Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

And Volvo EX30 ends May in 2nd place.

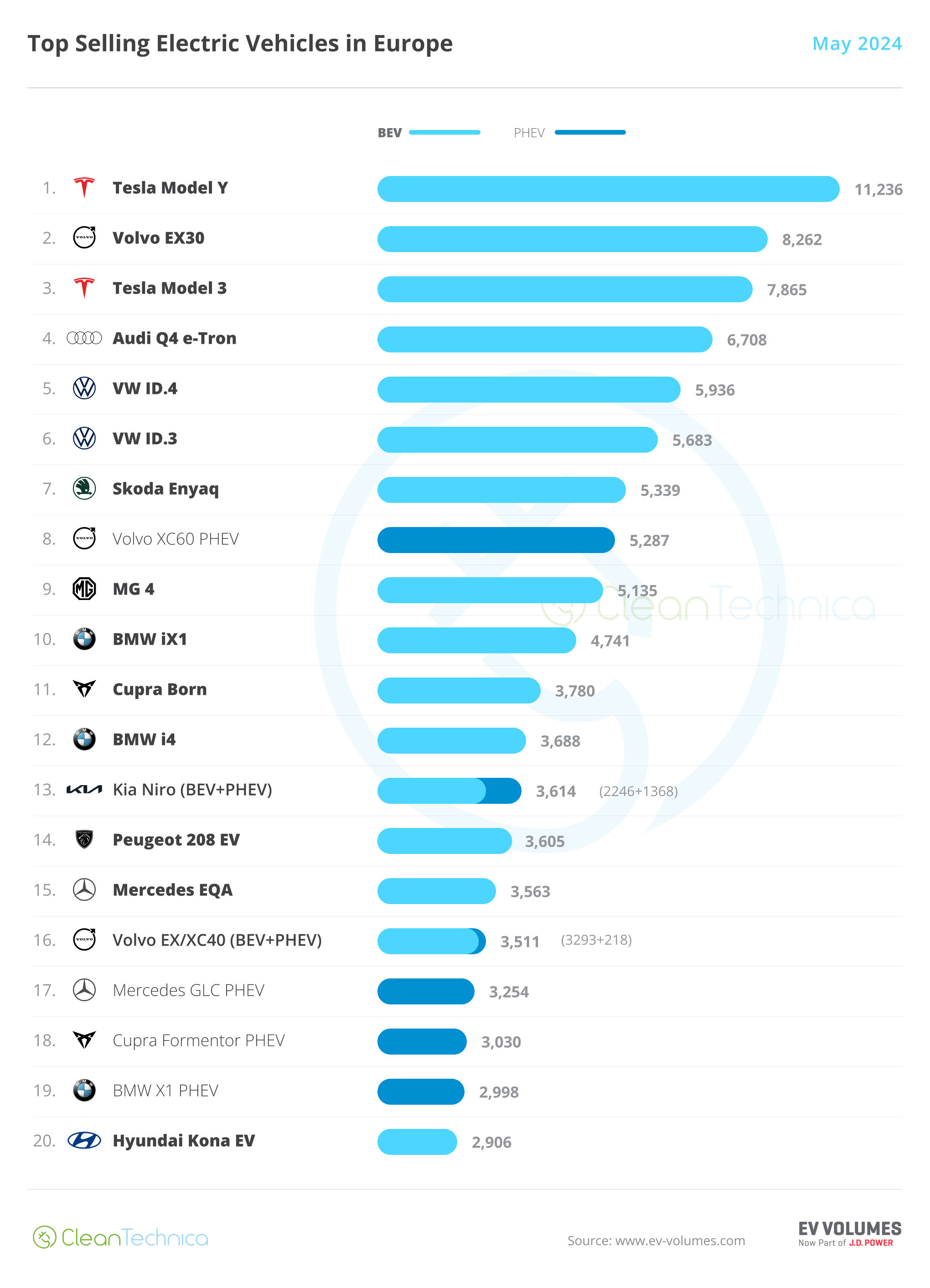

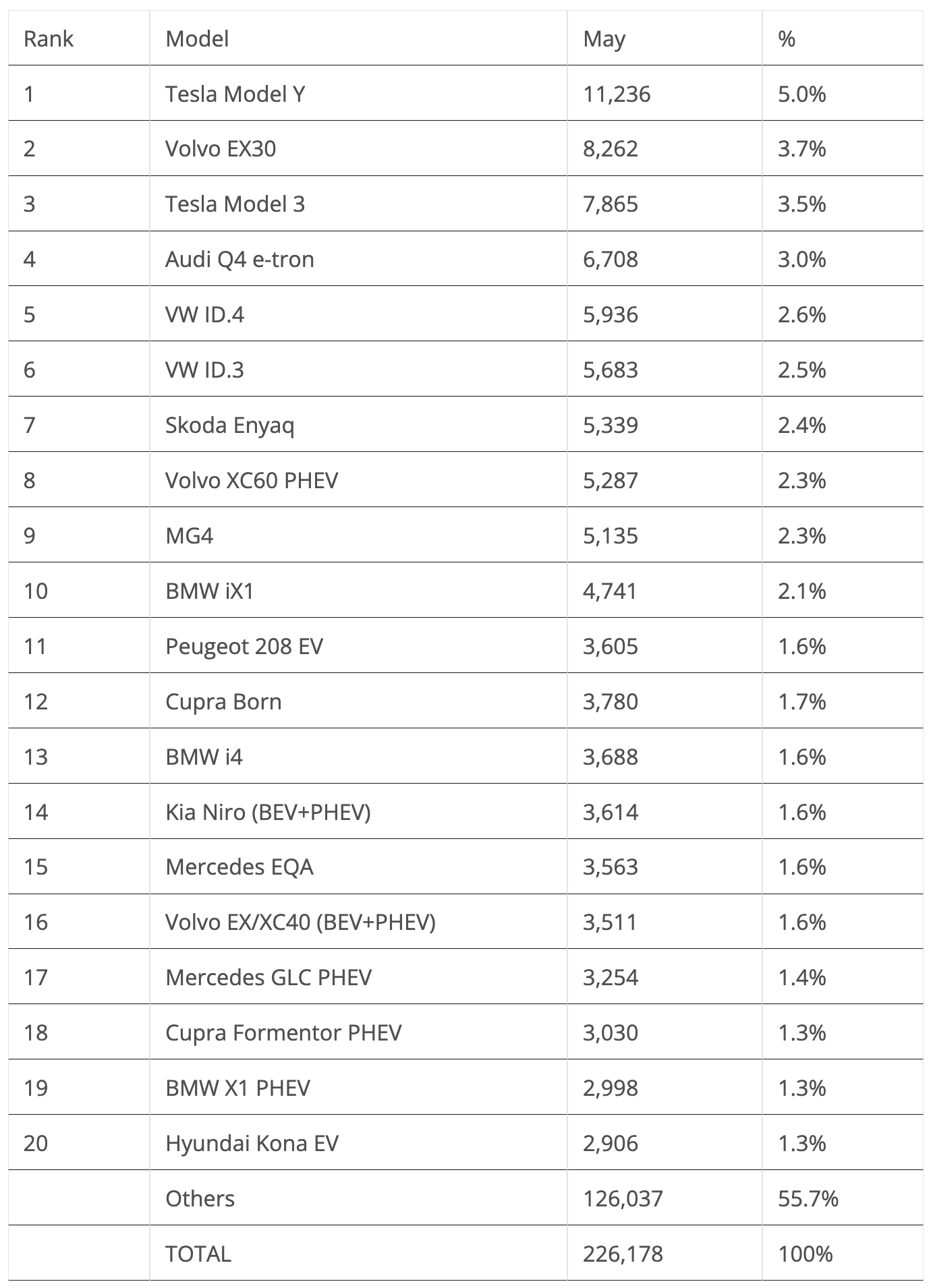

Some 226,000 plugin vehicles were registered in Europe in May, which is down 10% year over year (YoY), which is a more significant slip than what the overall market experienced (-3% YoY). And while this time Tesla carries most of the blame (Tesla’s deliveries crashed 35% YoY in May), if we were to remove Tesla from the tally, plugins would still be down.

Taking a more focused examination of the market, BEVs were down by 11%, while PHEVs weren’t that much better, dropping by 10%. So, with Tesla crashing, non-Tesla BEVs dropping (-7%), and PHEVs also on the way down, what’s up?

Well, the two silver linings among all this doom and gloom are the new Volvo EX30, which is now running at the same pace as the Tesla frontrunners, and the Tesla Model 3 — thanks to the recent refresh, it saw its sales increase by 26% YoY in May (on the other hand, the Tesla Model Y saw its deliveries drop by half, but more on that below…). Notably, the EX30 and the Model 3 have one thing in common (besides being fully electric) — they are both Made in China.

So, thank goodness for those models, which are helping to sustain Europe’s EV market, and … oh, wait! What did you say? Tariffs? Riiight….

Looking at the other powertrains on the market, plugless hybrids were the fastest only growing technology in May, with +15% YoY growth. They represented 30% of the total market. Added to the 21% of plugin vehicles, one can say that over half (51%) of the European car market is already electrified … in some way. But, for some to grow, others must decline. Petrol dropped by 6% and diesel dropped even more (- 11% YoY). Diesel vehicles had only 12% of the European passenger car market in May 2024, a far cry from the 50% share they had in 2015 or the 55% average it experienced before that. At this rate, in this category, diesel will be dead by 2028, well before the 2035 ICE ban….

May’s plugin vehicle share of the overall European auto market was 21% (14% full electrics/BEVs). That result kept the 2024 plugin vehicle share at 21% (14% for BEVs alone) by the end of May.

The highlights of the month were the recently introduced Volvo EX30, which remained in 2nd, and the fact that the Tesla Model 3 was back on the podium. But let’s look closer at May’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. But despite this, things look shaky for the US crossover. In May, the midsizer had 11,236 registrations, which was down 49% YoY. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? It is starting to show. The midsized crossover’s deliveries were down 19% YoY in the first quarter of the year in Europe, as the market’s natural limits (and new competition) are starting to bite. Add the refreshed Tesla Model 3, which is stealing sales in some markets, and the Model Y’s performance is not as amazing as it once was. And this time it even had some competition for the leadership position, with the runner-up Volvo EX30 ending some 3,000 units behind. Sure, 3,000 units is not 300, so the US crossover didn’t really have to sweat to keep the #1 spot, and with June expected to be a peak month for Tesla, do not expect the Model Y to be contested in June. In July, however … we’ll see. The good thing is that, because of the upcoming tariffs, part of the Model 3 volume will revert to the Model Y…. Regarding last month’s performance, the Model Y’s biggest European markets included the UK (2,100 units), France (1,421 units), Germany (1,169 units), and the Netherlands (1,126 units).

#2 Volvo EX30 — The China-made (but with a Swedish passport) crossover is starting to live up to the hype, staying in the 2nd spot in May. The model had 8,262 registrations in May. Expect the EX30’s sales to peak in June (10,000 units?), and then drop due to the increased tariffs for Made-in-China models, probably dropping sales to some 6,000 units/month. Currently Volvo’s cheapest model(!), it starts out at 39,000 euros, versus the 40,000 euros of the gasoline XC40. The EX30 is also Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that it would have to cost less than 35,000 euros), currently it can nevertheless be considered well priced, especially considering the premium standing it holds. Regarding the EX30’s May results, the distribution is now more balanced. The Netherlands (1,063 units) leads and is the only market above 1,000 deliveries. The two other major markets, Germany (992 units) and the UK (880), stayed just below that threshold.

#3 Tesla Model 3 — Unlike in China, last year’s refresh has helped the Model 3’s career in Europe, allowing the sedan to grow 26% YoY in May, to 7,865 deliveries. Despite the recent uptick, though, the veteran BEV (it was launched back in 2017) is now far from its best days — it won the Best Seller trophy in 2019 and 2021. Now, all it can aspire to is keeping the runner-up status away from models like the Volvo EX30 or VW ID.4. but with the tariffs pushing its price upwards in July, expect its sales to be hit in the second half of the year. Luckily, its most direct competitor, the Volvo EX30, will also be affected…. Back to May’s performance, the Model 3’s main markets were the UK (1,040 registrations), Spain (792 registrations), France (763 registrations), Germany (710 registrations), and Portugal (704 registrations).

#4 Audi Q4 e-tron — Although it didn’t reach record sales levels, the compact crossover had another positive month, allowing it to stay in the top 5. With 6,708 sales, it seems the Q4 is immune to broader sales fluctuations, probably due to its premium positioning in the market. Looking into the near future, it will be interesting to see if the upcoming Q6 e-tron midsize SUV will steal sales from its smaller sibling. Something to follow throughout the rest of the year…. Looking at May’s performance, the highlight is the UK (1,563 registrations), but Germany (1,058 registrations) and Belgium (1,067 registrations) also deserve a mention.

#5 VW ID.4 — The Volkswagen crossover is returning to form, scoring 5,936 registrations in May. With demand recovering, due to the recent refresh, the ID.4 is hoping to be back in the game. A top 5 position is possible for 2024, but on the other hand, it will be nearly impossible to regain the bronze medals of 2022 and 2023, as both of the Teslas and the ID.4’s cousins, the Audi Q4 e-tron & Skoda Enyaq, as well as the Volvo EX30 should be this year’s podium contenders. But enough of futurology and back to the crossover’s May performance — its biggest market was by far its domestic one, with Germany having 1,339 registrations, followed at a distance by Norway (741 registrations) and Denmark (702 registrations).

Looking at the rest of the May table, the highlights go to two models, both of them BEVs from Volkswagen Group. The #6 spot of the VW ID.3 was celebrated with 5,683 sales, the hatchback’s best result since August, with the recent refresh surely helping the VW model’s performance, while the Cupra Born returned to the table in #12, with 3,780 sales, with the MEB-platform placing five representatives in the top 20.

Elsewhere, the Volvo XC60 PHEV remains the new King of PHEVs, having ended May in 8th, with 5,287 registrations. That’s well above the category runner-up, the #17 Mercedes GLC PHEV, which scored 3,254 registrations.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Below the top 20, one highlight was the BMW i5 reaching 2,075 registrations. Although that wasn’t enough to beat the category leader, the Porsche Cayenne PHEV (2,121 units), it came mighty close, allowing the attractive BMW to come closer in the YTD table to the category leaders, the Porsche Cayenne PHEV (13,241 registrations), Volvo XC90 PHEV (9,967 registrations), and Audi Q8 e-tron (9,319 registrations).

Other highlights are the production ramp-ups of several recent models, with the most impressive of them being the Renault Scenic EV crossover. With 1,661 registrations in May, not only is it threatening to beat the current best seller from the Renault stable, the Megane EV (which had 2,545 registrations in May), but it’s also becoming top 20 material. Its Peugeot rival, the e-3008, is also ramping up, but at a slower pace, with the compact crossover reaching 932 deliveries in May.

Finally, the new Mini Countryman EV is also ramping up, reaching 926 registrations in May. With the upcoming tariffs, the Made-in-Germany crossover looks to be Mini’s only hope to score significant volumes in the EV market, as both the new Mini Cooper EV and the upcoming Mini Aceman will be hit by tariffs.

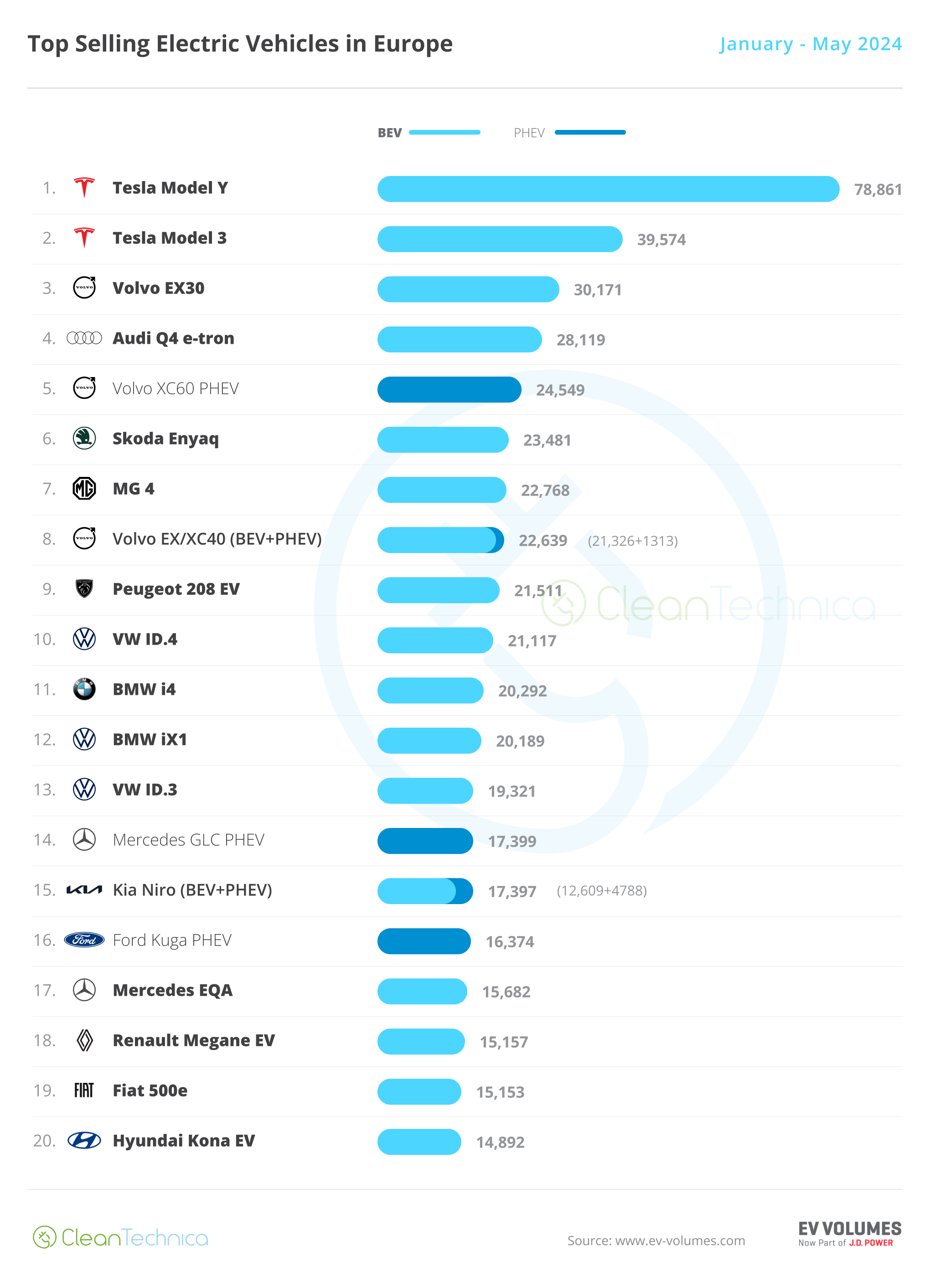

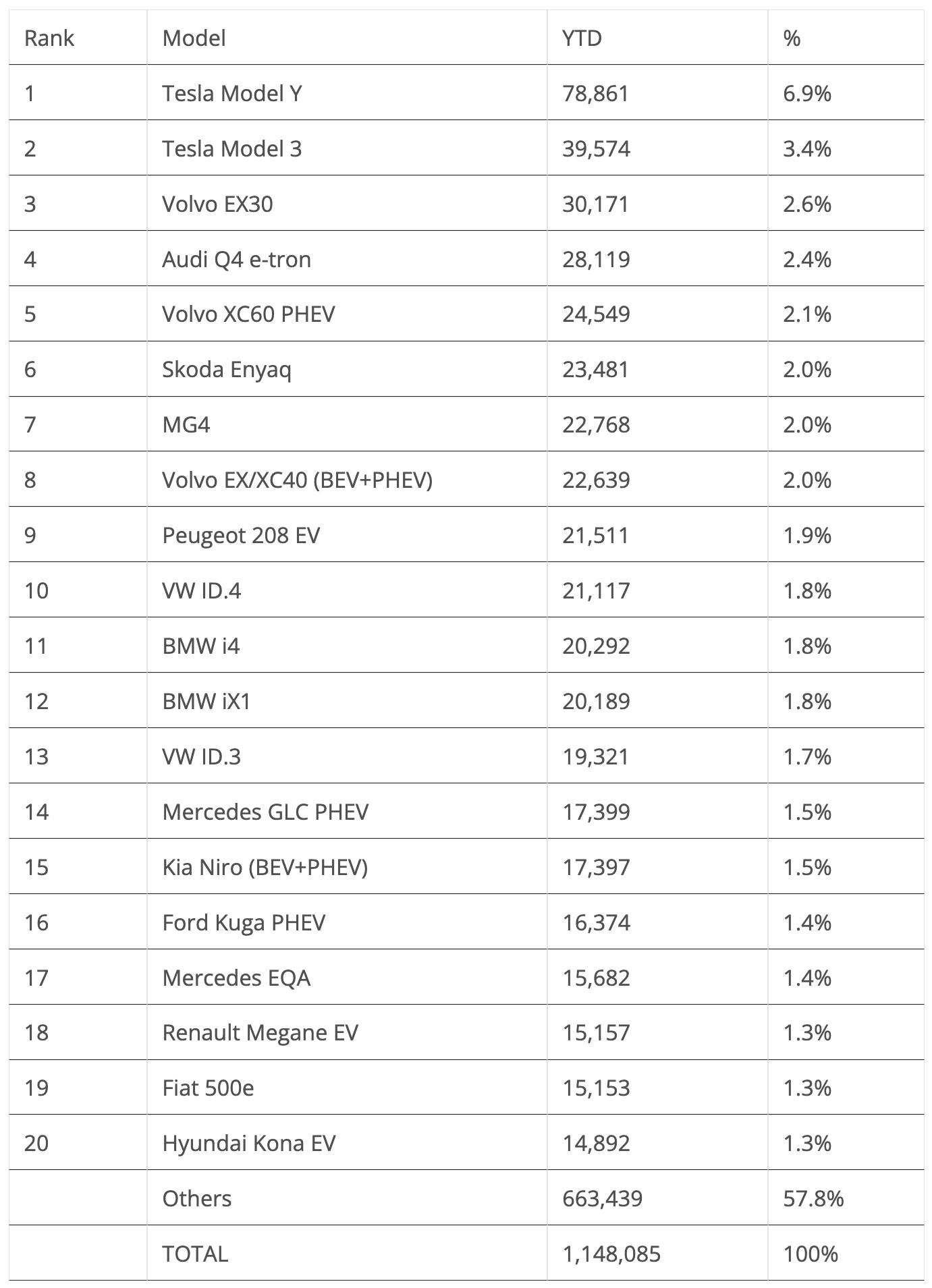

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having twice as many deliveries as the runner-up Tesla Model 3, the leadership position is already taken and the Model Y is set to win its 3rd Best Seller title in a row. However, below it, the Tesla Model 3’s runner-up position could still be in play. And while the difference between the new #3 Volvo EX30 and the #2 Tesla Model 3 is over 9,000 units, the truth is that both models will be hit by the upcoming tariffs on EVs produced in China. It is uncertain how each will be affected. Imagine if the Volvo model gains significant ground over the Tesla sedan in July and October, all while running at the same pace as the Model 3 in the remaining months of the year — we might have a close race between these two at the end of the year….

The first position changes happened in the 6th and 7th positions, with the Skoda Enyaq and MG4 jumping two positions each, but expect both models to have very different performances in the second half of the year, while the Czech could climb another position or two by the end of the year, as it should benefit from the increased tariffs imposed on Made-in-China EVs. The Sino-British model should be impacted by the tariff increase and lose a few positions by the end of the year.

Still on the top 10, the VW ID.4 jumped to 10th in its race against time. It looks to recover lost time, but the 3rd spot the German crossover won in 2022 and 2023 seems already out of reach.

Elsewhere, the remaining position changes happened in the second half of the table. The VW ID.3 jumped three places in the table to 13th, with the hatchback now looking to regain a position in the top half of the table. The Mercedes EQA was up to 17th. And the Hyundai Kona EV joined the table, in 20th, thus kicking out the Audi A3 PHEV and leaving just three PHEVs in the table (the #5 Volvo XC60 PHEV, #14 Mercedes GLC PHEV, and #16 Ford Kuga PHEV).

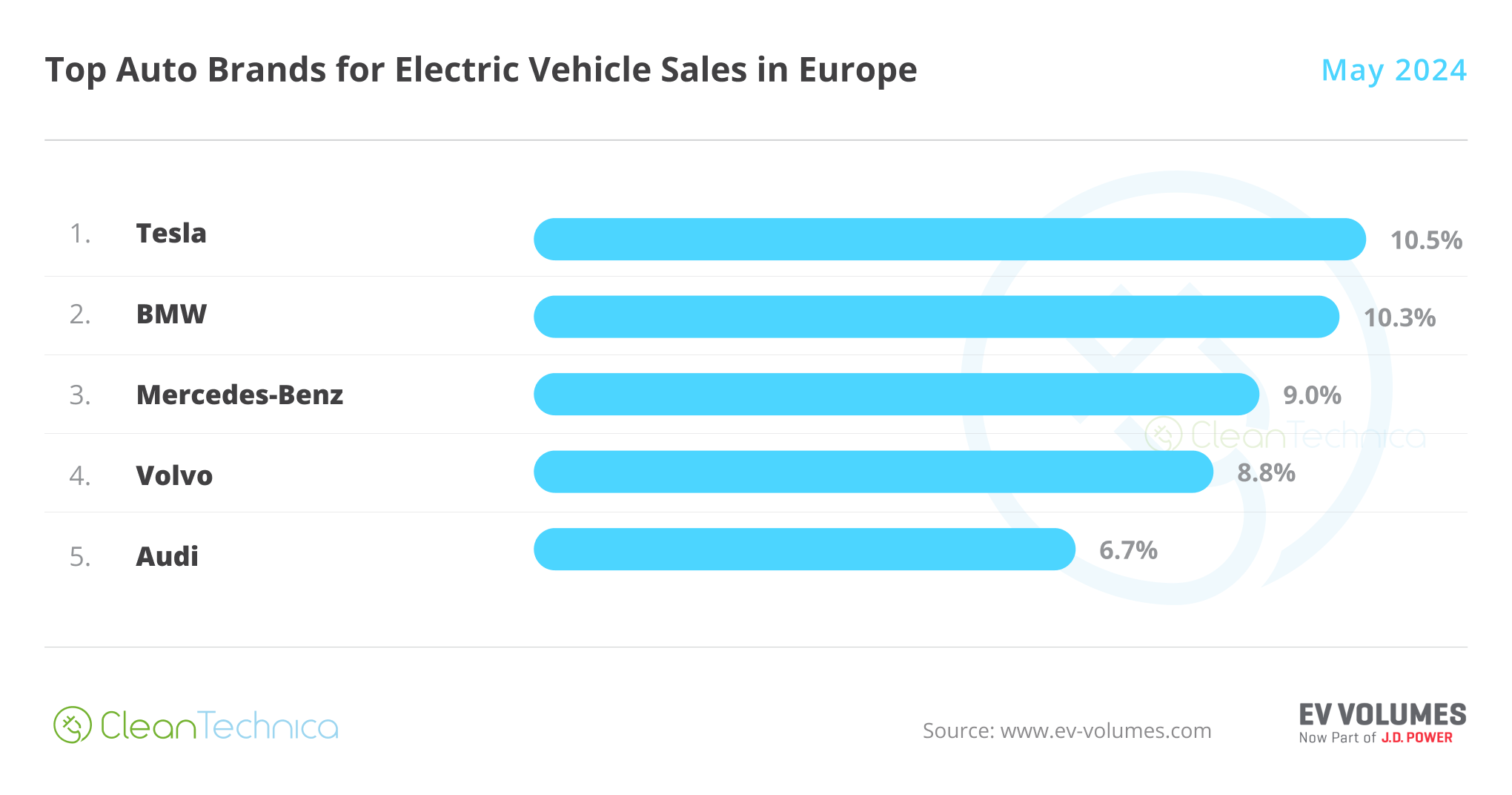

As for the plugin auto brand ranking, despite sinking in May (10.5% in May vs. 10.8% in April), Tesla is still leading over #2 BMW, which has 10.3% share. With June expected to be a peak month for Tesla, expect it to recover a significant advantage over the German make.

3rd placed Mercedes (9%, down from 9.4% in April) has lost significant share, while #4 Volvo (8.8%, up from 8.6%) continues to rise. (In fact, Volvo was the only brand in the top 5 to increase its share). A lot can still happen between these brands.

Finally, #5 Audi (6.7%, down from 6.8%) is sliding due to the poor result of the Q8 e-tron (only 1,142 registrations in May). We could see a position change happening in May, especially considering that #6 Volkswagen (6.2%) is returning to form. Expect the Wolfsburg make to surpass its premium sister brand in the the upcoming months.

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), expect it to do everything in its power to push sales up and reach the 3rd position. The only problem it has is that Volvo is also going strong…. Well, nothing that a Made-in-China tariff raise won’t solve … but I digress.

A sign of the times, all top 5 brands are premium makes, with the best selling mainstream brand, Volkswagen, only in 6th, and Peugeot in 7th.

Those cheap EVs really need to land as soon as possible….

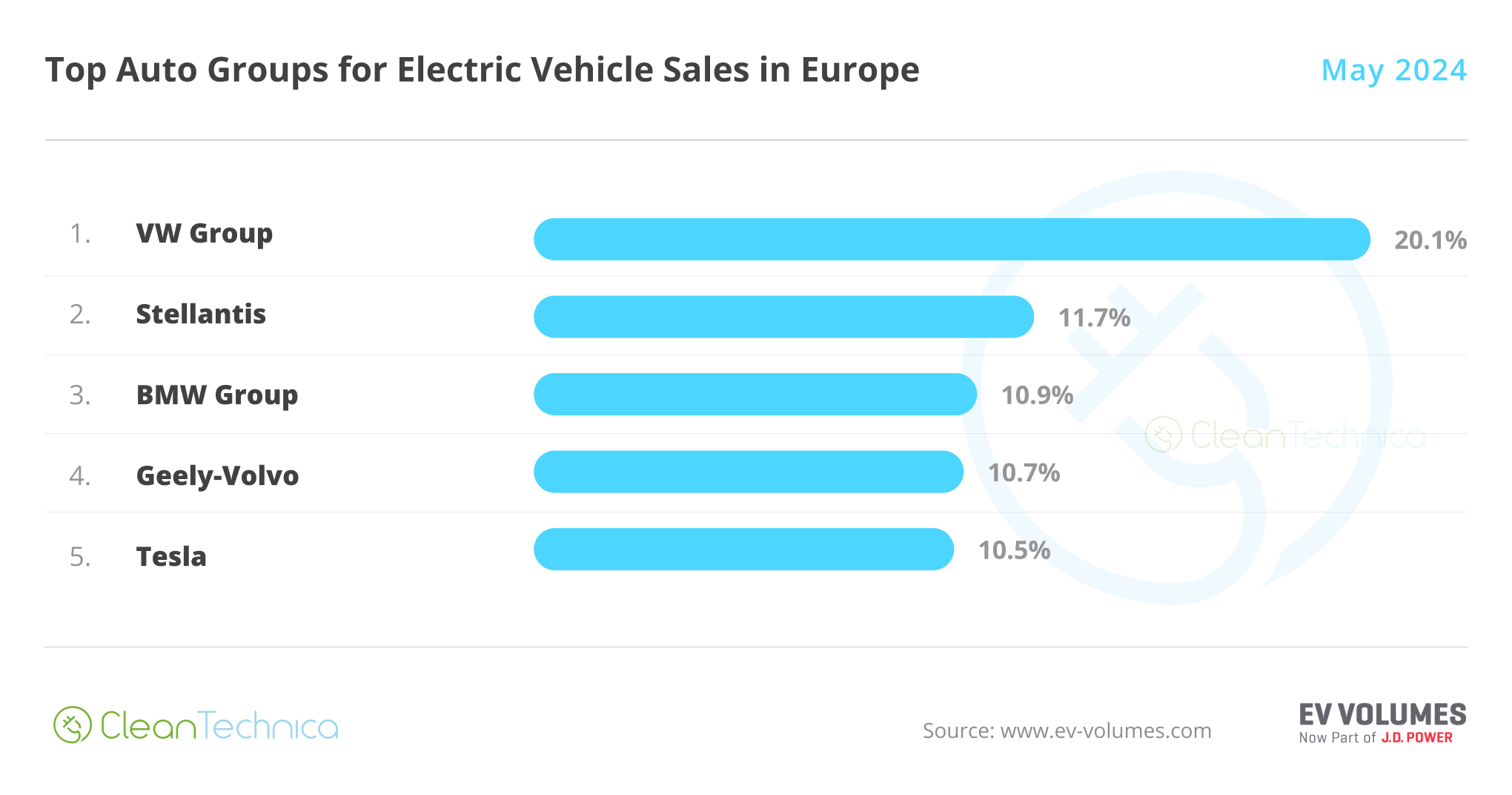

Arranging things by automotive group, Volkswagen Group benefitted from good performances across its brand lineup to stay at 20.1%. So, the German OEM is keeping a comfortable lead over the competition.

Runner-up Stellantis had a horrible month, dropping 1.5% in share in May, to 11.7%, with poor performances from a number of brands. The prime example of a drooping Stellantis performance was the Fiat 500e, which didn’t manage to reach the top 20. A year before, it was a regular in the top 5…. A refresh is needed for the little Italian, but above all, so is a significant price cut. Upcoming cheaper EVs — the Renault 5, Citroen C3 EV, and Hyundai Inster — offer more for less money.

Both BMW Group (10.9%, up from 10.8%) and Geely–Volvo (10.7%, up from 10.4%) surpassed Tesla, which dropped to 5th, with the German OEM benefitting from the Countryman EV’s ramp-up while Geely’s conglomerate saw good performances across the board — besides the good performance of Volvo, Polestar (the 2 liftback had 2,189 registrations in May), and Smart (the #1 reached 1,483 registrations) also helped the OEM to grow.

Expect Tesla to recover ground in June, probably surpassing both, but with the US OEM, and especially Geely, being hurt by the upcoming tariff increase, expect BMW Group to end up ahead of both Tesla and Geely–Volvo.

Off the top 5, Mercedes-Benz Group (9.5%) is stable in 6th (for now), as #7 Hyundai–Kia (8.1%, down from 8.2%) does not look able to climb positions anytime soon and #8 Renault-Nissan-Mitsubishi (5%) is too far behind.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.