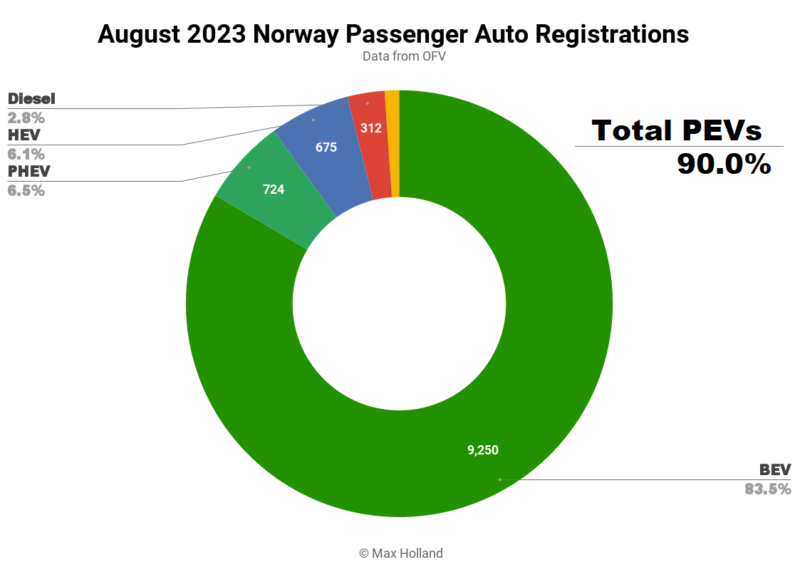

August saw plugin EVs at 90.0% share in Norway, up from 86.1% a year ago. Full electrics continued to gain ground, taking 83.5% share. Overall auto volume was 11,083 units, down over 10% year on year. August’s best selling vehicle was the Tesla Model Y.

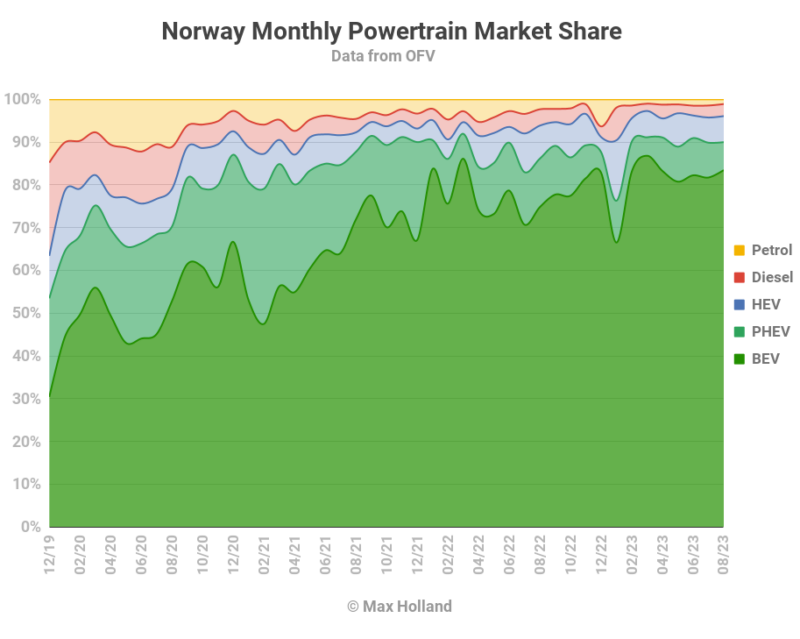

August saw combined EVs at 90% share in Norway, comprising 83.5% full electrics (BEVs), and 6.5% plugin hybrids (PHEVs). These compare with YoY figures of 86.1%, 74.9%, and 11.3%, respectively. We can see that BEVs have gained almost another 10% of the market in the past 12 months, and PHEVs are in decline, along with all other non-BEV powertrains.

In volume terms, BEVs are actually flat YoY, and all other powertrains have lost volume, leading to the overall 10.4% decline in overall market volume. Petrol-only vehicles lost 58% of their volume YoY, seeing just 122 units in August. Even PHEVs lost 48% of their volume, falling to 724 units.

HEVs (plugless hybrids) fell in volume by “only” some 30%, and are shrinking more slowly than PHEVs. Both have a little over 6% market share. It would be ironic if PHEVs, which can drive most of their miles on renewable energy when used as intended, fell below HEVs, which are entirely dependent on fossil fuels. The issue is likely the price difference, with PHEVs being generally expensive, whereas basic HEVs, with tiny batteries and modest motors, can be produced for not much additional expense over a combustion-only vehicle.

Once BEV models have filled out more niches, and lower price points — in the context of Norway’s extensive DC charging network — all other powertrain sales, including both forms of hybrid, will quickly fade.

August Best Sellers

After a slow July, Tesla was back in August with the Model Y taking top spot, with 1,450 units. This was almost twice the volume of the runner up Skoda Enyaq (733 units). The Volkswagen ID.4 took third spot.

There were no big moves in the model rankings, just the normal amount of inevitable shuffling resulting from manufacturers’ varying monthly shipment allocations.

There were also no new BEV models making a Norwegian debut last month. Even recently arrived high end models like the Lucid Air, and Lotus Eletre, seemed to be taking a holiday in August.

September is usually a more active month in Norway’s BEV market – let’s keep an eye out over this month and see if there’s some more notable news in time for the next report.

Meanwhile, let’s take a look at the three month picture:

Here the Model Y continues to be dominant, not far from the combined volume of the two closest models, the ID.4 and Enyaq. The latter has recovered to its usual spot, after temporarily seeing lower volumes in the early part of this year.

Further down the rankings, the Volvo XC40 (in 11th) has had a relatively quiet summer, both in Norway, and in its Swedish home-market. Perhaps this is just temporary allocation choices, or perhaps there are some production adjustments going on — let us know in the comments if you have insights.

The most notable climb was the MG4, climbing to 13th spot, from 26th in the previous period (March to May). If there’s enough production capacity, the MG4 may make it into the top 10 in the coming months, despite not being an SUV or minivan, as all the other favourites are.

Fleet Transition Update

Once per quarter we get updated fleet composition data from Elbil.no. I’ve incorporated the data into the long term records, and so we can see the trajectory of change over time:

By the end of June 2023, combined plugins were at 29.6% of Norway’s passenger vehicle fleet, with BEVs alone at 22.6%. This is an increase of 1.2% for combined plugins, and 1.1% for BEVs, over the share seen at the end of March. March itself saw plugin share growth just 0.7% over the previous quarter.

A strong quarter typically sees plugin share of the fleet grow by almost 1.5%. The modest progress so far in 2023 is due to the H1 auto market being some 4% down YoY. Even with BEVs growing in share, their H1 volume has only increased by 2% YoY, in large part resulting from the hangover effect of the January 1st incentive changes. The lacklustre consumer economy is also not helping (more below).

Nevertheless, taking a longer view, the growth of BEVs in the fleet is still accelerating (the curve is still exponential, not linear). The fuel use of the remaining combustion fleet is also declining faster than the fleet size, due to older vehicle being driven less.

To understand the dynamics of Norway’s fleet transition — and the resulting drop in road fuel demand — see my earlier deep dive here.

Outlook

Norway’s overall economy is slowing down, from 3.3% annual growth in Q1, to just 0.7% by the end of Q2. Inflation rates remain high, at 5.4%, and the consumer price index is still increasing. The interest rate has increased to 4%, from 3.75% in June. All of this is naturally taking a toll on new car sales.

“In short, we can probably say that tighter times with a challenging economy for many are slowing down new car sales… The August registrations show signs of tougher economic times and this has probably made many people think twice before choosing to buy a new car ” says OFV director Øyvind Solberg Thorsen.

He goes on to say that “many of the new car registrations so far this year are cars that were ordered by customers a long time ago, and the industry reports fewer new customers in car shops at the moment.”

Whilst this means that new car sales this year will likely continue to be down from last year, the preference of those who are still buying new cars remains focused on BEVs. It’s just that the speed of the change-over is slowing down this year.

What are your thoughts on Norway’s EV transition? Please jump in to the comments section below to join the discussion.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …