Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

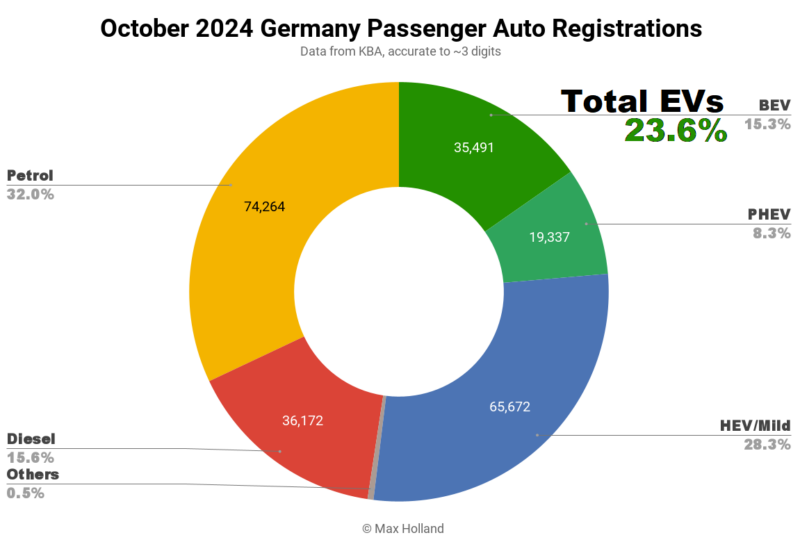

October saw plugin EVs take 23.6% share in Germany, down from 24.5% share YoY. BEVs in Europe’s largest auto market are now even below the levels of October 2021. Overall auto volume was 231,992 units, up 6% YoY. The bestselling BEV in October was the Skoda Enyaq.

The October auto market saw combined EVs take 23.6% share in Germany, with full electric vehicles (BEVs) at 15.3% share and plugin hybrids (PHEVs) at 8.3%. These compare with YoY figures of 24.5% combined, 17.1% BEV and 7.5% PHEV.

The October auto market saw combined EVs take 23.6% share in Germany, with full electric vehicles (BEVs) at 15.3% share and plugin hybrids (PHEVs) at 8.3%. These compare with YoY figures of 24.5% combined, 17.1% BEV and 7.5% PHEV.

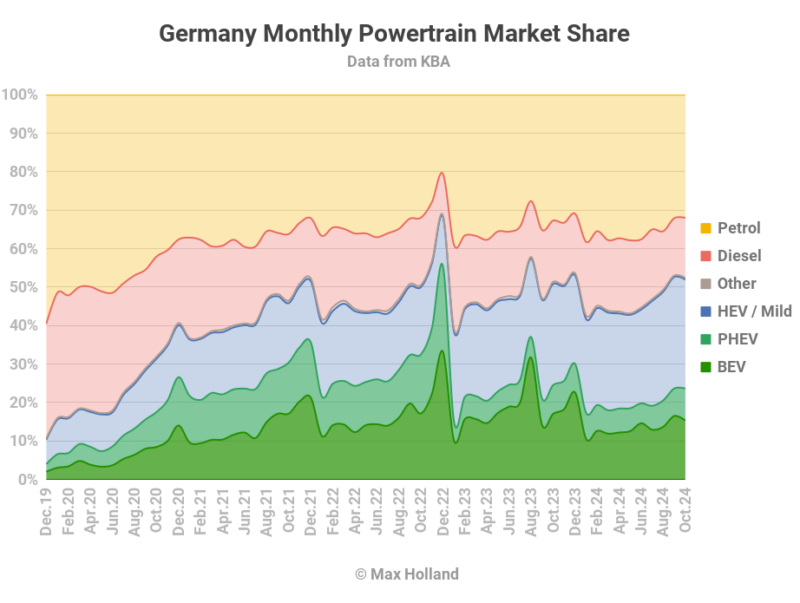

The final quarter of each year has typically seen an uptick in EV sales, at least since 2020. This year, however, EV share has fallen back so much that last month’s share was below the level seen in October 2021 (17.1% BEV and 13.3% PHEV). This is a sorry state of affairs, particularly since one of the parties of the German coalition government is “The Green Party”.

The German economy is in recession, and has been for most of the past 2 years. Legacy auto makers’ decades of rent-seeking from their ICE technologies have left them far behind the curve on BEV costs (and affordability), now made far worse by eye-watering energy costs (fatal for an industrial economy like Germany).

As a consequence, hard up consumers are not in a position to stretch for (overpriced) BEVs. The abrupt unplanned cancellation of BEV incentives in late 2023 was also a bitter pill for the transition.

Year-to-date BEV sales now stand at almost exactly the same level seen in the same period of 2022, and far down (>25% down) from 2023’s equivalent.

Meanwhile, both diesel and petrol vehicle sales have actually increased YoY. This implies that the overpricing of BEVs is a bigger factor (in their sales slump) than simply the weak consumer economy. If BEVs were outcompeting ICE vehicles on price (as they are in tech-forwards China), they would of course be growing very rapidly – would appeal more as “the smarter choice” during a recessionary squeeze – and would have overtaken plugless vehicle sales (as they have in China).

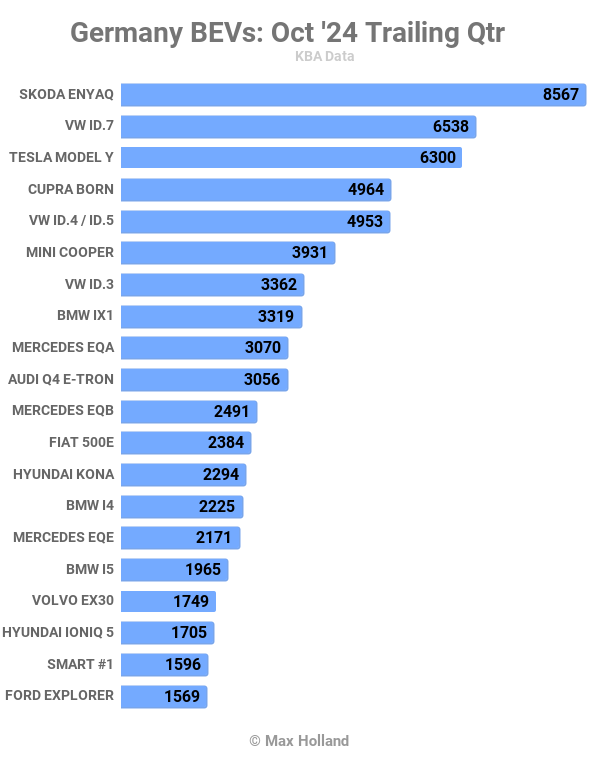

Best Selling BEVs

Best Selling BEVs

With Tesla going slow in October, Skoda had a chance to take back the leading spot for BEV models, with the Enyaq registering 3,312 units.

The Volkswagen ID.7 took second spot with 2,427 units, and the ID.4 / ID.5 came in third, with 2,174 units.

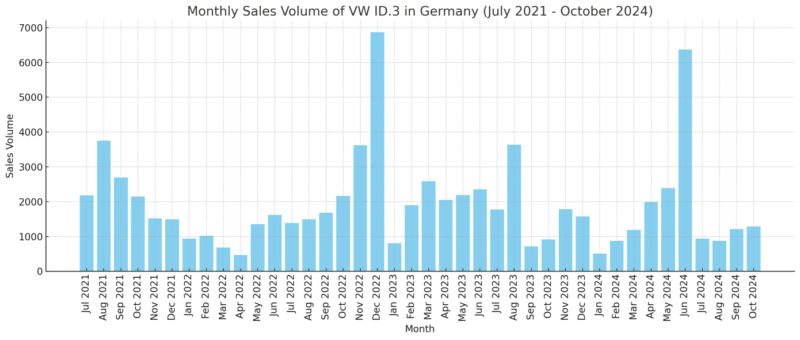

Volkswagen group is – for some reason – quite erratic in monthly sales volumes for several of its BEV models in the home market of Germany (and we see some of this irregularity in Sweden and Norway also). This leads to noticeable swings in rankings as different models are given a boost, at seemingly random times (e.g. Enyaq or ID.4, Born or ID.3), and then fall back again.

For bread-and-butter BEVs like the Volkswagen ID.3, in a large market like Germany, demand doesn’t change erratically between adjacent months. Production for domestic ID.3 sales is made locally, so there should be no long shipment times, and Volkswagen presumably has decades of experience with smooth and relatively efficient logistics around Europe.

So what explains the ID.3’s abrupt ranking variance month-to-month? In January it was ranked 12th, then — 8th, 6th, 2nd, 1st, and 1st (June). From July onwards, it has been 13th, 11th, 8th, and now 6th (October). This is not simply a story of the ID.3 staying steady but being messed up by Tesla dipping in and out each quarter to disrupt the rankings. The ID.3’s own domestic sales volume over the past 3+ years has been highly erratic:

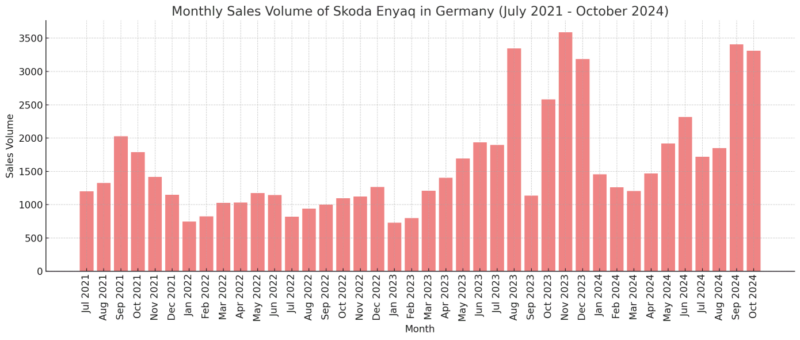

Similar (though less extreme) patterns also exist for the ID.4 / ID.5, and their cousins, the Skoda Enyaq, and the Cupra Born. Case in point for this month, the Skoda Enyaq (leading the sales rankings for the past two months) has also been up and down the rankings, though to a much lesser extent than the ID.3 Here’s the Enyaq’s monthly volume chart:

There seems to be a 6-month sub-pattern from mid-2021 to mid-2023, after which there is less of a pattern (no pattern?). Can any of our readers enlighten us please — in the comments? Is there method to this madness at Volkswagen Group?

With this variance for the large volume models, I won’t deeply analyse the changes in ranking in October, but to note some newer models that are entering (or nearing) the top 20 for the first time. The new Porsche Macan, which launched in August, further improved on its great September score of 536 units (and 20th spot), with 834 units and 14th spot in October.

Further back, the Renault Scenic (now 5 months old in Germany) is still finding its place, with 31st spot and 285 units. It’s not clear if the Renault will be able to climb very much further from here, although it is a very well balanced BEV and reasonably good value. It faces challenges from brands with more local support, including Volkswagen Group’s Cupra brand (with Spanish verve) and its new Tavascan (which debuted in August). The newcomer was one spot behind the Renault, in 32nd place, with 276 units in October. Its older, smaller brother, the Cupra Born, sometimes hits the top 5 in Germany, so surely the Tavacan has a lot further to climb?

The final recent-release to take note of is the new Renault, the “R5” as it’s called in the German market. Recall that this saw 25 dealer units in August, though then went quiet in September (1 unit). In October the Renault R5 came back with its first proper customer volumes, with 160 units and 43rd ranking, a decent start.

Obviously we can expect the Renault 5 to climb much further from here, but is it destined for Germany’s top 20, and if so, how long might that take? Small BEVs from the BMW-owned MINI brand already have good traction in Germany, and a similar sized BEV from Renault will have to strongly undercut the Minis on price to compete. Don’t forget the Smart #1 which is often in the top 20 also! If the Renault can be marketed as “more affordable” than other superminis, it might have a chance to hit Germany’s top 20.

There were a few BEV debutants in October. The new Ford Capri landed with 45 units, and will rise from here. Its sibling the Ford Explorer has already proven popular in Germany, ranking around 20th place soon after its own launch, so there’s every chance for the Capri to see similar popularity.

The new Volvo EX90 also launched in October, with 17 initial units. Other than the VW ID.Buzz, there are no home-grown 3-row competitors to the EX90, so it has a chance to be the popular choice for those who need this kind of people-carrier. But to do so, it will have to overcome the very capable Kia EV9, which is arguably better value.

Talking of Kia, its new generation of compact SUV, the Kia EV3, has now launched in Germany, seeing 12 initial units. Based on a new dedicated BEV architecture, the EV3 will eventually replace the legendary Kia Niro, which broke new ground for BEV capability-and-value when it launched in 2018. The Niro is still selling well, and has almost always been well inside Europe’s top 20 best selling BEVs over the past 5 years. In a year from now, however, we can expect the Niro to fade into the shadows as the EV3 reaches peak production volumes, and takes over.

Finally the much anticipated Citroen e-C3 has now launched in Germany, with 12 units in October. We saw commercial volumes launched in the home market of France in September, and October has now seen debuts in Sweden, Norway, and Germany (as well as Italy, Spain, the Netherlands, and a few other markets).

Unlike in France, Spain and Italy, where small cars are always very popular, the German market has favoured its entry size vehicles being slightly larger (most popular being compacts like the VW Golf), but the Fiat 500 and Mini Cooper have strongly bucked that trend in the past couple of years. There’s thus every chance that these smaller cars like the Citroen e-C3, and the Renault 5, could prove almost as popular in Germany as they are in France.

The new Citroen starts from €23,300 in Germany, much more affordable than most other simple-but-competent BEVs (but notably, still far more expensive than entry level ICE cars in Europe — whereas BEVs already undercut the cheapest ICE cars in China).

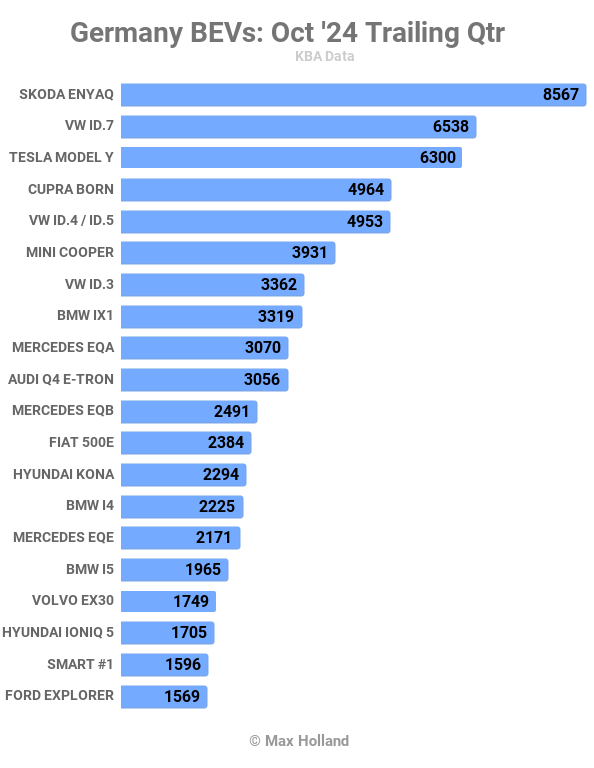

Let’s now glance at the 3-month chart:

Here the Skoda Enyaq’s recent two months at the top of the monthly chart (and prior two months in second place) have secured it a decent lead over runner-up, the Volkswagen ID.7, and the Tesla Model Y in third.

Here the Skoda Enyaq’s recent two months at the top of the monthly chart (and prior two months in second place) have secured it a decent lead over runner-up, the Volkswagen ID.7, and the Tesla Model Y in third.

It’s worth mentioning that the Tesla Model Y still leads the Enyaq by around 25% in volume in the year to date race. The Tesla will likely keep or extend that margin by the end of December.

Since launching around a year ago, the VW ID.7 has done remarkably well to climb to second place in the trailing 3 months — very unusual for a non-SUV (or non-CUV) in this era.

The new Ford Explorer has done very well to reach 20th in the chart after only 3 months of customer deliveries. Just behind, in 23rd spot, the new Porsche Macan is also climbing rapidly, and we can expect it to climb above 15th spot by the end of December.

Will the Citroen e-C3 enter the top 20 by the end of the year, or will we have to wait until Q1 2025 to see that? Which other incoming models do you think will be popular in Germany?

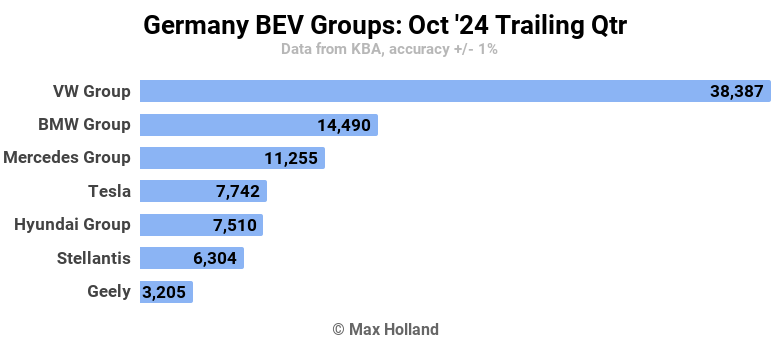

Here’s the ranking of BEV manufacturing groups in Europe’s largest auto market:

Volkswagen Group has a strong lead, and has pulled further ahead by taking an additional 5.2% of the market since the prior period (May to July). BMW group also grew its share, taking a further 2.4%, remaining in second place.

Most other moves were very modest. Ford is now just one place off from entering the chart, with 2,041 units, and 2.1% share. As the new Ford Capri ramps up, we may see Ford potentially take 7th spot from Geely sometime in H1 2025, let’s keep an eye on that.

Outlook

We discussed above the important brake on EV progress that Germany’s weak consumer economy is exerting, exacerbated by BEVs still being priced much higher than ICE cars.

The country’s economy remains weak, with the recent Q3 2024 update to GDP data recording negative 0.2% annual growth, though not as bad as the negative 0.3% of Q2. Headline inflation crept back up to 2% in October, having moderated to 1.6% in September. ECB interest rates have reduced further to 3.4%, from 3.65% in September. Manufacturing PMI improved from the very weak 40.6 points in September, to a still weak 43.0 points in October.

What does the future path of Germany’s EV transition look like? Will the incoming, less expensive BEVs, like the Citroen e-C3, help the EV transition return to growth? Or will the main driver be the European emissions regulations, which tighten from 2025 — forcing manufacturers to improve? Please share your thoughts in the discussion below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy