Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

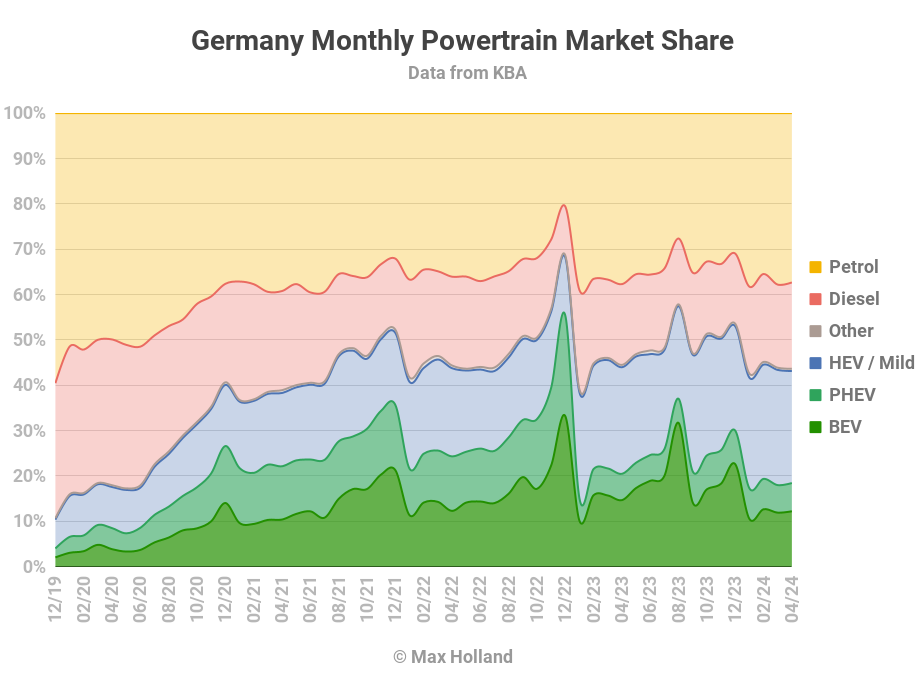

April saw plugin EVs take an 18.4% share in Germany, down YoY from 20.5% — still reeling after the abrupt cancellation of incentive schemes in late December. Overall auto volume was 243,087 units, up by some 20% YoY, but still 20% below 2017–2019 seasonal norms (~305,000 units). The bestselling BEV in April was the Volkswagen ID.4.

BEV sales remain weak, in a hangover from the unexpected and abrupt cancellation of eco-bonus purchase incentives in mid December 2023. In an overall auto market that grew in volume by some 20% YoY, BEV sales volume was essentially flat YoY, at 29,668 units.

PHEV volumes were up by 28% YoY, unaffected by the policy changes, having gone incentive-free a long time ago. PHEVs’ perceived value is thus unchanged compared to 2023, whereas the perceived value of BEVs — after the abrupt December change — is still “lower than it was a few months ago.” Thus it’s no great surprise that PHEVs are holding up well, while BEVs are suffering. It will be several more months before the trauma of the abrupt incentive cut has receded for BEVs.

BEV sales in Germany are also not helped by models being overpriced relative to where they should be (given the lowering cost of batteries), combined with the country being in an economic recession for the past two quarters. Items considered expensive tend to be avoided in a recession.

To give an example I’ve used before — the Fiat 500 BEV has an MSRP (€34,990) — twice that of the mild hybrid/ICE variant (€17,490), which is positioned and priced as an economy car in Germany. To choose the BEV variant (over the mild hybrid) is perceived as a relatively expensive choice.

Returning to the overall share of powertrains in the market — as a result of the poor performance of BEVs, diesel share has now actually increased YoY, from 17.8% to 19.1%. Diesel volume is up YoY by over 10,000 — to 46,317 units. Higher sales than combined plugins!

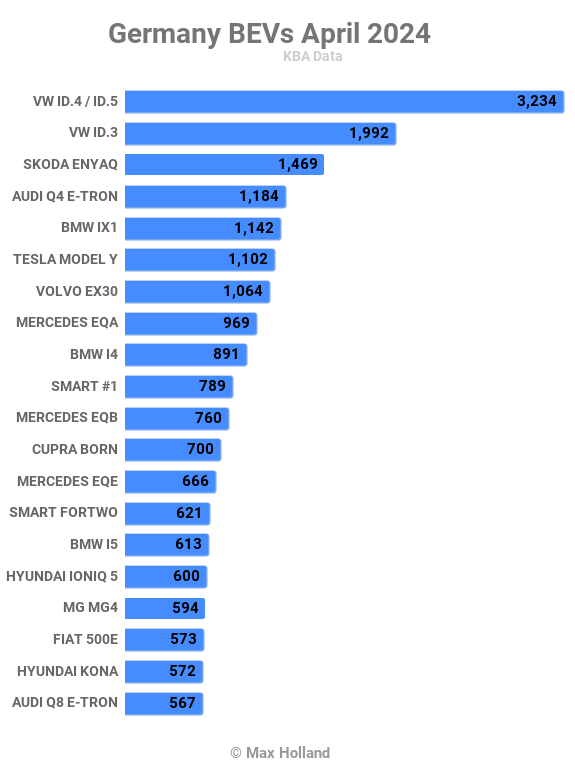

Bestselling BEVs

The Volkswagen ID.4 / ID.5 was the bestselling BEV in April, with 3,234 units registered, retaking the lead it last saw in December.

In second place was its sibling, the Volkswagen ID.3, with 1,992 units. Their cousin, the Skoda Enyaq, came in third, with 1,469 units. Even the fourth spot was occupied by yet another VW Group MEB-platform car, the Audi Q4 e-tron.

The long term favorite, Tesla Model Y, was predictably down in April (6th spot), as it habitually is at the start of a quarter.

The new Volvo EX30 has climbed impressively since its volume debut in December. It took 7th rank in April, with 1,064 sales, and has potential to keep improving.

In terms of new arrivals, the KGM (formerly Ssangyong) Torres has seen its first deliveries in Germany, with 28 units. This is a mid-large 4,715 mm long SUV with a 72 kWh (usable) LFP blade battery sourced from BYD, good for a rated range of 462 km (WLTP). It recharges 10-80% in 37 minutes.

The price, from €43,990, (with a 7-year warranty) is competitive, compared to e.g. €46,335 for the 77 kWh ID.4, which is 130 mm shorter in length than the Torres. The interior of the Torres also appears to be a bit more premium, and the VW has just a 3-year warranty. Let’s see how the Torres gets on, it is good value and deserves to do well.

One other new entrant was the Maserati Grecale, which sold an initial 6 units in April. The Grecale is an expensive (€124,000+) mid-large luxury SUV, not likely to sell in any significant volume in relation to the overall BEV market.

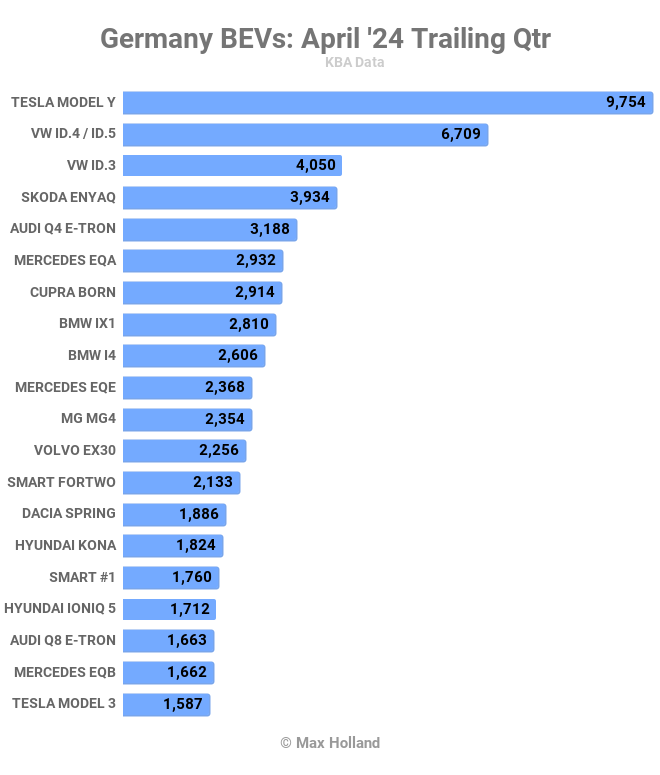

Let’s check up on the longer term rankings:

The Tesla Model Y sold 36% more volume than the VW ID.4 / ID.5 across 2022 and 2023. It retains a strong lead over the latest trailing 3 months, almost 50% ahead of the VW.

There are few new faces in the top 20. The new Volvo EX30 has climbed to 12th, and should enter the top 10 by the time we collate next month’s report.

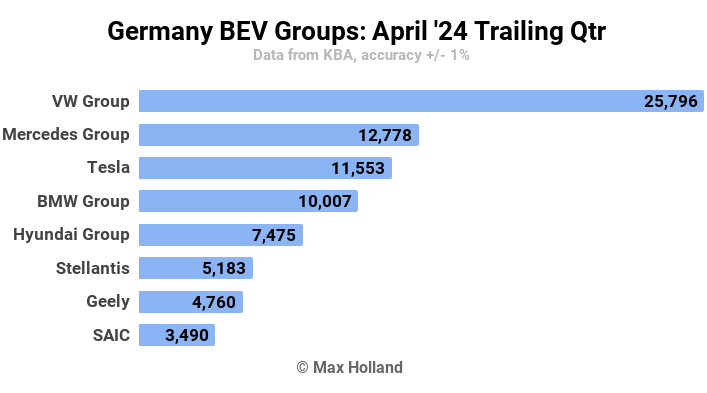

Now let’s turn to the manufacturing group rankings for the past 3 months:

Volkswagen Group still has the lead, with 29.5% of Germany’s BEV market, roughly unchanged from three months prior.

Mercedes Group has climbed from fourth into second place, with a 14.6% share, gaining a 4.4% share since the prior period. Tesla is in third with 13.2% of the market, up by 3.3% share, up from 5th spot prior.

BMW Group slipped from second to fourth, swapping places with Mercedes Group. BMW shed a 4.6% share, to 11.4%.

Stellantis, previously in 3rd spot, dropped dramatically to 7th spot, with market share more than halving from 13.3% to 5.9%.

Outlook

Although the auto market increased 20% YoY, the German economy is now solidly in recession, with both Q3 2023 and Q1 2024 showing falling GDP, both of negative 0.2%. Inflation remained flat MoM, at 2.2% in April. Interest rates remained flat at 4.5%. Manufacturing PMI was steady, at 42.5 points in April from 41.9 points in March. Consumer confidence remained negative at -24.2 points.

The head of the auto industry association VDIK said “the decline in fully electric vehicles that has been observed since the beginning of the year is becoming more pronounced. The BEV segment is currently suffering a crisis of confidence, which was primarily caused by the decision to abolish the electric bonus at short notice.” [Machine translation.]

As I said above, the psychological effects of the sudden incentive abolition will likely stay around for a few more months. Overpriced BEVs, combined with an economic recession, are not helping either.

What do you think of Germany’s EV transition? Let’s discuss in the comments below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.