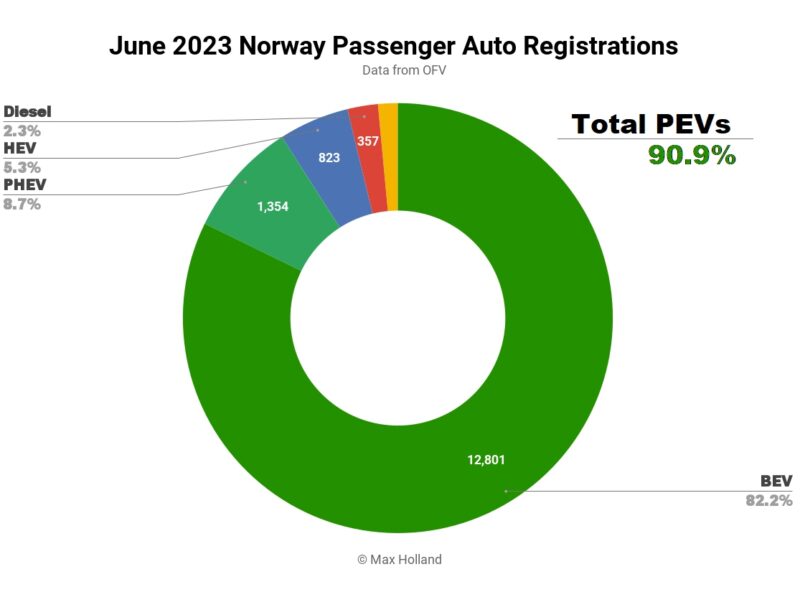

June saw plugin EVs at 90.9% share of Norway’s auto market, up from 89.9% a year ago. Full electrics increased their share to 82.2%, with plugin hybrid share diminishing to 8.7%. Overall auto volume was 15,566 units, up 4.5% YoY. Tesla’s Model Y was yet again Norway’s bestselling vehicle, almost 3x the volume of the runner up.

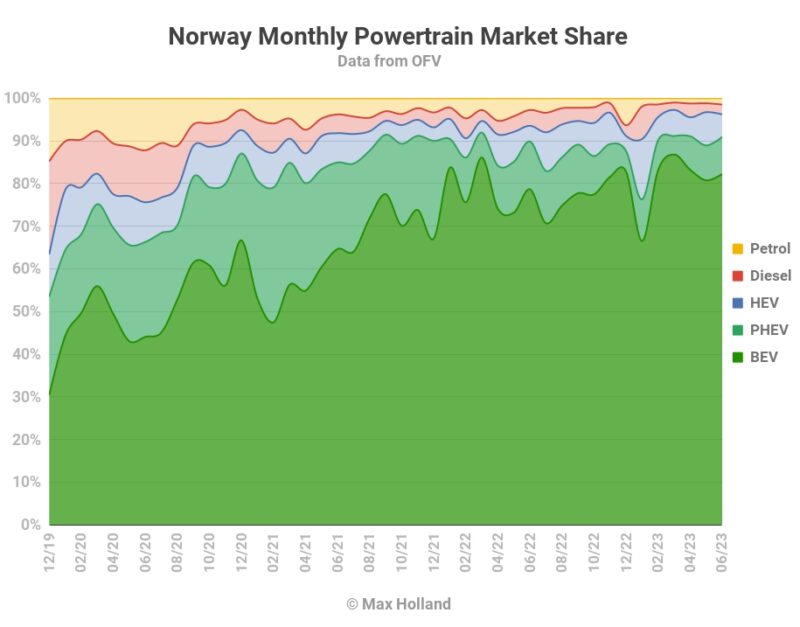

With combined EVs at 90.9% share in June, full battery electrics (BEVs) contributed 82.2%, with plugin hybrids (PHEVs) at 8.7%. These compare with corresponding YoY shares of 89.9%, 78.7%, and 11.2%. We can see that the plugin weighting is shifting towards BEVs.

In volume terms, BEVs grew by 9.2% YoY to 12,801 units. PHEVs meanwhile shrank 18.9% to 1,354.

Combustion-only powertrains combined lost 39% volume YoY, falling to 588 units in June, and 3.8% of the market.

Due to the new higher emissions taxes from January 1st, plugless hybrids (HEVs) have taken over share from combustion-only vehicles this year, currently at 6.2% YTD cumulative share.

Plugless vehicles will continue to be sold in Norway until plugin options — most likely BEVs — appear in all vehicle segments, and at affordable price points.

Norway’s Bestsellers

As usual, the Tesla Model Y is again the bestseller, with 3,125 units, almost 3x the volume of the runner up Volkswagen ID.4. The third place goes to the Skoda Enyaq.

There were no new faces in the top 20, just some shuffling of already established models. The only top 20 model to put in a personal-best performance was the MG4, with 242 units, and gaining 15th spot, a new high. As one of Europe’s best value BEVs, we can expect the MG4 to keep climbing.

There were no new faces in the top 20, just some shuffling of already established models. The only top 20 model to put in a personal-best performance was the MG4, with 242 units, and gaining 15th spot, a new high. As one of Europe’s best value BEVs, we can expect the MG4 to keep climbing.

Outside the top 20, there were a few newcomers. The most significant is the Jeep Avenger making its Norway debut, though with just 3 units for now. Let’s see if this somewhat affordable small SUV can catch on in Norway, as it already is doing in France.

The commercial brand, Maxus, well known for good value vans in Norway, has recently released a pickup truck to the Norwegian market, the Maxus T90 (36 units in June). It is moderately affordable (€50,000), and is perhaps the first BEV available in Norway that can appeal as a realistic work-vehicle option for farmers and rural workers.

The T90 has one glaring issue, however — it is currently only available as rear-wheel drive! To appeal as a dependable field-and-forest vehicle, especially in snowy Norway, Maxus will have to make a 4WD variant available.

Further down the ranks, Lotus debuted their premium sporty SUV, the Eletre. This is priced over €90,000, so won’t make a volume impact on Norway’s transition. It’s nevertheless good to see a long established ICE sportscar brand starting to offer BEVs. If it sells well, it might motivate others in the performance SUV segment to hurry their own electric offerings (are you listening Porsche?).

Let’s now view the longer perspective:

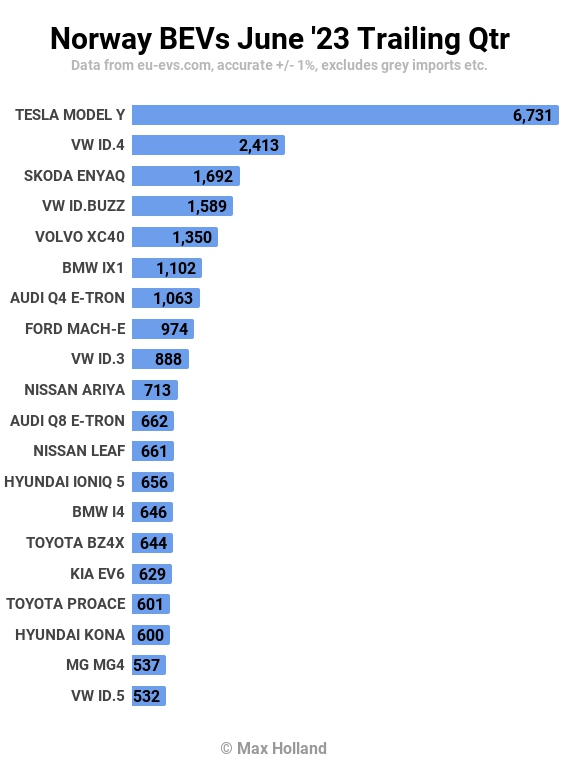

In the 3-month view, the Tesla Model Y is still incredibly dominant, with around 2.8x the volume of the runner up Volkswagen ID.4.

In the 3-month view, the Tesla Model Y is still incredibly dominant, with around 2.8x the volume of the runner up Volkswagen ID.4.

There are a few significant movers in the top 20. Most impressive is the BMW iX1, which more than trebled its previous 3-month volume, to a record 1,102 units, putting it in sixth spot.

The Nissan Ariya saw 2.5x its previous volume, with 713 units, and took 10th place. The MG4 also put in a strong performance, with volume 2x its previous best, and took 19th place.

Let’s give a shout out also to the Volkswagen ID. Buzz which continues to do remarkably well for this large format of vehicle (selling almost twice the volume of the ID.3!) The Buzz’s volume grew 46% over the previous quarter, to a healthy 1,589 units, and it took 4th place overall.

June’s EVs At 90.9%… How About The Fleet?

Let me give a quick update on Norway’s fleet transition to plugins. As of the end of Q1 2023 (the latest available fleet data), plugins made up 28.4% of Norway’s passenger car fleet, with BEVs at 21.5%. Once we get the end-of-June figures, they will likely show give-or-take 30% plugin share of the fleet (~22.7% BEV).

The fleet turnover rate to plugins is currently around 5.5% per year, and will be a little over 6% per year once plugins take 95% to 99% of new sales. If very affordable BEVs arrive in plentiful supply, folks may decide to retire their old ICE car “earlier” than usual, to grab the running cost savings of BEVs, and the annual fleet turnover rate could — in principle — approach 7%.

For the definitive deep dive on the dynamics of Norway’s fleet transition to EVs, and decline in road fuel demand, see my exclusive report.

Outlook

Despite YoY auto market growth in June, the first half of the year saw overall auto volume down by 2.9%. Norway’s auto industry group, the OFV, attributes the drop to “uncertainty among consumers”. They go on to say “We expect that some will have to postpone the purchase of a new car due to financial challenges with the current level of interest rates and price increases.” (OFV, machine translation)

The inflation rate is currently at almost 7%, and although fossil fuel sales have grown massively over the past 18 months, the non-fossil fuel portion of the economy is almost stagnant.

These factors obviously weigh on consumer sentiment, as OFV points out. However, Norway remains an extremely wealthy country overall, so don’t expect purchases of new vehicles, particularly BEVs, to dry up. As more models become available at lower price points, and more diverse vehicle segments, BEVs will continue to steadily grow share. The speed at which these models become available will dictate the final stages of Norway’s transition to BEVs.

What are your thoughts on Norway’s EV transition? Please join the discussion by jumping into the comments section below.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …