Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

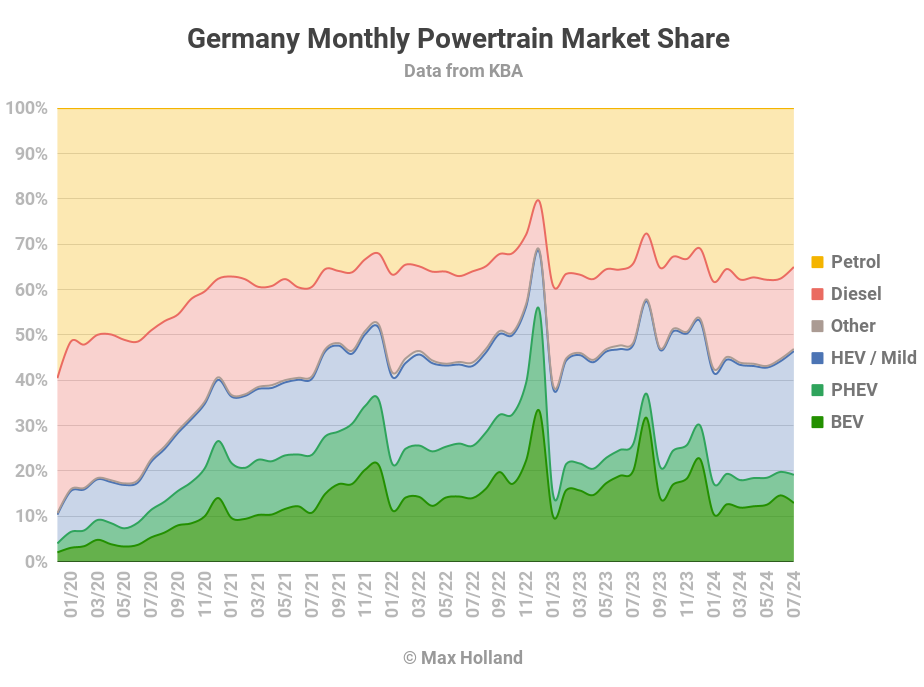

July saw plugin EVs at 19.1% share in Germany, down from 25.9% year on year. BEV share has even dipped below where it was 2 years ago, and PHEV share has also fallen since then. July’s overall auto volume was 238,263 units, down 2% YoY, and down around 23% from 2017–2019 seasonal norms (~310,000 units). The best selling BEV in July was the Tesla Model Y.

July’s auto sales figures saw combined EVs at 19.1% share in Germany, with full electrics (BEVs) at 12.9% and plugin hybrids (PHEVs) at 6.2% share. These compare with YoY figures of 25.9% combined, 20.0% BEV and 5.9% PHEV.

The drop in YoY BEV share is certainly a poor showing, yet the magnitude is amplified further by a high baseline. The baseline of July 2023 was experiencing a BEV pull-forward ahead of the imminent cutting of incentives for commercial buyers (businesses and fleets, etc.) at the end of August, so saw a higher share than normal. Even without that pull forward, the July 2023 baseline BEV share would likely have been in the 15% to 17% range. However, that’s still embarrassingly far ahead of the current BEV share of 12.9%. As noted in the intro, even July 2022 had higher BEV share, 14.0%!

The woeful backsliding in Germany’s BEV market share is a combination of several key factors. The recent proximate factor remains the abrupt unscheduled cut of BEV purchase incentives in December 2023, which was a very public shock to the market and has made BEVs effectively more expensive from the perspective of the end consumer. This sudden change was so poorly handled by Germany’s politicians that it became highly visible and thus widely known about — every new car buyer is aware that BEVs are now effectively “more expensive” than a few months ago, due to the subsidy removal.

This short-term trauma is combined with the more fundamental fact that, over the past couple of years, many of Europe’s legacy automakers have overall increased the list prices of their entry BEVs, instead of reducing them, whilst these same auto brands have paid out record profits to management and shareholders. Multiple independent reports have documented this increase in the price of Europe’s legacy brand BEVs. These include reports by JATO Dynamics and briefing papers by Transport & Environment.

Unsurprisingly, then, big European legacy marques like Volkswagen, Stellantis, and Renault have actually decreased their BEV sales from Q1 2023 to Q1 2024 across 15 key European markets, including Germany, Europe’s biggest auto market.

The BEV price increases from legacy automakers effectively mean that — instead of steadily becoming more affordable to consumers (as new technologies almost always do) — BEVs are now far overpriced in Europe compared to ICE alternatives. This is in sharp contrast to the increasing affordability of BEVs in most other parts of the world — for example, Latin America, Australia, and especially China, where BEV adoption is growing very fast. In China, BEVs are now at price parity with ICE vehicles across most key segments, and as a result, plugins are now at 50% of the auto market.

The dearth of affordable BEV options in Europe (despite battery and other BEV powertrain costs being at record lows) is fundamentally because most legacy European auto companies are determined to do the legal minimum to switch over to BEVs, and want to keep selling ICE cars for as long as they can.

In Germany’s case, the trend of overpriced BEVs combines with a very weak national economy. Every quarter over the past 12 months has shown consistently negative economic output. Obviously, items perceived as relatively expensive become less attractive during a recession, especially when interest rates (on financed items) are also high.

This combination of factors, particularly the cynical BEV pricing in Europe, is the cause of the declining BEV share in Germany’s auto market.

Meanwhile, sales of plugless vehicles in Germany have increased year to date compared to 2023, as has their market share. These include hybrids, but also combustion-only vehicles. Year to date, petrol-only vehicles are up in volume more than 6.5% compared to 2023, with increased market share. Diesel-only are up in sales volume by even more — 8.9%!

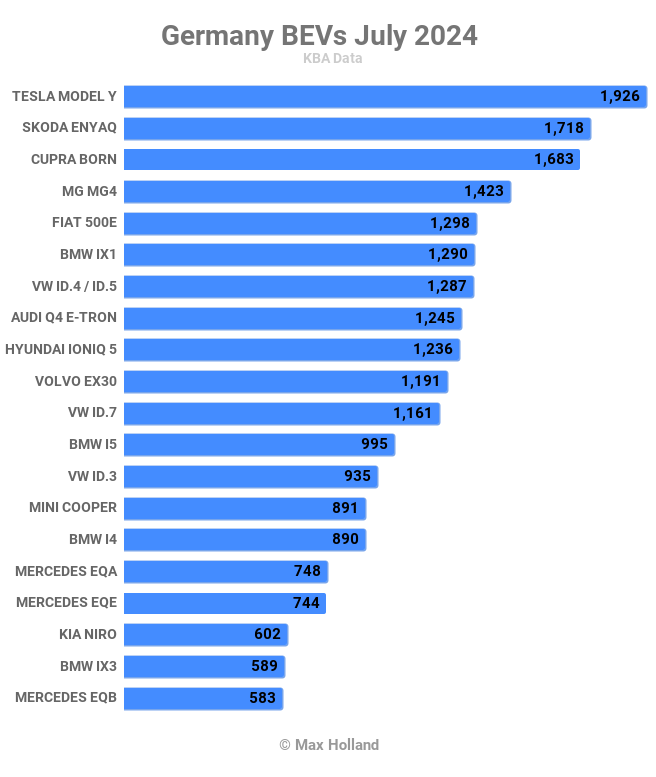

Best Selling BEV Models

The Tesla Model Y was back to the top of the charts in July, with 1,926 units registered. June’s leader, the Volkswagen ID.3, slid down to 13th spot.

In second place was the Skoda Enyaq, with 1,718 registrations, up from 4th in June. Third place went to the Cupra Born, with 1,683 registrations, up from 6th in June.

Seeing decent climbs compared to June were the Fiat 500e, the BMW iX1, the Volkswagen ID.7, and the BMW i5. Just outside the top 20, the new Audi Q6 e-tron climbed to 21st position (with 473 registrations), up from 68th in June (69 registrations).

Perhaps not coincidentally, the Audi Q8 e-tron slipped from 23rd in June to 28th in July. The older Q8 now looks like poor value compared to the new Q6 e-tron (based on the new PPE platform and offering a better ratio of interior space to overall length). Audi will presumably have to fundamentally update the Q8 (perhaps also employing the PPE platform) in order for it to remain relevant.

There were four all new BEV debutants in July. The Polestar 4 and the Polestar 3 both saw their first deliveries, with 88 and 70 registrations, respectively.

The Polestar 4 is a large CUV format vehicle with a coupe silhouette, with length of 4,839 mm. It starts from €61,900 in Germany, for a 94 kWh of battery (usable) and ~30 minute DC charging (to 80%). Rated range is 620 km (WLTP).

The Polestar 3 is a slightly longer (4,900 mm) and heavier vehicle in a more classic boxy SUV shape. It has a larger 107 kWh (usable) battery with a 650 km rated range (WLTP) and similar charging speed. It is more expensive, with German pricing from €78,590 and up. Let’s see how these new Polestar models get on in the German market.

Next up is the new Ford Explorer (16 initial units), which is basically Ford borrowing the MEB platform from Volkswagen Group and styling its own version of the Volkswagen ID.4. The Ford restyle has a slightly more traditional boxy shape, instead of the ID.4’s more obvious curves.

At launch, the Ford Explorer is available only in the 77 kWh (usable) battery, priced from €49,500. Though, the smaller 52 kWh variant is planned for later. These battery sizes, the output power, and other technical specs are almost exactly the same as its Volkswagen ID.4 second cousin, unsurprisingly. For some reason, however, Ford quotes a WLTP range of 602 km, more than the 550 km of the ID.4 (with the same battery). The interior styling, however, is more distinct from the ID.4. And yet — in a shocking decision — the Ford still inherits the ID.4’s annoying haptic buttons!

The final debutant of the month was a low-volume sports sedan from Lotus, the Emeya (9 initial units). Priced from over €100,000, this is not going to move the needle on the BEV transition, but it’s still good to see yet more of the high end of the market switching over to BEV.

Regarding last month’s apparent debutant, the Audi A6 e-tron, there were another 8 units registered in July, but these are almost certainly only for showrooms. Official customer orders only open in early September, and there’s still no pricing information.

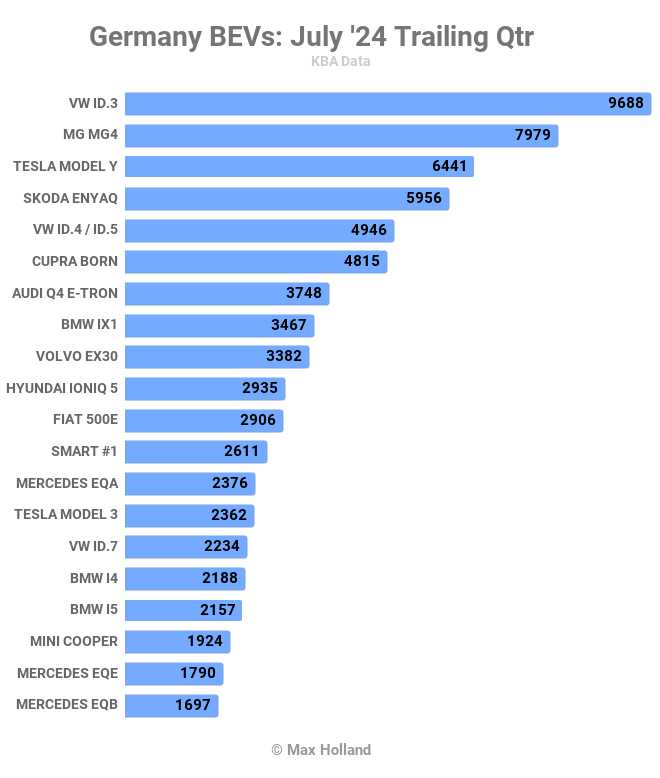

Let’s now turn to the longer perspective:

Despite weak numbers in July, the Volkswagen ID.3 remains on top of the 3-month ranking, ahead of the MG4 and Tesla Model Y. This is a big climb for the MG4 over the prior period (11th), mainly thanks to May and June volumes (likely a pull forward ahead of the higher EU tariffs from early July).

Models climbing the ranking since 3 months prior include the Fiat 500e (up 13 spots), the Volkswagen ID.7 (up 16 spots), and the refreshed Mini Cooper (also up 16 spots). Less dramatically, but perhaps more significantly, the Volvo EX30 has continued to climb, now up to 9th position.

Let’s quickly check in with the manufacturing group rankings:

Volkswagen Group has increased its share of the German BEV market to 34.8%, from 29.4% three months prior. It overshadows all of the others.

BMW Group has increased its share and jumped up from 4th to 2nd, overtaking Mercedes and Tesla, which both step back one position as a result. SAIC, due to the pre-tariff push, has climbed from 8th to 5th, but will step back again in the coming months.

Toyota Group and Honda remain dragging their feet at the back of the pack, each with 0.3% of the BEV market, an even worse performance than 3 months prior.

Outlook

The 2% YoY shrinkage in auto sales in July correlates with a wider German economy which is in recession. Every quarter over the past 12 months has seen YoY negative GDP growth, with 2024 Q1 and Q2 both showing negative 0.1% results.

Inflation was at 2.3% in July, and not much changed since February. Interest rates fell to 4.25% in early June, and have remained there since. Manufacturing PMI improved slightly to 43.2 points in July, from 42.6 points in June.

As discussed in the Sweden report, legacy auto manufacturers in Europe are not interested in speeding the transition to BEVs, they are simply doing the minimum legally required by the emission regulations (whilst instead making record profits).

Unfortunately, these regulations do not require more progress in 2024 compared to recent years, so the manufacturers are not trying (or trying not) to increase their BEV sales. The rules will tighten somewhat in 2025, so Europe’s transition is on pause until then.

What are your thoughts on Germany’s auto market and recent (backward) trend in the EV transition? Please jump into the discussion below and let us know.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy