Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Some 220,000 plugin vehicles were registered in Europe in July, which means it is another month in the red year over year (-6% YoY). That’s contrasted with the overall market experience (+2% YoY).

Taking a more focused examination of the market, BEVs behaved slightly better (-6% YoY) than PHEVs, which fell by 8%.

But to really understand what is going on, we need to dig deeper to see the reasons for these numbers.

The first factor to take into consideration is the expected sales hangover from the announced tariff increase for Made-in-China (MiC) BEVs, which had pushed the BEV market into a small sales rush in June. Now in July, the sales hangover wasn’t as bad as feared, with BEVs falling by just 6% YoY. So, a small sales rush leads to a small hangover.

The second factor to take in account is the end-of-subsidies-derived doom and gloom in Europe’s biggest automotive market, Germany. The largest automotive market in Europe is having a horrible 2024 when it comes to plugin sales, and especially BEVs, which is dragging the whole continent down with it.

July’s plugin vehicle share of the overall European auto market was 21% (14% full electrics/BEVs). That result kept the 2024 plugin vehicle share at 21% (14% for BEVs alone) by the end of July.

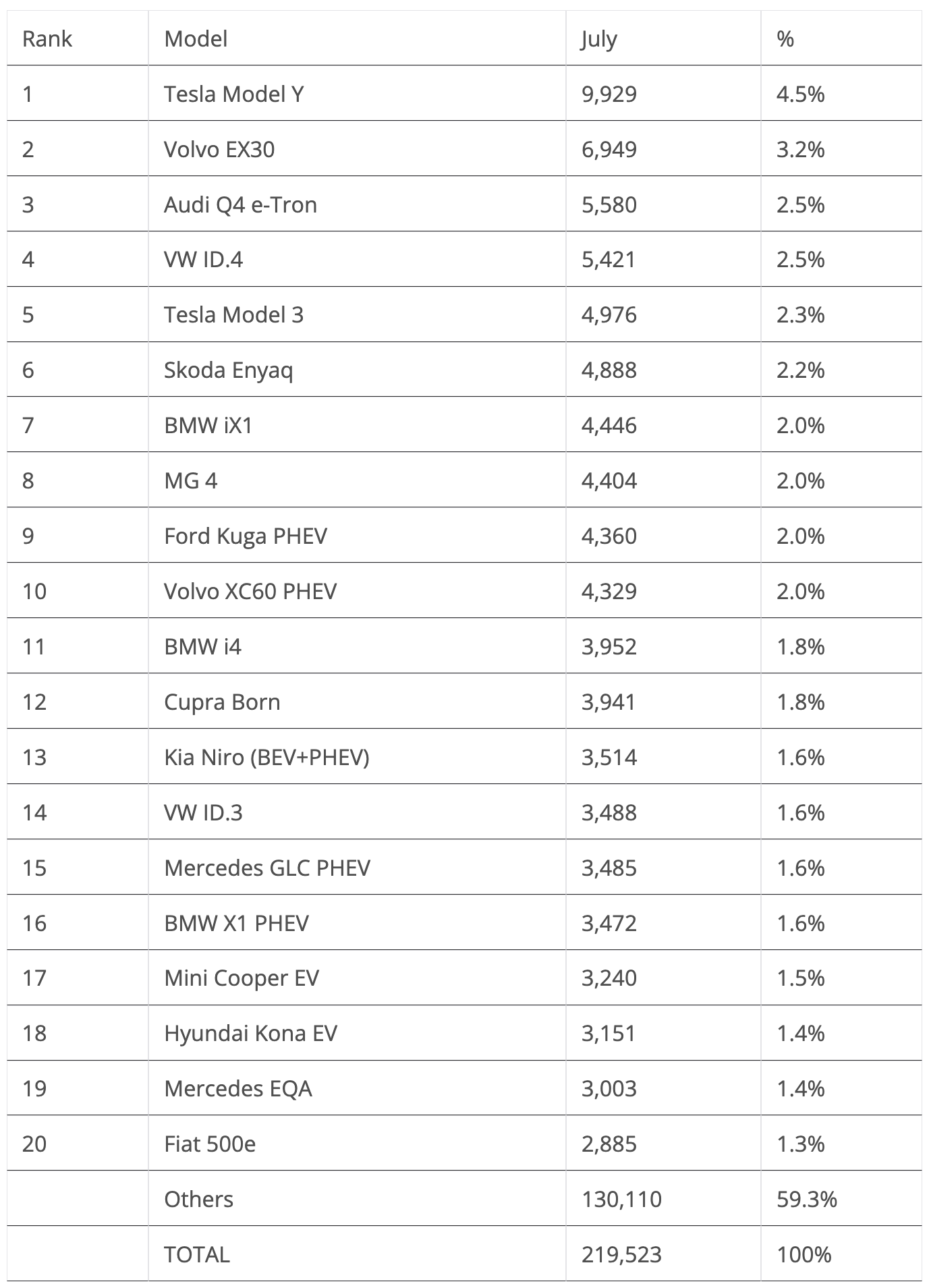

The highlight of the month was the VW ID.4, nearly nabbing a podium position. But let’s look closer at July’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. But despite this, things look shaky for the US crossover. In July, the midsizer had 9,929 registrations, which was down 16% YoY. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? It is starting to show. The midsized crossover’s deliveries were down 26% YoY in the first half of the year in Europe, as the market’s natural limits (and new competition) are starting to bite. Add the refreshed Tesla Model 3, which is stealing sales in some markets, and the Model Y’s performance is not as amazing as it once was. And this time it even had some competition for the leadership position, with the runner-up Volvo EX30 ending some 3,000 units behind. Sure, 3,000 units is not 300, so the US crossover didn’t really have to sweat to keep the #1 spot, but the Model Y’s domination is not as undisputed now as it once was. It will be interesting to see what happens in August.

#2 Volvo EX30 — The China-made (but with a Swedish passport) crossover is living up to the hype, selling 6,949 registrations in July and collecting another silver medal. Currently Volvo’s cheapest model, it starts out at 39,000 euros, versus the 40,000 euros of the gasoline XC40. The EX30 is also Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that, it would have to cost less than 35,000 euros), it can nevertheless be considered well priced, especially considering the premium standing it holds. Currently, one can say that the delivery ramp-up of the EX30 is now finished, and we’ll start to see the cruising speed of Volvo’s smaller BEV.

#3 Audi Q4 e-tron — The compact crossover won a podium presence in July, with the posh MEB model delivering 5,580 units. While not exactly cheap, with prices starting at around 50,000€, this good looking ID.4 from another mother is proving to be quite popular, even outselling the more utilitarian Skoda Enyaq and the aforementioned VW ID.4. It seems its new, bigger sibling, the Q6 e-tron, despite having much better specs (while also being significantly more expensive), is not putting a shadow on the Q4. So, with no internal competition to speak of, Audi’s crossover only needs to fear the rising BMW iX1.

#4 VW ID.4 — The Volkswagen crossover is returning to form, scoring 5,421 registrations in July and nearly winning a podium presence. With demand recovering, due to the recent refresh, the ID.4 is hoping to be back in the game. A top 5 position is possible for 2024, but that will depend a lot on how deeply affected its MiC adversaries (we are looking at you, MG4) will be hit by the recent tariff increase. Now that we are talking of futurology, I would like to see a styling refresh of the ID.4, something that would make it less … Pure Vanilla. It could still be vanilla, but please add a little more flavor to the recipe, to make it less bland and forgettable.

#5 Tesla Model 3 — Tesla’s sedan had its usual low first month of the quarter, delivering 4,976 units. Still, the veteran BEV (it was launched back in 2017) is far from its best days, having suffered a two-digit drop in July. It won the Best Seller trophy in 2019 and 2021. Now, all it can aspire to is keeping the runner-up status away from models like the Volvo EX30. And I still think that a liftback/station wagon version of the Model 3 would do wonders for its career in Europe…. But I digress. Expect it to continue playing as the running mate of Tesla’s current star, the Model Y, all while it keeps the #2 position away from the 3rd placed Volvo EX30.

Looking at the rest of the July table, a few models deserve a mention, like the #7 BMW iX1 (4,446 units), which continues to push BMW upwards. The #12 Cupra Born (3,941 units) is confirming the return to form of the MEB-platform models, and the #17 Mini Cooper EV (3,240 units) is helping BMW Group to move forward.

Finally, looking at the PHEV category, this time the Ford Kuga PHEV has narrowly beaten the Volvo XC60 PHEV, with just 31 units separating the two SUVs. The Ford model thus won July’s best seller prize. With 4,360 sales, it also ended in 9th.

Below the top 20, one highlight was the BMW i5 registering 2,248 units, allowing the good looking BMW to win the full size category. The new Audi A6 e-tron will have a hard time taking the Beemer away from the top of the category….

Other highlights are the production ramp-up of the Renault Scenic EV crossover — with 2,257 registrations in July, it is starting to become top 20 material. Elsewhere, the VW ID.7 worked hard in July and gained a record performance, 2,187 registrations. Will VW’s midsize EV finally start to live up to expectations? It has everything to do so … except the price. Come on, Volkswagen, 58,000 euros for the ID.7?!?! That’s BMW i4 money!!! Have a look at the talented Hyundai Ioniq 5 & 6 — both start at around 45,000 euros! Now, that would be a good price for the ID.7.

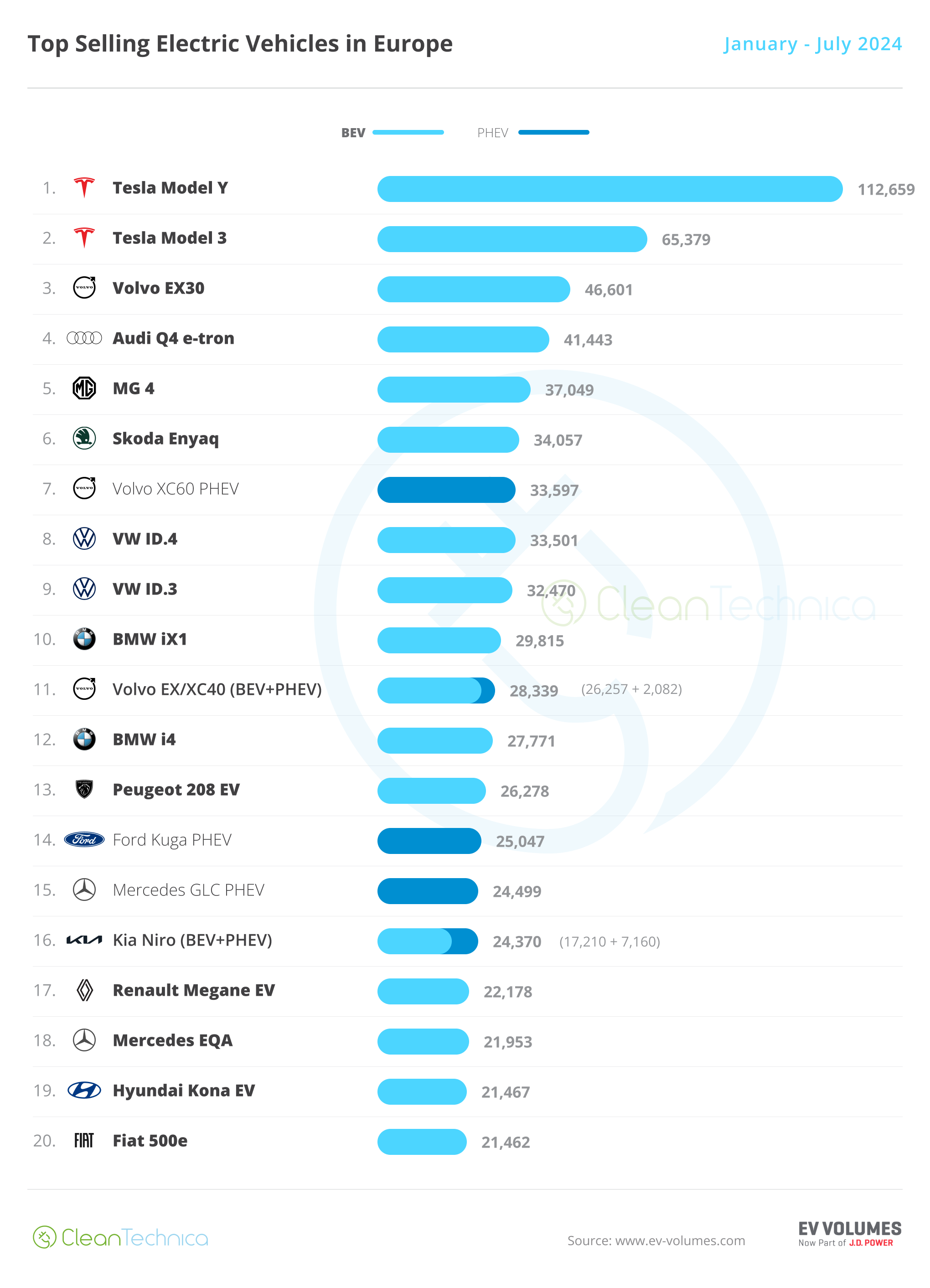

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having a 40,000-unit lead over the runner-up Tesla Model 3, the leadership position is already taken and the Model Y is set to win its 3rd best seller title in a row.

Below it, it seems the Tesla Model 3 has also secured the runner-up position, having gained an advantage of close to 20,000 units over the #3 Volvo EX30. So, this one should also be secured, and Tesla will most likely have a gold plus silver finish in Europe this year.

As for the 3rd spot, the picture is less clear, because it is not certain how the recent tariff increase will affect the Volvo EX30. With 5,000 units of advance over the #4 Audi Q4 e-tron, the Swede seems to have a significant cushion over the German crossover, but time will tell how the EX30 will behave under the new tariffs.

The first position changes happened in the 6th position, with the Skoda Enyaq climbing one position at the cost of the Volvo XC60 PHEV.

Still on the topic of the top 10, VW’s best sellers had their own little fight, with the ID.4 surpassing the ID.3 and climbing to 8th. It is good that the crossover is recovering lost time, but the #3 spot of the German model, won in 2022 and 2023, seems already out of reach.

The BMW iX1 joined the top half of the table, relegating the Volvo EX/XC40 to #11. The Belgian-made Volvo is now being outsold and outclassed by its EX30 sibling, so one wonders what will become of it. Will Volvo refresh it in order to revive the nameplate, or will it let fade away into oblivion by next year?

Elsewhere, the remaining position changes happened in the second half of the table. The BMW i4 followed in the iX1’s footsteps and also climbed one place, in this case to 11th, with the liftback midsizer now looking to gain a position in the top half of the table. The busy bee Ford Kuga PHEV is again on the way up, having jumped to #14 in July and surpassing the Mercedes GLC PHEV on the way. It thus became the new #2 in the PHEV category. But with the leader Volvo XC60 PHEV more than 8,000 units ahead, there’s not expected to be any position change between these two.

Finally, the Hyundai Kona EV surpassed the Fiat 500e and is now the new #19 in the table.

Times are hard for Stellantis, as both the #13 Peugeot e-208 EV and #20 Fiat 500e lost positions in July, and we could even see the little Italian slide down from the top 20 next month, as the #21 Cupra Born is getting closer by the day.

As for the plugin auto brand ranking, Tesla had its expected first-month-of-quarter slump (10.8% in July vs. 11.4% in June). Although, looking at YoY sales, deliveries were down by 16%, so it’s clear Tesla’s dominance isn’t as solid as in the past. It should have enough to win the 2024 title, but looking at 2025, the US make should have a harder time renewing its title.

Meanwhile, #2 BMW has gained share compared to June, going from 9.9% to 10.1% share. Although it shouldn’t be enough to go after Tesla, the Bavarian advantage over #3 Mercedes should be enough to earn it the silver medal, would would be its 3rd in a row.

#4 Volvo (8.6%) remained stable, because while the EX30 is gaining share for the brand, the EX/XC40 sales slide is dragging down the EX30’s good work.

Finally, a rising #5 Volkswagen (6.7%, up from 6.5% in June) has distanced itself from #6 Audi (6.5%), which only has the Q4 e-tron pulling the brand forward.

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), expect it to do everything in its power to push sales up and reach the 3rd position. The only problem it has is that Mercedes and Volvo are also going strong….

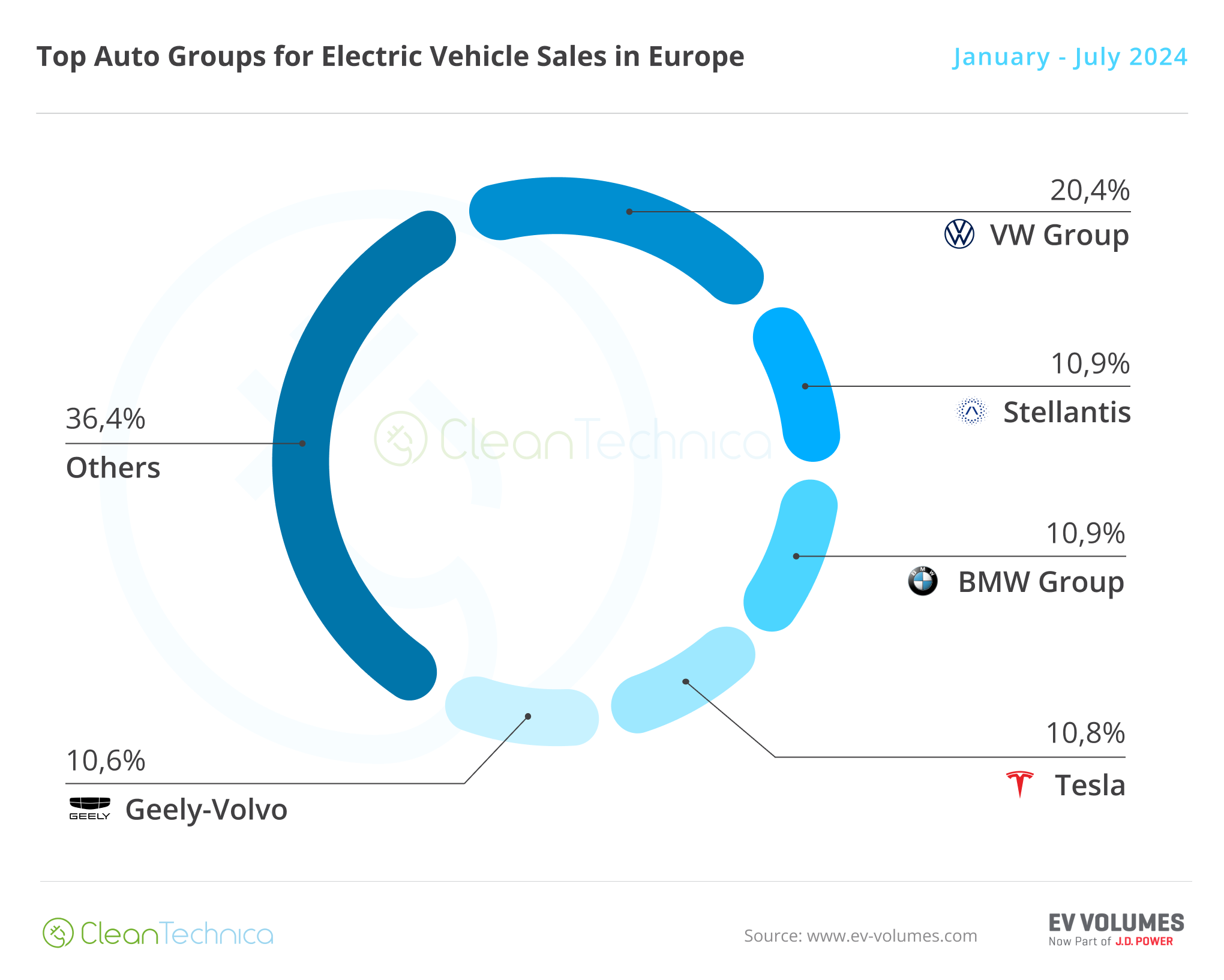

Arranging things by automotive group, Volkswagen Group benefitted from good performances from several members of its brand lineup. It thus rose to 20.4% share and the German OEM is keeping a comfortable lead over the competition.

The previous runner-up, Tesla, has dropped two positions, due to the expected slow month, being surpassed by both Stellantis and BMW Group. But these last OEMs are in a very different place. While Stellantis had another horrible month, dropping 0.3% in share in July to 10.9% (with Tesla expected to surpass it again in September, if not in August already), BMW Group (10.9%, up from 10.7%) is banking on the success of the iX1 and i4, with the recent i5 providing an extra dose of volume that allows the German OEM to look forward to winning more share in the remainder of the year, and possibly even surpass Tesla in the race for the runner-up position.

Geely–Volvo (10.6%) is stable in 5th, while Mercedes-Benz Group (9.1%) is in a distant 6th position.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy