Support CleanTechnica’s work through a Substack subscription or on Stripe.

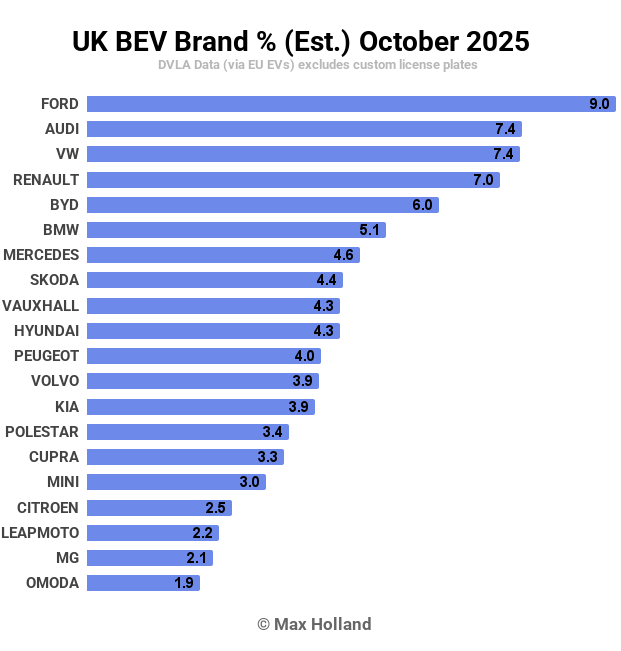

October’s auto market saw plugin EVs at 37.6% share in the UK, up from 30.2% year on year. BEVs grew volume 24% YoY, and PHEVs grew 27%. Overall auto volume was 144,948, almost flat YoY. The UK’s leading BEV brand was Ford, with a 9% share of the BEV market.

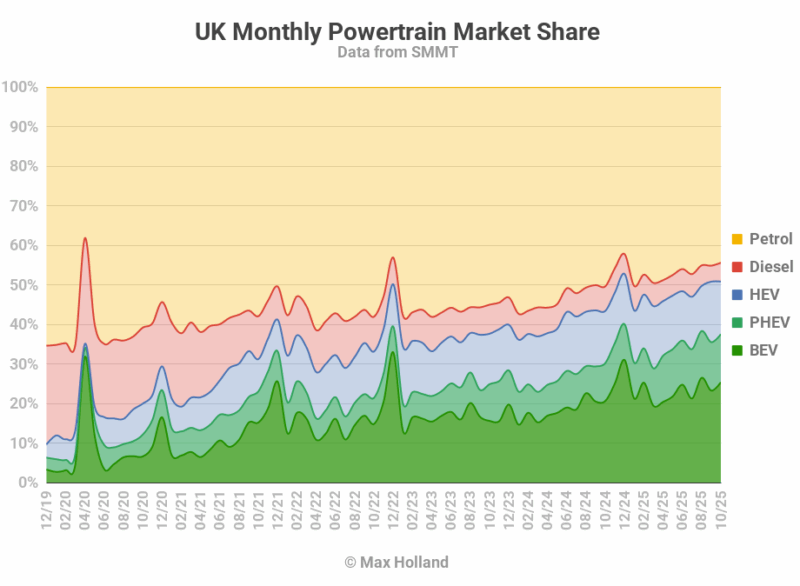

October’s auto market saw combined plugin EVs at 37.6% share in the UK, with full electrics (BEVs) taking 25.4% and plugin hybrids (PHEVs) taking 12.1%. These compare YoY with shares of 30.2% combined, 20.7% BEV, and 9.6% PHEV.

The UK BEV market is now benefiting both from the ZEV mandate, and from the recently re-introduced BEV purchase incentive. The headline “28% ZEV” target for full year 2025 actually translates to a BEV target of around 23% once the various “low emissions” fudges are included. Currently the overall YTD BEV share is 22.4%, so it seems likely that the required 23% will be reached by the end of the year.

One damaging government policy which is currently under consideration is a proposed 3 pence / mile tax on BEVs. Ostensibly this will help compensate for the tax revenue shortfall from foregone road-fuel taxes. But with BEVs still representing just 5% of the UK passenger vehicle fleet, is this really the best time to introduce a new tax burden on BEVs? The proposed tax will average around £300 per year for a typical BEV driver, a significant consideration over the 15+ year life of a BEV.

It would be more sensible to introduce such a tax mechanism at a nominal level initially, e.g. at 1 pence per mile, just to iron out kinks and establish the idea, without shaping purchasing decisions. Once BEVs constitute 50% of new auto sales (in 3 or 4 years time), and outcompete ICE vehicles on purchase prices across every segment, then would be the right time to gradually ratchet up the tax rate.

The UK is still a net importer of oil, and any sensible government would take a big-picture approach to fiscal rationality, reasoning that BEVs’ ability to use locally produced energy is a net positive for the economy, compared to ICE vehicles’ dependence on costly imports.

Combined ICE-only market share remained under 50% for the second consecutive month, at 49.2%. We should expect November and December to maintain this pattern.

Best-Selling Brands

Ford has finally taken the monthly top spot in BEV market share, with 9.0% of all BEV sales in October. This is actually down from its 9.1% in September, but Tesla has slipped further, giving Ford the pole position.

In another interesting development, Audi has marginally overtaken Volkswagen brand for the first time to take second place, with both brands at around 7.4% of the market.

Ford’s top spot was made possible by big sales of the Puma and the Explorer, both in the top 10 BEV bestsellers. Audi’s strength came from its Q4 and Q6 models, also both in the top 10.

In fourth spot, Renault (rarely in the top 10 normally) got a big boost from the Renault 5 which sold over 1300 units in October, a new record high. The Scenic also sold in decent numbers. The new Renault 4 sold over 130 units, its best month yet, and has much further to go.

October is often a hang-over month after the September “new license-plate” push, so we can’t read too much into individual model numbers for this single month, especially for globally shipping vehicles which arrive in irregular batches.

The new Mercedes CLA was down in volume from September, but at a slightly higher share of the market, with over 380 units sold in October.

It doesn’t appear that any new BEV models debuted in October.

Now here’s the 3-month ranking:

Despite seeing a very quiet October (512 units), Tesla still retains the top spot thanks to its big push in September. Ford however has been more consistent, has now climbed from 4th to 2nd, and is currently less than 100 units behind Tesla, both with around 8.6% of the market. As noted above, this is largely due to the success of the new Ford Puma.

Despite seeing a very quiet October (512 units), Tesla still retains the top spot thanks to its big push in September. Ford however has been more consistent, has now climbed from 4th to 2nd, and is currently less than 100 units behind Tesla, both with around 8.6% of the market. As noted above, this is largely due to the success of the new Ford Puma.

The Volkswagen brand still holds on to 3rd spot (and 7.0%) in the 3-month ranking, but Audi is not far behind in 4th, with 6.3%.

The out-performers in the latest 3-months have been Mercedes and Renault. With the new CLA, Mercedes now has a new top seller, and has jumped from 12th to 6th in the rankings, and this only on the basis of two months of volume sales of the CLA.

Renault has jumped up mainly thanks to the continued growth in popularity of the Renault 5, which is still increasing sales each month and may challenge the Tesla Model Y to become the UK’s best-selling BEV in the long-term. Or perhaps the Ford Puma will be the challenger. Let’s keep an eye on them.

Outlook

The UK’s ZEV mandate and revived BEV incentive mean that it is now leading Europe’s “big-3” markets (with Germany and France) in the EV transition. However, progress is still much slower than we expected a few years ago, with legacy auto still clinging to rent-seeking from their past ICE investments, and slow-walking their BEV offerings. This is despite very steep drops in battery costs, and China already passing 50% EV market share this year.

The wider UK economy is not in great shape, with YoY GDP growth dropping to 1.3% in Q3, from 1.4% in Q2. Headline inflation fell from 3.8% in September to 3.6% in October, and interest rates remained flat at 4.0%. Manufacturing PMI increased to 49.7 points in October, from 46.2 points in September. The UK prime minister is facing a leadership crisis, with the worst approval ratings (13%) since records began (mid 1970s).

What are your thoughts on the UK’s EV transition? Will the Tesla Model Y continue to hold onto its top spot in the BEV rankings for much longer, or will “people’s car” BEVs like the Renault 5 and Ford Puma begin to replace it at the top over the next year or two? Please share your perspective in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy