Canadian nickel exploration company EV Nickel has completed its private placement, raising aggregate proceeds of around $5.12m.

This offering, which was led by PowerOne Capital Markets and Clarus Securities, included 1,705,000 premium flow-through common shares priced at $0.95 each, totalling $1.62m, and 4,666,667 flow-through common shares at $0.75 each, amounting to $3.5m.

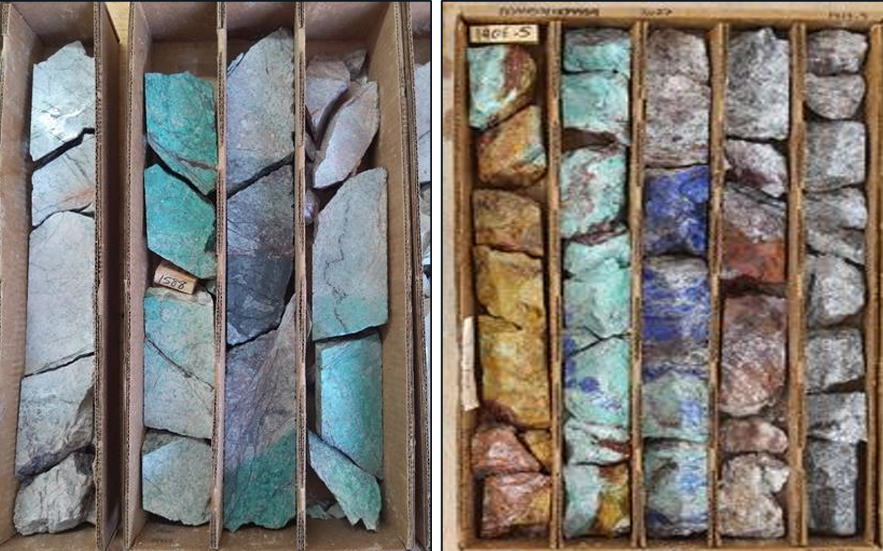

The company will utilise the funds raised to support eligible “Canadian exploration expenses” at the company’s Shaw Dome assets in Ontario.

These expenses are designated as “flow-through critical mineral mining expenditures,” which will be renounced to subscribers by the end of December 2024, ensuring that the total renounced amount is at least equal to the gross proceeds from the offering.

As compensation for their services in the private placement, EV Nickel has paid PowerOne Capital Markets and Clarus Securities a cash fee of $358,382.52.

Additionally, the company issued 446,017 compensation warrants to the agents. Each warrant grants the holder the right to purchase one common share of EV Nickel at a price of $0.75.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

This move comes after EV Nickel’s earlier agreement this month with PowerOne Capital Markets and Clarus Securities for a brokered private placement of up to 4,666,667 flow-through common shares at $0.75 apiece, aiming to raise up to $3.5m in gross proceeds.

EV Nickel Exploration vice-president Paul Davis said: “We are very appreciative for the strong interest in this financing, which will be utilised by the company to further develop our high grade and large-scale nickel resources.

“Together with the funds raised from recent warrant exercises, the Company is well capitalised and is in active preparation for its upcoming work programme.”

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.