Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

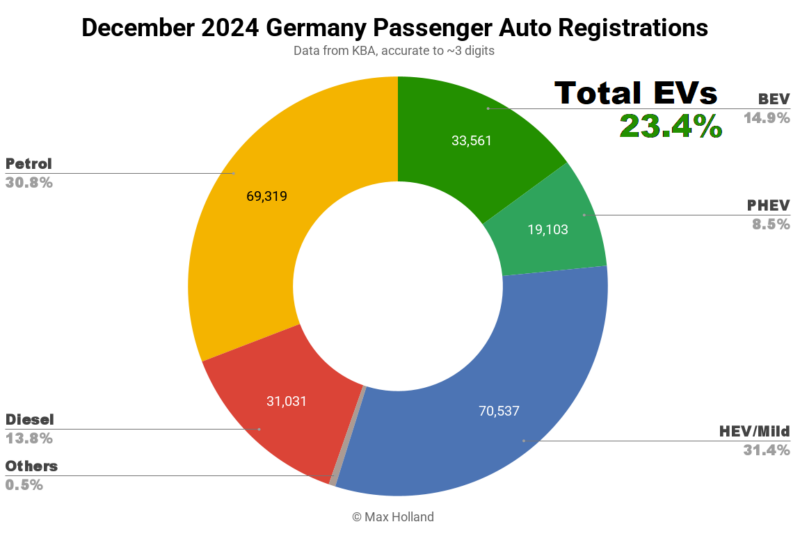

December saw plugin EVs take 23.4% share in Germany, down from 30.0% share YoY. BEV volume was sharply down YoY in a hold-back ahead of tighter 2025 emissions regulations. Overall auto volume was 224,721 units, down 7% YoY. The bestselling BEV in December was the Tesla Model Y.

The December auto market saw combined EVs take 23.4% share in Germany, with full electric vehicles (BEVs) at 14.9% share, and plugin hybrids (PHEVs) at 8.5%. These compare with YoY figures of 30.0% combined, 22.6% BEV and 7.4% PHEV.

The YoY comparison for BEV is weakened by two simultaneous effects. The first is a pull-forward effect in the baseline December 2023 volumes, ahead of a planned incentive trimming in January. In the event, we know now that the incentive was in fact entirely cancelled, but the pull-forward effect anyway led to a relatively strong December 2023. Against this, December 2024 was going to struggle to look impressive.

Additionally, December 2024 suffered from a hold-back effect on BEV deliveries by many manufacturers. Why? Because 2025 sees a step change tightening in fleet emission requirements for new sales, and thus BEV share of auto sales has to step up quite significantly. Many legacy brands chose to delay end-of-2024 BEV deliveries and hold them back until 2025, to get a decent start on meeting the tighter rules.

Beyond BEVs, PHEVs saw a minor increase in YoY share in December, whilst HEVs (including mild hybrids) jumped from 23.0% share to 31.4% YoY. Diesel-only share dipped, but petrol-only share remained mostly unchanged. The latter can also be somewhat attributed to 2025’s tighter emissions regulations. From the POV of laggard legacy auto, it was better to pull forward some higher emission petrol vehicle sales and deliveries into the final weeks of 2024, rather than have them negatively impact the fleet emissions totals in 2025, which are more strict.

Full Year 2024 Analysis

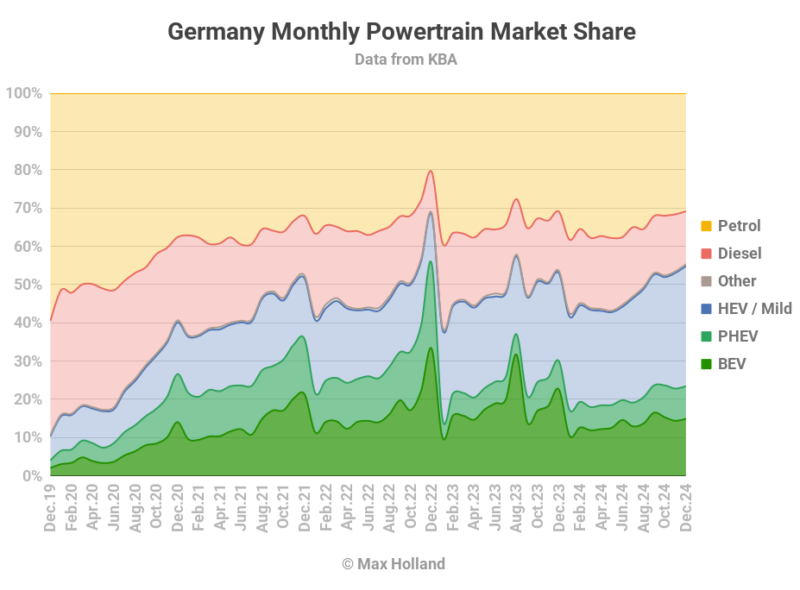

2024’s full year powertrain shares were 13.5% BEV, 6.8% PHEV, 26.8% HEV, 17.2% diesel, and 35.2% petrol. These compare with 2023 shares of 18.4% BEV, 6.2% PHEV, 23.4% HEV, 17.1% diesel, and 34.4% petrol.

Full year BEV volumes fell dramatically to 380,609 units (from 524,219 YoY), PHEV volumes increased slightly to 191,905 (from 175,724 YoY), while the overall market fell by just under 1% to 2,817,294 units (from 2,844,361 YoY).

Let’s not beat around the bush – 2024 was a huge step backwards in terms of the EV transition in Germany. BEV share was even lower than 2021’s 13.6% – an appalling result. How could this happen? After all, the component costs of BEVs (batteries, motors, power electronics) have become much cheaper this year, as is normal for quickly scaling new products. BEV prices should have become cheaper, especially relative to ICE vehicles, and their sales volume should have increased.

The key issue is that Europe’s legacy car makers still don’t really want to sell BEVs any faster than they have to (as legislated by the EU plus EEA combined fleet emissions targets, more on these below). Zach Shahan has recently summed it up pithily:

“In Europe, automakers are following the orders required of them by [rules akin to] corporate average fuel economy (CAFE) standards. They sell more and more EVs — somehow — as they are required to do so. When they have a year of pause, they stall sales growth. Even as they hit their sales targets, they complain it’s all too fast….”

Since Europe’s legacy auto-makers don’t actually want to sell any more BEVs than they have to – if some parts of the EU + EEA area have seen growing sales (UK, Netherlands, Norway, Denmark, Spain, some others), while others were flat (France, Italy), how can this be balanced out elsewhere? Well – Germany’s consumers (along with Sweden, Finland and a couple of others) have ended up getting the short end of the stick. This was somewhat inevitable in Germany’s case because local BEV purchase incentives (which ultimately go towards manufacturers’ profits) were cancelled at the end of 2023. Germany was thus always going to be relatively deprioritised for BEV sales in 2024.

As I’ve recently discussed in the auto market report for France, in the EU plus EEA zone countries, 2024’s regulations were mostly unchanged compared to the past couple of years, and this is why overall BEV sales have stagnated across the region as a whole. If you want to know more details of the timing and the extent of the emission tightening, take a look at that France report.

Thus the EV transition in countries like France (flat to marginally negative) and Germany (dramatically negative) has been unimpressive in 2023 and 2024. Zach’s hot take is correct. This stagnation is also the clearest evidence that most of Europe’s legacy auto makers continue to do the bare minimum required by law in their move towards EVs.

This lack of ambition, and foot dragging, also explains why legacy auto increased their BEV pricing over the past few years – they don’t want to sell them in volume yet, even as latent demand is increasing – so the solution is to increase their prices to effectively counter the organic growth in demand. After all, most of these manufacturers’ short-term profit still comes from past ICE investments, which they want to milk for as long as possible. This retrenchment and increase in pricing (across all models) helped Europe’s legacy brands make record profits in 2022-2023. To repeat – BEV component costs reduced dramatically even whilst BEV prices were increased.

The tighter 2025 regulations also explains the delayed timing of the long-awaited (by consumers) launch of simpler and somewhat more affordable BEVs models, that have finally been seen only in the last months of 2024.

My position is that it is also not a coincidence that tariffs have been raised on actually affordable BEVs from Chinese brands over the past months. The tariffs have effectively been “in play” (shaping the market) since they were threatened in mid-2023. The tariffs proposal came almost exactly at the time when BEVs had reached price parity with ICE vehicles in China, and the European public was becoming increasingly frustrated with the lack of affordable BEV from European legacy brands. Sorry folks – you are not allowed to choose better value alternatives.

All of these shenanigans are unfortunately par for the course when vested interests, and their friends in the media, collaborate with the ruling classes to slow-walk changes, and preserve their gravy train. Or to put it differently, legacy auto are doing all they can to delay and soften “the Osborne effect on the auto industry” that our colleague Maarten Vinkhuyzen compellingly wrote about back in 2019.

The good news is that – better late than never – emissions from new vehicle sales are finally having to tighten up once more in 2025. The stricter emissions regulations mean the laggards now have to start to make a bit more effort with their BEV offerings, and allow prices to come down.

In short, we should see Europe’s overall share of BEVs jump up in 2025. But again – which countries across the region get prioritised (or de-prioritised) will depend on where manufacturers can charge the highest prices, and this in turn depends on the presence of incentives, or low taxes, and where consumers have the deepest pockets.

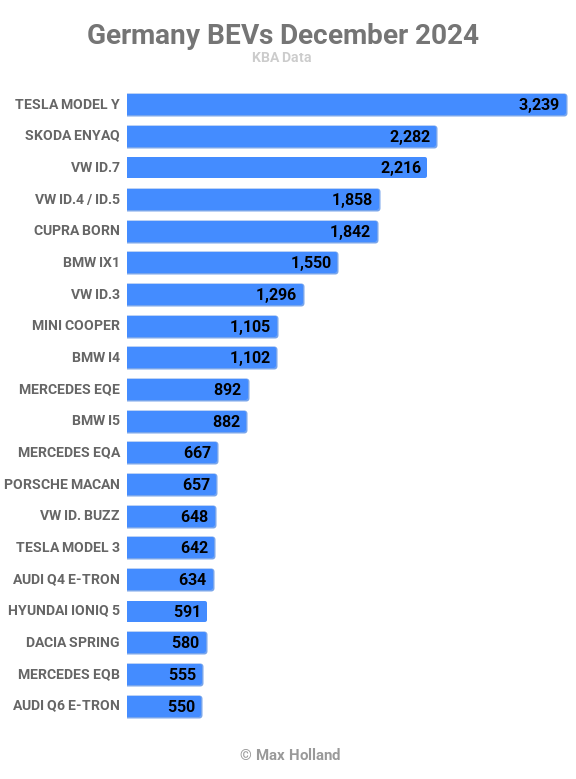

Best Selling BEVs in December

After several months of the Skoda Enyaq consistently taking the number 1 spot in the German market, it was displaced again by the Tesla Model Y in December, and had to settle for second place. The Model Y delivered 3,239 units, ahead of the Enyaq’s 2,282 units.

The Volkswagen ID.7 took third place, just slightly behind the Enyaq, with 2,216 units.

The BMW iX1, climbed 5 spots from 11th to 6th, due to having its best volume of the year, with 1,550 units.

Another interesting development was that the (Dongfeng-Renault) Dacia Spring returned to some volume, despite the raised tariffs, with 580 units. Don’t forget that its price in China is €6,600 (called the “Nano Box”) and if it were priced at anything close to that in Europe it would be highly disruptive. That must not happen.

In China, the Spring/Box model is seen as outdated, and has now largely been phased out. It has been replaced with the newer, larger, more hatchback-shaped Dongfeng Nano 01. This Nano 01 starts from €9,500 for the 31.5 kWh version, and also offers a decent-sized LFP battery of up to 42.3 kWh (from €12,300).

The new Renault 5, which saw regular customer deliveries starting in October, stepped up to 438 units in December, placing it just outside the chart in 24th spot. Let’s see how far it can climb.

As for November’s newcomers, the Leapmotor T03 fell back from its initial 105 units, to 54 units, and its bigger brother the C10 grew from 9 units to 10 units – not spectacular growth. The new Skoda Elroq, which debuted with 46 units in November, didn’t show up in December, but will be back. Likewise for the BYD Sealion.

There was only one debutant in December, the new Hyundai Inster, with 27 units. The Hyundai Inster is a small hatchback with a length of 3825 mm. It comes with a base battery of 42 kWh (gross) rated for 327 km WLTP range. This one starts from €23,900, but can be had on a monthly lease of €199 (including VAT) with zero deposit down. The larger battery variant, with 49 kWh (gross, 46 kWh usable) is rated for 360 km WLTP range, and has an MSRP of €25,400 and up. Let’s see how it gets on, particularly relative to rivals the Renault 5, and Citroen e-C3 (which had just 49 deliveries in December).

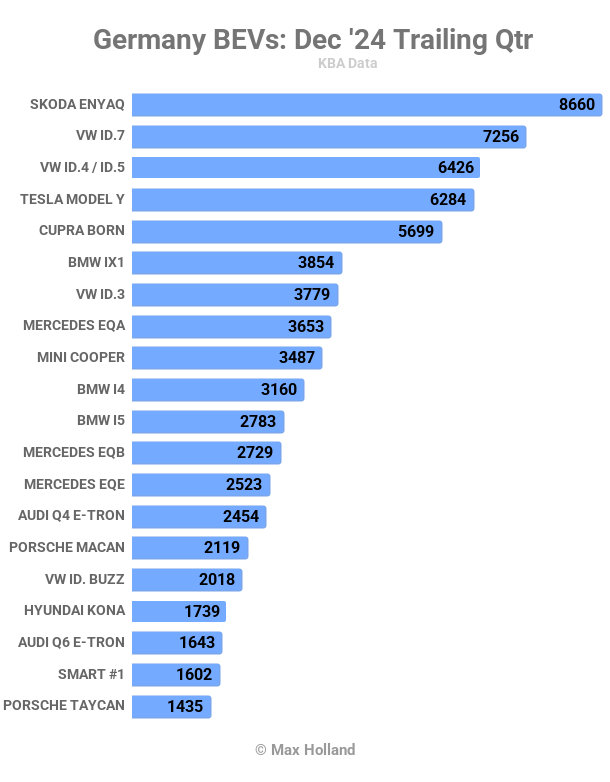

Let’s check up on the trailing 3-month rankings:

Thanks to a couple of prior months at number one, and at number two in December, the Skoda Enyaq has a clear lead in the 3-month chart, ahead of the Volkswagen ID.7, and the ID.4 / ID.5. With the Cupra Born in 5th, this is a good result for Volkswagen Group.

The Tesla Model Y dropped two places from Q3, now down to 4th, though it still leads in the full year chart (below).

The Mercedes EQA climbed to 8th, from 12th in Q3, a decent result. The BMW i4 and i5 were together in 10th and 11th spots, each up 4 places from Q3.

The new Porsche Macan has settled at monthly volumes of 600-something over the past two months, and is in a very respectable 13th position. The Audi Q6 e-tron is close behind in 16th.

In its third month of volume sale, the Renault 5 hadn’t yet quite gathered the tally needed to enter the top 20 (it’s in 29th), but could jump up in the next couple of months.

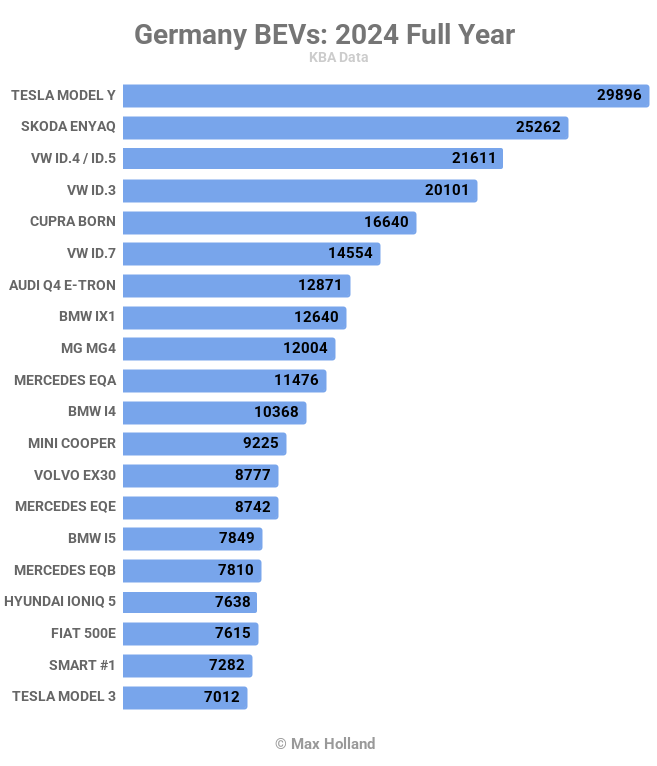

Here’s a look at the full year model rankings:

Here the Tesla Model Y retains its full year crown, its third consecutive year at the top of the heap. Its margin of victory, and volume, have shrunk, however. In 2023 the Model Y scored 45,818 units, ahead of the runner-up Volkswagen ID.4 / ID.5 with 36,353 units.

In 2024, on the other hand, the Tesla saw “just” 29,896 units, from the Skoda Enyaq’s 25,262. Still, a victory is a victory, despite Model Y losing some YoY volume in Europe overall. Let’s see if the long-rumoured new more-affordable Tesla model will arrive in Europe in 2025, or whether it will only be seen in the US and China in decent volume in its first year. Don’t expect Tesla to talk about it much before it’s already baked.

Beyond the leadership, the Volkswagen ID.7 had a great year, landing in 6th, having only arrived in volume towards the very end of 2023. Likewise the new Volvo EX30 had a decent debut year, landing in 13th (though did even better in other European markets).

Another decent performance came for the BMW i5, which had only just debuted at the end of 2023, and climbed to 15th spot. Impressive considering that its sibling the i4 is also here, in 11th spot.

The Smart #1 just squeezed in, taking 19th spot in 2024, from 24th in 2024. Just outside the top 20, the Volkswagen ID. Buzz sits in 23rd. With new affordable BEV models now arriving (which will likely see higher volumes and regularly be in the top 20), the Buzz probably doesn’t have much chance to make the cut in 2025, despite its recent Q4 top 20 appearance.

The Tesla Model 3 had a bad year in Germany, falling down to 20th, from 8th in 2023. Other big fallers included the Fiat 500, down to 18th from 4th in 2023! The Opel Corsa dropped 20 places, ending in 31st, and its sibling the Mokka fell 29 places to 45th! Stellantis are likely playing the “minimum required by law” game however. They cooled off December 2024 deliveries in their most important market of France, likely because they felt they had just about done enough to meet the Europe-wide requirements. Germany was simply deprioritised by them in 2024.

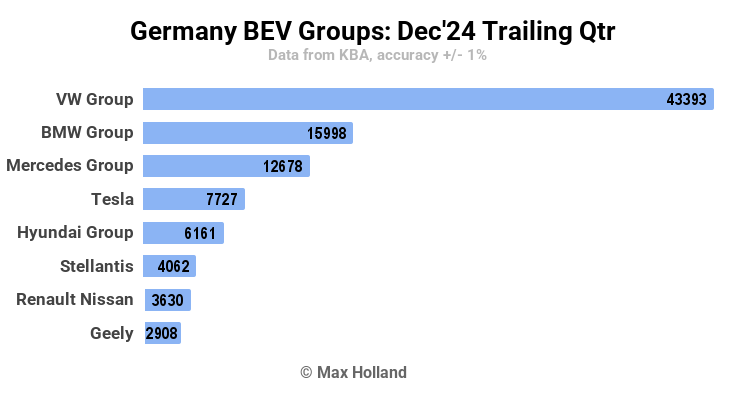

Now let’s look at the quarterly manufacturing group chart, and then their full year results:

Briefly, Volkswagen Group made a large push in Q4, increasing their volumes by 33% over Q3. Having been just over twice runner-up BMW’s volume in Q3, they got close to 3x in Q4.

All of the top six names stayed the same from Q3 to Q4, but their weightings changed. Like Volkswagen Group, Mercedes Group grew volume significantly, up by 32% over Q3.

All the others in the chart dropped back significantly (losing 25% or more volume), except for more modest changes for BMW (7% up) and Tesla (10% down).

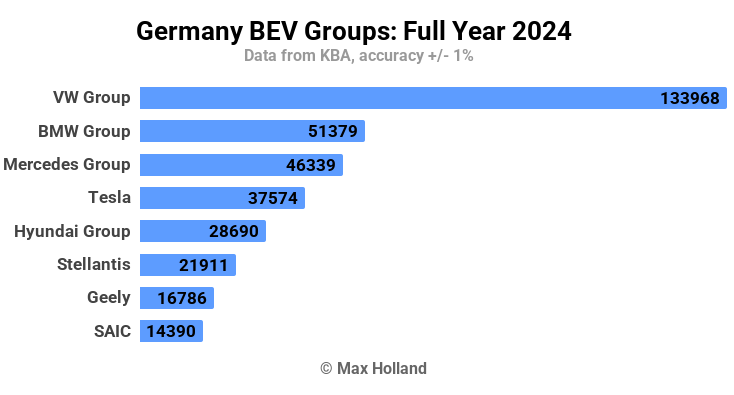

Here’s the full year chart:

Volkswagen Group kept their number 1 spot, leading strongly in full year 2024, though with a total volume which fell by 8.7% from 2023.

BMW Group climbed from 4th in 2023 to 2nd in 2024, and that they did that despite their volume being down some 6% YoY, tells you how weak Germany’s 2024 was.

Mercedes lost more — some 17% of their YoY volume — but still climbed from 5th to 3rd.

Stellantis had the most dramatic drop in volume, shedding 69.4% compared to 2023, and fell from 2nd to 6th. Not much better was Renault-Nissan Group, which shed just under two thirds of their volume, dropped down from 7th to 9th, and sold under 11,000 units (falling off the chart).

Tesla was somewhere in-between, losing a significant 41% of its 2023 volume, and falling from 3rd to 4th.

In the top 8 rankings, only Geely increased their YoY volume, from 14,879 to 16,786 units. That’s the legacy auto vs Chinese auto story in a nutshell right there. Thank you Geely.

Outlook

As mentioned earlier, the proximate cause of Germany’s BEV decline in 2024 was the cancellation of purchase incentives (in combination with the “do the bare minimum required across Europe” attitude of legacy auto). But the cancellation of the incentives was itself a result of Germany’s economic recession which started in mid-2023.

The economy of Europe’s key manufacturing nation has unfortunately not improved recently. Q3 GDP figures were -0.3% YoY, a repeat of the negative growth of Q2. Meanwhile inflation actually grew to 2.6% in December from 2.2% in November. Interest rates, however, cooled to 3.15% from 3.4% in November. Manufacturing PMI remained very weak at 42.5 points in December, from 43 in November.

I’ve already detailed my thoughts on Germany’s BEV transition progress. Even with EU-EEA emissions regulations pointing to a decent growth for BEVs in 2025, it’s not guaranteed that Germany will be a significant beneficiary of this, since auto makers will be able to change higher prices in other European countries that still have incentives (or tax cuts) in place, and whose economies are in much better shape.

What are your thoughts on all of this? Please share your perspective in the comments below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy