Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Some 268,000 plugin vehicles were registered in Europe in November, a 2% year drop over year (YoY).

Interestingly, BEVs and PHEVs had different behaviors, with the former growing 1% YoY to 185,000 units while PHEVs remained stuck in red, falling 9% in November to 83,000 units.

As such, November saw the plugin vehicle share of the overall European auto market reach 25% (18% full electrics/BEVs).

These results kept the 2024 plugin vehicle share at 22% (15% for BEVs alone) through the end of November.

Finally, looking at the sales breakdown between BEVs and PHEVs, pure electrics represented 69% of plugin sales in November, 2% above of the 2024 tally. With new or refreshed models landing soon for both powertrains — namely, cheaper BEVs and longer range PHEVs — and new CO2 ceilings in Europe, it will be interesting to see how the two technologies behave next year.

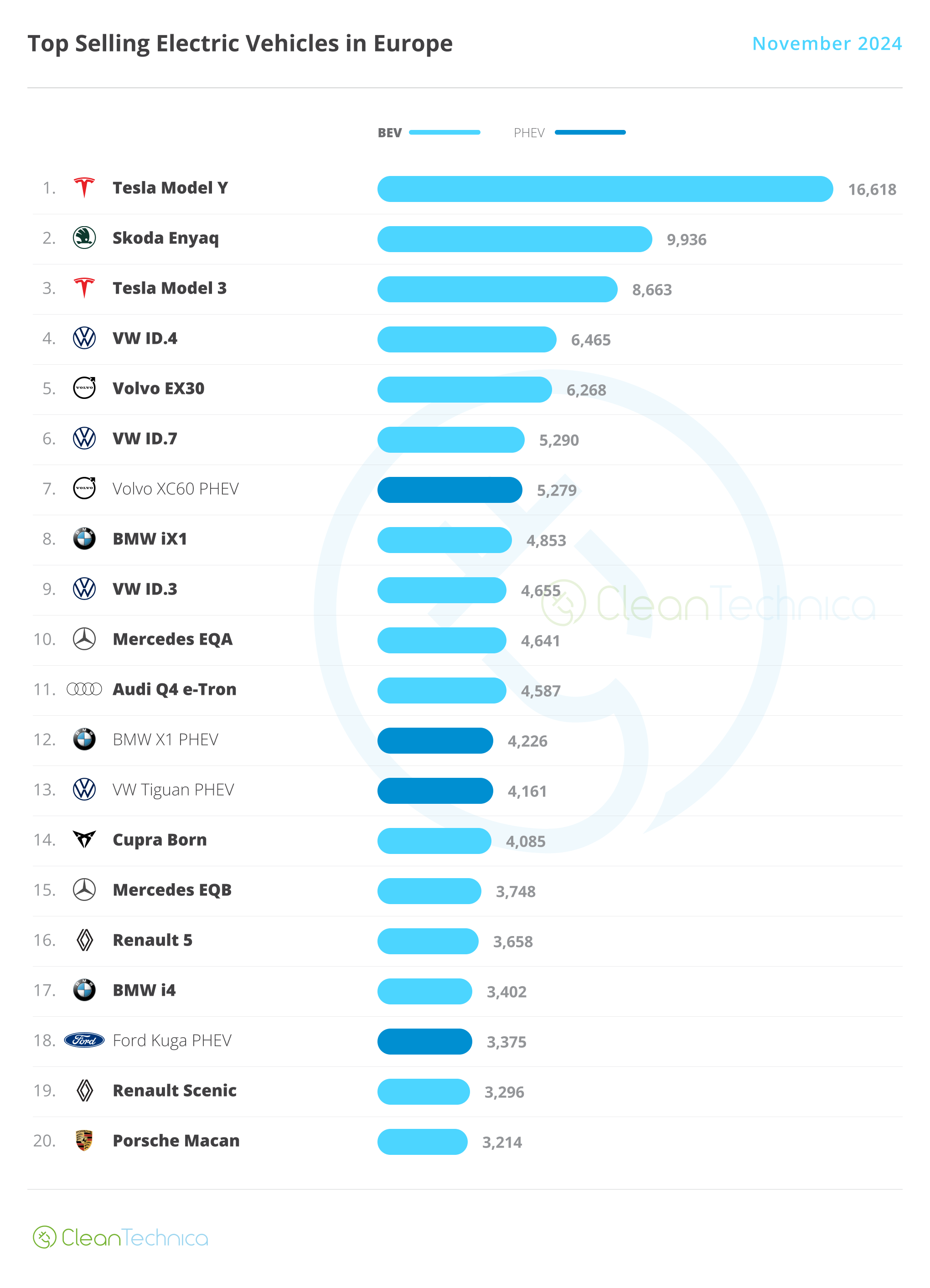

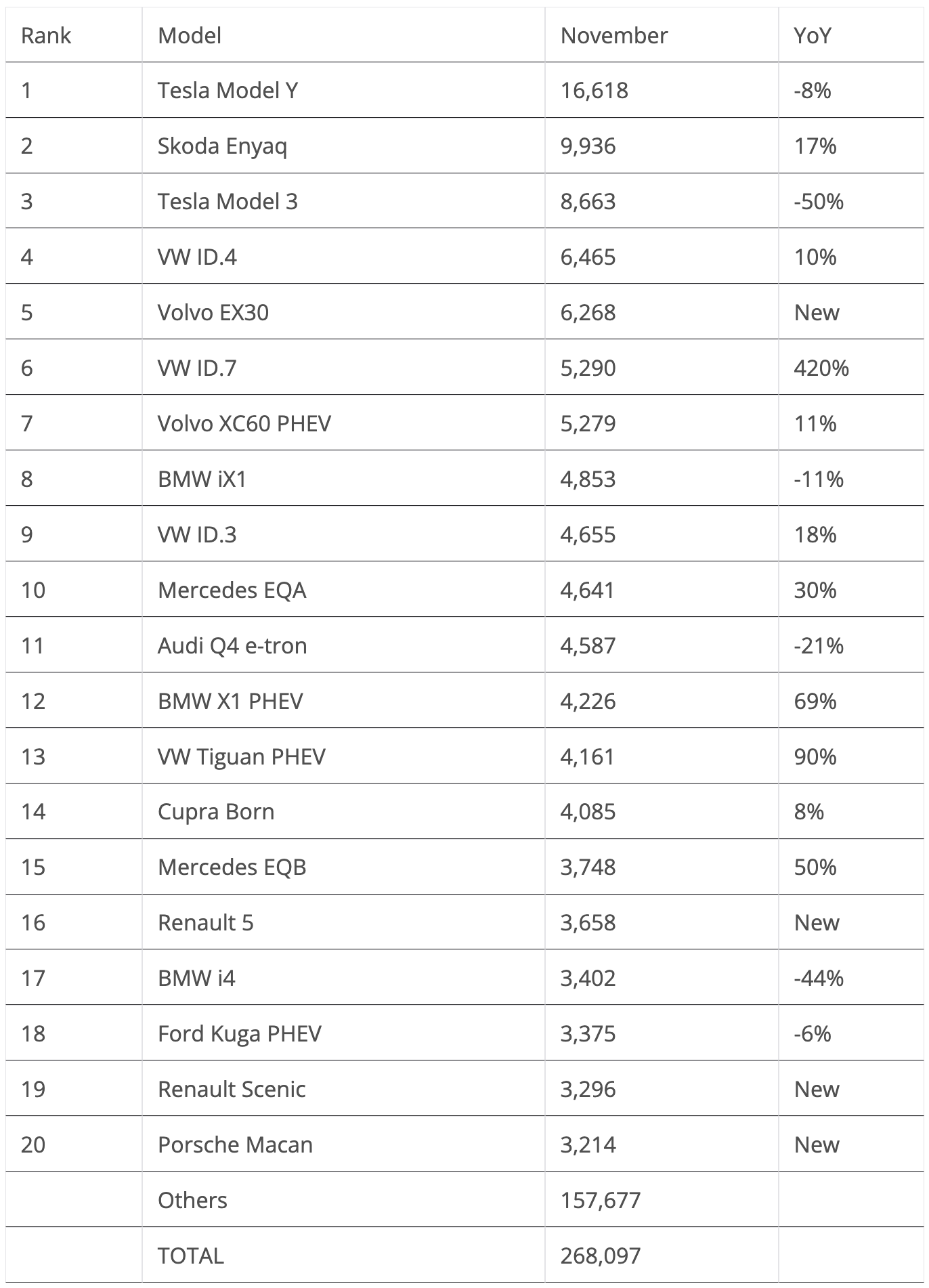

In November, the Tesla Model Y recovered the leadership position in Europe, relegating the Czech Skoda Enyaq to the runner-up position:

#1 Tesla Model Y — After a stumble in October, the US crossover was back at #1. The midsizer had 16,618 registrations, which was down 8% YoY. Remember when I mentioned that 2023/24 would be considered the “peak Model Y” period in Europe? Tesla’s midsizer has hit the market’s natural limits. Sure, the refreshed Model Y version, said to land early next year, will bring a second youth to it, but do not expect the Model Y’s performance to go much above what it once was. From now on, expect the leader of the European EV market to stay on top in the foreseeable future, but with smaller winning margins as the increasing competition erodes the Model Y’s sales.

#2 Skoda Enyaq — Skoda’s crossover has returned to form, scoring 9,936 registrations in November, which represents 17% growth YoY. An impressive result for the value for money king, especially considering that its younger, slightly smaller, and cheaper Elroq sibling is landing soon. Even if Enyaq sales drop from now on, the potential for Skoda to become a serious contender in the European EV market has been demonstrated. That will depend a lot on how the landing of the Elroq affects it.

#3 Tesla Model 3 — Tesla’s midsize sedan scored 8,663 registrations, which is a 50% decrease YoY. While the comparison with last year number seems scary, there is an asterisk that helps to explain it, which is the fact that at the same time last year, the refreshed version was being launched, leading to a peak in deliveries. Still, with the refresh of the Model Y coming soon and increased competition next year, like the new Mercedes CLA, one wonders if 2025 will be a year of decline for Tesla’s eight-year-old sedan.

#4 VW ID.4 — The compact crossover was 4th in November, with the MEB platform model scoring 6,465 deliveries, 10% growth YoY. This allowed Volkswagen Group to place two models in the top 5, the Skoda Enyaq and the VW ID.4. With improved specs and lower prices, the German EV is once again competitive, even if its Czech cousin is currently outselling it. With a deep refresh coming only in late 2026, one wonders how Volkswagen will keep its crossover’s sales up to expectations until then.

#5 Volvo EX30 — The China-made (but with a Swedish passport) crossover scored 6,268 registrations in November. That is some 800 units better than October, but still far from the 8,000 units/month of the time before the tariffs on EVs produced in China. After the start of the tariffs, the Volvo EV hasn’t managed to reach that same level of registrations. With the Belgian made EX30 said to start deliveries in the first half of 2025, the compact Volvo might get a second wind in the second half of next year, something that it will surely need if it wants to stay among the continent’s best sellers.

Looking at the rest of the November table, a few models deserve a mention, like the continued good results of Volkswagen’s new ID.7, which had another near-record performance, 5,290 registrations, allowing it to end in 6th. With the GTX versions now being delivered, and AWD being standard in these versions, expect its sales to stay high in Scandinavia, which might allow it a top 5 presence sometime in the future.

Still on the Volkswagen brand, the make placed four representatives in the top 20, with the ID.4 in 4th, the ID.7 in 6th, the ID.3 in 9th, and the Tiguan PHEV in 13th — and with a record to boot, thanks to 4,161 deliveries. Add the silver spot of the Skoda Enyaq, the 20th place of the Porsche Macan (yep, Porsche has done it again, another top 20 position — 3,214 units of its midsize SUV, even if it starts at 84,000 euros…), the 14th spot of the Cupra Born, and the 11th position of the Audi Q4 e-tron, and we have eight models from the Volkswagen Group galaxy in the top 20. Not bad….

Elsewhere, Mercedes also had a positive month. The EQA ended at #10, with a record 4,641 registrations, while its 7-seat sibling, the EQB, ended the month in #15, with 3,748 registrations. The EQB is quite possibly the most interesting electric Mercedes in the lineup, not because it offers class-leading specs, but when you look at value-for-money, it is the best of them — one of the reasons why it is leading the 7-seater class.

Renault is also in celebration mode, placing two models in the top 20 for the first time in years! The production ramp-up stage of the smiley face 5 hatchback has already allowed it to join the table, at #16, with over 3,600 units, while the Scenic MPV crossover ended the month at #19.

An interesting fact about this top 20 is that there are five new models (Volvo EX30, VW ID.7, Porsche Macan, Renault Scenic, and Renault 5).

Below the top 20, the ramp-up of the new Audi Q6 e-tron seems to have been completed, for now at least, with Audi’s SUV hovering at 2,900 deliveries. In isolation, that’s not a bad number, until you realize that its 14,000-euro more expensive Porsche cousin, the Macan, started the ramp-up later and is now delivering higher volumes than its Audi relative. (Still, a midsize Audi SUV starting at 70,000 euros is just … absurd.)

The BMW i5 is the new king of full size vehicles, scoring 2,585 registrations, while the Dacia Spring is having a second … spring, delivering 3,212 units in November, its best score in several months.

BYD’s models are starting to show up on the radar, with the best of them being the Seal U (euro-spec BYD Song), thanks to a record 2,155 registrations, the majority of them being of the PHEV variety.

With plugin hybrids unaffected by the increased China tariffs, expect a whole bunch of Chinese PHEVs landing in Europe next year, and if the Seal U’s performance is anything to go by, expect them to have even greater success than their BEV siblings.

Finally, November has been the first full month of the Kia EV3, with 2,132 registrations, a solid start for the compact Korean. Expect it to join the top 20 soon, if not already in December.

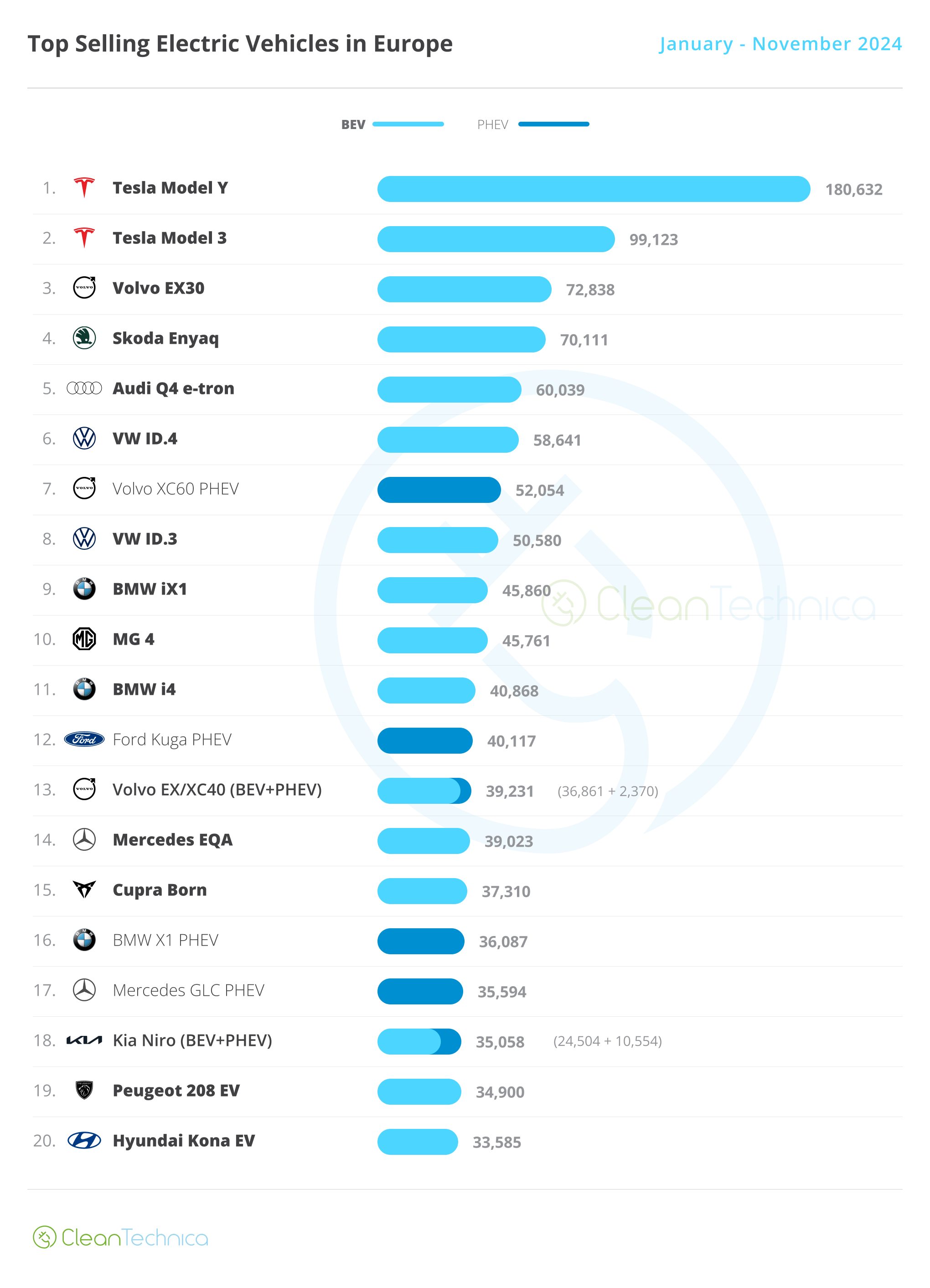

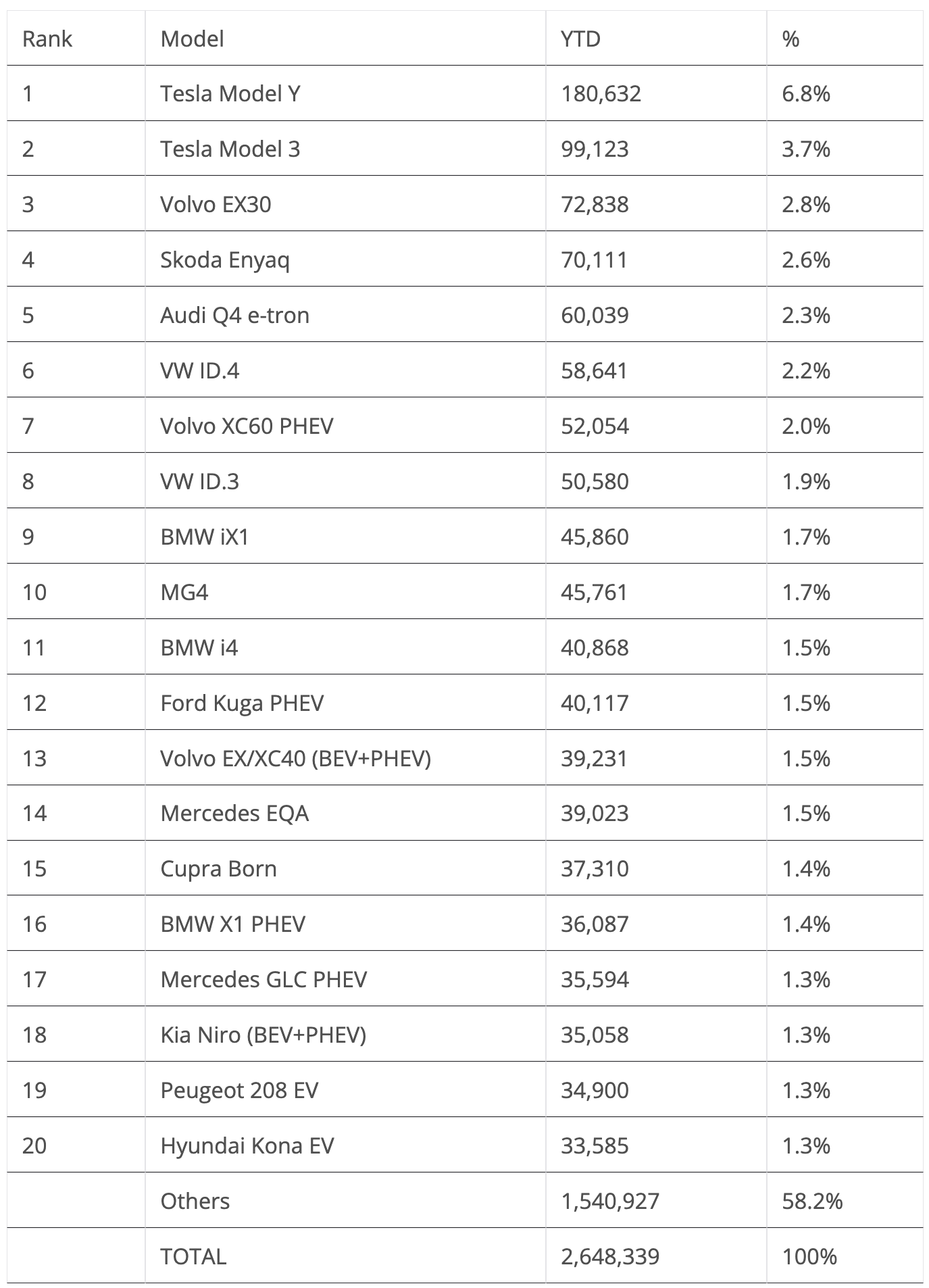

Looking at the 2024 ranking, the top two positions are already taken. With the leader, the Tesla Model Y, having a 80,000-unit lead over the runner-up Tesla Model 3, the US crossover is set to win its 3rd best seller title in a row.

Below it, the Tesla Model 3 has also secured the runner-up position, having kept an advantage of some 21,000 units over the #3 Volvo EX30. Tesla will have a gold plus silver finish in Europe this year, repeating the feat it achieved in 2022 and 2023.

2025, though? That will be harder. Not because of the Model Y, which should remain on top, but next year, the Model 3 will be met with increased competition, starting from the refreshed Model Y. Also, a number of new, lower priced EVs are expected to be sold in large volumes. So, if gold won’t be a topic of discussion next year, the remaining two podium positions will be.

As for the 3rd spot, things look shaky for the Volvo EX30, with just 2,700 units of advance over the hot selling #4 Skoda Enyaq and the Swedish EV suffering from the China tariffs, it looks like the Czech will get its first podium position this year. It also would be the Czech make’s first medal on the European market.

There was only one position change in the top 10, with the BMW iX1 climbing to 9th while kicking the MG4 down to 10th. Again, the Sino-British hatchback is feeling the impact of the China tariffs.

In the second half of the table, benefitting from the end of the road Kia Niro, the Mercedes GLC was up one position, to #17.

Also see: The Top Selling Plugin Vehicle Brands in Europe in November.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy