Support CleanTechnica’s work through a Substack subscription or on Stripe.

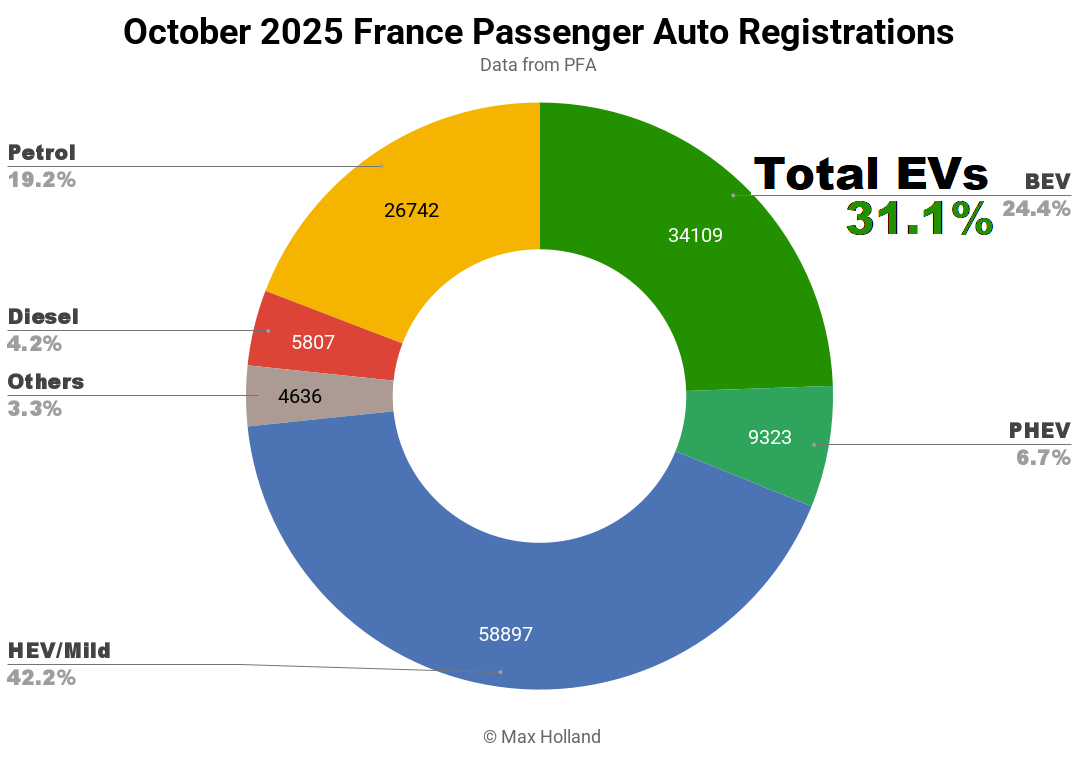

October’s auto market saw plugin EVs at 31.1% share in France, up from 23.5% year on year. BEVs grew YoY volume by 63% and gained an additional 9% share of the market. Overall auto volume was 139,514 units, up some 3% YoY. The Renault 5 was France’s best-selling BEV in October.

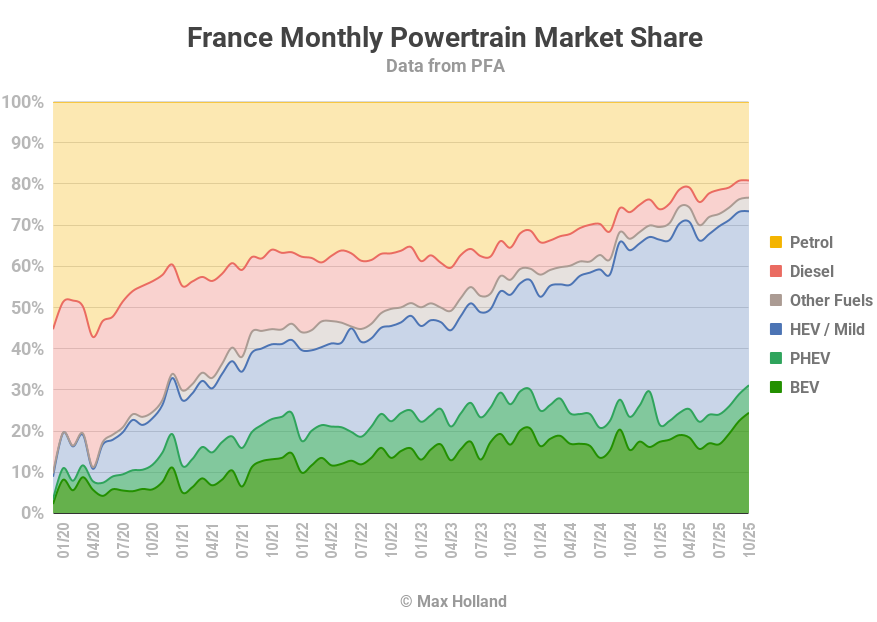

October saw combined EVs at 31.1% share in France, with full battery electrics (BEVs) at 24.4% and plugin hybrids (PHEVs) at 6.7%. These compare with YoY figures of 23.5% combined, 15.4% BEV and 8.0% PHEV.

October’s notable increase in BEV sales (up 63% YoY to 34,109 units) is a welcome result of the first deliveries under the 2025 “Social Leasing” programme. How long will the programme’s boost to BEV volumes last? The Renault 5 delivered 4,551 units in October, some 2,000 units higher than normal. In total, the Renault 5 recorded 10,000 signed lease contracts under the programme, so we can conclude that roughly 20% of these were fulfilled (and delivered) in October.

Assuming this 20% per month is roughly pro rata over all Social Leasing vehicles, the programme’s boost to BEV volumes might last up to 5 or 6 months. While this is thus a temporary boost, it will however also get more (relatively affordable) BEVs on the road, increase dealerships’ familiarity with BEVs, as well as the public’s familiarity, increase production volumes and reduce costs, etc – all benefits which will endure after the programme ends.

Thanks to the increase in BEV market share, combined combustion-only share fell to a record low of 23.3%, with diesel at an equal-record low of 4.2% and petrol an equal-record low of 19.2% (flat from last month). We may see their combined share dip below 20% in December.

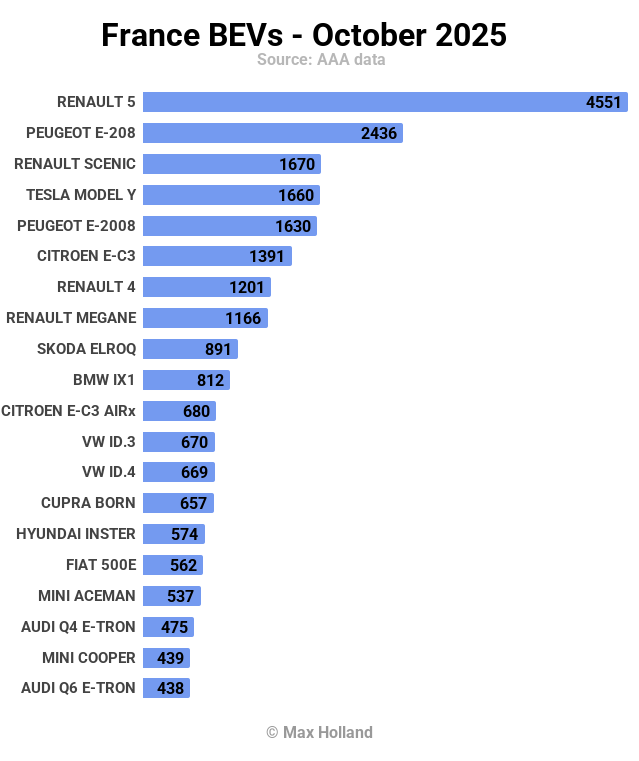

Best-Selling BEV Models

Thanks to the Social Leasing programme, the Renault 5 saw close to record volumes in October, with 4,551 units delivered, taking the top spot.

Another Social Leasing participant, the Peugeot e-208, took second with 2,436 units (some 3x its recent monthly average volume). The Renault Scenic (not in the programme) took third, with 1,670 units.

Two other models which got a notable boost from the programme were the Peugeot e-2008, with 1,630 units (over 4x its recent monthly volume), and the Renault Megane, with 1,166 units (some 2x recent volume).

The Citroen e-C3 hasn’t yet shown any particular boost from the programme, with a modest 1,391 units (lower than its volume in four previous months this year).

Meanwhile the Renault 4 continued to ramp, with a personal best 1,201 units, and the Hyundai Inster also saw a P.B. of 574 units.

Most other models in the top 20 were healthy, albeit not necessarily at their record volumes.

As usual, limited public data on auto sales means that we can’t detect launches of new BEVs in the French market. It’s notable however, that well over half of the top 20 volume is made up of models in A and B segments.

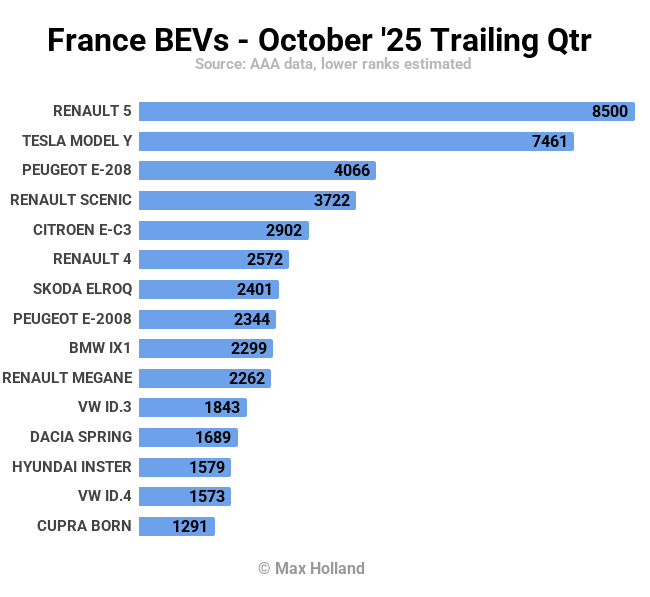

Let’s get an update on the trailing 3-month sales rankings:

Despite its big September, the Tesla Model Y’s more modest October volumes have seen it fall back to second place this month, as the Renault 5 once again stands in the lead. The small Renault also has a big lead over the Tesla in the YTD race, so this is not just about the Renault’s outsized October result.

The Peugeot e-208, on the other hand, has leapt up to 3rd in October (from 7th in the prior period) mainly thanks to the Social Leasing programme. Its sibling, the e-2008, had an even bigger relative climb, to 8th, from 23rd previously.

The two other big climbers compared to three months prior were the Renault 4, now in 6th, from 13th, and the Hyundai Inster, in 13th, from 24th prior. In both cases, this is mainly a result of their newness, and continuing production ramp-up.

How far will these new models continue to climb? I would expect the Renault 4, which is a small SUV form factor, to eventually be almost as popular as its hatchback sibling, the Renault 5. The coming months will see them both regularly in the top 5, and likely both staying there for a long time.

Outlook

The 3% YoY growth of the auto market is almost all thanks to the boost in BEV volume, resulting from the start of Social Leasing deliveries. This YoY boost will continue over the next few months.

The broader French macroeconomy remains undynamic, with Q3 2025 data showing 0.9% YoY GDP growth, following on from 0.7% in Q2. Headline inflation decreased to 1.0% in October, from 1.2% in September. ECB interest rates remain flat at 2.15% (since early June). Manufacturing PMI was up slightly, at 48.8 points in October, from 48.0 points in September.

Macron’s approval rating is now just 11% according to recent polling, but he still refuses to call fresh elections, since his ego is apparently bigger than the views of the French people. I’m waiting for the pitchforks to emerge. Starmer (UK) and Merz (Germany) are only marginally less unpopular, clearly demonstrating that the policies and postures of Europe’s political class don’t represent the will of the people (so who are they representing?).

The European ruling classes’ support for the Gaza genocide (against the will of the people) has been the clearest example of this charade, and evidence of their enduring supremacism (contra the sentiments of regular people). This blatant supremacism is also a disaster for Europe’s image in the world, and the significant fall in foreign investment into the region reflects this, signalling an even worse economic outlook in the future. Technology transitions require investment and economic buoyancy, and the current ruling class is on the wrong side of history, clinging on to Europe’s imperial age.

What are your thoughts about France’s transition to EVs? Which brands and models do you expect to have the most success? Please share your perspective in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy