Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

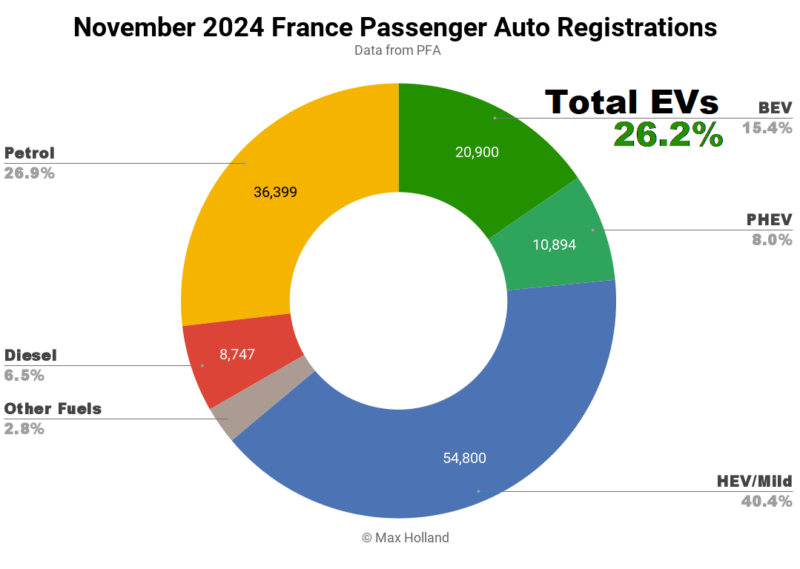

November’s auto sales saw plugin EVs take 26.2% share in France, a drop from 29.7% year on year. Both BEV share and PHEV share fell YoY. Overall auto volume was 133,320 units, down by around 13% YoY. The new Renault 5 was the best selling BEV in November.

November’s sales tallies saw combined plugin EVs take 26.2% share in France, with 17.4% full battery-electrics (BEVs), and 8.8% plugin hybrids (PHEVs). These compare with YoY figures of 29.7% combined, 20.1% BEV, and 9.4% PHEV.

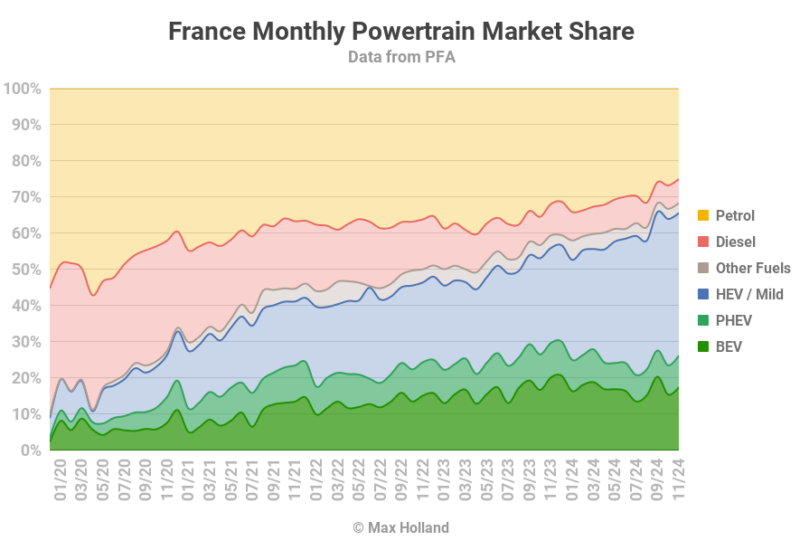

The YoY fall in BEV share (and volume) is disappointing, though partly explained by a high YoY baseline due to the start of a pull-forward of some sales in late 2023 ahead of incentive cancellation for China-made BEVs in mid-March. The temporary government social leasing programme enacted from spring 2024 also pulled-forward BEV sales ahead of the end-of-September deadline for delivering on those leases (recall September’s pull forward). So we are looking at the combined effects of a temporary hangover, plus a high YoY baseline.

Meanwhile PHEV share also fell YoY, although was higher than recent months. As with the previous two months, the HEV segment has seen the highest growth, with volume up 31% YoY, to 52,462 units. Recall that the PFA’s data methodology rolls traditional HEVs and mild-hybrids together, however. Around half the sales in this segment are in fact mild-hybrids, which are little more than a band-aid placed over simple combustion-only powertrains, in an effort to cheaply improve their emissions to meet tighter regulations.

In short, don’t mistake HEVs, and especially mild-hybrids, for new technologies that have a bright and lasting future. These are now window-dressing technologies designed to breathe a few years more life into old-tech ICE engines, in an era which is rapidly transitioning toward fully electric propulsion.

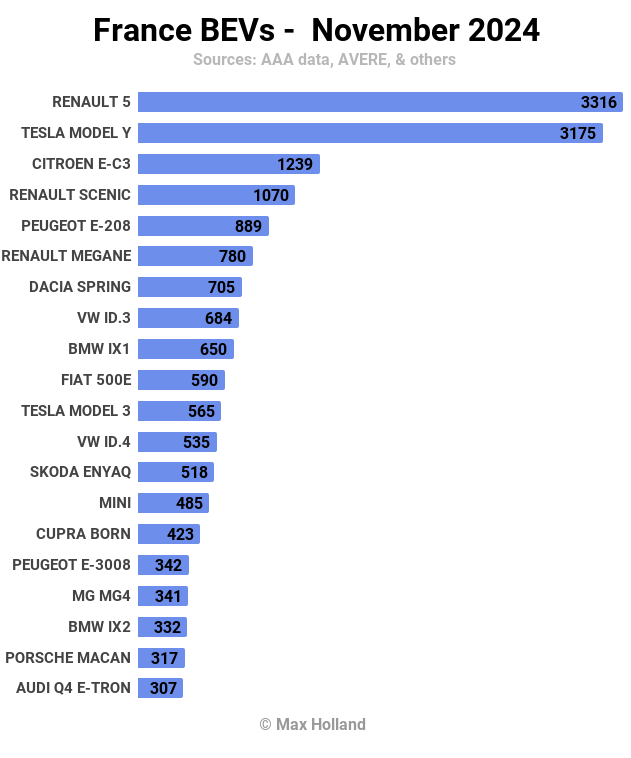

Best Selling BEV Models

November saw a new BEV model take the top spot in the sales rankings, the Renault 5, with 3,316 units. This is a great result for the new somewhat-affordable Renault, and is surely the first of many top-spots in the next year or two.

In a close second place was the long-term leader, the Tesla Model Y, with 3,175 units. A long way back in third spot was the Renault’s nearest direct competitor, the new Citroen e-C3, with 1,239 units, stepping down from the lead it held in September and October.

The Dacia Spring was back to decent volume in November (705 units and 7th position), despite now being ineligible for purchase incentives, and being subject to the EU’s WTO-rules-violating unilateral import tariffs. Dacia (or rather, Dongfeng Renault) have obviously decided to take the margin hit, and return to selling the Spring in decent volume.

The Dacia Spring was back to decent volume in November (705 units and 7th position), despite now being ineligible for purchase incentives, and being subject to the EU’s WTO-rules-violating unilateral import tariffs. Dacia (or rather, Dongfeng Renault) have obviously decided to take the margin hit, and return to selling the Spring in decent volume.

The Spring’s official MSRP, at €18,900 in France (though for the non-base 65 HP variant) remains close to what it was previously, but the demand is coming via very affordable leasing deals – now available for €89 / month after a €3,000 first payment. This compares well with current lease pricing of €99 / month for the Citroen e-C3, after a much higher €10,000 first payment.

Note that the more attractive Citroen leasing deals (effectively a €1,000 first payment, after incentives) that were once temporarily available as part of the social leasing programme, are now no longer available. The ending of the social leasing programme, and the Citroen effectively being no longer the cheapest choice, seems to explain the timing of the revival of the Spring to decent volume. Let us know in the comments if you have insights into these dynamics.

As usual, the French industry body (PFA) that reports on the auto market, does not freely provide detailed BEV sales data, so we can’t detect newly debuting BEV models in November. BEVs models have to enter the top 20 before we can typically spot them (and remain in the top 20 to accurately track them over time).

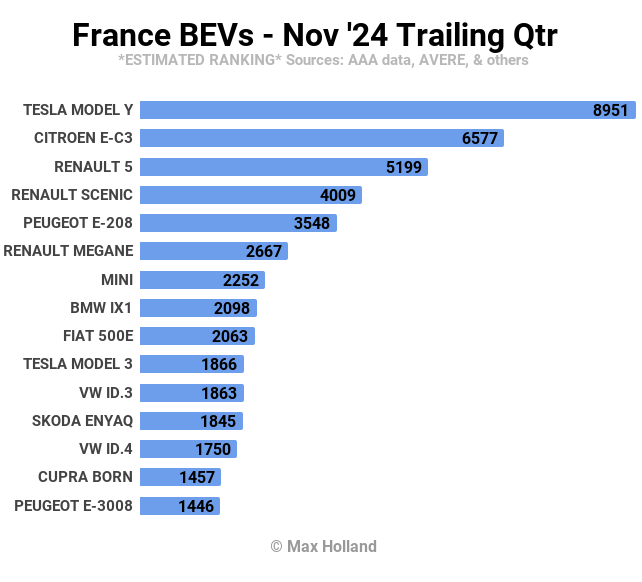

Here’s the 3-month ranking, within which we can define the top 15 best sellers: We can see that the Tesla Model Y has a strong lead in the longer-term chart, as it does in so many other European markets. Its volume is 36% ahead of the nearest runner-up, the Citroen e-C3. We can expect the e-C3 to perhaps close this gap slightly in 2025, and it will play a vital role in stimulating segment competition at the affordable end of the market. This in turn will force all other segments to become more competitive too. Price-competition has long been missing in Europe, which has dramatically slowed the EV transition.

We can see that the Tesla Model Y has a strong lead in the longer-term chart, as it does in so many other European markets. Its volume is 36% ahead of the nearest runner-up, the Citroen e-C3. We can expect the e-C3 to perhaps close this gap slightly in 2025, and it will play a vital role in stimulating segment competition at the affordable end of the market. This in turn will force all other segments to become more competitive too. Price-competition has long been missing in Europe, which has dramatically slowed the EV transition.

Globally best-selling cars tend to be those closer towards the middle of the bell-curve (the Beetle, Golf and Corolla were never “the cheapest cars” of their eras, but were the most popular). As for price-point, the Model Y is probably too expensive to remain the best seller for many more years (unless it reduces in price), as more and more varieties and prices of BEVs become available. Currently, Tesla’s holding the title of best-selling-model is significantly maintained by its accompanying unique selling point – access to the world’s most widespread, easy-to-use, reliable, and reasonable-cost charging network.

Tesla knows this, of course, and that’s one of the reasons why the company isn’t in a rush to sell a cheaper, more simple model (which would give consumers much of the Tesla “value” – the charging network – for much less money). Individual BEV models from other brands (at pricing close to the equivalent of a Beetle or Corolla) won’t compete one-to-one with a “single” Tesla model worldwide until general BEV charging networks are much more ubiquitous, reliable, and cost-competitive, which will take a good few years. We might benefit from CATL, BYD, LG, and Samsung getting together to collaborate on a competitive global charging network to accelerate the EV transition.

Once charging network maturity draws near, Tesla may finally release a lower-cost model, and thus perhaps maintain an over-weighted single model in the top BEV spot for a while longer, but eventually the distribution and relative weighting of BEV models will spread out — and more closely match that of the historical auto market.

With legacy makers like Citroen and Renault now starting to compete in the competent-but-affordable BEV space, and Hyundai starting to bring the Inster, where is Volkswagen Group? The ID.3 launched in late 2019, and no more-affordable model has been released by VW Group since. There’s talk of an ID.2 (and other-branded siblings) coming at some point in 2025, but the competitors are already selling in volume today.

Outlook

France’s broader economy is still not in great shape, though better than the average European economy, and much better than neighbouring Germany. Latest French data saw a Q3 2024 YoY GDP figure of 1.2%. Official inflation crept back up to 1.3%, and (ECB) interest rates came down to 3.4%. Manufacturing PMI is still stubbornly negative, falling to 43.2 points in November, down from 44.5 points in October.

European auto-makers are now lobbying EU politicians to water down EV transition targets, claiming that the market is not ready – whilst concealing the fact that they themselves have for years deliberately been keeping their BEV prices over-inflated and inaccessible (while making record profits). Let’s see if the EU politicians fall for this nonsense.

What are your thoughts on France’s EV transition? Have you test-driven, or are you considering purchasing one of these new-generation more affordable small BEVs from the European brands? Please share your experience and perspective in the comments section.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy