Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

February saw plugin EVs at 24.8% share of the UK auto market, up from 22.9% year on year. Full electric volume increased by 1.21× YoY, with plugin hybrids up by 1.29×. Overall auto volume was 84,886 units, up 13% YoY and the highest February in 20 years. Tesla was the UK’s leading BEV brand.

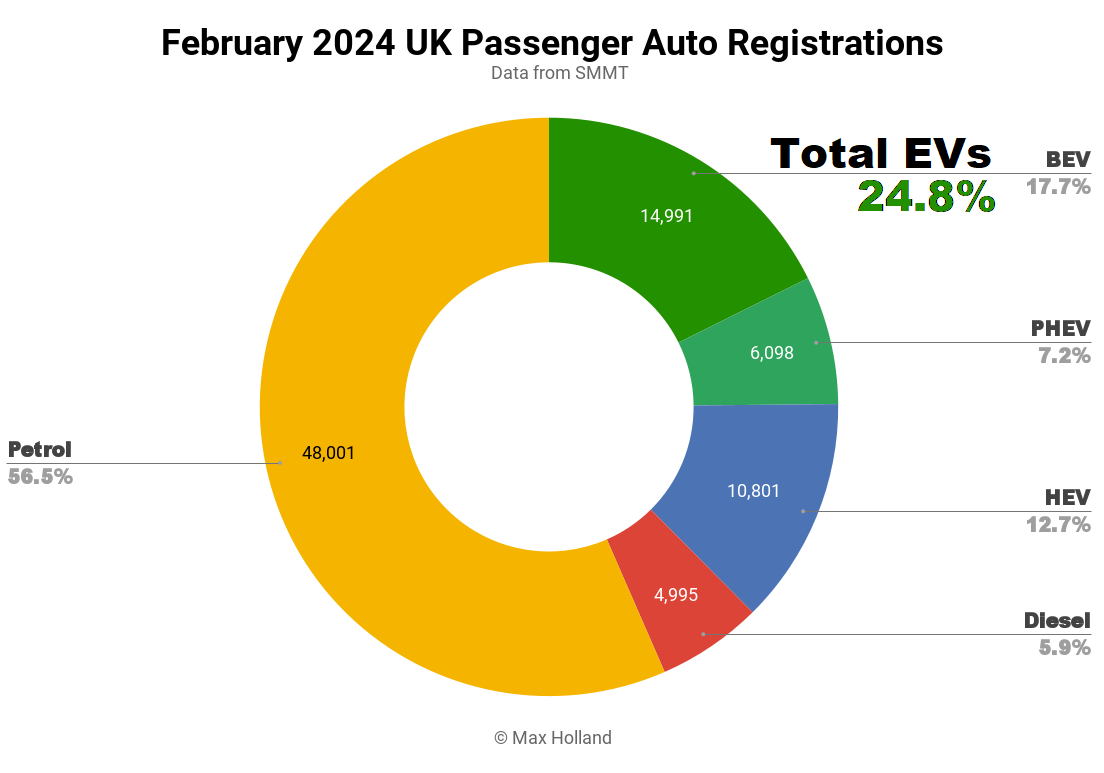

February’s results saw combined plugin EVs at 24.8% share, with full electrics (BEVs) taking 17.7% and plugin hybrids (PHEVs) taking 7.2%. These compare with shares of 22.9% combined, 16.5% BEV and 6.3% PHEV, year on year.

With the new zero emissions vehicle (ZEV) mandate in place, February sees the worst laggards — like Toyota, Honda, and Mazda — in the novel position of actually making noticeable volumes of BEV sales. This follows on from the first signs of this that emerged in January. Stellantis brands had also delayed deliveries in Q4 2023 and are releasing them in Q1 2024 to help achieve the new mandate.

In market volume terms, BEVs were up 21% YoY to 14,991 units and PHEVs up 29% (from a low baseline) to 6,098 units. The overall auto market volume was up 13.3% YoY, which was matched by the growth in petrol vehicles (no change in share).

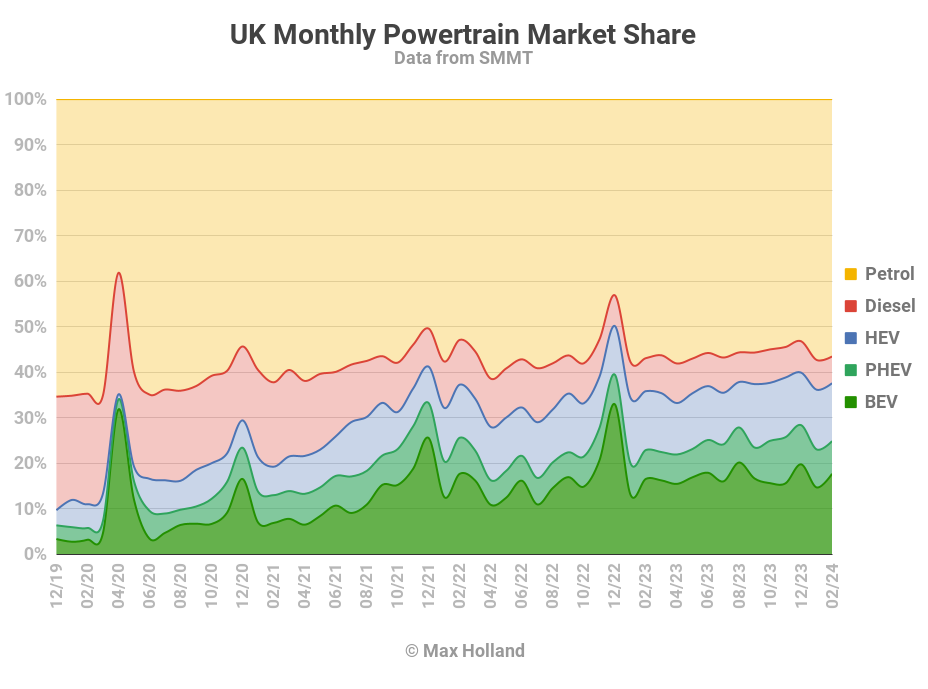

HEVs slightly underperformed the overall market, at 12% volume growth, or 10,801 sales, dropping share from 12.9% to 12.7% YoY. It is too early to say whether HEVs have already peaked in the UK — they have been fairly flat for the past 18 months, mostly hovering around 12% to 12.5% share.

Diesel sales lost 8.5% in volume YoY, to a record low of 4,995 units. Diesel market share also hit a new low, 5.9% (from 7.3% YoY).

Best Selling BEV Brands

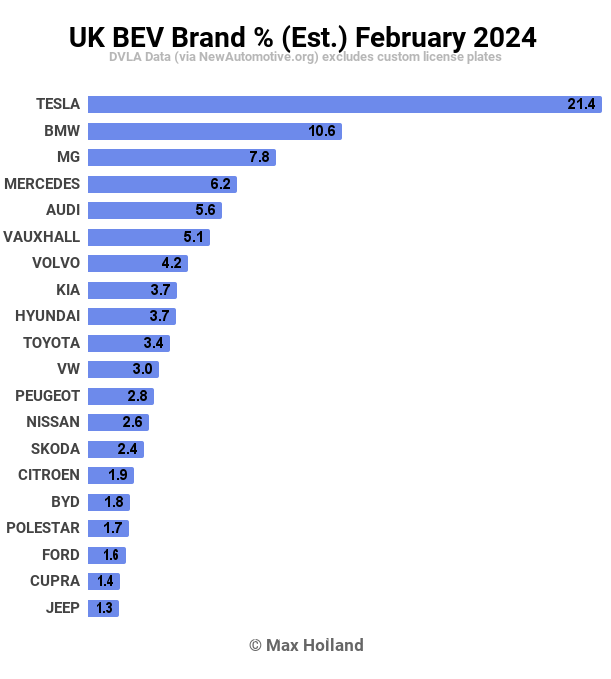

Tesla took the BEV lead back from BMW in February, pushing the Bavarian brand down to second place again. MG Motors came in third.

Tesla is back with a clear lead, with over twice the share of runner-up BMW, a margin that’s clear when looking at the chart. Tesla’s lead in March, when its deliveries traditionally peak, will likely be larger again. More on the Tesla vs. BMW race further below.

Recall that in the brand discussion in last month’s UK report, we found that Toyota, Honda, Mazda, and several Stellantis brands were all making uncharacteristically large BEV deliveries in January, compared to 2023 Q4 delivery volumes. Obviously, they were trying to get a jump on the 2024 ZEV mandate.

This pattern continued for some of these brands in February. Data showed Stellantis’ Vauxhall (Opel) brand again at unusually high volumes compared to Q4 last year (when it was in 11th place), and climbing up to 6th place as a result. Other Stellantis brands — Citroen, Jeep, and Fiat — were all significantly up in rank compared to Q4.

We can see that Toyota has climbed into 10th place, whereas its Q4 ranking was 23rd.

As I said last month, we will get a clearer picture in the months ahead about how laggard automakers are responding to the ZEV mandate. The BEV volume leaders — most obviously Tesla, BMW, and MG — are already way ahead of the mandate and their performance won’t show a step-change. Many other brands will have to radically change this year in order to meet the bar, and we will see this change emerging in their numbers.

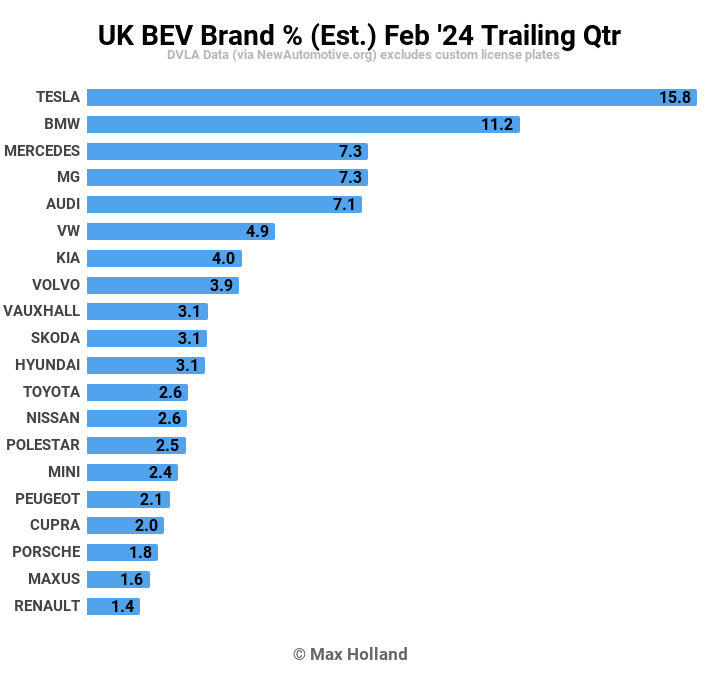

Let’s now turn to the trailing-3-month rankings:

Tesla has a clear lead once more. BMW has a good second place ranking, with a significant margin over others. It’s good to see a tight race for third, with Mercedes, MG, and Audi neck-and-neck.

In the discussion below last month’s report, where BMW had a slight lead in the trailing-quarter ranks, a couple of BMW fans jumped into the chat. My commentary that “we can expect Tesla to be back in the lead in February” was met with dismay … and yet here we are.

It might be worth just taking a step back to understand why Tesla will most likely continue to dominate the UK BEV market over the next year or so (and perhaps longer).

Tesla and BMW have been competing in the UK BEV market for many years. Nissan (with the Leaf) and BMW (with the i3) regularly had the UK’s top two spots from 2014 until Q3 2019 when the Tesla Model 3 started arriving in huge numbers. Before that, even the combined Model S (from June 2014) and Model X (from late 2016) had never been ahead of BMW’s i3.

After mid 2019, the BMW i3 was not only outcompeted by the Tesla Model 3, but was also steadily overtaken in monthly volume by the refreshed VW Golf, the Hyundai Kona, and the Kia Niro, as well as more expensive cars like the Jaguar I-PACE and Audi e-tron. BMW fell far down the UK BEV brand ranks, and for most of 2020 and 2021 was outside the top 10.

Things started to turn around for BMW from September 2021, when the new iX and the iX3 arrived on the UK market. By December 2021, BMW was back in the race, in the 4th spot in the rankings, just behind Nissan and Volkswagen.

By Q3 2022, BMW was back in second place, this time behind Tesla, and has stayed mostly in or around the top three since then, often vying with MG for second spot. BMW now has a wide range of great BEVs (albeit at the pricey end of the market), which I regularly commend in my European reports.

The end of January 2024 briefly saw BMW ahead of Tesla in the trailing-quarter rankings, mainly due to a recent quiet period for Tesla. This had BMW fans believing that Tesla’s dominance was coming to an end, and that their champion could now make a sustained challenge for the top spot in the UK.

The BMW fans overlooked that Tesla had an unusually quiet December in the UK (not necessarily demand limited, perhaps RHD logistics limited) and was low on Model 3 deliveries ahead of the refresh, which arrived in late January. The “Highland” refresh started delivering on January 27th and deliveries have surged, as expected. Once the honeymoon period wears off, the Model 3 will likely be back to around 30% of Tesla’s UK volume.

I think we can all agree that, as BEVs have become normal in Europe, it is certainly the case that Tesla’s two volume models may not have the wow factor that they once did. But for anyone looking for a good value BEV in the UK, the Model Y and Model 3 are still extremely hard to beat (not least because of their pricing, range, and DC charging advantage). If demand cools, Tesla still has room to further reduce the price of these models, ahead of the next “Redwood” model which will be lower priced and see much higher demand.

The Redwood should arrive in the UK in 2026. There will probably be a temporary Osborne effect on Tesla’s sales in the few months before Redwood arrives in the UK (where other brands have a chance to temporarily grab top spot)! This is why Musk has been talking down the Redwood model (just as pre-2017 he sometimes talked down the Model 3 compared to the Model S).

Once Redwood arrives, Tesla will be back to high overall volumes, and very likely back in the lead in the UK, at least in the premium market. If, by that time, traditionally higher volume brands (Volkswagen? BYD?) have stepped up to offer unconstrained volumes of affordable, competent BEVs, then, yes, Tesla may no longer have the overall BEV volume lead in the UK. I would love to see such affordable models in plentiful volumes. Who wouldn’t? I don’t see it happening pre-Redwood, unfortunately.

If BMW can offer a sub-£39,000 BEV, and undercut the Model 3 on price, and on range and ease-of charging, they might have a chance to beat Tesla’s volumes before the Redwood arrives. Or might BMW have its own secret master plan to go sub £29,000 and compete directly with the Redwood itself? Anything is possible, but I would not put money on either of those things happening. At the end of the day, though, all this competition is welcome and benefits consumers.

If you agree or disagree with this take, please jump into the comments below and make your case (preferably with data).

Outlook

Despite the growing auto market, recent economic output in the UK further weakened in the latest data from Q4 2023, with negative 0.2% growth YoY. Inflation was flat at 4%, and interest rates flat at 5.25%. Manufacturing PMI improved slightly to 47.5 points in February, from 47.0 in January.

The UK auto industry body, the SMMT, has requested the government reduce VAT on BEVs (though, not suggesting a price cap on this, which is a non-starter) and reduce VAT on electricity at public chargers (more realistic). So far as I can see, in the breaking budget announcements, neither of these requests have moved the government policy in the official 2024 budget planning.

The ZEV mandate will mean that the share of BEVs will continue to grow for the foreseeable future.

What are your thoughts on the UK EV transition? Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.