Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Some 295,000 plugin vehicles were registered in Europe in September, rising 6% YoY, which represents the EV market’s return to growth for the first time since April. This is even more significant when you consider the overall market fell by 4%, to 1.1 million units.

Interestingly, BEVs are the ones pushing the market upwards, growing 14% YoY to 212,000 units. PHEVs remain stuck in red, falling 9% in September to 83,000 units.

Looking at the remaining powertrains, only HEVs were positive, growing 12% YoY, while petrol was down 19% and diesel continued to free fall, dropping 24%.

As such, September’s automotive market has seen some seismic changes, with plugin vehicle share of the overall European auto market rising to 26% (19% full electrics/BEVs). Added to the 34% market share of HEVs, that means that 60% of all passenger cars sold in Europe last September had some kind of electrification.

Even more importantly, for the first time, sales of HEVs (34% share) surpassed sales of petrol vehicles (29% share) in September, a trend that is surely here to stay. Meanwhile, diesel (8%) continues to lose relevance every passing day. At this pace, I wouldn’t be surprised if diesel was dead in Europe before 2030, with petrol following it a couple of years later.

These results kept the 2024 plugin vehicle share at 22% (15% for BEVs alone) through the end of September, which is only 1% less than where we were a year ago, at 23%.

Finally, looking at the sales breakdown between BEVs and PHEVs, despite the good result for pure electrics in September, they represented 72% of all plugin sales, and they are at exactly at the same level in 2024 as they were a year ago (67%). With new or refreshed models landing soon for both powertrains — namely, cheaper BEVs and longer range PHEVs — and new CO2 ceilings in Europe, it will be interesting to see how the two technologies behave next year.

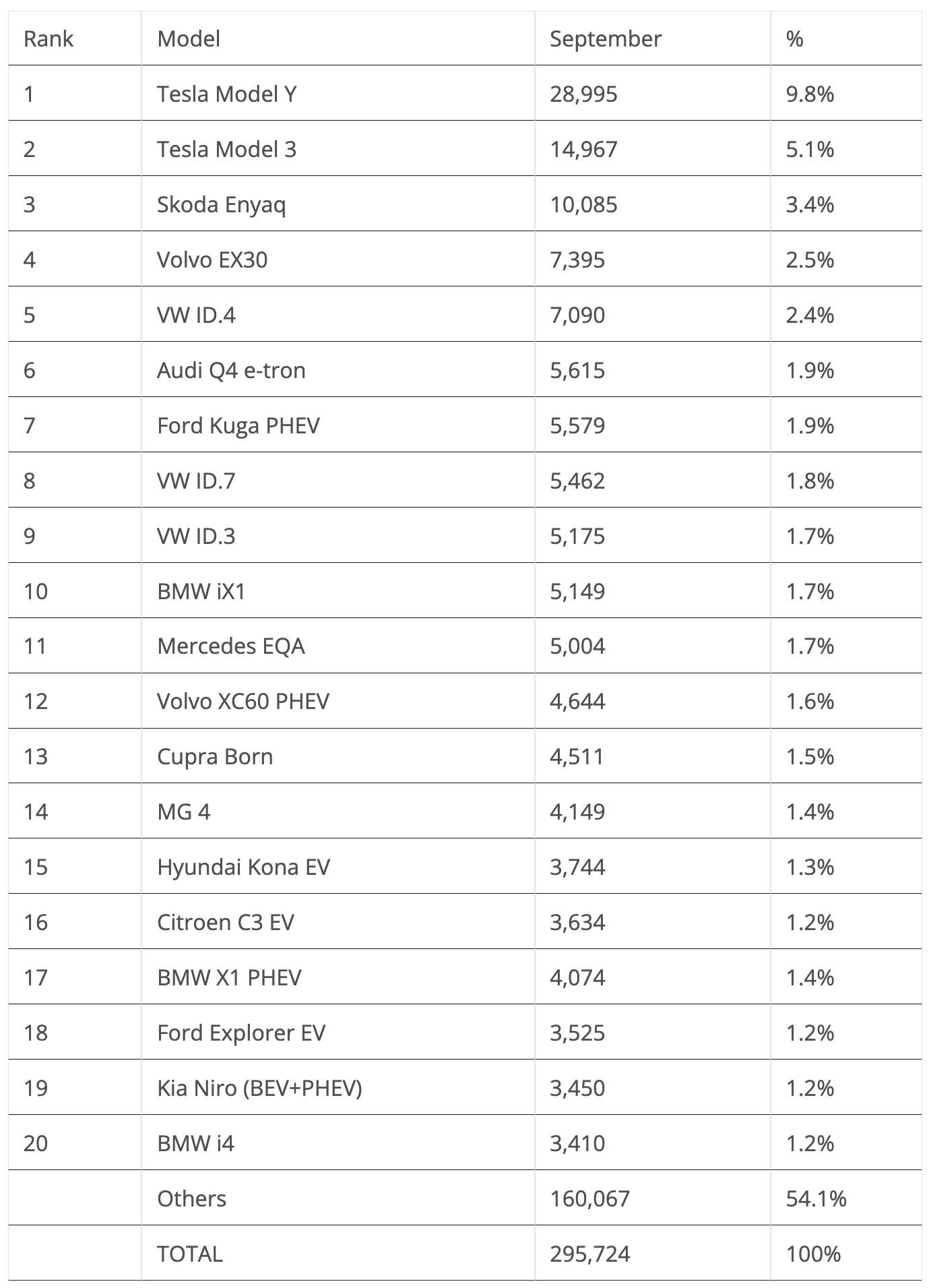

The highlight of the month was the Skoda Enyaq, nabbing a podium position. But let’s look closer at September’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. In September, the midsizer had 28,995 registrations, which was down 1% YoY. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? Tesla’s midsizer has hit the market’s natural limits. Add the refreshed Tesla Model 3 and the rumours of the refreshed Model Y version, said to land early next year, and it is only natural that the Model Y’s performance is not as amazing as it once was. Looking at individual countries, the biggest seller was the UK, with 5,780 units, followed by France (4,591 units), Sweden (4,125!) Germany (3,067), the Netherlands (2,600), Norway (2,105), and Belgium (1,283).

#2 Tesla Model 3 — Tesla’s sedan delivered 14,967 units, tripling the result it had a year ago. Of course, a year ago, the sedan was in the middle of a transition to the refreshed model, so … expect it to continue playing as the running mate of Tesla’s current star, the Model Y, while it keeping the #2 position away from the competition. As for the markets with the most deliveries, there is an interesting difference compared to the Model Y. The crossover’s main markets are all situated in Northern Europe, while the Model 3 had sedan-loving Spain (2,221 units) as its main market and also had Italy (1,284) among its bigger markets, along with more regular ones — the UK (1,845 units), Norway (2,067), and the Netherlands (1,258).

#3 Skoda Enyaq — Skoda’s crossover has returned to form, scoring a record 10,085 registrations in September, the first time the Czech model has hit a five-digit result in a single month. It thus won a podium presence to boot. With demand at a new all-time high, due to the recent refresh, the value for money king in the Volkswagen Group galaxy is back in the game. A top 5 position is possible for 2024, but that will depend a lot on how its younger (and cheaper) sibling, the Elroq, affects it. Looking at the Czech’s biggest markets, Germany was by far the largest, with 3,406 units, followed by Norway (776) and the UK (1,520).

#4 Volvo EX30 — The China-made (but with a Swedish passport) crossover is at cruising speed, scoring 7,395 registrations in September, but this time it wasn’t able to get a podium position. And actually … it seems that the China tariffs have somewhat hurt the crossover’s performance, because while before the start of the tariffs, the EX30 was on a roll, with three consecutive scores above 8,000 units/month, after the start of the tariffs, the Volvo EV hasn’t managed to reach that same level of registrations. Coincidence? Back to September, and looking at the EX30’s biggest markets, the UK leads, with 1,620 units, followed by the Netherlands (904 units) and Norway (803 units).

#5 VW ID.4 — The compact crossover won a top five presence in September, with the MEB model scoring 7,090 deliveries. The ID.4 is recovering from a poor first half of the year, thanks to a recent refresh that improved its specs, if not its styling. Looking at the crossover’s biggest markets, its home Germany had 1,371 registrations, which is almost a third of what its Czech cousin the Skoda Enyaq had in the same period. But the news was better in the UK (1,921 units), making the insular market the biggest in September for the Volkswagen EV. Interestingly, the UK was the main market for three of the top five best sellers in Europe, highlighting the current importance of the British EV market, which had the highest EV sales volume in Europe last month. With the German EV market still reeling from the end of incentives, and the French EV market waiting for the ramp-up of its new domestic EVs, the UK is now a critical player, allowing EV sales to soldier on, until the 2025 CO2 rules come into play in the EU to provide another boost. But, back at the ID.4, its third largest market was Belgium (666), which once again showed up among the best selling markets due to its strong BEV company car incentives.

Looking at the rest of the September table, a few models deserve a mention, like continued good results of Volkswagen’s new ID.7, which hit its 3rd record performance in a row(!) by getting 5,462 registrations, allowing it to join the top 10 for the first time, in #8. With the GTX versions now being delivered, and AWD being standard in these versions, expect its sales to grow significantly in Scandinavia.

The #11 Mercedes EQA also had a record performance, 5,004 registrations, while the MG 4 returned to the top 20 for the first time since the start of the new tariffs — in #14 thanks to 4,149 registrations.

Highlighting Volkswagen Group’s good month — it placed five models in the top 9 — the Cupra Born was the 6th representative of the OEM in the top 20 table, ending the month in 13th from 4,511 registrations, a new year best for the German-born Spaniard.

Finally, looking at the PHEV category, the Ford Kuga PHEV was the best seller of the category. With 5,579 sales, it ended in 7th, five positions ahead of the category runner-up, the Volvo XC60 PHEV, whose 4,644 registrations were its best result in 18 months.

The third PHEV model on the table was the BMW X1, which scored a record 4,074 registrations, allowing it to end in 17th.

But the truly interesting stuff is closer to the bottom of the table as we start seeing the first moves from OEMs as they start preparing for the 2025 season.

As such, we salute the entry in the top 20 of the new Ford Explorer EV, which reached 3,535 units in only its second month on the market, allowing it to finish in 18th. While not exactly cheap, it starts at 47,000€, and although it doesn’t have groundbreaking specs — after all, it is a VW ID.4 with a different costume — the compact crossover has a better design, inside and out, compared to its Volkswagen Group cousins. It won’t be a future podium candidate, but I wouldn’t be surprised if it secured a top 10 position in 2025.

But perhaps even more eventful is the Citroen C3 EV landing on the market in 16th with 3,634 registrations. And Citroen wished it could have landed with some 5,500 deliveries….

Still, this is one of the best landings ever for a BEV in Europe, and only France received it in significant volumes. If the production ramp-up goes well, and that is a big if, expect the French EV to start 2025 at full speed. Would 100,000 units by the end of the year be too much to ask?…

Below the top 20, more 2025 models are landing, or ramping up. The Renault 5 (1,138 units), Porsche Macan EV (1,777), Polestar 4 (1,645), and Tiguan PHEV (3,108) belong to the first case, while the Mini Countryman EV (2,964 units), Audi Q6 e-tron (1,452), Renault Scenic EV (3,225), Peugeot 3008 (3,156), and Toyota C-HR PHEV (2,854) fall to the latter.

A few notes on all these models: first, regarding the hotly anticipated Renault 5, it is an example of retro done right. While it has one of the best designs out there, it also serves a purpose, which is to be Renault’s EV representative in the B-segment. And while 2025 will begin with its production ramp-up still underway, I believe the French EV could be able to reach 100,000 units next year.

As for the Porsche Macan, it had an impressive landing, already beating its cousin, the Audi Q6 e-tron, which landed a couple of months before. This is a good omen for Porsche’s new EV, so I believe 50,000 units could be possible in 2025.

The new VW Tiguan PHEV has landed with a bang, with the new generation offering a new PHEV powertrain, including a 20 kWh battery, over 100 km of range, and even fast charging. The German crossover is a strong candidate for the PHEV title in 2025.

With the Mini Cooper EV suffering from the increased tariffs on EVs produced in China, the Made-in-Germany Mini Countryman EV is now the brand’s top seller, joining the French Renault Scenic EV and Peugeot 3008 as strong candidates for a top 20 position. The two crossovers are their brand’s current best sellers.

Last, but not the least, the Toyota C-HR PHEV is also ramping up. It was the Japanese make’s best seller in September, so it too could be a candidate for a table position.

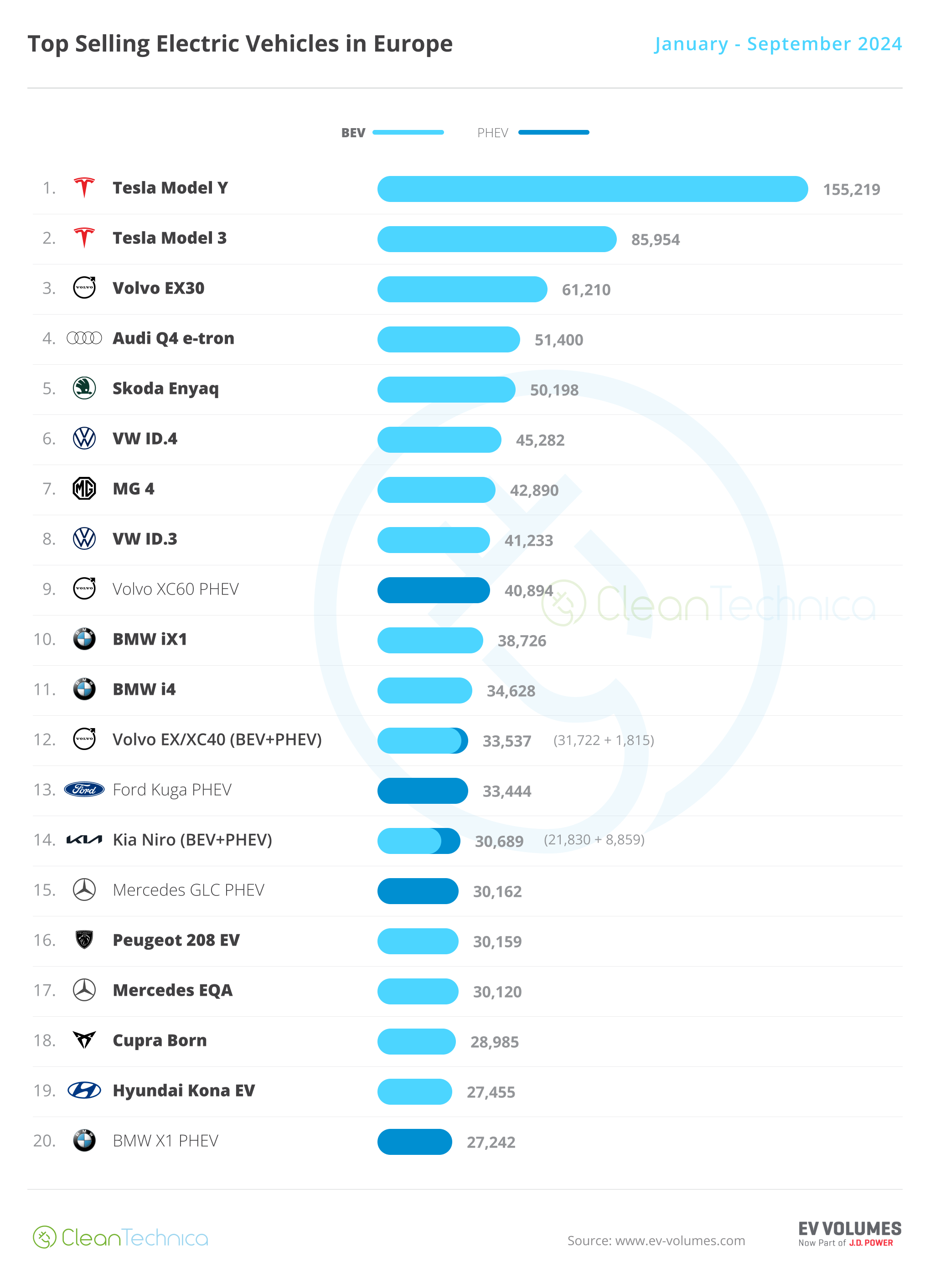

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having a 70,000-unit lead over the runner-up Tesla Model 3, the US crossover is set to win its 3rd best seller title in a row.

Below it, the Tesla Model 3 has also secured the runner-up position, having kept an advantage of some 24,000 units over the #3 Volvo EX30. So, this one should also be secured, and Tesla will most likely have a gold plus silver finish in Europe this year, repeating the feat of 2022 and 2023.

As for the 3rd spot, the picture is less clear, but with 10,000 units of advance over the #4 Audi Q4 e-tron and 11,000 units over the #5 Skoda Enyaq, the Swede seems to have a significant cushion to manage, especially considering there are only three months until the end of the race.

The first position changes happened in the 6th position, with the VW ID.4 climbing another position, at the cost of the MG 4, still feeling the weight of the new tariffs.

Still on the top 10, the other VW best seller, the ID.3, surpassed the Volvo XC60 PHEV and climbed to 8th. It is a good sign that the VW models are recovering on lost time, but the #3 spot of the ID.4, which it won in 2022 and 2023, seems already out of reach.

In the second half of the table, the Kia Niro and Mercedes GLC PHEV benefitted from another poor month from the Peugeot 208 EV (only 2,474 units in September), and each climbed one position, to 14th and 15th, respectively.

Finally, we have two models returning to the table, in the bottom positions of the table. The Hyundai Kona EV jumped to #19, while the BMW X1 PHEV was up to #20.

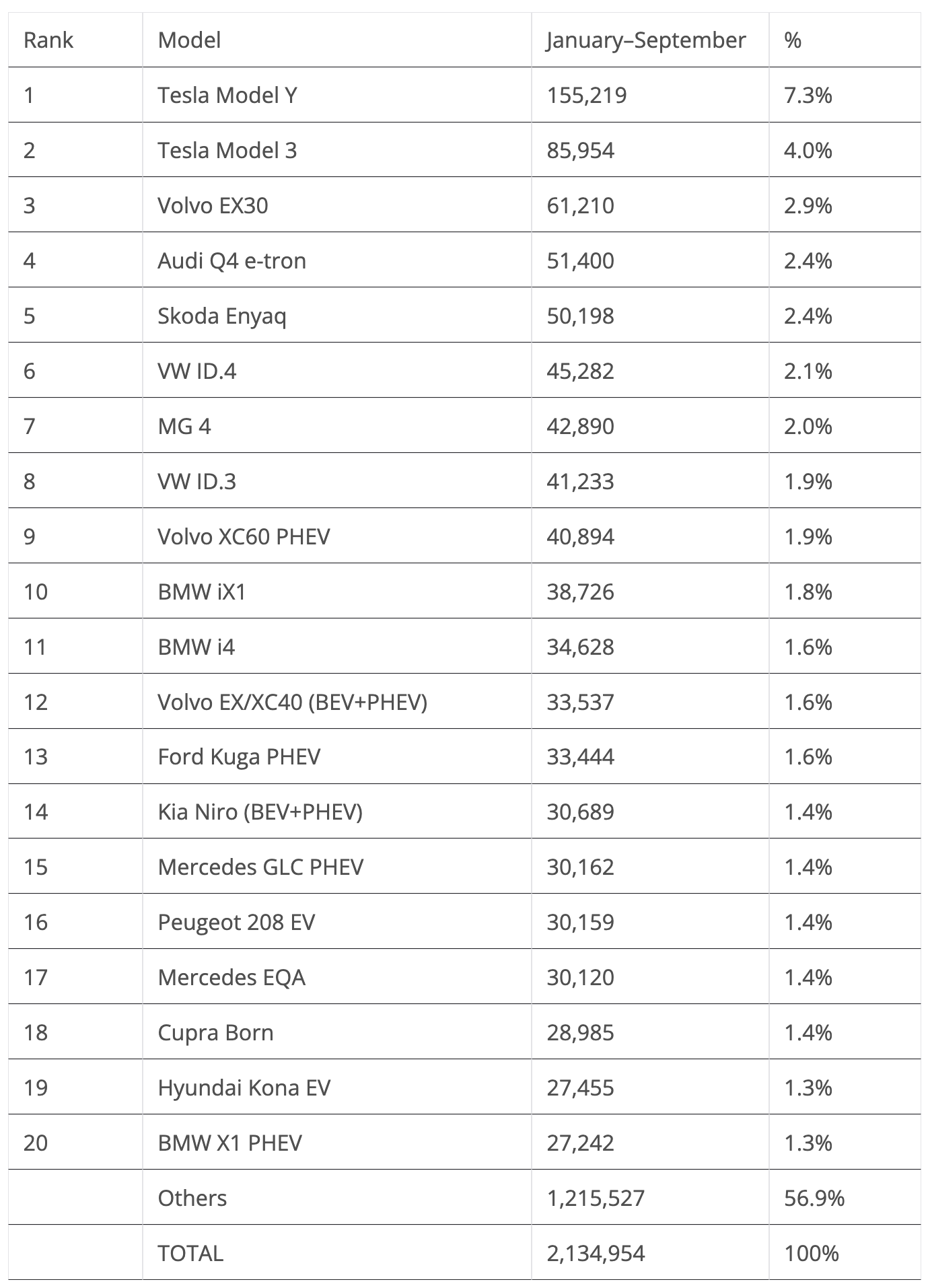

As for the plugin auto brand ranking, Tesla profited from its end-of-quarter peak (11.4% in September vs. 10.9% in August) and secured enough distance to win yet another title, its third in a row. Still, compared to the previous year, the distance above its competition has shortened significantly (Tesla had a 4.3% advance over the runner-up twelve months ago, against its current 1.4%), so looking at 2025, the US make should have a harder time renewing the title.

Behind the US make, only Volkswagen gained share, going from 6.7% in August to its current 7%. The Wolfsburg make had a terrible first half of the year and is now recovering, but it is still 1.4% share behind its score a year ago (7% now vs 8.4% then).

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), expect a sales push to reach the 3rd position. But with only three months left, time is running out for the Wolfsburg make.

#4 Volvo (8.3%, down from 8.5%) lost some ground to #3 Mercedes (8.7%), and it might lose its spot to Volkswagen towards the end of the year.

Finally, #6 Audi (6.3%, down from 6.4%) lost more ground to the top 5, but with its most immediate followers #7 Kia (4.4%) and #8 Peugeot (4.2%) also losing ground, the Ingolstadt make is safe in its position.

Arranging things by automotive group, Volkswagen Group is stable in the lead, with 20.8% share (up from 20.4% in August).

Tesla (11.4%) jumped two positions in September, to 2nd, profiting from its usual end-of-quarter peak, while BMW Group (11.1% in September, up from 11% in August) was also on the rise, thanks to Mini. So, there should be an interesting race happening here, especially considering that #4 Stellantis (10.7%) might rebound in Q4, if the ramp-ups of its new, cheap EVs go smoothly.

#5 Geely–Volvo (10.5%) is stable in 5th, and is betting on troubles continuing at Stellantis to catch it in Q4. Mercedes-Benz Group (9%) is in a distant 6th position, with the German OEM putting more ground between it and #7 Hyundai–Kia, which dropped from 7.9% share in August to its current 7.7%.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy