Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

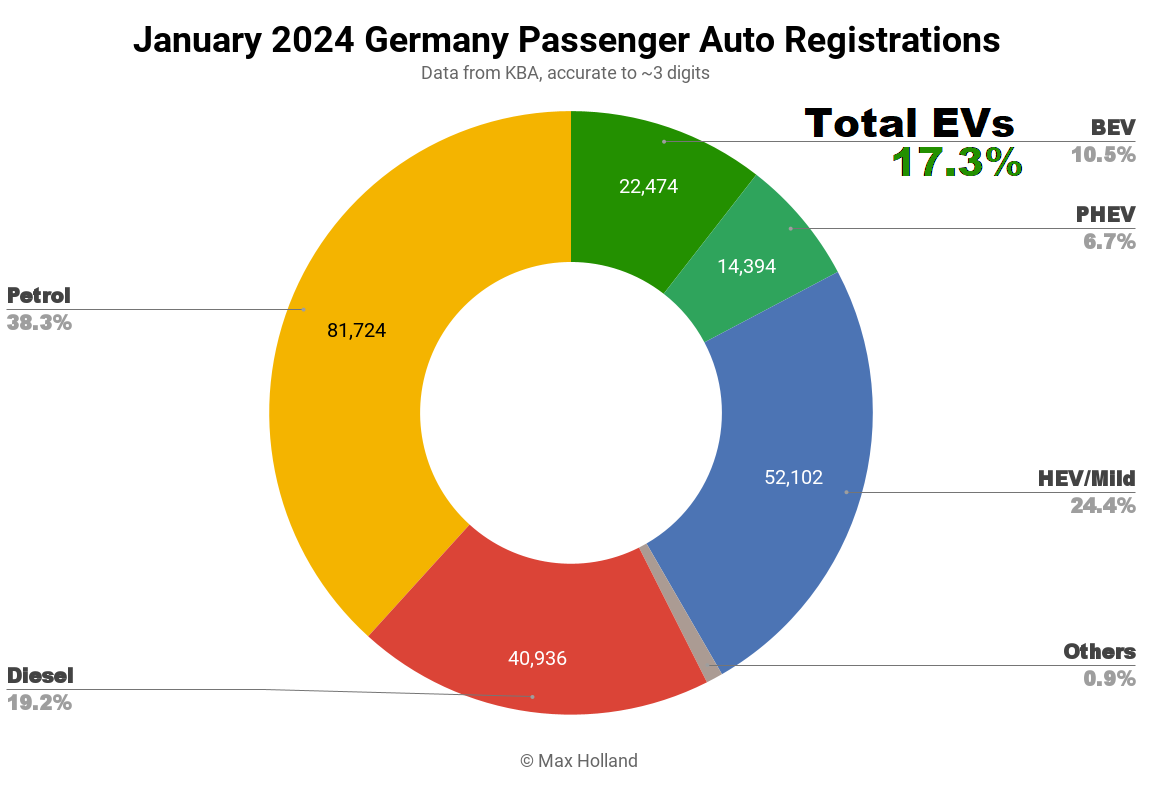

January saw plugin EVs drop to a 17.3% share of the German auto market, after an out-of-the-blue cancellation of all incentives, in late December. BEVs were hardest hit, while PHEVs remained at normal levels. Overall auto volume was 213,548 units, down some 17% from pre-2020 seasonal norms (~260,000 units). January’s best selling full electric was the Tesla Model Y.

The combined EVs drop to 17.3% share was mainly due to low full electric (BEV) share, at 10.5%, with plugin hybrids (PHEVs) at 6.7% share. These compare with 15.1%, with 10.1% BEV, and 4.9% PHEVs, year on year.

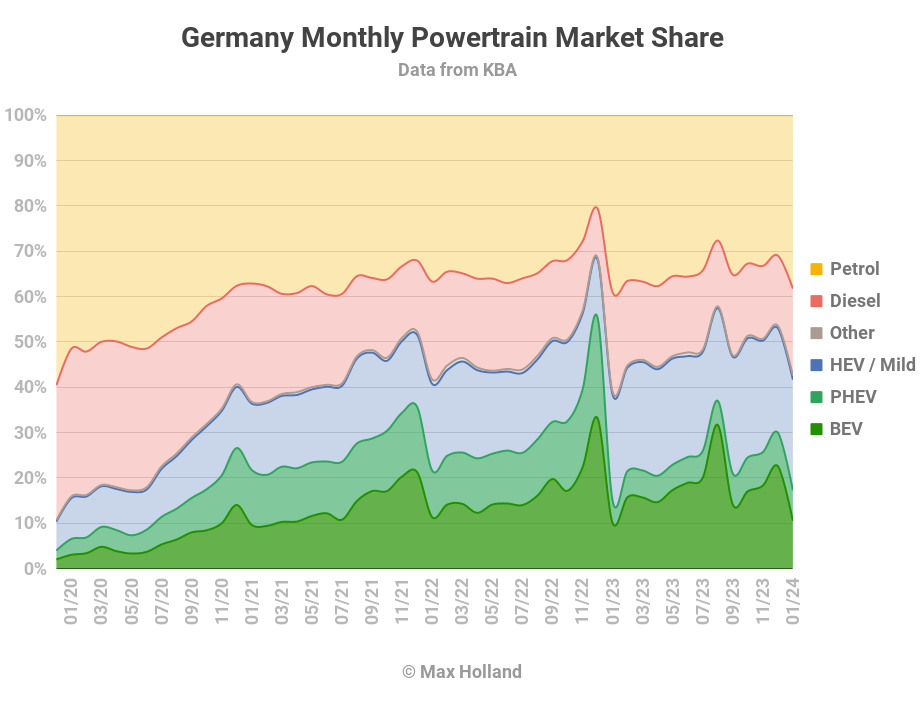

The comparison baseline from January 2023 was already very low as plugins were at that time in a hangover (after a massive pull-forward in December ‘22 ahead of lower incentive policies from January 1st 2023). For January 2024 to be slightly ahead YoY compared to such a weak baseline is nothing to celebrate.

The reality is that the sudden immediate cancellation of all remaining BEV incentives from 18th December 2023 was unplanned for, given that the prior promise had been to keep a trimmed incentive (roughly €3,000) throughout 2024. Many buyers who were scheduled to register their new car after that date were left out in the cold. As Arne Joswig, President of the ZDK (the auto industry association), put it, “This is an incredibly big breach of trust for tens of thousands of customers who ordered their electric vehicles on the condition that the funding would be paid.” (Machine translation)

Before the cut was summarily announced, there was the start of a modest pull-forward effect in December, since the existing understanding was that BEV incentives would be getting a trim anyway from January 1st. As it turned out, however, that nascent pull-forward could not properly play out, due to the incentive doors being unexpectedly slammed shut, which naturally led to the cancellation of many orders.

To put it plainly, the sudden cut was probably deliberate by the government, to prevent a budget-sapping late surge of incentive claims ahead of a pre-announced future cut. Their strategy appears to have been to just cut it immediately, precisely in order to leave everyone out in the cold. Shameless.

Thus January’s BEV result is seeing a major hangover. PHEVs, whose incentives were cut a year ago, had already found a stable demand level in mid 2023, and have since consistently been in the 5.5% to 7.5%. January was a normal month for PHEV share.

Some manufacturers have already offered discounts and special pricing in order to maintain buyer interest in their BEV offerings, though the amount and duration of such discounts varies greatly between brands. Some of these offers were limited to the end of December, effectively to compensate for the government’s door-slamming behaviour, whilst other offers extend through to March or potentially longer. See this list at efahrer for some examples. Obviously the intention is to maintain some level of trade volume whilst the market (folk’s buying psychology) recovers from the mid-December horror show.

The BEV market in Germany will eventually find its new equilibrium level in the coming months, just as it did in the UK after the last purchase incentives there were scrapped in June 2022 (although those were a more modest loss than Germany is now experiencing). It may take until the second half of 2024 for an equilibrium to return, or perhaps longer, since Germany is now in an economic recession. There are still some modest in-use tax benefits that apply to BEVs in Germany, despite the cancellation of the purchase incentive. And of course the long term total cost of ownership advantages are still present.

With BEVs at a low point in January, petrol vehicle share saw an uptick, at 57.3% of the market, the highest level in 12 months. On the other hand, diesel vehicles had their lowest share ever, with 6.5% of the market.

Best Selling BEVs

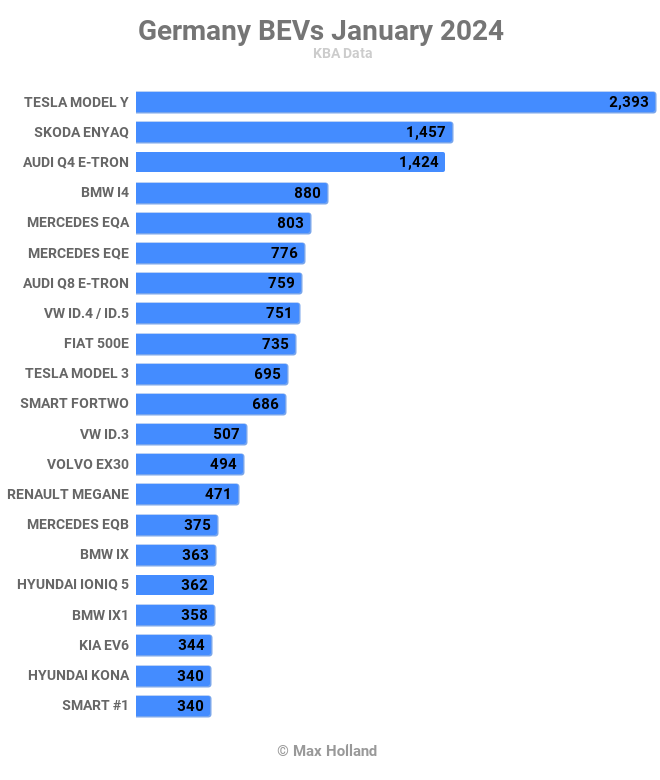

The Tesla Model Y was back on top as the best selling BEV in January, with 2,393 units delivered. The Skoda Enyaq and Audi Q4 e-tron, were in second and third.

Only one model in the top 20, the Renault Megane, put in a decent volume in January, 29% up on its trailing 3 month average volume. In the context of other BEV volumes being lackluster at best, this was enough to lift the Megane from 37th in December, to 14th in January.

Most others were significantly down, although the Tesla Model Y and Smart ForTwo were at parity with recent average volumes.

The Volkswagen ID.4 / ID. 5, for example, was only at 32% of its recent volumes in January, and fell from first position in December, down to 8th. Most of these changes are obviously temporary disruptions from the incentive cancellation. Once manufacturers work out their new pricing strategy, something close to the prior monthly rankings will likely reemerge.

The new Audi Q6 e-tron made its German debut in January, with 22 units, although these few examples may not be for customer delivery just yet. The Q6 is a platform-sharing cousin of the new Porsche Macan BEV which will also debut soon, and which Steve outlined the specs of recently. The new Audi will start from around €70,000 in Germany, and should eventually outsell the still very popular Q8 e-tron.

A few new models saw ramping volumes. The important new Volvo EX30, a reasonably priced premium compact SUV, saw an impressive 494 units (and 13th place), having only debuted in November with 6 units. Similarly, the Smart #3 climbed to 154 units, having debuted at thin volume in October. Both of these models share the same platform but with slightly different technical specs. The Volvo is the more affordable, starting from around €36,000 list price (although you can get offers from around €32,000).

I’m expecting the EX30 to enter Germany’s top 10 in the next couple of months, and stay there for a while.

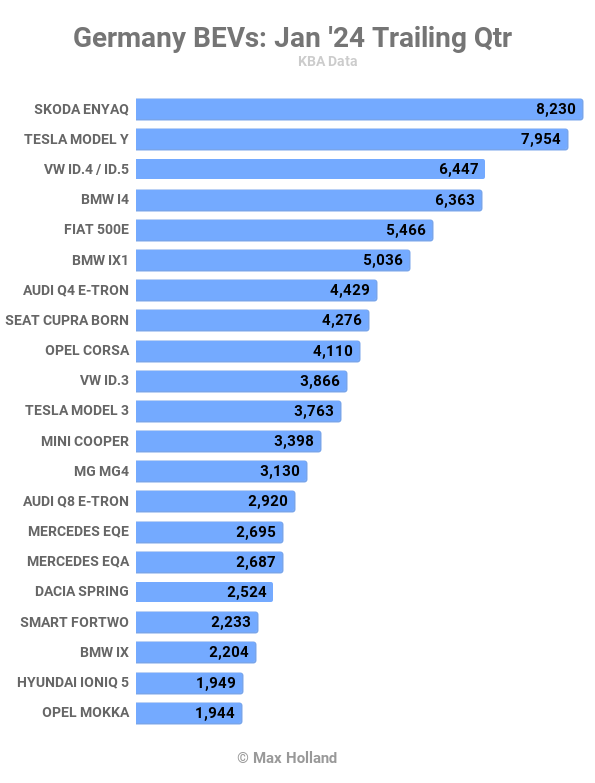

Let’s look at the 3-month rankings:

Here the Skoda Enyaq and Tesla Model Y are in an ongoing race for the lead, with the Enyaq having overtaken on the basis of a strong December and November. The Skoda advances from being back in 3rd in the prior period (August to October), when the Tesla was in pole position.

The BMW i4 has seen an impressive uptick in volumes since October, and is rewarded with 4th spot, from 20th in the prior period. Its sibling the BMW iX also climbed, to 6th spot from 13th previously.

It will take a while for manufacturers to reposition their pricing strategy in the new normal no-incentives market. We will see how the chips fall over the coming months, and what pattern emerges.

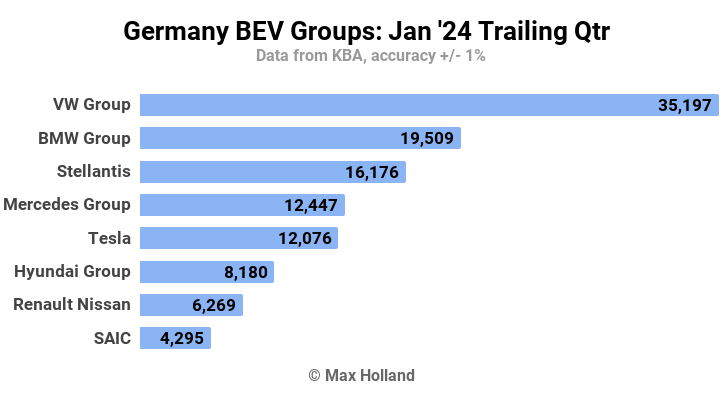

A quick look at the manufacturing group rankings shows BMW Group having climbed strongly over the past quarter, to reach second position now. Its share of the BEV market climbed to 16.1%, from just 9.3% in the prior period, an impressive rise.

Stellantis fell one place to 3rd, losing 3.6% share, down to 13.4%. Further back, Hyundai Motor Group fell 3 places to 6th spot, losing 3.4% share, down to 6.8% share.

These were the only moves in the top 8 ranks, although leader Volkswagen Group extended its market share by 3.8% to 29.1%.

Outlook

Over the past 3 months, the Germany auto market is down in volume by 7% year on year. The broader economy is in recession, with Q3 and Q4 2023 (latest data) seeing YoY GDP tallies of -0.3% and -0.2% respectively. Inflation calmed to 2.9% in January, from 3.7% in December. Interest rates remain flat again at 4.5%. The manufacturing PMI improved to 45.5 points in January, from 43.3 in December.

We’ve discussed how the German BEV market is now in flux, trying to find a new equilibrium after the sudden cancellation of purchase incentives in December. This will likely take another several months, but by Q3 we should see a pattern emerging.

The rate of BEV growth from now on will be influenced by the health of the broader Germany economy and consumer pocketbooks, which look weak in the short term (at least). We will have to see how it plays out.

Do you have thoughts on Germany’s transition to electric vehicles? Please jump in and join the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.