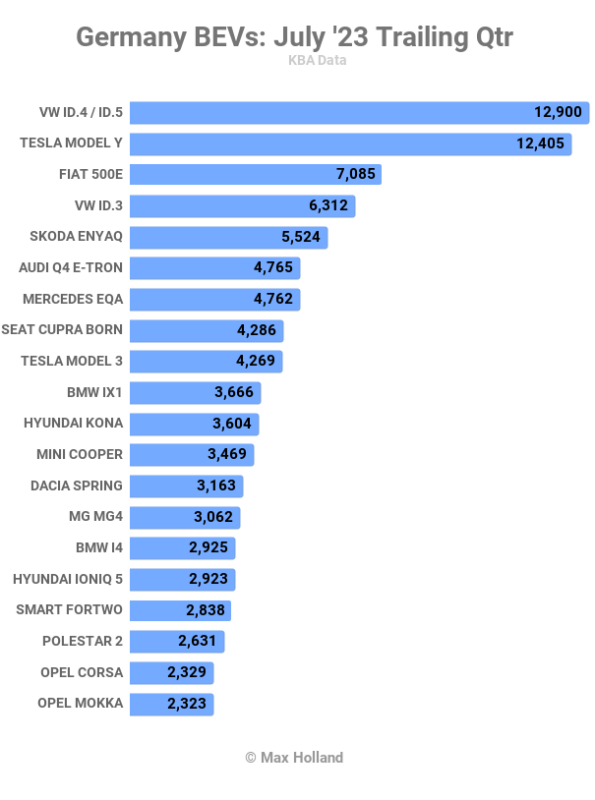

Now let’s turn to the 3 month picture:

Here, the Volkswagen ID.4/5, and the Tesla Model Y, have swapped position since the February-April period, and remain in a closely fought race for the top spot. Year to date, the Tesla has a strong lead (29,892 units, vs 22,405), and the company is still ramping production capacity at Berlin-Brandenburg.

Tesla has recently applied to double the factory’s capacity to 1 million units per year. On this basis, it looks likely the Model Y will maintain its overall lead in Germany in the months ahead, unless Tesla decides to prioritise deliveries to other European markets.

Outside this tussle, the Mercedes EQA has done well, climbing from 13th to 7th, from its recent record volumes mentioned above. Its closest domestic competitor, the BMW iX1 has also stepped up, from 16th to 10th.

Just outside the top 20, in 26th, the new Smart “#1” has increased volumes by 3x over the previous period, when it was in 44th position. If it can keep growing, it may be able to enter the top 20. This will depend on whether the brand chooses to diversify its European markets, or prefers for now to keep concentrating supply in Germany, via already established dealerships.

The Jeep Avenger, on sale for just 2 months, is still back in 36th position for now. But another couple of months on its current trajectory will see it well inside the top 20.

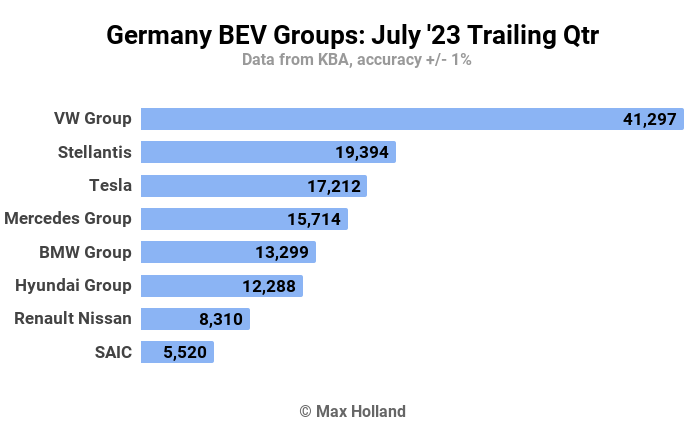

Let’s finally take a quick look at the group performance:

Here, Volkswagen Group have extended their strong lead over the runners up, but slightly lost share over the previous period (3 months to April) from 29.6% to 28.9%.

Stellantis’ share has grown strongly, from 10% to 13.6%, and overtaken Tesla, whose share fell dramatically (18.1% to 12.0%). This is likely down to country allocation decisions from Tesla, as their overall production growth rate remains high.

Other changes in rank and share were more modest, part of the usual ebb and flow.

Far down from the top ranks, Toyota group (Toyota, Lexus, Subaru) lost share from an already miserable 0.9%, down to 0.6%. Report card — stop daydreaming about hydrogen.

Outlook

The overall German economy remains in recession (negative 0.2% annual growth rate). The German central bank currently forecasts that the economy will shrink by 0.3% in 2023. Inflation remains high at 6.2%, with interest rates also high, at 4.25%. The combination of recession and high inflation is commonly known as stagflation.

The growth of BEV sales is largely responsible for keeping the auto retail figures positive, although domestic production of autos is less rosy, with the federal statistics office pointing to a 3.5% decline in production in June (latest figures).

With road fuel prices still high, the long term value of BEVs is still recognized by increasing numbers of auto buyers, especially when plugged in on cheap overnight electricity tariffs.

What are your thoughts on Germany’s transition to EVs? Please jump in below to join the discussion.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …