Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

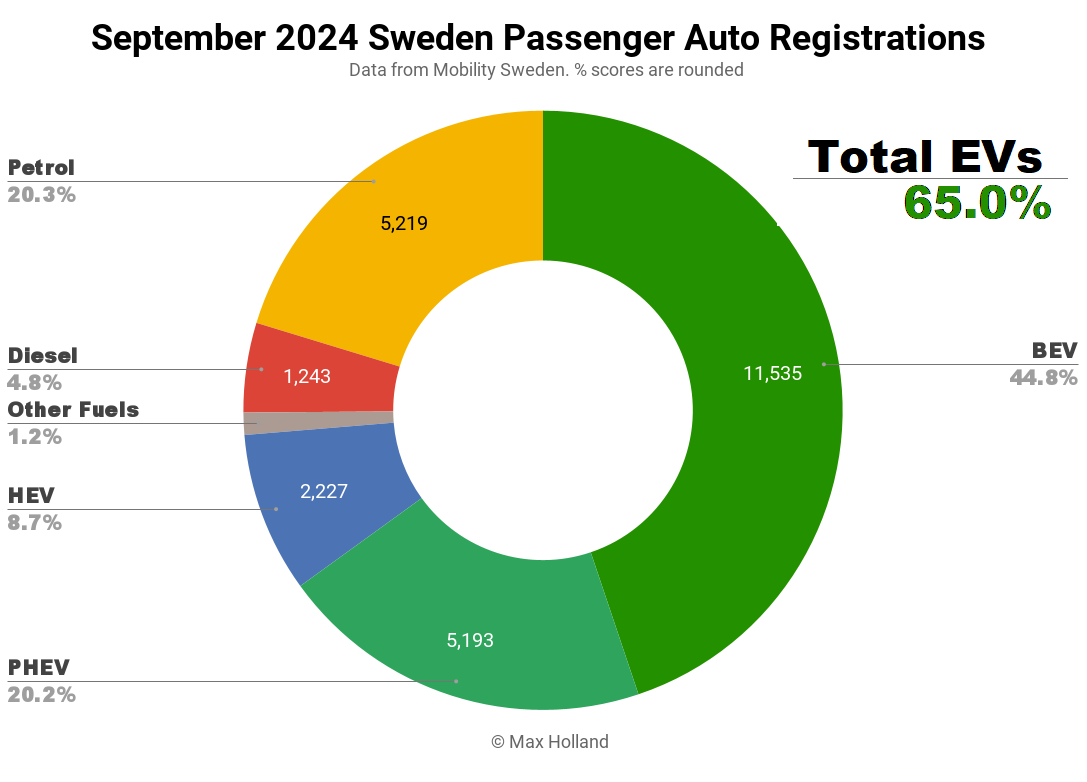

September’s auto sales saw plugin EVs at 65.0% share in Sweden, modestly up YoY from 63.4%. BEV share was almost flat, though volumes were down YoY by 8%. Overall auto volume was 25,725 units, down 9% YoY. The Tesla Model Y was by far the best selling BEV, with volume greater than the next 9 models combined.

September’s market data showed combined plugin EVs at 65.0% share in Sweden, with full electric BEVs at a near-record 44.8% and plugin hybrids (PHEVs) at 20.2%. These figures compare YoY against 63.4% combined, 44.4% BEV and 19.0% PHEV.

This is the 2nd highest market share ever for BEVs in Sweden, only bettered by December 2022 (which befitted from a pull-forward ahead of incentive cuts). That’s a good result, but the actual BEV unit volumes were nevertheless down some 8% compared to September 2023, albeit slightly outperforming the overall market drop of 9%. It’s also worth noting that, as we will see below, much of September’s BEV volume came from a huge shipment of the Tesla Model Y (29% more than any previous end of quarter), so the flip side is that we will see relative cooling of Model Y volumes (and thus overall BEV volumes) in October’s figures.

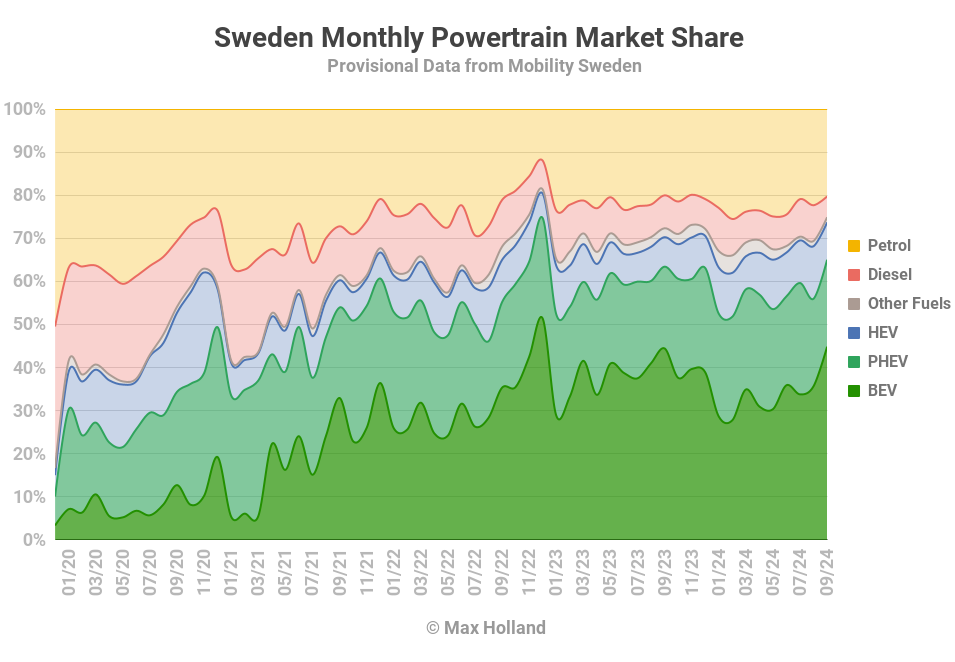

PHEVs have seen steady market share in the 19% to 26% range for the past 12 months, and will likely remain in this zone until more BEV models, at more affordable prices, become the norm. More ubiquitous fast-charging infrastructure will also help blunt the attraction of PHEVs for those cautious consumers who have phantom refilling anxiety. Until that stage, PHEVs remain a net-positive solution relative to the far greater number of newly registered plugless vehicles still being added to Sweden’s roads.

Put differently, Sweden is still in the mid-stage of the EV transition, where plugless vehicles still represent over a third of all new car sales. The current generation of PHEVs, such as the popular Volvo XC60 (representing over 20% of PHEVs sold), have relatively large batteries and can get close to 80 km of electric-only range.

When used as designed (not always a given, especially when tax-breaks skew behaviour), current PHEVs can convert 80% of annual km driven to electric. This is obviously a big improvement compared to the 100% ICE-derived energy of plugless vehicles. That being said, back in 2021, there was talk of Volvo planning to offer a full-BEV version of the XC60 by late 2024, but this obviously hasn’t materialized, which is disappointing.

One bright spot is that diesel-only share continues to steadily decline, reaching a record low of 4.8% of the Swedish market in September (and just 308 units), down from 7.6% a year ago.

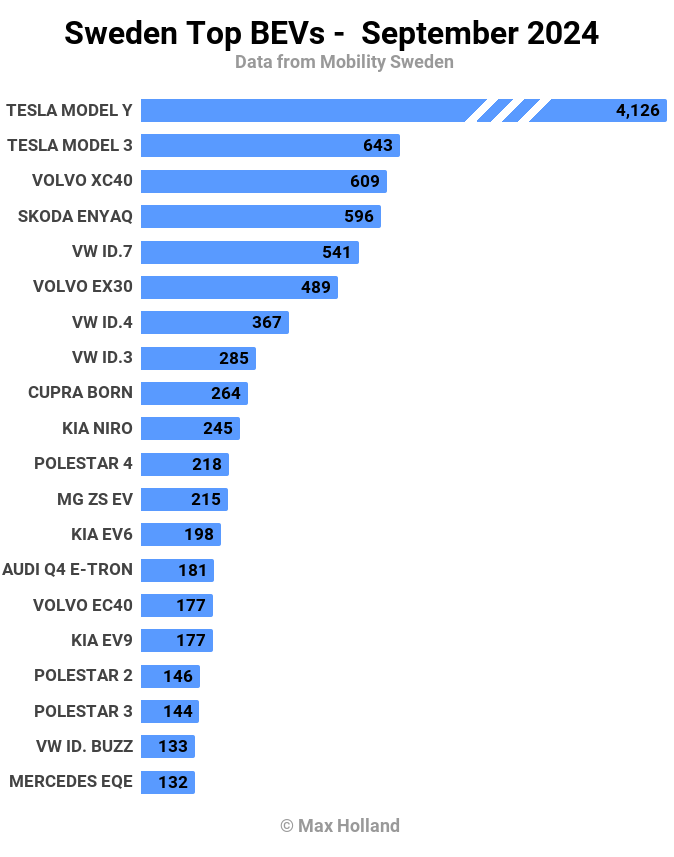

Best Selling BEV Models

The Tesla Model Y was overwhelmingly dominant in the BEV market in September, with a huge 4,126 units registered, its highest ever volume. This might in fact be an all-time record volume for any auto model sold in a single month in Sweden (it is certainly a record for BEV models). Jump into the comments if you have insights into this.

In second place was its older sibling, the Tesla Model 3, with 643 units. In third was another long-term favourite, the Volvo XC40, with 609 units.

The Tesla Model Y was so dominant in September that it more than matched the combined volume of the next 9 BEV models!

The rest of the top 20 BEV rankings were fairly normal, with one or two noteworthy performances. The new Polestar models, the Polestar 3 and Polestar 4, have now started customer deliveries in earnest, with 144 units (18th) and 218 units (11th), respectively, in September. Time will tell if this healthy volume represents simply catching up with an order backlog or meeting a trend of rising demand for these new models.

There were 5 BEV model debuts in September. The highest-volume debut came from the new Porsche Macan, which saw 114 units. See last month’s Germany report for a brief overview of the new Porsche. This is a compelling vehicle, though expensive, starting from 940,000SEK (€83,000), so I would be surprised if the monthly volume can be sustained at much more than September’s volume. Let’s see.

Next up was the new Peugeot e-5008, which saw 35 initial units registered ahead of its official market debut in October. We will go into more detail about this mid-large SUV model in the French report when it arrives in decent volume. This is a crowded part of the market, so don’t expect wonders from Stellantis, especially given their history of overpricing their BEVs.

Somewhat to my surprise, Cadillac registered 8 units of the new Lyriq in September. I haven’t seen many Cadillac models (of any kind) around Europe in recent decades, so perhaps this decent new BEV model is a chance for Cadillac to establish a niche foothold in Europe?

Finally, the new Mini Aceman also saw its first registrations, with 8 units in September. In terms of Mini’s present BEV lineup, the Aceman, at 4079 mm in length, sits closer to the already established Cooper hatchback (3858mm) than the much larger Countryman CUV (4433mm). However, the Aceman has pseudo-crossover styling (e.g., with “rugged” plastic wheel-arches) that make it visually more similar to the larger Countryman.

The Mini Aceman has battery options from 38.5 kWh (usable) up to 49.2 kWh, giving a WLTP range of up to 406 km for those who want that decent range. Having this option is a big improvement over the first-generation Mini BEV, the Cooper, with its very modest range. On that note — the new Cooper also gets these larger battery options, and the bigger Countryman gets a 64.6 kWh (usable) battery with a WLTP rated range of 462 km. With these decently long-range options, Mini has now properly entered the BEV era.

Last month’s debutant, the Volvo EX90, saw its volume increase from its initial 14 units to 22 units in September. It surely has much further to climb from here, so let’s keep an eye on the new Volvo.

The Xpeng G6, which debuted back in July, is still steadily climbing, reaching a decent 51 units in September. This is no great surprise, as the G6 is a very compelling proposition in its segment.

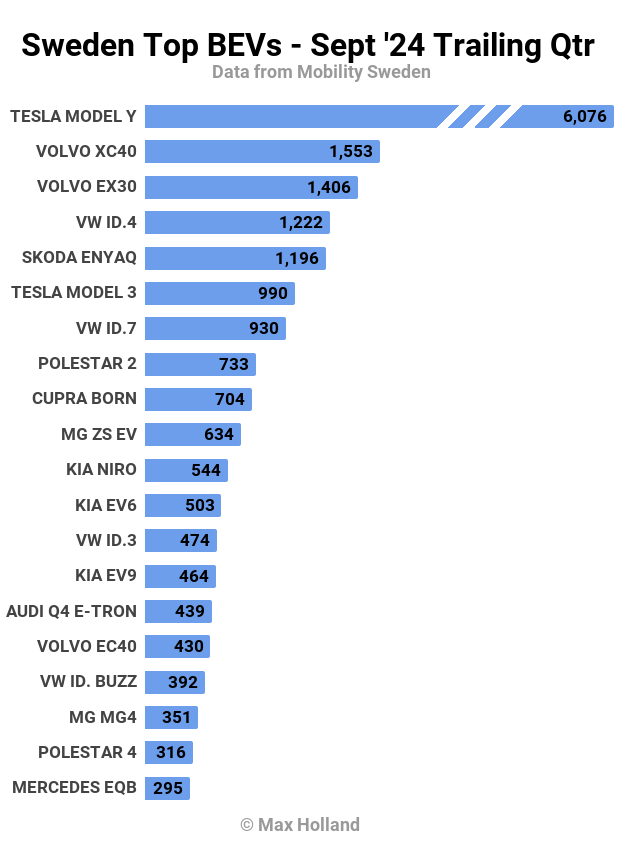

Let’s now turn to the longer-term rankings:

Obviously, the Tesla Model Y is strongly dominant here also, with more volume than the next 4 BEV models combined.

There are no great surprises in the top 10, but the Skoda Enyaq continues its recovery into the top 10 ranks, after a quiet first half of the year. Likewise, the Volkswagen ID.7 is doing very well, climbing into the 7th spot, from 15th in the Q2 rankings.

Most other moves in the top 20 are shuffles within the normal range of variation.

Just outside the top 20, the Zeekr X (a cousin of the Volvos and Polestars), following a quiet initial few months from the spring into summer, has recently stepped up. It gained 27th place in the 3-month rankings, after a decent 91 units in September. If it can maintain these kinds of volumes, it will draw close to the top 20 in the coming months.

Finally, one model which is on the cusp of breaking into the top 20 is the new Audi Q6 e-tron, which is proving popular in Sweden. This should come as a surprise to no-one, given the original Audi (Q8) e-tron’s outstanding popularity in Sweden a few years ago, despite its high price point.

The new Q6 e-tron has quickly climbed to 21st spot, from its July customer debut, and should break into the top 20 next month.

Outlook

Sweden’s auto market is down in volume 8% year to date, with BEVs down by a much higher 19%. Put differently, almost all of the lost auto volume in 2024 is due to a decline in BEV sales. This is unsurprising during an economic recession, with BEVs from legacy auto still grossly overpriced. For context, the remaining best selling petrol-only models are mostly simple value models at price points around or under €20,000. These basic ICE cars seem affordable by comparison to BEVs, which still have few to no model offerings at these prices in Europe. Meanwhile, in China, BEVs are dominating ICEVs in all market segments, even those below €10,000.

High prices for BEVs, combined with a weak economy, will continue to put a dampener on Sweden’s EV growth in the months ahead. The latest national economic data from Q2 records GDP at a lacklustre 0.5% YoY growth. Headline inflation has cooled to 1.9%, and interest rates are at 3.25%. Manufacturing PMI fell back slightly, to 51.3 points in September, from 52.6 in August.

What are your thoughts on Sweden’s position in the EV transition? Please jump into the discussion below and join the conversation.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy