MILAN, Jan 11 (Reuters Breakingviews) – Europe may have overplayed its energy security strategy. President Vladimir Putin’s 2022 attack on Ukraine exposed the European Union’s heavy dependence on cheap gas imported from Russia, chiefly via pipelines. To address the imbalance, the bloc rushed to add facilities to import liquefied natural gas (LNG) by sea from friendlier nations. But with renewable power set to depress fossil fuel demand, some of the newly built infrastructure risks becoming redundant.

Putin’s invasion of Ukraine created a seismic energy shock. The year before the invasion, Europe imported some 155 billion cubic metres (bcm) of discounted Russian gas, representing around 40% of its total gas consumption of 412 bcm, according to European Commission data. Drastically cutting reliance on Moscow’s fuel, as EU nations agreed to do in March 2022, called for a Plan B. After identifying LNG as a key part of the energy mix, Europe rushed to upscale its capacity to turn billions of cubic metres of LNG imports, chiefly from the United States, back into a usable gaseous form.

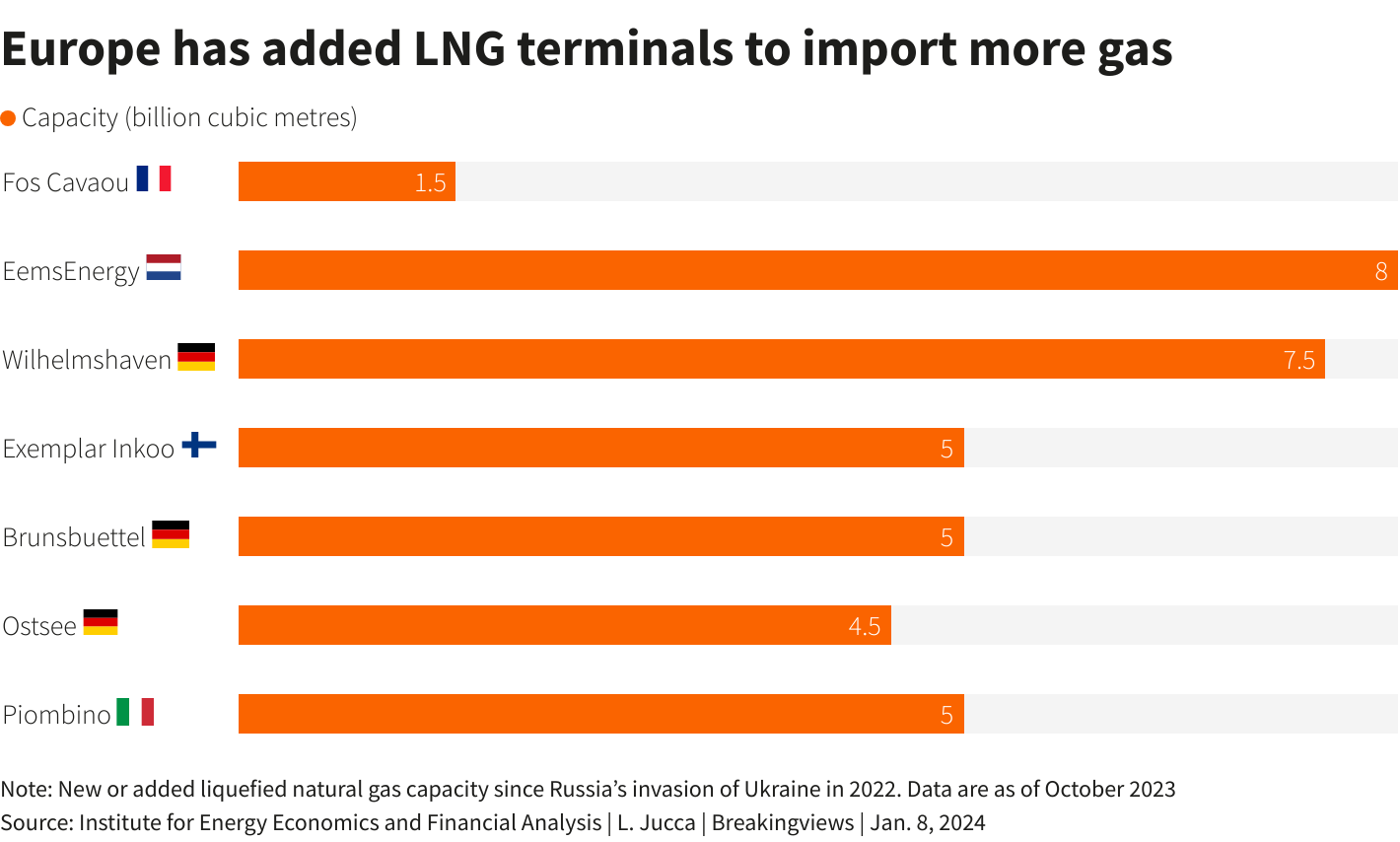

By and large, this has been a success. Putin’s gamble that the EU would crack and collapse under the costly challenge of keeping its population warm and its factories open did not work. Between the start of the war and August 2023, the 27-nation bloc added six LNG terminals to its pre-existing network of around 20 regasification facilities and expanded one French site, according to the Institute for Energy Economics and Financial Analysis’ (IEEFA) LNG tracker. That has added 36.5 bcm of regasification capacity. The rush to secure sufficient gas means the EU may end up with 19 more LNG terminals in 2030 than in 2022.

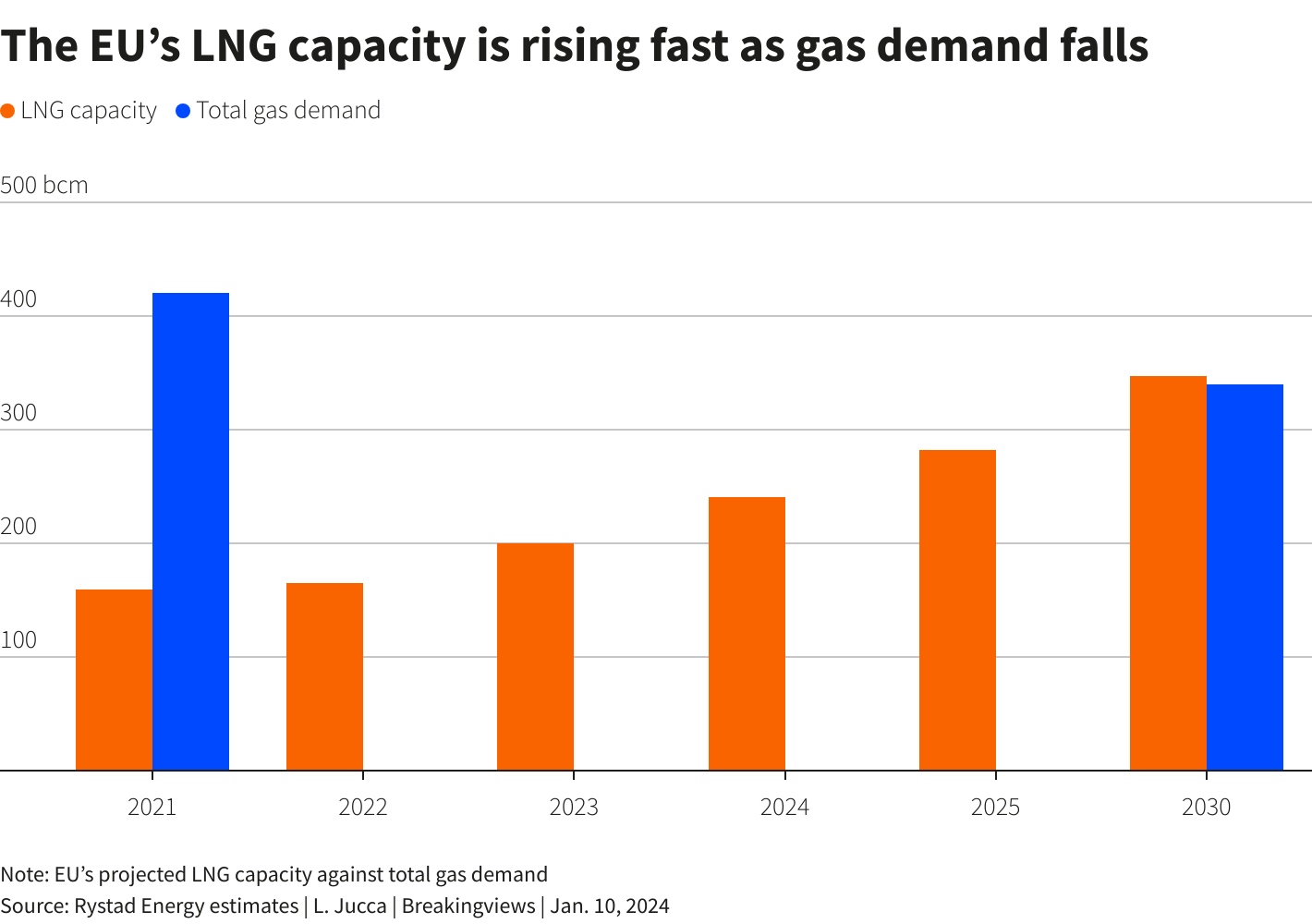

Even so, something in Europe’s energy security strategy is starting to look out of place. If all projects under construction are finalised, the EU’s LNG import capacity could balloon to nearly 350 bcm by the end of the decade, from just 160 bcm in 2021, according to forecasts from research firm Rystad Energy. Yet the bloc’s total gas demand is set to fall to 340 bcm by then, down 19% from 2021. That means Europe’s projected 2030 LNG capacity would be higher than all the gas the bloc may need.

All this is despite the fact that the region is likely to continue to rely on pipeline imports from Norway, North Africa and Azerbaijan for the bulk of its gas requirements, and also on some local production. The gap between local European production and pipeline imports versus estimated demand is forecast to be around 190 bcm by 2030, data published in the Shell LNG Outlook 2023 that also include Britain show. That is likely to be filled with LNG imports, but is only half the region’s projected regasification capacity.

Building a bit of a gas import buffer makes sense. Demand for the fossil fuel during the colder winter months can be double what the continent needs in the summer. LNG also offers more flexibility on imports and prices than pipeline gas. And Europe is not alone in adding liquefaction capacity to ensure energy security. The International Energy Agency believes LNG projects under construction globally will add 250 bcm to the world’s annual liquefaction capacity by 2030, almost 50% more than the 540 bcm approximate level of LNG traded in 2022.

The augmented global capacity should prevent a repeat of the 2022 energy crisis in Europe, when prices of the benchmark Title Transfer Facility contract for next-month delivery spiked to above 300 euros per megawatt hour, 10 times higher than the current 31 euros per megawatt hour, LSEG data show. But infrastructure overabundance raises question marks about the financial viability of all the LNG terminals countries put on the launchpad during the energy crisis, chiefly with taxpayers’ money.

Take Germany. Europe’s biggest economy was also the most dependent on Russian gas, deriving more than 50% of its gas needs from Moscow before the Ukraine war. Prior to 2022, it also had no LNG regasification terminals. The invasion triggered political backing for seven floating regasification units, at a cost of around $10 billion, financed by the German state, the first of which become operational in December 2022 in the Baltic port of Wilhelmshaven. Berlin also started work on three, more permanent onshore gas ports by 2030. In Italy, which depended on Moscow for around 40% of its gas imports, $17.5 billion Milan-listed gas network operator Snam (SRG.MI) has invested over 1 billion euros to acquire and install two floating LNG terminals off the cost of Tuscany and in Ravenna.

Those investments, however, may turn out to be a bit of a waste. It’s one thing to have a buffer against future energy shocks, but if countries treble their renewable energy capacity and move away from fossil fuels already this decade, as agreed in December at the COP28 meeting, gas demand may fall more rapidly. Europe might then need even less LNG import capacity.

Infrastructure projects tend to repay their big upfront costs with decades of cash flows. Were these not to materialise, the likes of Snam could face impairments. So could port company Buss Group, buyout fund Partners Group (PGHN.S), $4.5 billion Spanish energy firm Enagas (ENAG.MC) and $38 billion U.S. giant Dow (DOW.N), which have invested in the construction of the onshore Hanseatic Energy Hub in the German city of Stade, slated to be ready in 2027. Berlin might have to explain to taxpayers why it is doing the same.

LNG’s public and private investors do have some cause for comfort. Governments could sell or lease back the floating LNG facilities they have installed, perhaps to Far East Asian or Indian players. Investors could also repurpose onshore terminals to operate them with low-carbon hydrogen or ammonia, or use them for carbon capture. And if the pace of decarbonisation is inadequate, the need for gas will stay elevated.

Still, if regasification capacity greatly outstrips demand, offloading the LNG terminals may have to come at a discount. Hydrogen has potential, but may only become a commercially viable and scalable alternative for gas by 2050, Deloitte reckons. To avoid having to deal with stranded gas infrastructure, European governments may need to consider scaling back some of their projects now.

Follow @LJucca on X

CONTEXT NEWS

Europe added six liquefied natural gas terminals and 36.5 billion cubic metres of LNG regasification capacity between the start of the Ukraine war and August 2023, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA).

The European Union had 21 operational LNG terminals plus one mothballed before Russia’s invasion of Ukraine, the IEEFA says. The bloc has been working to add 19 new terminals by 2030.

Editing by George Hay and Oliver Taslic

Share This: