Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Whilst Latin America’s largest vehicle markets have been undergoing significant EV growth (we can already predict Brazil’s plug-in market share will surpass 5% in 2024 and Mexico’s will be above 2%) and several minor markets are showing meteoric growth (Costa Rica, Uruguay, and Colombia), this does not mean the entire region is moving as fast. Time is due for a report on laggards, as well as smaller markets that may not provide a lot of information but are important regardless.

(And, yes, the main reason I haven’t been reporting more often on Brazil, Mexico, Chile, and Costa Rica is that things aren’t moving much. You can refer to the latest report and be confident things are more or less static).

LatAm’s Overview

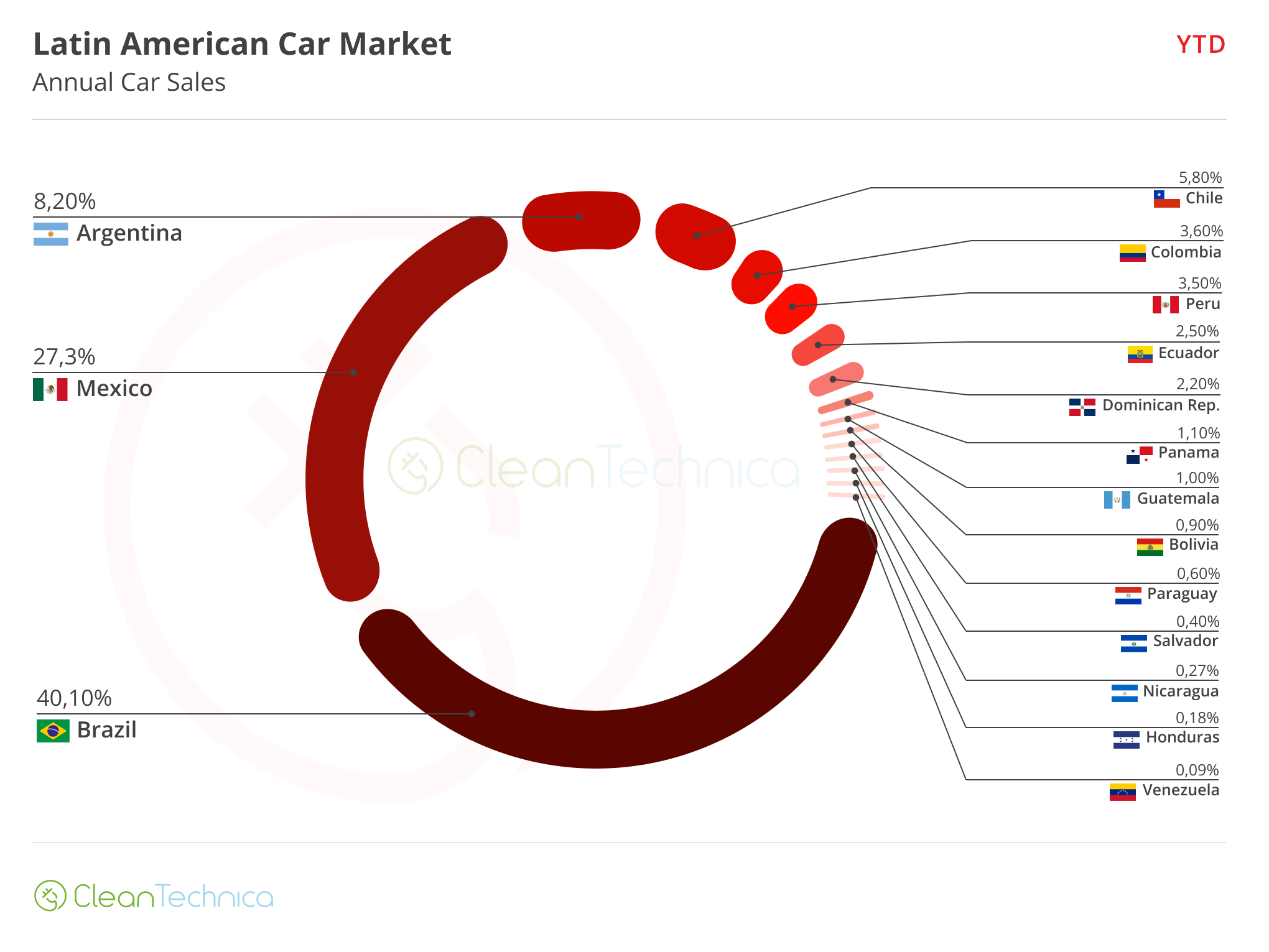

Latin America’s total vehicle market (including cars, buses, and trucks, but excluding the omnipresent motorcycles and the surprisingly few three-wheelers) amounts to some 5.5 million units a year. This is including fossil-fueled vehicles, EVs, and the various hybrids.

The market is extremely concentrated in the two largest countries, which together account for two-thirds of of the region’s sales:

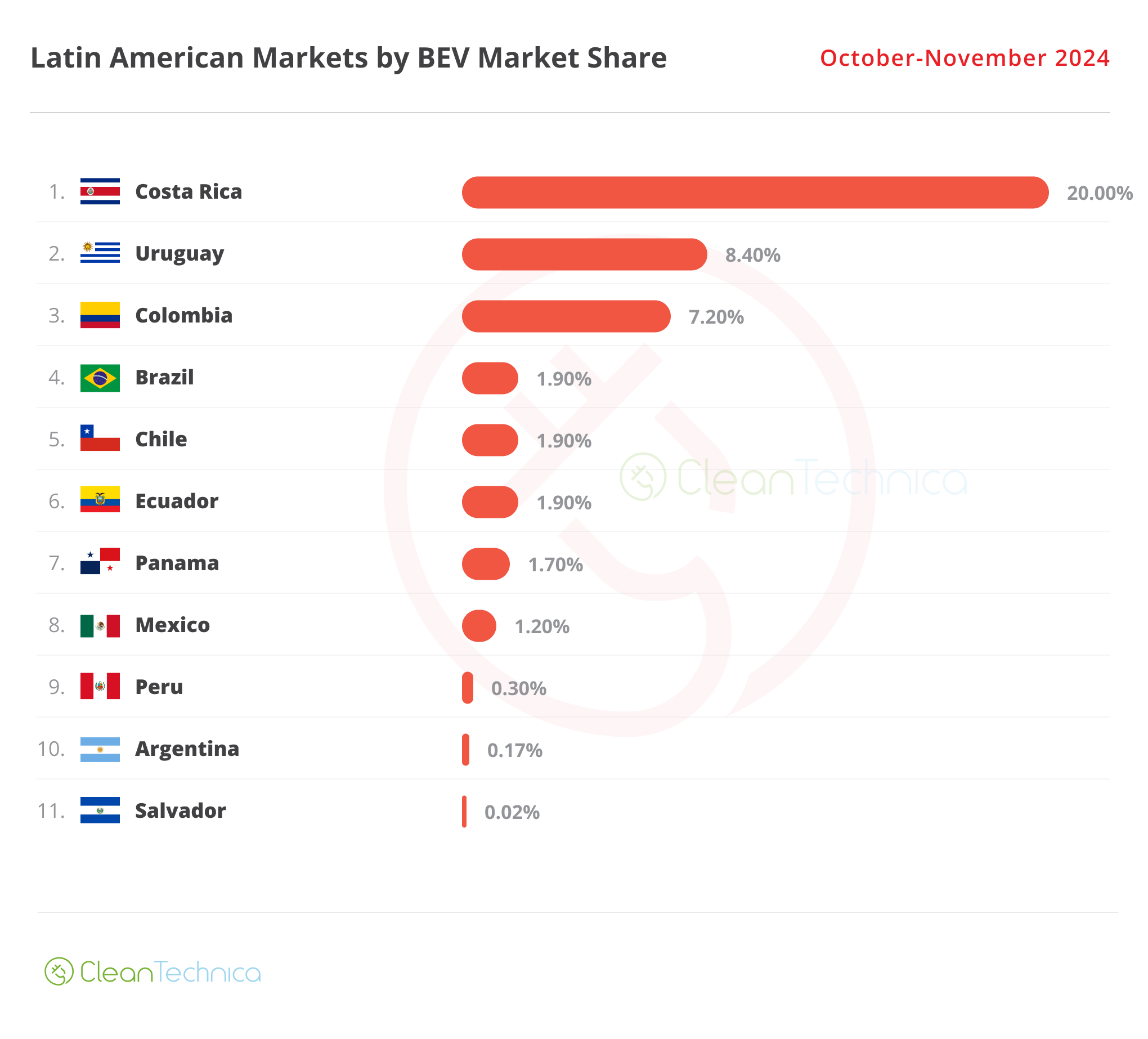

As such, the fact that electrification has advanced rapidly in these two markets means that the region itself is advancing, if still far behind China, Europe, and even the US. Whereas the leaders are heavily skewed towards purely electric vehicles (BEVs), other countries (including Brazil and Mexico) have significant presence of plug-in hybrids (PHEVs). In this article, we will focus on BEV sales only, and as far as BEV sales go, we have quite a divergence in the region:

The regional leaders (Costa Rica, Uruguay, Colombia) and the largest markets except Argentina (Brazil, Mexico, Chile) have been covered individually on several occasions. But as the year comes to a close, I felt it was time to look for those countries I’ve not been following as closely and for those that I do follow but find too stagnant to be worthy of an individual report. As you can see in the previous chart, it’s quite easy to divide that group in two: those who are truly lagging, and those who are a surprising bright spot in the region.

Argentina, El Salvador, Peru: the True Laggards

When a country has such marginal penetration of EVs as these three have, it’s hard to even find proper information on what’s going on. Peru is the only of the three providing decent data on BEV sales, so let’s start with it.

First, let me get this off of my chest: Peru is a mystery.

The country lacks significant oil reserves, has a decent grid, and most important of all, has very close links with China, recently opening the Mega-Port of Chancay, one of the main Chinese investments on the continent. As EV prices fall, Peru should’ve rapidly become one of the leaders in the region and probably on par with Colombia (a similar country as far as the economy goes), yet there has been no Chinese armada arriving on Peruvian shores. As a matter of fact, BYD is only arriving this month, and under the umbrella of Colombia’s distributor: Motorysa. And worst of all, with little competition, Motorysa is not making EVs as affordable as they should be, charging around 25% more for them in Peru compared to Colombia.

Still, that should be enough to bring the market above 1% at least. Hopefully, in the coming two years new arrivals will increase competition and prices will come down, reaching price parity with ICEVs in the medium term. For now, however, Peru’s BEV sales are at only 0.3% market share. Though, last year it was 0.15%, so there’s at least growth.

Moving on with our list, El Salvador provides very little information, but we do know it has marginal EV sales, with less than 10 units being sold in November 2024, and around 50 in October. With overall sales at around 2,000 a month, EVs remain a rare sight in this market, yet it could be well ahead of Honduras and perhaps even Guatemala, who don’t even report EV sales at all. As with Peru, El Salvador has many things going for it in theory, including a minuscule size (a BYD Seagull could easily make a cross-country trip without charging), a highly internationalized economy, and a lack of oil reserves. However, it stands as the smallest EV market proportionally in the region as far as countries with available information go.

At last, we come to Argentina. The third vehicle market on the continent and an economy that has seen brighter days, Argentina is currently facing one of the harshest economic adjustments in the history of the region. Current President Javier Milei was elected with the mandate to reduce the size of the state and curb spending to solve pervasive inflation that has been plaguing the country for years, and he has not been shy in doing so (with significant success) regardless of the short-term suffering this may cause. For some, this is a painful yet necessary reform if the country is to prosper, as too much wealth has already been wasted. For others, it means the destruction of the welfare state Argentinians fought so hard to build, something that only benefits the elites.

I will not delve into the intricacies of Argentina’s political situation, as that stands beyond the scope of this article, but there’s one thing that could greatly affect the EV market under Milei’s proposed reforms, and that is the systematic lowering of tariffs.

If you remember our report on Latin America EV sales from 2023, we mentioned back then that one of the reasons for Argentina’s minuscule BEV sales was protectionism. Tito Corradir, a locally assembled mini EV, was the most sold model in 2023 as competition suffered from high prices due to tariffs. But Milei has worked to reduce tariffs and this could affect EV prices, as several EV makers are starting to enter the country.

Milei is also a well known Musk fan, and has recently mended the country’s relationship with China, claiming they are “interesting partners” even if he remains politically aligned with the US. Both Tesla and the Chinese EV makers could have a chance here, and with Argentina’s large vehicle market, this is not peanuts we’re talking about. But big ships take time to turn, and I bet the winner will be whoever starts exporting from Brazil to Argentina the fastest … which means it will either be BYD, Chery, or GWM.

Argentina’s BEV market is also growing, already reaching 2023’s total (300 units) in the first six months of 2024, and finally surpassing 0.1% market share. It seems the Renault Kwid E-Tech has also become the best-sold EV, surpassing the locally produced Tito Corradir with 100 sales in those six months. 2025 should bring better numbers, but Argentina and El Salvador remain the ultimate frontier for BEVs in Latin America.

Ecuador & Panama: the Bright Spot

Panama is a relatively wealthy country with a very small territory and, lacking in oil reserves, it should be one of the main EV adopters in the region, perhaps rivaling Costa Rica. It isn’t, of course, but Panama is still showing strong growth, with BEV sales increasing by 109% between October 23 and October 24, and reaching over 100 sales and almost 2% market share.

Panama is committed to a rapid transition, it has deployed a decent number of chargers, and it seems to be moving slowly but surely to a mostly BEV market by the end of the decade. However, progress has been slow compared to other countries and not much information is available on brands or models. Though, it seems prices in the country remain relatively high, on par with those of Peru or Mexico.

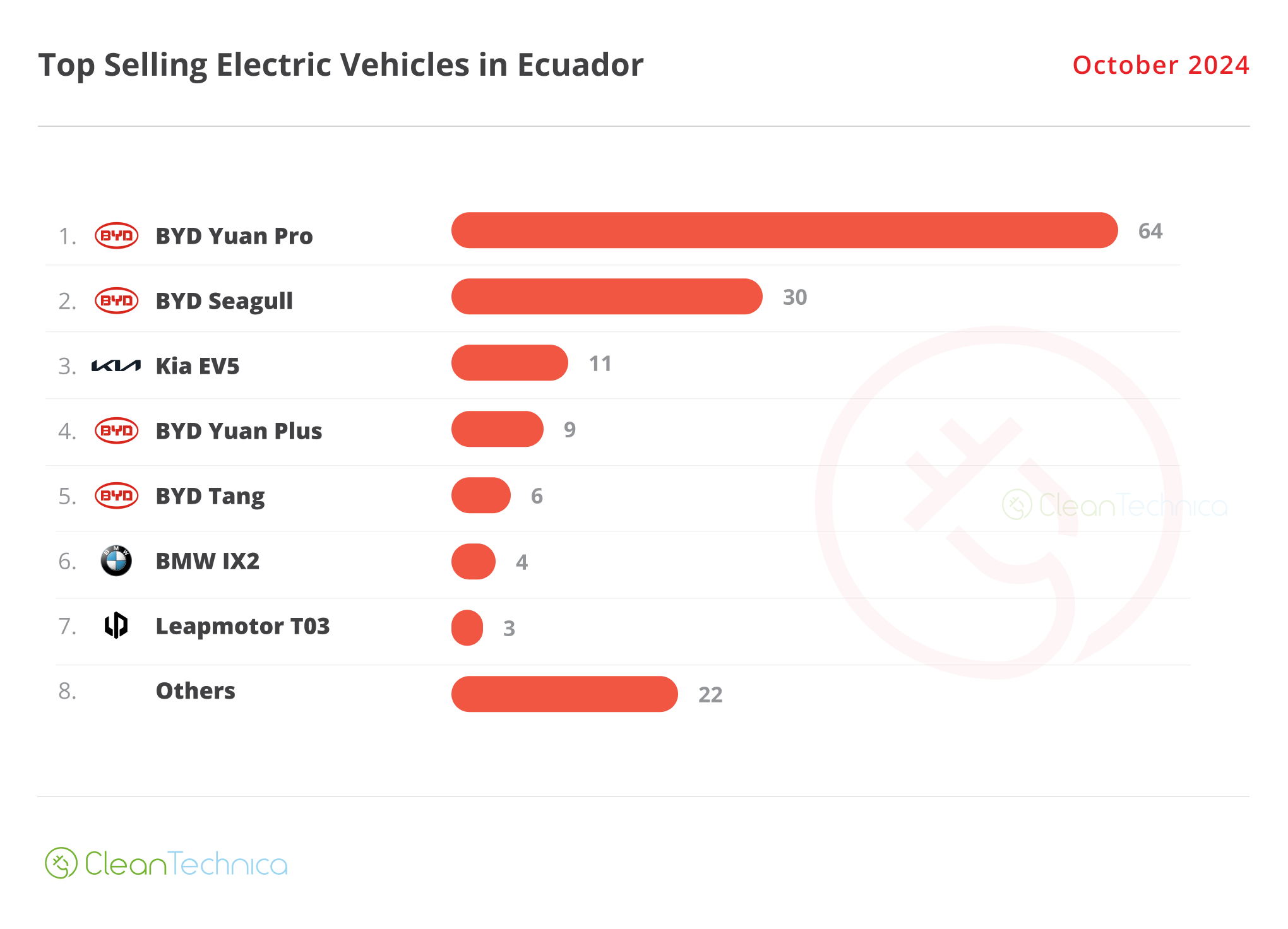

Unlike Panama, Ecuador had long been a laggard, and one that I’m ashamed to say I had not been following closely. If you remember our report from 2023, they messed up their statistics (accounting for the Nissan X-Trail as a fully electric vehicle), and they have not fixed that, which means acquiring the data for this country involves a significant amount of work. Regardless, back then, market share was a mere 0.5%, yet the country had risen to 1.9% by November 2024! Ecuador is the unquestionable star of this article, and the country may well warrant exclusive reports from now on.

Ecuador has risen above Mexico and Panama as far as BEV sales go, and is now on par with Chile, thanks probably to the arrival of more affordable EVs. BYD absolutely dominates the market with 74% market share, followed by Kia and Leapmotor/Mercedes in distant second and third positions.

And it’s Leapmotor that has impressed me the most. The T03, roughly comparable to the long-range BYD Seagull, is available in Ecuador from $18,000, making it only $3,000 more expensive than the Kia Picanto, $1,500 more than the Renault Sandero, and roughly on par with the Suzuki Swift. This car boasts a 41 kWh battery, which should be enough for a country the size of Ecuador, so we’re closing in on price parity.

However, the fact that BYD is selling 10 times more Seagull as Leapmotor sells T03, despite a price difference of over $4,000, is a testament to the brand recognition BYD has achieved in Latin America. Truly, this company is a force to be reckoned with.

At last, Ecuador just went through severe blackouts, up to 12 hours a day, due to the severe drought that the region faced in early 2024 (which depleted water reserves) and less rain than expected later in the year. 90% of Ecuador’s electricity comes from hydroelectric dams, so this was a massive blow to its system, which will only come fully online in December 20 thanks to energy imports from Colombia (imports previously unavailable due to that very same drought).

I assume at least a few EV-interested buyers will opt for a fossil fuel vehucle under the threat of not being able to charge their cars at some point in the future. Hopefully this will not happen again and people will grow to trust the Ecuadorian grid, but meanwhile, blackouts could deal a blow to EV sales.

Final Thoughts

Some countries are far ahead, while others remain behind. Yet, as the largest markets are pivoting to EVs, and as several mid-sized markets are booming, the region itself is moving faster than many of us expected.

Sure, there are laggards, and I have reasons to believe some countries may be even further behind. Central American countries, for example, import a lot of used vehicles, so they won’t electrify anytime soon. But something to keep in mind is that, regardless of how ahead or how behind a country may be, not a single market that we’ve got data on shows falling EV sales.

Yes, that’s right. EVs are growing everywhere.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy