Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Both MG4 and Volvo EX30 reach record results in June.

Some 294,000 plugin vehicles were registered in Europe in June, which means it is another month in the red year over year (-5% YoY). That’s contrasted with what the overall market experienced (+4% YoY).

Taking a more focused examination of the market, BEVs were basically flat (0% YoY), while this time PHEVs took the blame for the fall, dropping by 15%.

But to really understand what is going on, we need to dig deeper to see the reasons for these numbers.

The first factor to take into consideration is the announced tariff increase for Made-in-China (MiC) BEVs, which pushed the BEV market into a small sales rush. That led to record registrations of MiC models, like the MG4 and the Volvo EX30.

And now, the second factor to take in account is the end-of-subsidies-derived doom and gloom in Europe’s biggest automotive market, Germany. Germany is having a horrible 2024 when it comes to plugin sales, and especially BEVs, with the latter falling 18% YoY in June.

If we were to exclude Germany from the BEV sales tally, we would see that in June, instead of staying flat, the European BEV market would have grown by 5%, which admittedly is not a lot, especially considering what is going on in China, but it would mean that the BEV market would grow faster than the overall market (5% vs. 4%), thus allowing it to gain market share.

Yep, right now, Germany is dragging down the EV momentum in Europe.

Looking at the other powertrains on the market, plugless hybrids were the fastest only growing technology in June, with +24% YoY growth. They represented 30% of the total market. Added to the 22% of plugin vehicles, one can say that over half (52%) of the European car market is already electrified … in some way. But, for some to grow, others must decline. Petrol dropped by 3% and diesel by 2%. Diesel vehicles had only 11% of the European passenger car market in June 2024, a far cry from the 50% share they had in 2015 or the 55% average it experienced before that. At this rate, in this category, diesel will be dead by 2028, well before the 2035 ICE ban….

June’s plugin vehicle share of the overall European auto market was 22% (16% full electrics/BEVs). That result kept the 2024 plugin vehicle share at 21% (14% for BEVs alone) by the end of June.

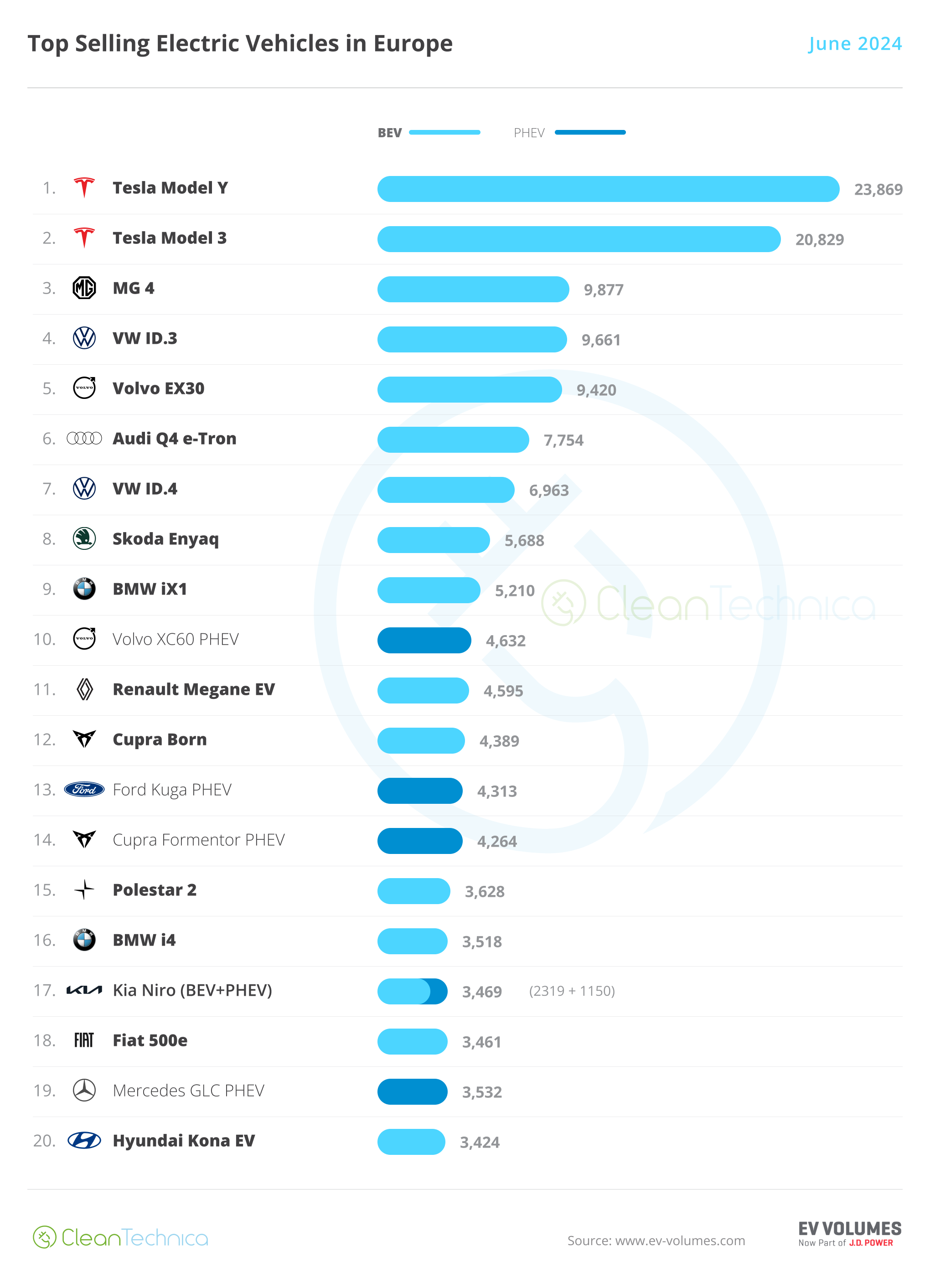

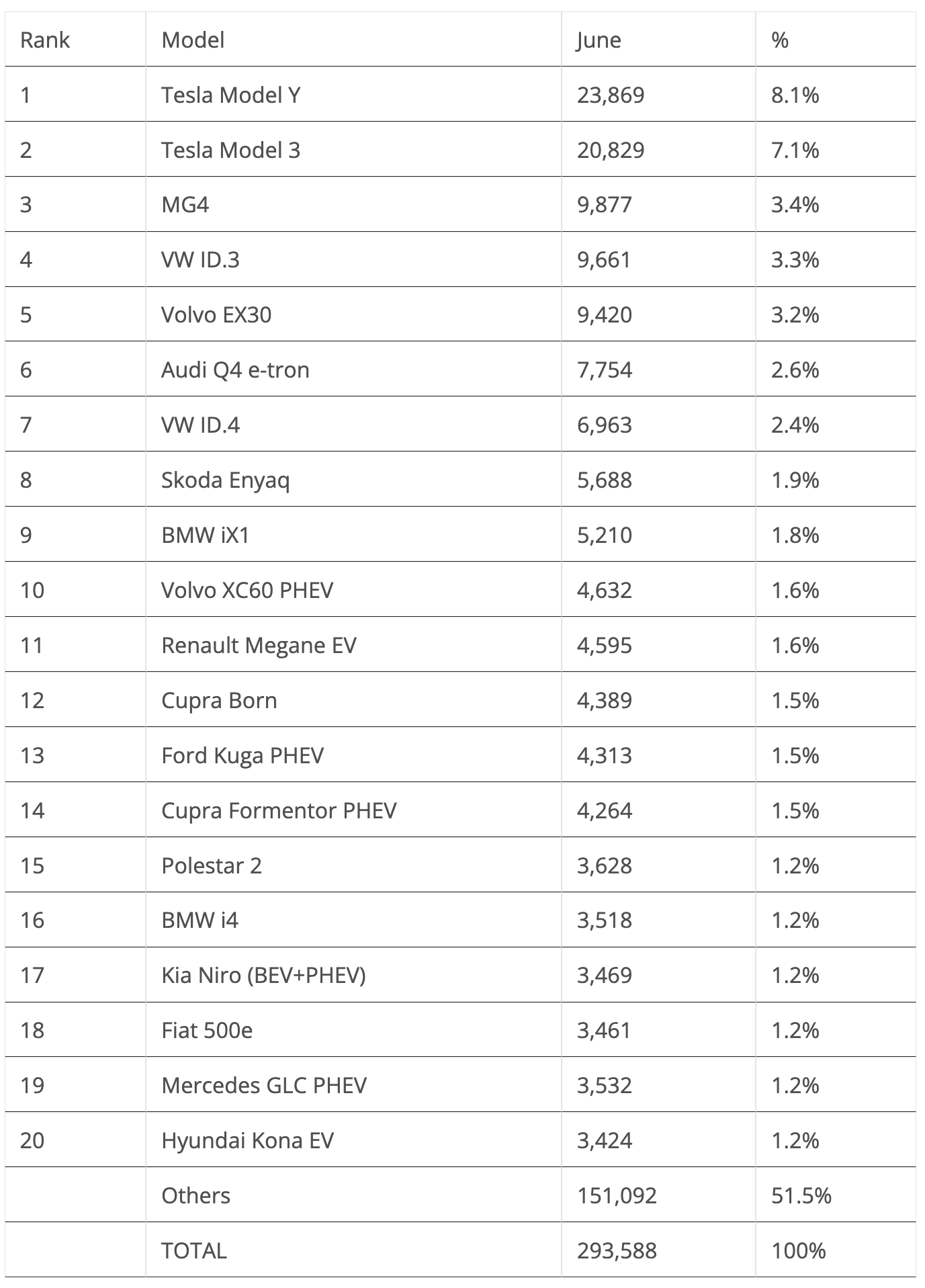

The highlights of the month were the Made-in-China models, next to a surprising performance from the VW ID.3. But let’s look closer at June’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. But despite this, things look shaky for the US crossover. In June, the midsizer had 23,869 registrations, which was down 28% YoY. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? It is starting to show. The midsized crossover’s deliveries were down 26% YoY in the first half of the year in Europe, as the market’s natural limits (and new competition) are starting to bite. Add the refreshed Tesla Model 3, which is stealing sales in some markets, and the Model Y’s performance is not as amazing as it once was. And this time it even had some competition for the leadership position, with the runner-up Tesla Model 3 ending some 3,000 units behind. Sure, 3,000 units is not 300, so the US crossover didn’t really have to sweat to keep the #1 spot, but the Model Y’s domination is not as undisputed now as it once was. It will be interesting to see what will happen in July. Regarding June’s performance, the Model Y’s biggest European markets included the UK (3,620 units), Germany (3,346 units), France (2,156 units), Norway (2,324 units), and Sweden (2,121).

#2 Tesla Model 3 — Unlike in China, last year’s refresh has helped the Model 3’s career in Europe, and with the tariff increase coming soon, the sedan experienced a higher tide than usual, allowing the sedan to have its best performance since March 2022 in June, 20,829 deliveries. Despite the recent uptick, though, the veteran BEV (it was launched back in 2017) is far from its best days. It won the Best Seller trophy in 2019 and 2021. Now, all it can aspire to is keeping the runner-up status away from models like the Volvo EX30. Back to June’s performance, the Model 3’s main markets were Italy, with a surprising 3,280 deliveries, the UK (3,111 registrations), France (1,821 registrations), Denmark (1,656 registrations), and the Netherlands (1,664 registrations).

#3 MG4 — Another model to benefit from the Made-in-China (MiC) tariff increase and experience record sales levels, this compact hatchback — the value-for-money king of the category — had 9,877 sales, the MG4’s best performance so far. With prices starting at around 30,000€ and having decent specs, this next-generation Ford Focus from another mother is proving to be quite popular, even outselling the local heroes, the VW ID.3 and Renault Megane EV. Looking at June’s performance, the highlight is Germany, the MG4’s biggest market(!), where it got 4,492 registrations. In its adopted home market, the UK, it had 1,024 registrations. France (1,169 registrations) and Norway (1,171 registrations) also deserve a mention.

#4 VW ID.3 — The Volkswagen hatchback is returning to form, scoring 9,661 registrations in June, its best result in 18 months. With demand recovering, due to the recent refresh, the ID.3 is hoping to be back in the game. A top 5 position is possible for 2024, but it will depend a lot on how deeply affected their MiC adversaries will be by the recent tariff increase. But enough of futurology and back to the hatchback’s June performance — its biggest market was by far its domestic one, with Germany providing an amazing 6,370 registrations (frankly, I find it too good to be true, as this must have been connected to some fleet deal — will be interesting to see how much volume the ID.3 will deliver in the next couple of months). Following Germany, at a distance, were France (1,342 registrations), the UK (602 registrations), and Norway (263 registrations).

#5 Volvo EX30 — The China-made (but with a Swedish passport) crossover is living up to the hype, by selling a record 9,42o registrations in June. Although, one has to wonder how much of it was organic demand and how much was due to the increased tariffs for made-in-China models and the rush to get them before the tariffs were applied. Currently Volvo’s cheapest model, it starts out at 39,000 euros, versus the 40,000 euros of the gasoline XC40. The EX30 is also Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that, it would have to cost less than 35,000 euros), it can nevertheless be considered well priced, especially considering the premium standing it holds. Regarding the EX30’s June results, the distribution is balanced. Germany (1,199 registrations) leads, slightly ahead of the Netherlands (1,172 registrations), with Norway (1,080 registrations) and the UK (1,074 registrations) staying just below the top two. As such, one can say that the delivery ramp-up of the EX30 is now finished, and we’ll now start to see the cruising speed of Volvo’s smaller BEV.

Looking at the rest of the June table, there are several models hitting year-best results, three of them BEVs from Volkswagen Group. The #7 spot of the VW ID.3 was celebrated with 6,963 sales, immediately followed in #8 by its Czech cousin, the Skoda Enyaq (5,688 sales), while the Cupra Born stayed in 12th with 4,389 sales. The MEB platform placed five representatives in the top 20.

Elsewhere, there were also other models shining, like the #9 BMW iX1. With 5,210 sales, it had its best score in 2024. The #11 Renault Megane had its best result in a year, with 4,595 registrations (see, Renault — if prices drop, sales increase; it’s as simple as that). Meanwhile, the Polestar 2 also benefitted from the MiC sales rush, scoring 3,628 sales, its best result in 11 months.

Finally, looking at the PHEV category, despite the Volvo XC60 PHEV collecting another best seller prize, with 4,632 sales, allowing it to end in 10th, the highlight was the Cupra Formentor PHEV. The sporty crossover hit a record result, 4,264 sales, and expect it to continue among the category best sellers, as the improved specs (26 kWh battery, DC charging) will surely make it one of the most interesting proposals in the category.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Below the top 20, one highlight was the BMW iX3 registering 2,071 units, a new year best. It’s surely another model to benefit from the MiC sales rush. But BMW had another model also in the fast lane, with the i5 reaching 1,858 registrations. Although that wasn’t enough to beat the category leader, the Porsche Cayenne PHEV, it nevertheless outsold the Mercedes EQE, its arch rival, and promises to be tough competition for the much awaited Audi A6 e-tron.

Other highlights are the production ramp-up of the Renault Scenic EV crossover — with 2,260 registrations in June, it is starting to become top 20 material. Elsewhere, the Hyundai Ioniq 5 scored 2,737 registrations, its best result in 10 months, while the Jeep Avenger scored its best result this year in June, thanks to 2,022 deliveries.

Finally, a couple of other models also had a slight bump in sales thanks to the tariff increase. The new Mini Cooper EV had 2,207 sales and the MG ZS EV had 2,018 sales.

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having a 40,000-unit lead over the runner-up Tesla Model 3, the leadership position is already taken and the Model Y is set to win its 3rd Best Seller title in a row.

Below it, it seems the Tesla Model 3 has now secured the runner-up position, having gained an advantage of more than 10,000 units over the #3 Volvo EX30 in just one month. So, this one should also be secured, and Tesla will most likely have a gold plus silver finish in Europe this year.

As for the 3rd spot, the picture is less clear, because it is not certain how the recent tariff increase will affect the Volvo EX30. With 4,000 units of advance over the #4 Audi Q4 e-tron, it seems to have a significant cushion over the German crossover, but time will tell how the EX30 will behave under the new conditions.

The first position changes happened in the 5th position, with the MG4 jumping two positions, but the question now will be how the Sino-British model will be impacted by the tariff increase, and how many positions it will lose by the end of the year.

Still on the topic of the top 10, VW’s best sellers continued in their race against time. The ID.3 jumped five spots, to 8th, while the ID.4 climbed to #9. It is good they are recovering lost time, but the 3rd spot of the German crossover, won in 2022 and 2023, seems already out of reach.

Elsewhere, the remaining position changes happened in the second half of the table. The BMW iX1 jumped two places in the table to 11th, with the crossover now looking to gain a position in the top half of the table. The Renault Megane EV profited from its recent spike in sales (<prices = >sales) to rise one position, to #17.

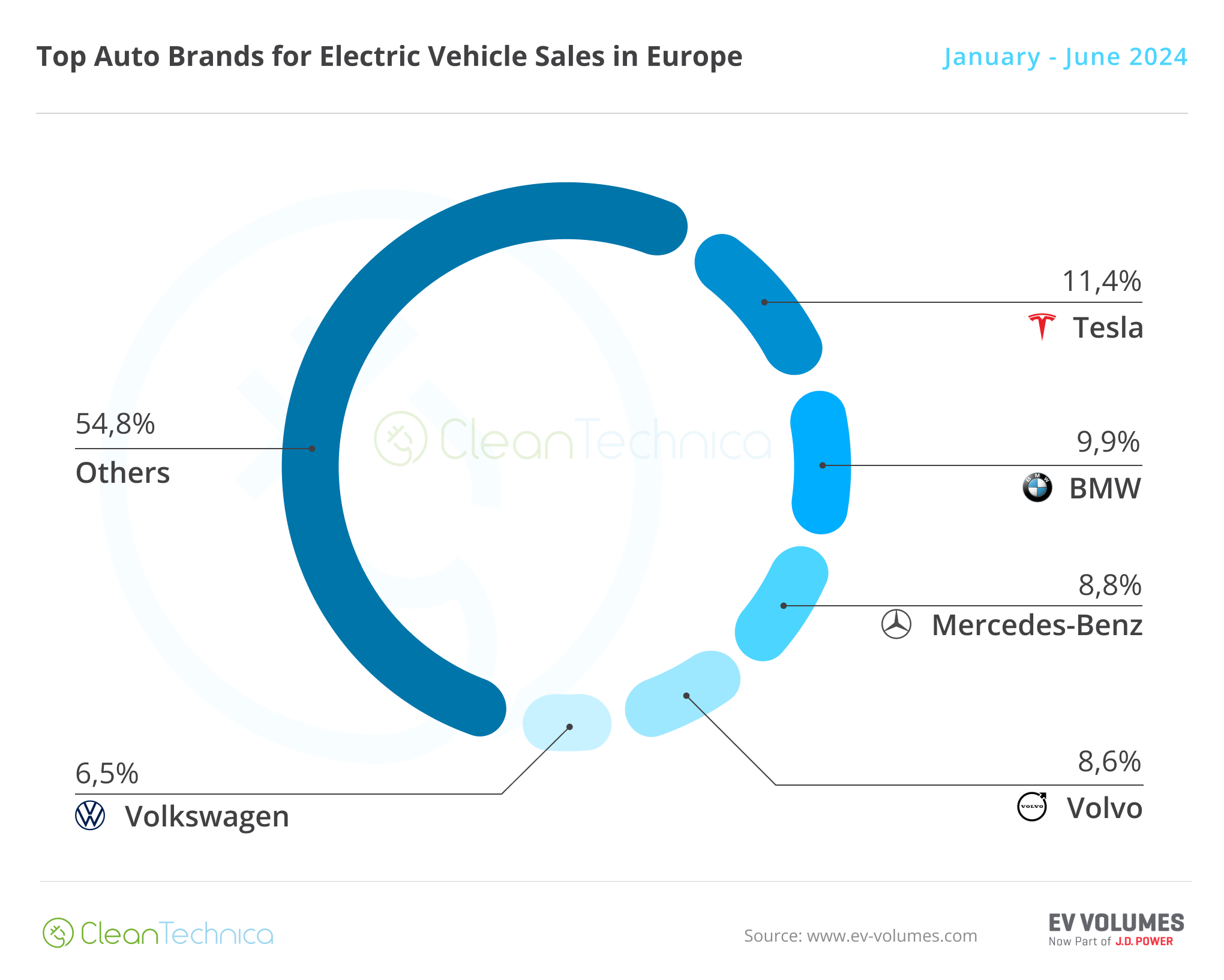

As for the plugin auto brand ranking, Tesla profited from the end-of-quarter peak to secure its leadership position (11.4% in June vs. 10.5% in May). Although, looking at where the US brand share was a year ago, it has lost a significant piece of the pie (13.1% in H1 2023 vs 11.4% now).

Meanwhile, #2 BMW has lost share compared to May, going from 10.3% to 9.9% share. But compared with the same period of 2023, BMW has reasons to smile, as it went up from 7.9% to its current 9.9% share.

3rd placed Mercedes (8.8%, down from 9% in May) had similar behavior to its Bavarian rival, losing share month over month but gaining year over year. It went from 7.4% in H1 2023 to 8.8% in the first half of 2024.

It’s a similar story for #4 Volvo (8.6%, down from 8.8%). While it has lost a bit of share compared to May 2024, compared to where it was a year ago, things now look much better. The Swedish make now has 8.6% share, versus 6.2% share 12 months ago.

Finally, we have a position change in #5, with a rising Volkswagen (6.5%, up from 6.2% in May) surpassing Audi (6.5%, down from 6.7%), which is sliding due to the poor results of the Q8 e-tron.

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), expect it to do everything in its power to push sales up and reach the 3rd position. The only problem it has is that Volvo is also going strong…. Well, nothing that a made-in-China tariff raise won’t solve … but I digress.

Arranging things by automotive group, Volkswagen Group benefitted from good performances from several members of its brand lineup. It thus rose to 20.2% share and the German OEM is keeping a comfortable lead over the competition.

The previous runner-up, Stellantis, had another horrible month, dropping 0.5% in share in June to 11.2%. The OEM had poor performances from a number of brands. Comparing with last year’s performance in the same period, things get even worse: It has lost 3.1% share in 12 months. Those new, cheap EVs need to land soon, and in large volumes, if the multinational conglomerate wants to keep its runner-up status in Europe.

Both BMW Group (10.7%, down from 10.9%) and Geely–Volvo (10.6%, down from 10.7%) also dropped, allowing Tesla to surpass three OEMs in one month. Tesla thus ended the month in the runner-up position! Despite losing 1.7% share YoY, Tesla is benefitting from the Stellantis debacle to rise one position compared to where it was a year ago.

Off the top 5, Mercedes-Benz Group (9.1%, down from 9.5%) is stable in 6th, and it has seen its share increase by 0.8% compared to a year ago.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy