Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Some 185,000 plugin vehicles were registered in Europe in August, which meant a steep drop year over year (-30% YoY). And while the overall market also fell (-17% YoY), the plugin drop seems even more dramatic.

Or is it?…

There’s more to it than meets the eye. Let me explain why.

Looking at the latest news regarding August BEV sales in Europe, I believe it is important to clarify a couple of points.

At first glance, the numbers seem to be bad. BEVs were down in Europe by 34% in August, which is a deep crash. But the explanation is largely the inflated numbers of August 2023, when, because of the end of BEV subsidies for company cars in Germany, the European BEV market experienced an end-of-subsidies sales surge, pushing the market up a lot artificially.

As such, Germany’s August data should not be taken into account in the overall scheme of things, as their August 2024 data is skewed by what happened last year.

If we were to remove Germany from the tally, the results would be as follows:

BEV sales -> -10% (vs -34% with Germany)

PHEV sales -> -23% (vs -19%)

HEV sales -> +11% (vs +8%)

Petrol sales -> -21% (vs -18%)

Diesel sales -> -28% (vs -26%)

Total sales -> -12% (vs -17%)

Looking at the numbers without Germany, BEVs had a much better performance, outperforming not only PHEVs, but also petrol and diesel, staying above the overall market decline (-12%) and losing only to HEVs.

On top of this, several markets, such as Denmark, Belgium, and the Netherlands, actually showed growth in BEV sales despite the broader trends.

As such, it is clear from these calculations that not only are BEVs behaving much better than what has been said, but only HEVs are performing better in Europe.

Finally, with several highly awaited cheap(ish) models coming in (Renault 5, Citroen e-C3, etc.), we are into the last months of the Osborne effect valley. Expect September to see the first signs of recovery, with Q4 surely bringing good news to the European EV market.

Considering all of these caveats, August’s plugin vehicle share of the overall European auto market was actually quite good — 25% (17% full electrics/BEVs). That result moved the 2024 plugin vehicle share to 22% (15% for BEVs alone) by the end of August, which is only 1% less than where we were a year ago, at 23%.

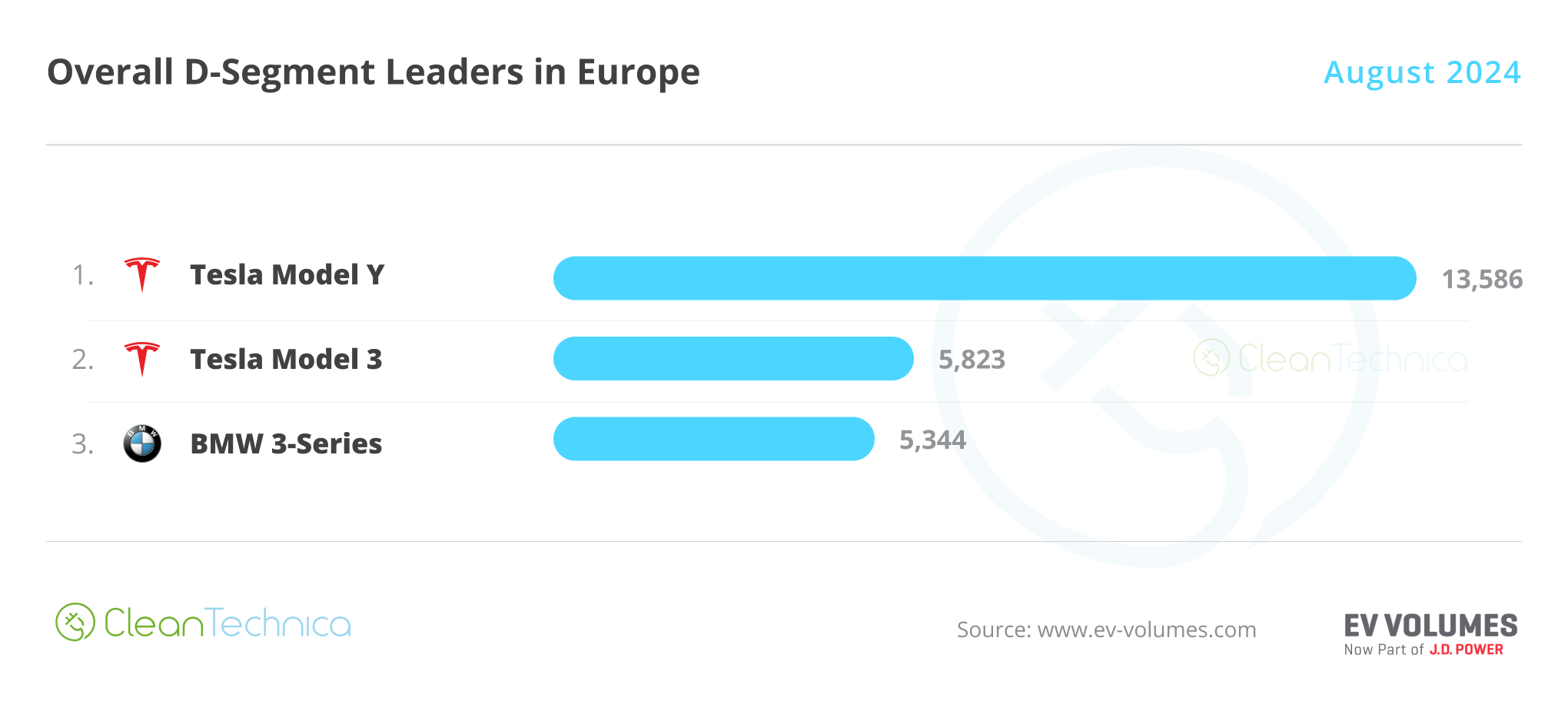

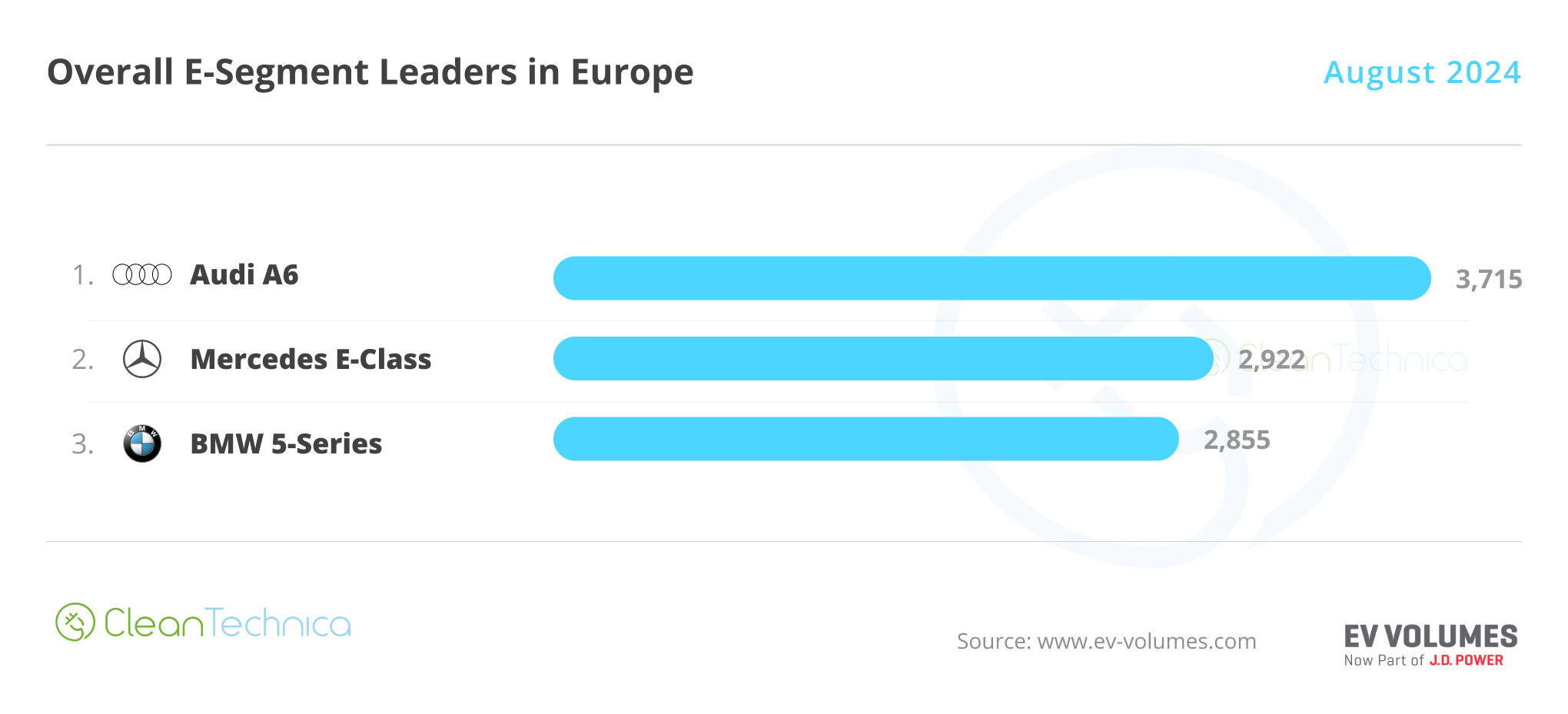

Looking at several categories, there is a stark contrast to the same exercise in China. In China, with the exception of the C (compact) segment, all the vehicle segments have 100% PEV podiums. In Europe, on the other hand, only the D (midsize) segment has plugins on the podium, with the Tesla Model Y leading and the Tesla Model 3 taking the runner-up position. Yep, you read that right — once a segment where the Three Marys (BMW, Mercedes, Audi) ruled uncontested, in 2024, it is Tesla’s turf.

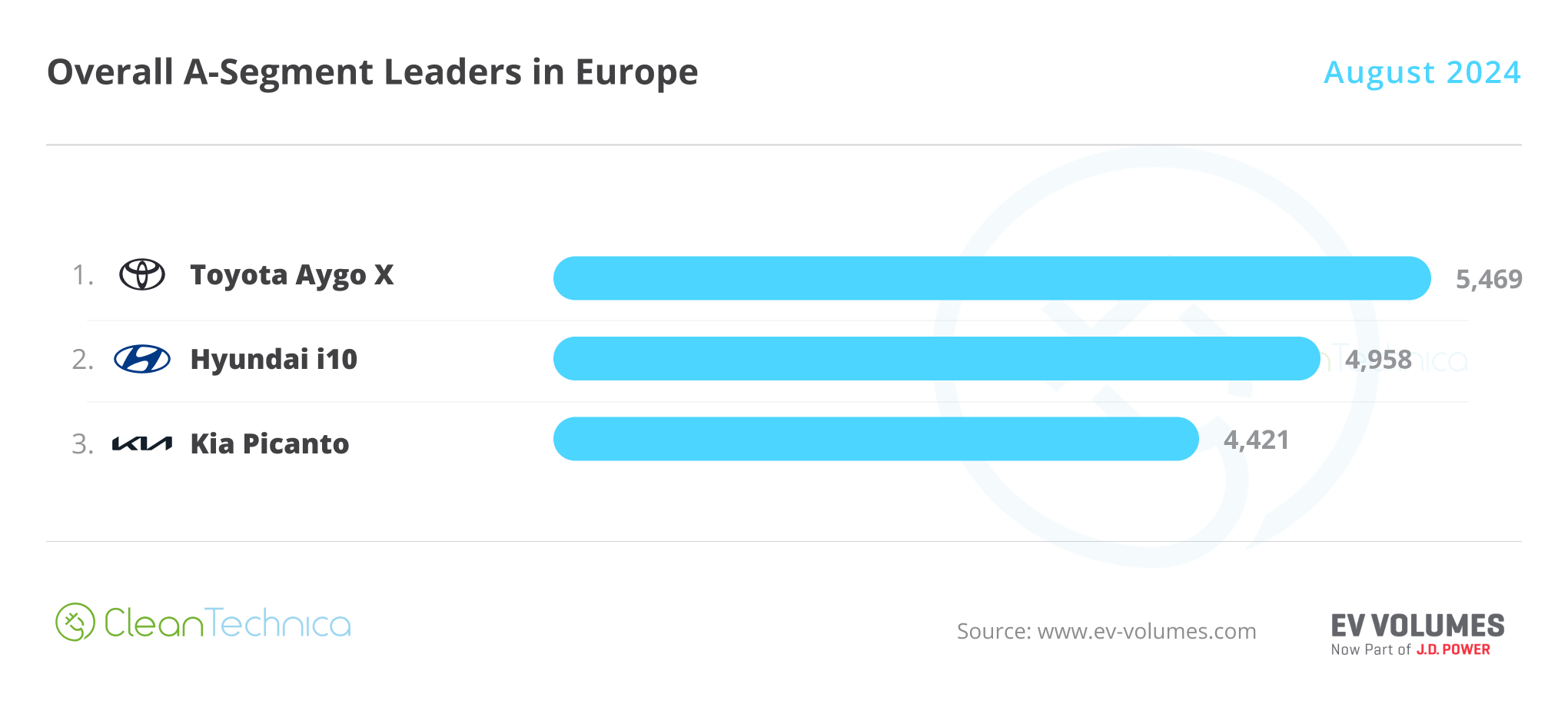

And contrasts with the past do not end there. The A (city car) segment used to belong to FIAT, with the Panda and 500 taking the #1 and #2 spots for the Italian make. Now, it is a 100% Asian podium, with Toyota, Hyundai, and Kia kicking FIAT off of the podium, to 4th in the case of the Panda (3,872 units) and 5th in the case of the 500 (3,818 units).

The B segment tells a similar story. Once a segment where the French ruled, now the best Gallic representative (the Renault Clio) is only 3rd, behind the #2 Toyota Yaris Cross and #1 Dacia Sandero.

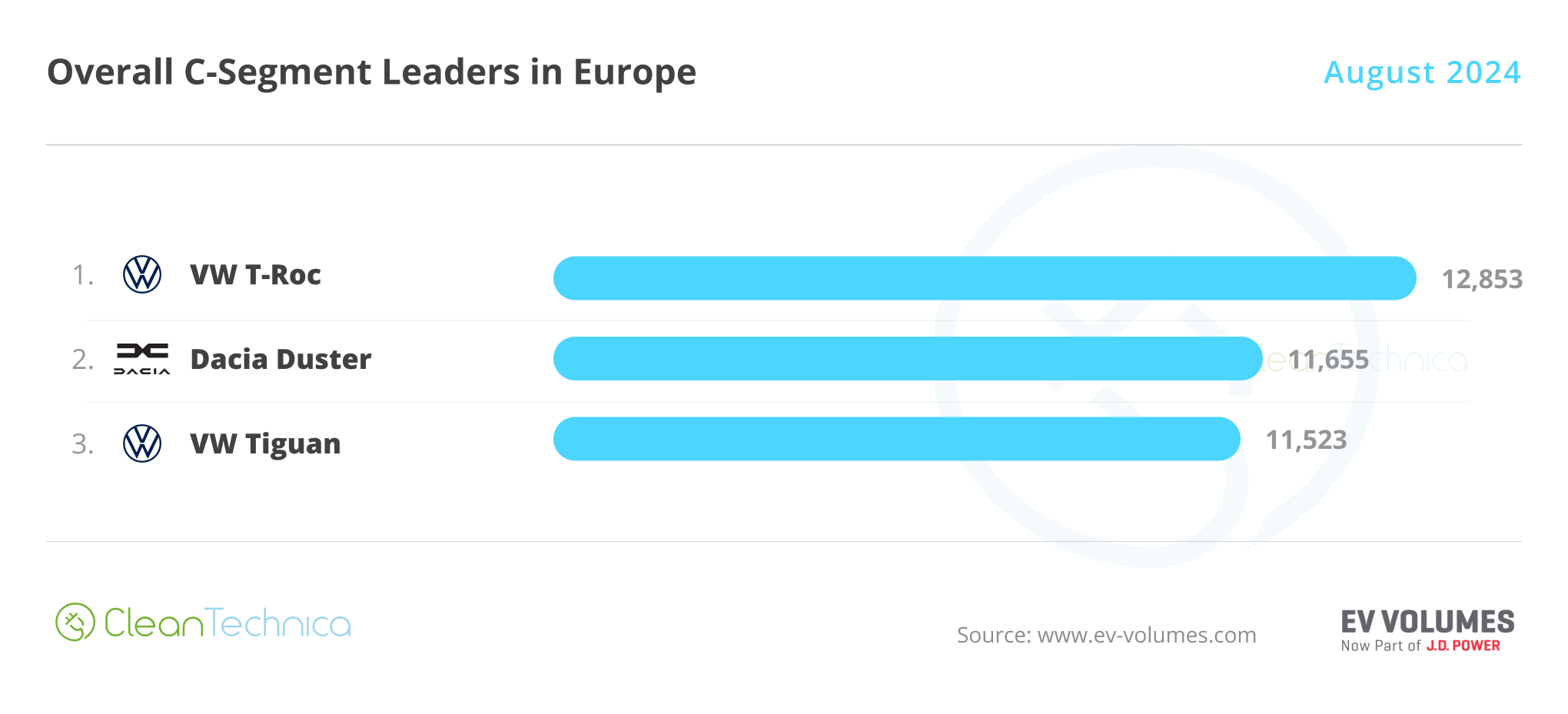

In the compact (C) category, the once almighty VW Golf is gone from the podium, replaced by two different crossovers from the brand, the #1 VW T-Roc and the #3 VW Tiguan, with the Dacia Duster in between them. This podium is also telling of current market trends — a 100% crossover/SUV podium, and another Dacia in the podium. With two Dacias in podium positions, this says how important value for money is right now for Europeans, while on the other hand, most local brands aspire for premium-ness, in order to increase their profit margins. This is creating a disconnect with the average buyer, which is becoming more and more open to good value proposals and less devoted to brand value.

So, the stage is set for seismic changes. With the current transition to an electrified market happening, and a disconnect between what people want and what they get, there are major opportunities for whoever provides good value BEVs. They do not need to be fancy or premium, or from a storied brand. They just need to offer good value, be space efficient, be reliable, and be easy to operate. Kind of like Dacia, but BEV.

Mmm … I wonder if such vehicles exist….

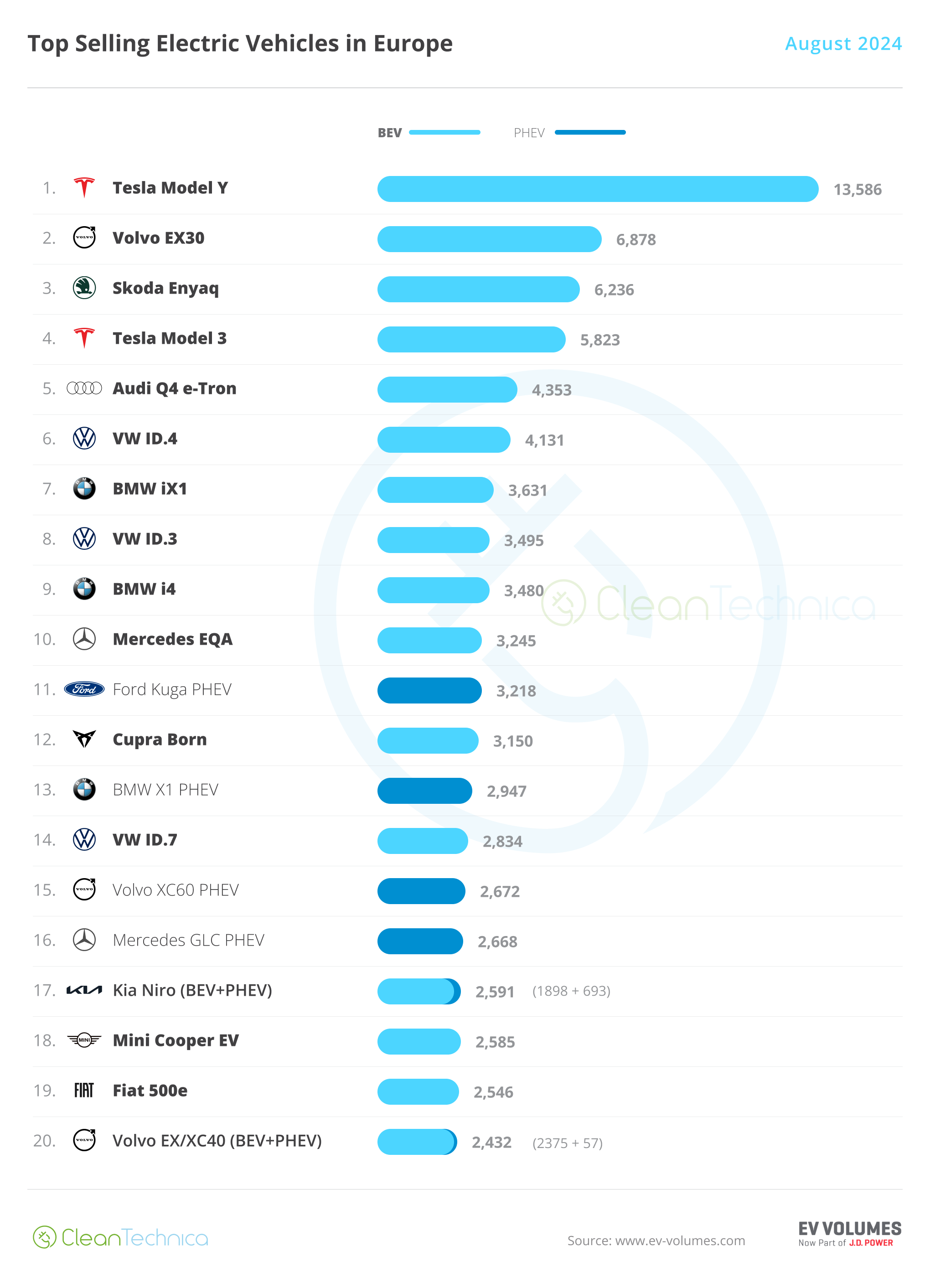

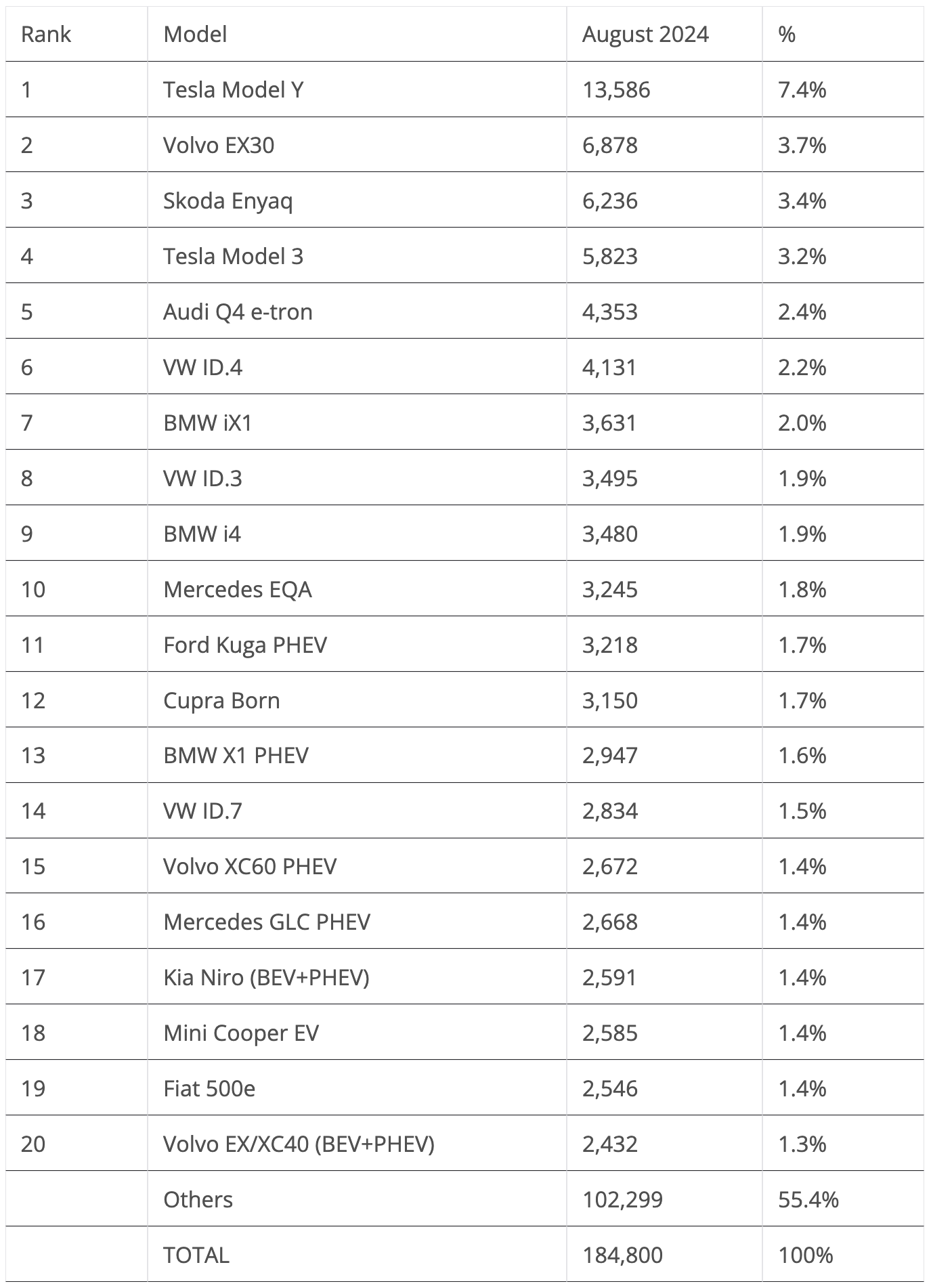

The highlight of the month was the Skoda Enyaq nabbing a podium position. But let’s look closer at August’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. But despite this, things could look better for the US crossover. In August, the midsizer had 13,586 registrations, which was down 37% YoY. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? It is starting to show. The midsized crossover’s deliveries were down 26% YoY in the first half of the year in Europe, as the market’s natural limits (and new competition) are starting to bite. Add the refreshed Tesla Model 3, which is stealing sales in some markets, and the Model Y are not having amazing performances, as they once were. Looking at individual countries, the biggest seller was Norway, with 2,107 units, followed by France (2,096 units), Germany (1,957), the UK (1,450), Sweden (1,101), and the Netherlands (1,064).

#2 Volvo EX30 — The China-made (but with a Swedish passport) crossover is living up to the hype, scoring 6,878 registrations in August and collecting another silver medal. Currently Volvo’s cheapest model, it starts out at 39,000 euros, versus the 40,000 euros of the gasoline XC40. The EX30 is also Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that, it would have to cost less than 35,000 euros), it can nevertheless be considered well priced, especially considering the premium standing it holds. Currently, one can say that the delivery ramp-up of the EX30 is now finished, and we are witnessing the cruising speed of Volvo’s smaller BEV. Looking at the EX30’s biggest markets, Belgium leads, with 975 units, followed by neighboring Netherlands (944 units) and Norway (932).

#3 Skoda Enyaq— Skoda’s crossover is returning to form, scoring 6,236 registrations in August, a new year best, and winning a podium presence. With demand recovering, due to the recent refresh, the value-for-money king in the Volkswagen Group galaxy is hoping to be back in the game. A top 5 position is possible for 2024, but that will depend a lot on how deeply affected its MiC adversaries (we are looking at you, MG4) will be hit by the recent tariff increase. Looking at the Czech’s biggest markets, Germany was by far the largest, with 1,849 units, followed by Norway (816) and the UK (720).

#4 Tesla Model 3 — Tesla’s sedan delivered 5,823 units. And although that is down a dismal 51% YoY, this is not the best month to analyse the sedan’s performance drop in Europe, due to the aforementioned peak in August 2023 in Germany (at the time, the Model 3 had delivered 2,015 units in Germany, versus fewer than 500 last month). Still, it is true that Model 3 sales are down in Europe … and that something needs to be done about it (I still think that a liftback/station wagon version of the Model 3 would do wonders for its career in Europe). But I digress. Expect it to continue as the running mate of Tesla’s current star, the Model Y, all while it keeps the #2 position away from the 3rd placed Volvo EX30. As for the markets with the most deliveries, they were the UK (1,530), Belgium (far behind, at 595 units), and the Netherlands (460 units).

#5 Audi Q4 e-tron — The compact crossover won a top five presence in August, with the posh MEB model delivering 4,353 units. While not exactly cheap (with prices starting at around 50,000€), this good looking ID.4 from another mother is proving to be quite popular, even outselling the aforementioned VW ID.4. It seems its new, bigger sibling, the Q6 e-tron, despite having much better specs (while also being significantly more expensive), is not putting a shadow on the Q4. So, with no internal competition to speak of, Audi’s crossover only needs to fear the rising BMW iX1. Looking at the crossover’s biggest markets, its home Germany had 893 registrations, followed by the UK (750 units) and Belgium (700), which once again showed up among the best selling markets due to its strong BEV company car market incentives.

Looking at the rest of the August table, a few performances deserve a mention, like the continued good results of BMW’s dynamic duo, with the iX1 (3,631 units) in 7th, and the i4 (3,480 units) in 9th. They continue to push BMW upwards. The #12 Cupra Born (3,150 units) is confirming the return to form of MEB-platform models, and the #18 Mini Cooper EV (2,585 units) is helping BMW Group to move forward.

Finally, looking at the PHEV category, the Ford Kuga PHEV was the best seller of the category. With 3,218 sales, it also ended in 11th on the plugin table.

But the true surprise of August’s table was the VW ID.7 debuting in the top 20, in #14, with a record 2,834 units! Is this for real, or will this be just a blip and September sees the ID.7 return to anonymity? At this point, Volkswagen really needs some good news….

Below the top 20, one highlight was the Renault Scenic registering 2,165 units, allowing the good looking Renault to become the brand’s best seller. The French crossover is starting to deserve a top 20 spot…. Elsewhere, the Mercedes EQB worked hard in August and gained 2,165 registrations.

Finally, a mention goes out to the landing of the Ford Explorer EV. With a strong 1,483 registrations in its first full month on the market, it has already made its presence felt. Will the MEB-based compact crossover from Ford be able to run with the best in the pack?

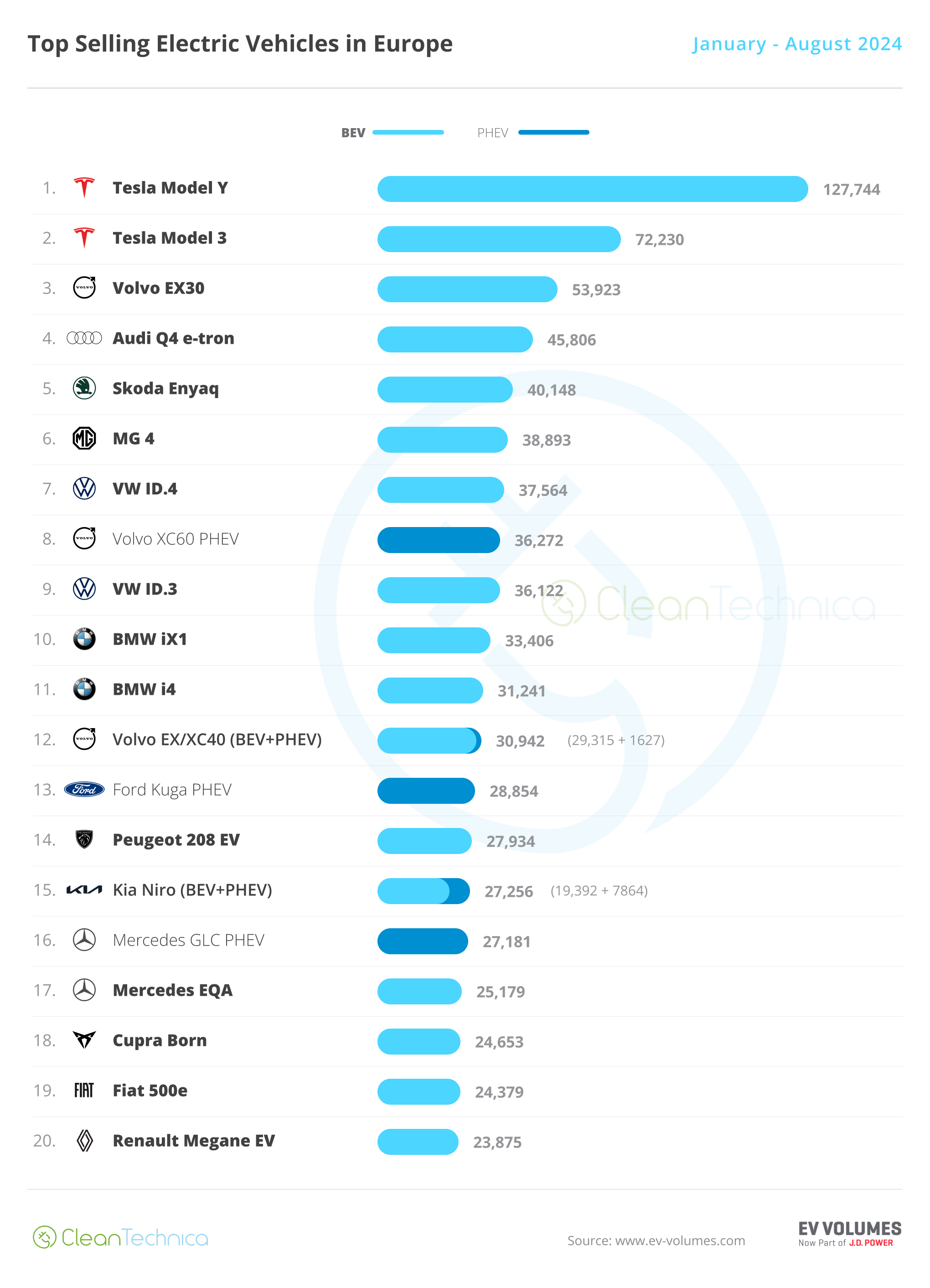

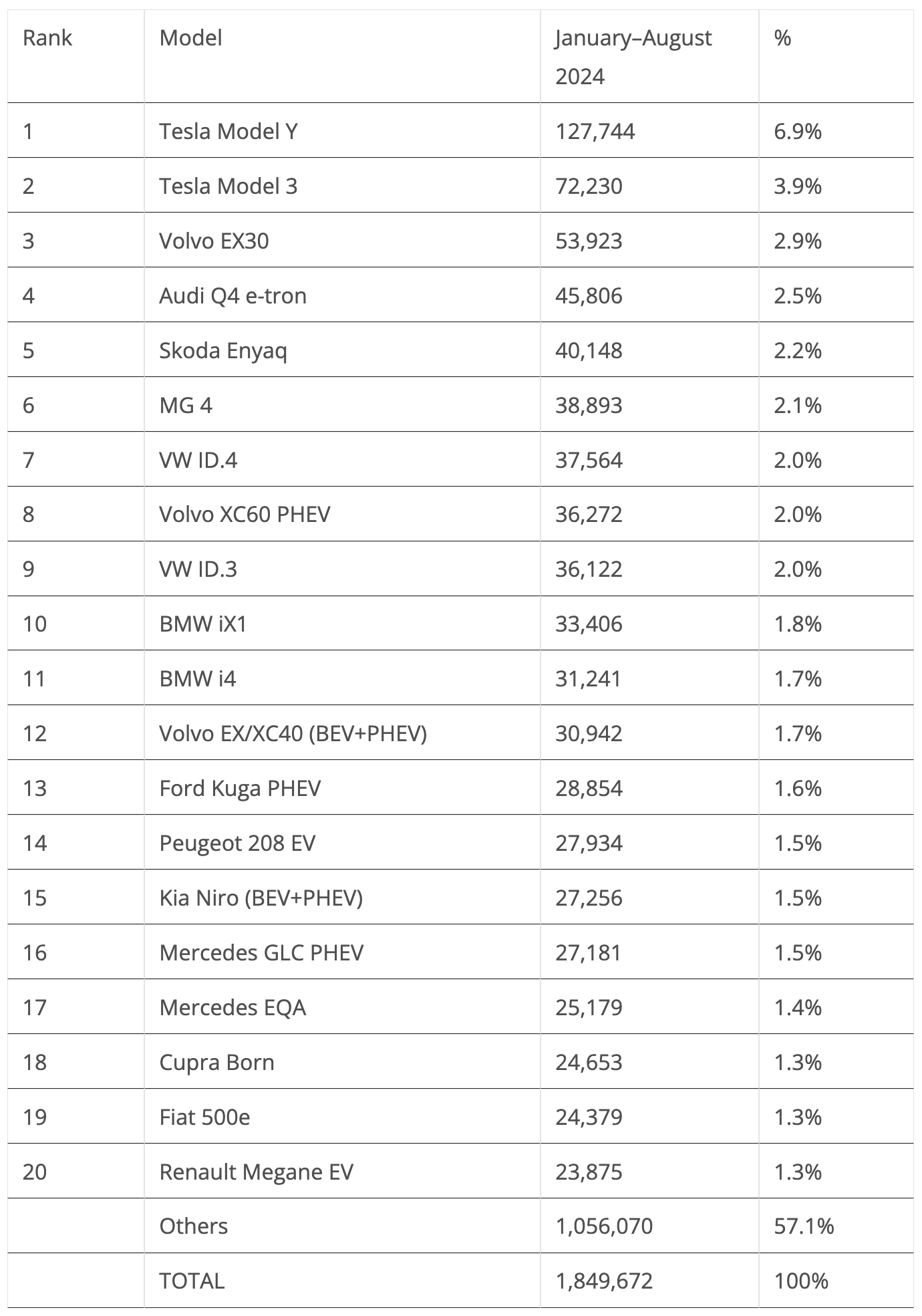

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having a 50,000-unit lead over the runner-up Tesla Model 3, the leadership position is already taken and the Model Y is set to win its 3rd best seller title in a row.

Below it, it seems the Tesla Model 3 has also secured the runner-up position, having kept an advantage of some 18,000 units over the #3 Volvo EX30. So, this one should also be secured, and Tesla will most likely have a gold plus silver finish in Europe this year, repeating the feat of 2022 and 2023.

As for the 3rd spot, the picture is less clear, but with 8,000 units of advance over the #4 Audi Q4 e-tron, the Swede seems to have a significant cushion over the German crossover. Time will tell how the EX30 behaves under the new tariffs.

The first position changes happened in the 5th position, with the Skoda Enyaq climbing another position at the cost of the MG 4, now feeling the weight of the new tariffs.

Still on the top 10, VW’s best seller, the ID.4, surpassed the Volvo XC60 PHEV and climbed to 7th. It is good that the crossover is recovering lost time, but the #3 spot of the German model, won in 2022 and 2023, seems already out of reach.

The BMW i4 fastback relegated the Volvo EX/XC40 to 12th and is now in 11th place. The Belgian-made Volvo is now being outsold and outclassed by its EX30 sibling, so one wonders what will become of it. Will Volvo refresh it in order to revive the nameplate, or will it fade away into oblivion by next year?

Elsewhere, the busy bee Ford Kuga PHEV is again on the way up, having this time climbed to#13 in August. But with the leading Volvo XC60 PHEV some 7,000 units ahead, there’s not expected to be any position change between these two.

The Kia Niro was up to #15, a surprising move considering that the much anticipated Kia EV3, a competing model that is cheaper, better looking, and with better specs, is right around the corner…. Also on the way up is the Mercedes EQA. Despite a high price and average specs, the EQA has managed to find enough sales to climb to #17.

Finally, the Cupra Born joined the table in style, landing in #18, all while the Fiat 500e recovered the 19th spot in the table, some welcome news to a battered Stellantis.

Times are hard for Stellantis, as the Peugeot e-208 keeps on losing positions (it was down to #14 in August) and the Fiat 500e is struggling to stay in the top 20, a far cry from the position held 12 months ago — when the little Italian was 8th on the table. Those new, cheap EVs (Citroen e-C3, Fiat Grande Panda EV, Opel Frontera EV, etc.) need to be delivered fast and in volume if the multinational conglomerate wants to break its current downward spiral.

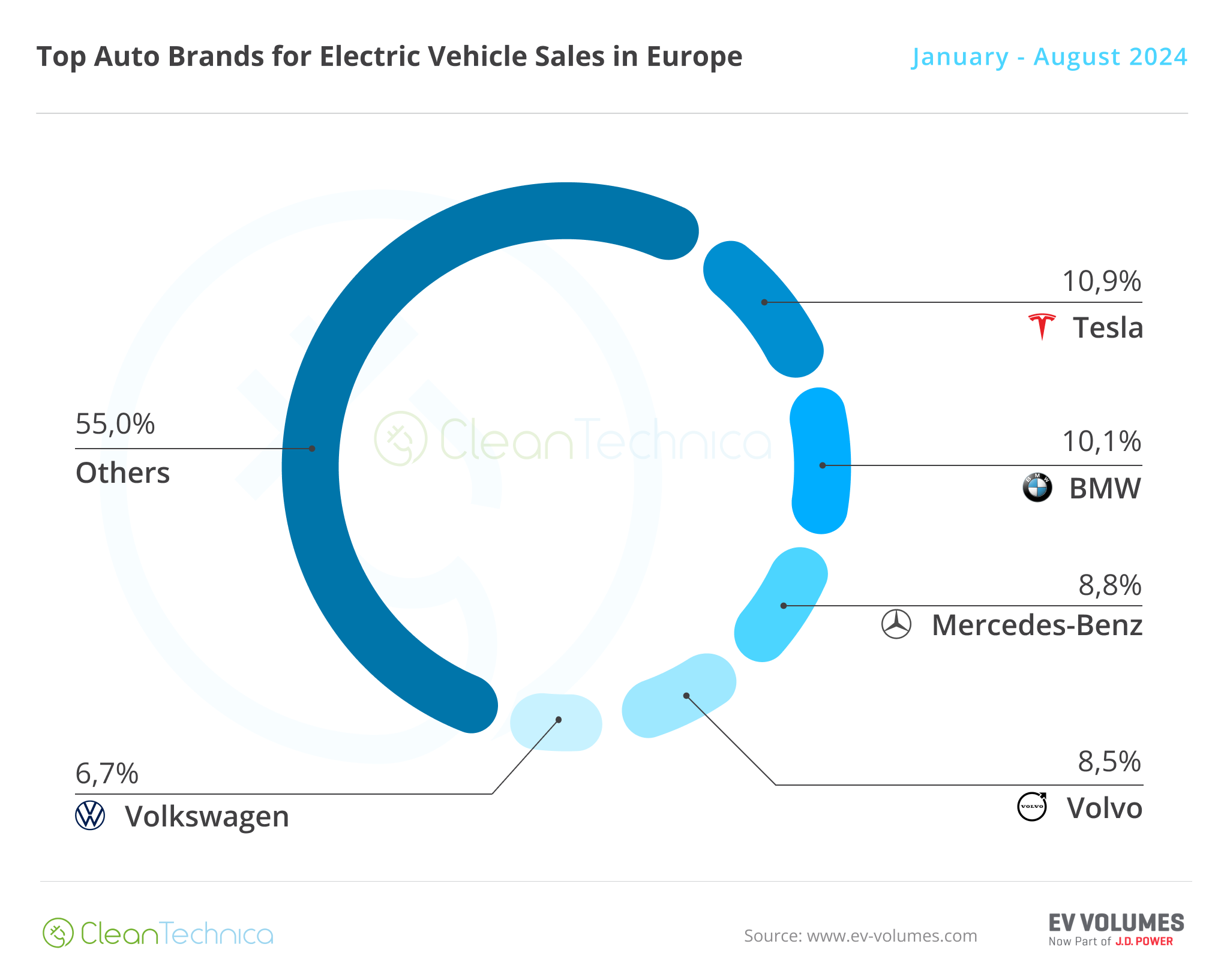

As for the plugin auto brand ranking, Tesla was at cruising speed (10.9% in August vs. 10.8% in July). Although, looking at yearly sales, deliveries are down by 17%, so it’s clear Tesla’s dominance isn’t as solid as in the past, and that is visible when we compare its current market share with that held a year ago (10.9% now vs. 12.3% a year ago).

It should have enough of a lead to win the 2024 title, but looking at 2025, the US make will have a harder time protecting its title.

More proof of closing distances is the fact that #2 BMW (10.1%) is just 0.8% behind Tesla, while in August 2023, the US make enjoyed a 3.6% lead over then #2 Volkswagen.

Speaking of the German brand, the fall from 2nd to 5th is the biggest difference between the current top 5 with the one of August 2023. The Wolfsburg make had a terrible first half of the year, and it is now recovering, but it is still a full 2% share behind its score a year ago (6.7% now vs. 8.7% then).

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), expect a sales push to reach the 3rd position. The only problem it has is that Mercedes and Volvo are also going strong…. So, in the end, we should see Volkswagen finish the year off the podium.

#4 Volvo (8.5%, down from 8.6%) lost some ground to #3 Mercedes (8.8%), because while the EX30 is gaining share for the brand, the EX/XC40 sales slide is dragging down the EX30’s good work.

Finally, #5 Volkswagen (6.7%) has distanced itself from #6 Audi (6.4%, down from 6.5%), which only has the Q4 e-tron pulling the brand forward.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

As for the overall brand ranking, the doom and gloom is almost unanimous, with only Volvo presenting positive numbers in the top 25. The Swedish brand had an amazing 33% growth rate in August, a barely believable number considering it was surrounded by a sea of double-digit drops.

Even more amazing, looking at the top 50 brands, only three other brands managed to beat Volvo’s growth rate: Chery’s recently launched Omoda brand, Xpeng (+519%), and Lotus (+86%). You might have noticed a common theme here, as they are either Chinese (Omoda, Xpeng) or Chinese-owned (Volvo, Lotus). Something to think about….

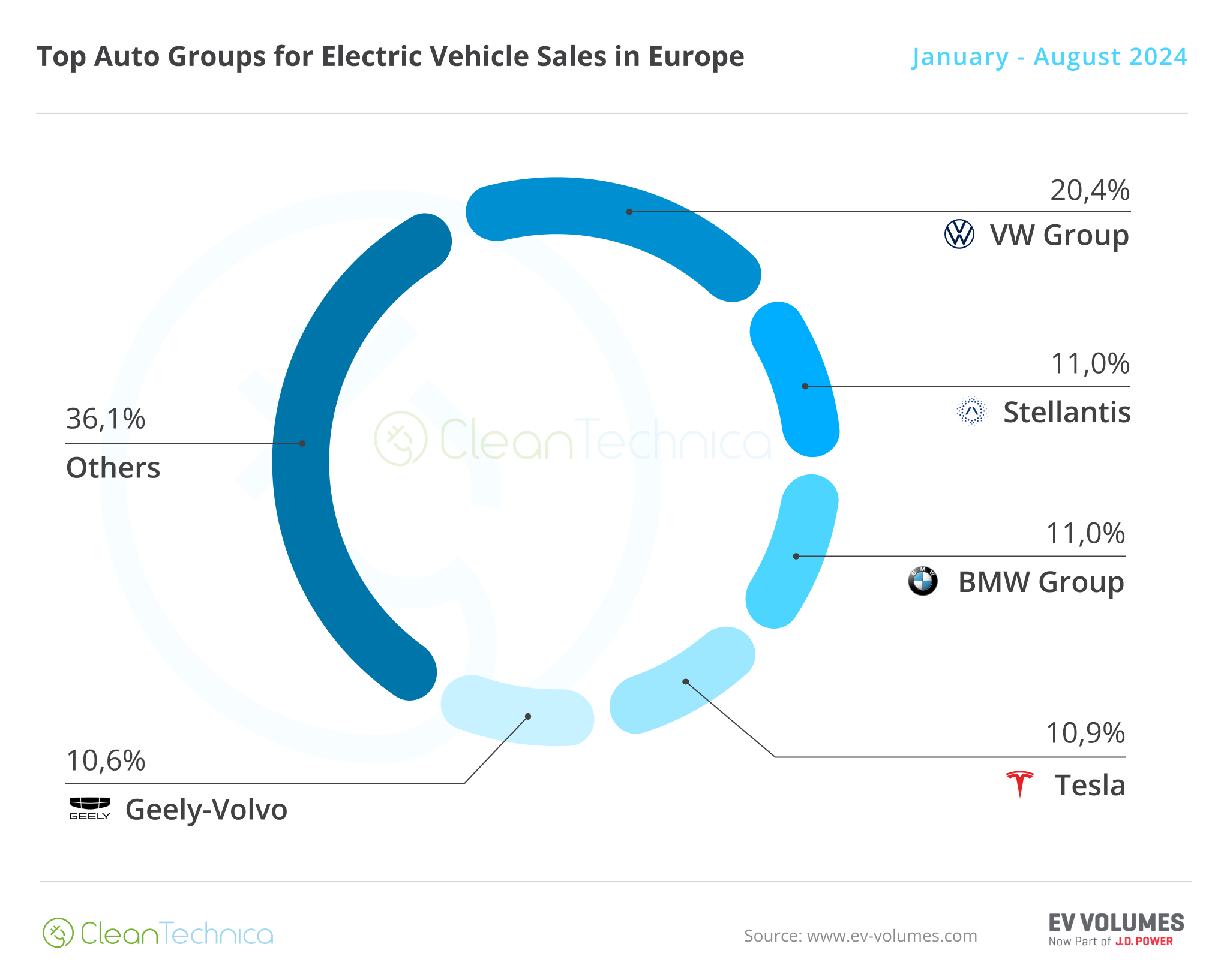

Arranging things by automotive group, Volkswagen Group is stable in the lead, with 20.4% share (interestingly, exactly the same number it had a year ago). The German OEM is keeping a comfortable lead over the competition.

The previous runner-up, Stellantis, has dropped to 3rd, despite increasing its share slightly, to 11%. Rising to 2nd was BMW Group (11%, up from 10.9%), which is banking on the success of the iX1 and i4, with the recently introduced i5 providing an extra dose of volume that allows the German OEM to look forward to winning more share in the remainder of the year, and possibly even ending ahead of Tesla (10.9%) in the race for the runner-up position. Although, the US make is still the favorite to win the silver medal at the end of the year.

Geely–Volvo (10.6%) is stable in 5th, while Mercedes-Benz Group (9.1%) is in a distant 6th position.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy