Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

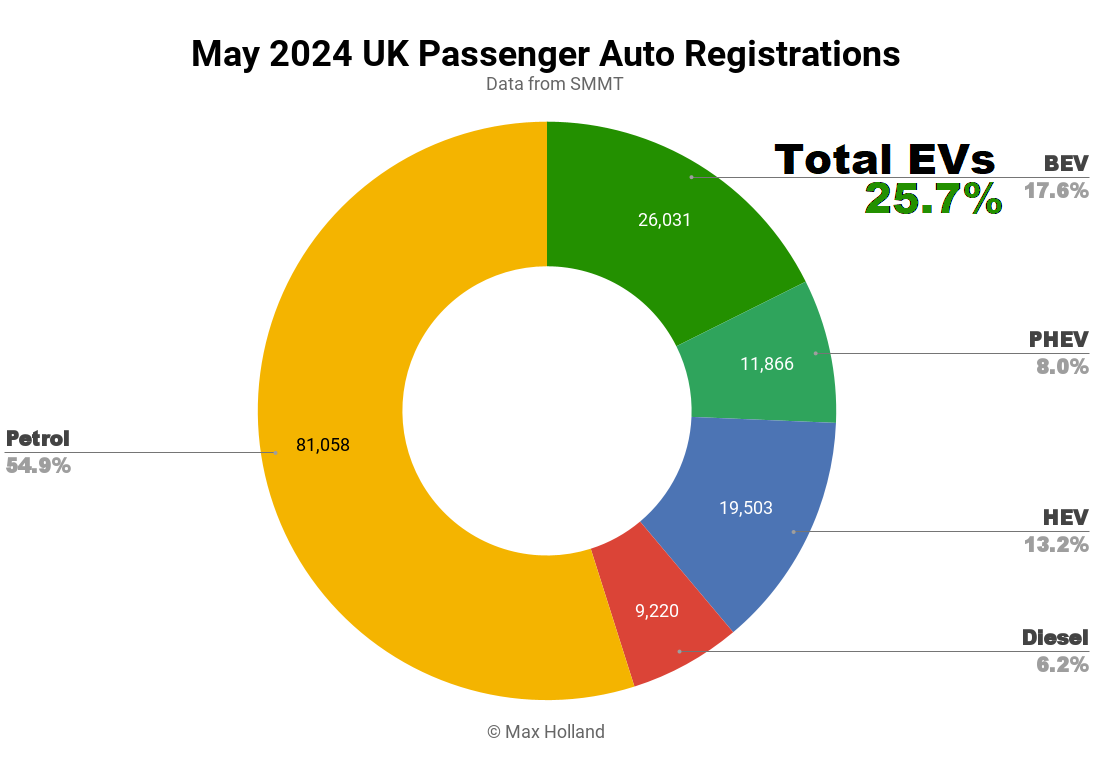

May saw plugin EVs take 25.7% share of the UK auto market, up from 23.1% year on year. Most of the gain was from PHEVs, whilst BEVs barely improved. Overall auto volume was 147,678 units, up by some 2% YoY, and still below pre-2020 norms (~175,000). The UK’s leading BEV brand in May remained Tesla.

May’s result saw combined plugin EVs take 25.7% share of the UK, with full electrics (BEVs) taking 17.6%, and plugin hybrids (PHEVs) taking 8.0%. These compare with YoY shares of 23.1% combined, with 16.9% BEV, and 6.2% PHEV.

We can see that most of the modest growth in market share came from PHEVs (contributing 1.8% more share YoY), whereas BEVs only won 0.7% more share. At this BEV growth rate, it would take almost 120 more years to reach 100% BEV. A rather miserable state of affairs, clearly.

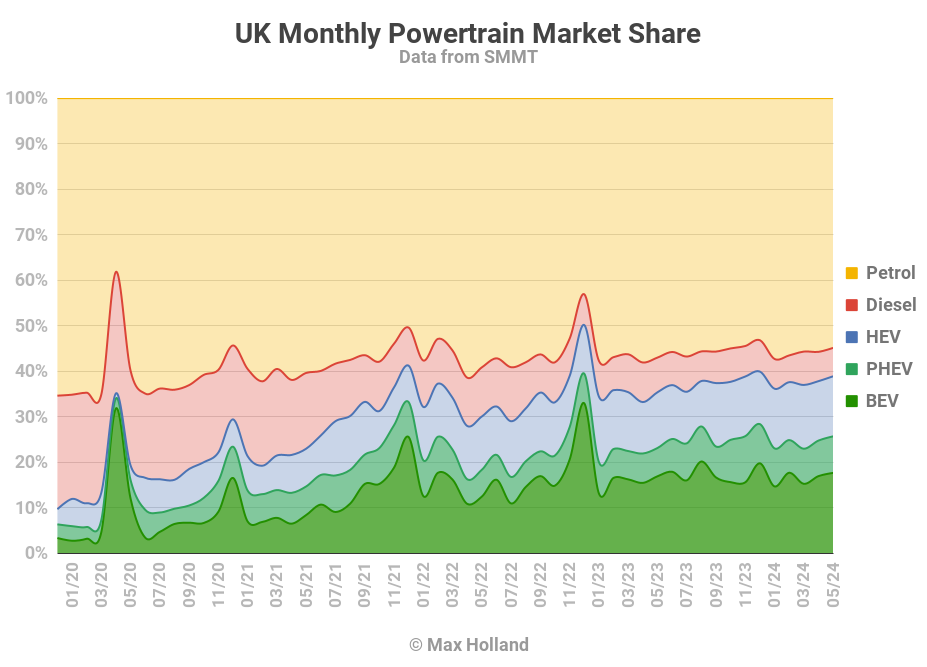

Looking back at the trajectory over the past 4.5 years (see also graph below), year-to-date cumulative BEV share stood at 0.9% in May 2019, 4.3% in May 2020, 7.5% in May 2021, and 14.0% in May 2022. That period represented a strong trajectory. But that was the end of it! A year ago the share had barely grown, to 15.7%, and now it has moved even less, to 16.1%.

Meanwhile — beyond Europe (where this miserable picture is commonplace) – the global market for EVs has increased every year, by an annual average of 59%, fairly continuously since 2019 (see Jose’s global reports). The transition has not slowed down from 2022 onward. With that continuous 59% annual growth in EV sales, of course the production of EV batteries, motors, and other EV components has also continued to scale up massively every year, with increasingly lower and lower costs.

With these rapidly lowering costs, the average price of LFP EV battery cells moved below $52 (€48) per kWh in April, this means that a basic 50 kWh pack costs well under $3,500 at this point. The rest of the powertrain (integrated inverter-motor-reduction unit, plus AC charger, and other power electronics) can be sourced for around $1,500 for large orders. Then there’s the savings on all the unneeded ICE-related (and emissions) components. Overall the net EV cost increment to install a BEV overtrain, compared to an ICE powertrain is now not much more than $3,000 (€2750). Simple ICE vehicles, like the Fiat Panda are sold in Europe from under €10,000 in some markets. So where are the simple 40 kWh to 50 kWh sub €15,000 BEVs?

They do exist in the competitive Chinese market, but in the UK and Europe, such affordable BEVs are nowhere to be found. The latent demand exists, every consumer-focused auto market publication repeatedly tells us that average drivers in Europe are crying out for affordable BEVs in order to make the switch, and yet legacy auto are refusing to offer them, and instead focusing on record profits.

I’ve quoted before from the October 2023 JATO Report (here’s the source) which clearly spells out the recent tactics taken by legacy auto:

“[European prices] continue to rise…. To buy an EV, consumers would need to spend at least €18,285 in Europe and €24,400/$26,500 in the US. This is 92% and 146% more expensive than what they would pay for the cheapest combustion car available, respectively … largely due to the industry’s continued focus on premium EVs ahead of more widely affordable mid-range [vehicles] … many Western carmakers increased their prices while consumers were made to wait longer for new vehicles. For many OEMs this strategy paid off. In 2022, most of these companies reported fewer units sold, but higher revenue and record profits.” (JATO’s “EV Price Gap” report, October 2023)

At the same time, the SMMT, which is the UK’s auto industry lobby association (representing the interests of Toyota, VW Group, Stellantis, and the rest), has just said:

“With a choice of more than 100 EV models now available, and a raft of compelling offers, manufacturers are dedicated to driving change, but meeting targets will require more support. Manufacturer discounting cannot be sustained indefinitely as it undermines the ability of companies to invest in next generation technologies. The [weak] market performance underlines the need for the next government to provide private consumers with meaningful purchase incentives.” (SMMT statement, my emphasis)

This is narrative spinning and obfuscation (or smoke and mirrors, if you prefer). Isn’t the paying out of record profits and record executive bonuses the most direct way to “undermine the ability of companies to invest in next generation technologies”? And why refer to it as “next generation”, when most European brands were already showcasing prototype BEVs in the 1990s.

The truth is that most of these legacy auto corporations don’t want to transition, and many of them have actively lobbied against energy efficiency policies in a variety of international markets (see Zach’s recent report). They instead want to continue to extract more profits from their legacy technology investments (and IP) around combustion engines.

The simple truth is that we need less profiteering and more competition in the European auto market, especially from manufacturers which are willing to make affordable BEVs.

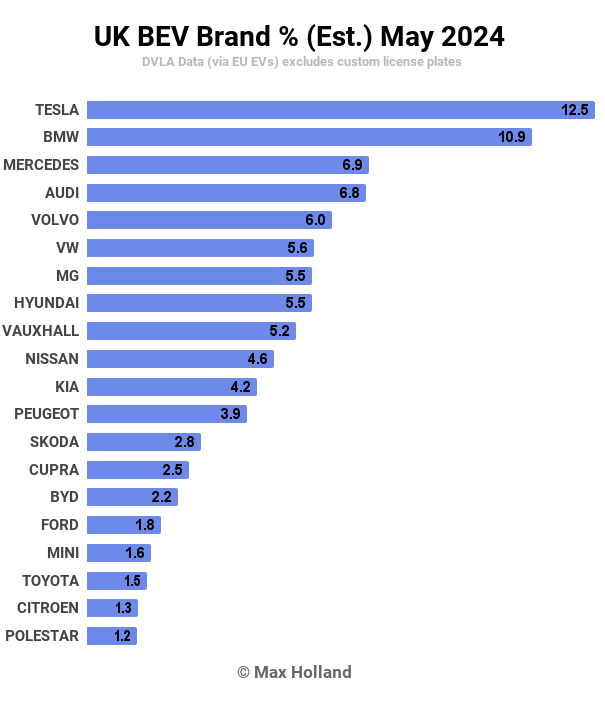

UK’s Top Selling BEV Brands

Tesla was the most popular BEV brand in the UK in May, with around 12.5% share of the BEV market. The Tesla Model Y was the most popular model.

Not far behind, in second place, was BMW, with 10.9% share. The BMW i4 sedan was its most popular model, with the iX1, i5, iX, and iX3, playing supporting roles, each with several hundred registrations.

In third was Mercedes-Benz, with 6.9% share, only fractionally ahead of Audi in 4th (6.8%). The popular Mercedes models were the EQA and EQB, and for Audi, the Q4 e-tron carried over 80% of the brand’s sales (second in volume only to the Tesla Model Y, in fact).

Other strong performers remain the usual suspects — Volvo, Volkswagen, MG Motor, and Hyundai — with some jostling in ranking.

After being well outside the top 20 since December, Mini is back (17th spot), thanks to a refreshed and technologically updated Cooper model, and the addition of the new Countryman CUV. Mini offers both models with options for decent range (~250 miles WLTP), allowing all-round competence. Unlike Minis of old, these are not at “Everyman” prices, with even the small battery versions (~177 miles WLTP) starting from £32,200.

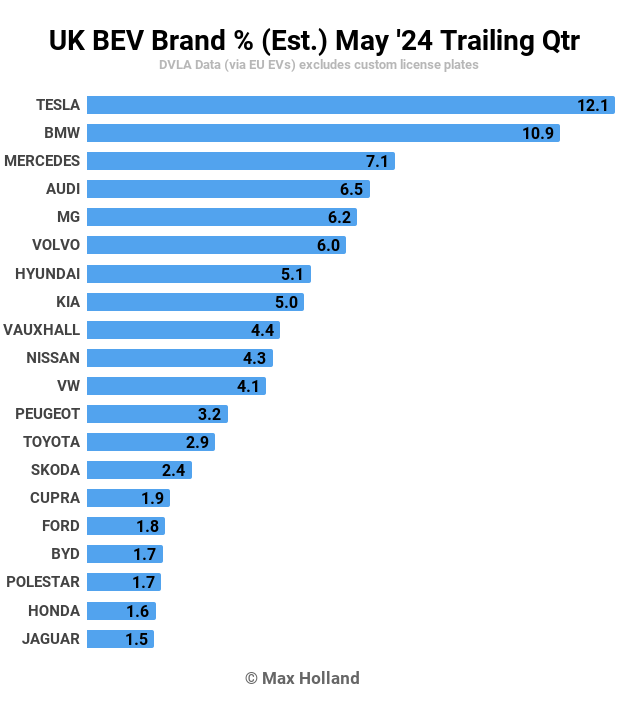

Let’s check up on the longer term ranks:

The top 5 ranks have the same players as three months ago, only Audi and MG have swapped positions. Tesla and BMW remain well ahead of other brands, though with their respective shares cooling to 12.1% (from 15.9%), and 10.9% (from 11.3%), over the period.

Further down the rankings, positions remained mostly stable, with no big surprises. Volvo climbed up two spots to 6th, thanks to the success of the new EX30.

According to calculations by New Automotive, year to date progress towards the UK’s new 22% ZEV mandate is slow for some big auto brands. The worst laggards are Suzuki at 0%, Mazda at 4.3%, Renault at 4.9%, Ford at 6.5%, and Jaguar Land Rover at 6.6%. In the low teens are Volkswagen, Toyota, Nissan, and Honda.

All these legacy auto brands have work to do to get close to the 22% target by the end of the year.

Outlook

Beyond the roughly flat auto market, the wider UK economy remains very weak, with Q4 2024 registering 0.2% growth, from -0.2%, 0.2%, and 0.2%, in preceding quarters. Inflation reduced to 2.3% in April (latest data), and interest rates remained very high, at 5.25%. Manufacturing PMI was 51.2 points in May, up from 49.1 in April.

With the UK’s SMMT constructing narratives to try to boost auto maker’s profits, whilst painting them as suffering whilst making sincere efforts, in reality, it is clear that legacy auto is having to be dragged kicking and screaming into the transition (again, see Zach’s report).

Fortunately the UK’s 22% ZEV mandate for 2024 (with some wiggle room), is laying out the ground rules with heavy fines for failure. Furthermore, the bar will rapidly ratchet up in the coming years.

What are your thoughts on the UK’s auto market and transition towards EVs? Please dive into the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.