Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

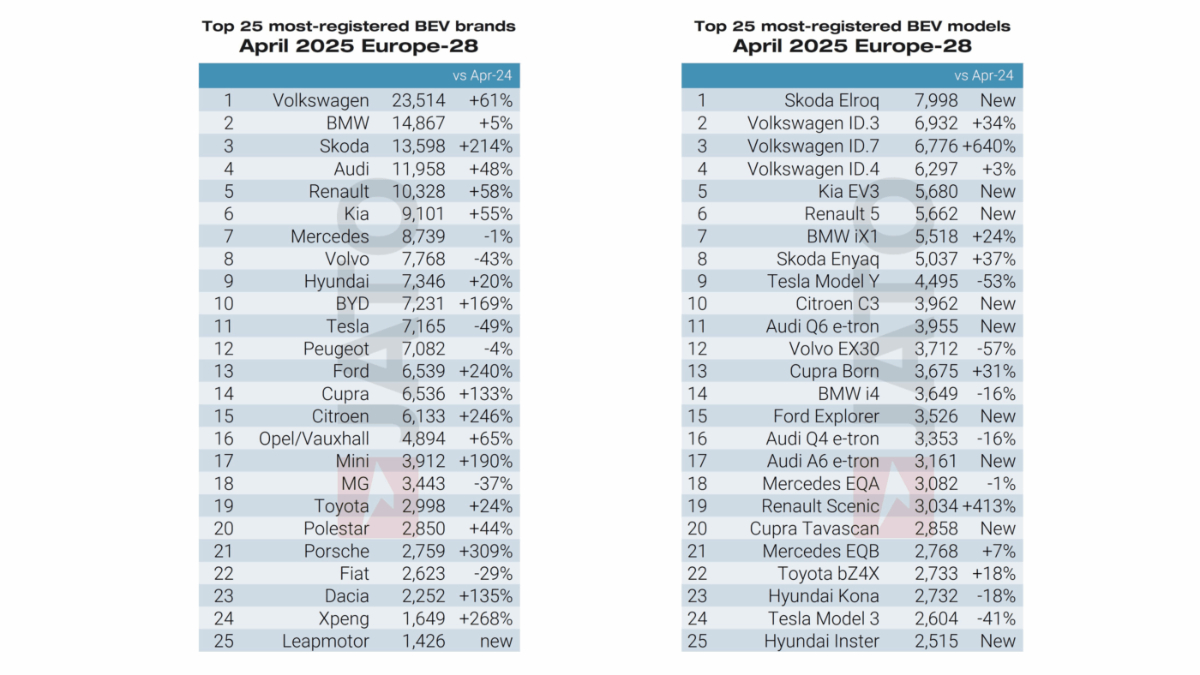

According to market research firm JATO Dynamics, BYD sold more electric vehicles in EU countries in April than Tesla — 7231 to 7165. Admittedly, that is not a huge difference, but as Felipe Muñoz, global auto industry analyst for JATO, said after the numbers were released, “Although the difference between the two brands’ monthly sales totals may be small, the implications are enormous. This is a watershed moment for Europe’s car market, particularly when you consider that Tesla has led the European BEV market for years, while BYD only officially began operations beyond Norway and the Netherlands in late 2022.”

Some readers will quibble that BYD sells both battery electric and plug-in hybrid vehicles, and that is a valid point. However, BYD sold over 1 million vehicles in total in the first quarter of this year, of which 416,000 were battery electrics. Tesla only managed to sell 337,000 electric cars during the same period, making BYD the global leader in BEV sales.

JATO Dynamics reports that new registrations for Tesla in the EU were down 49 percent in April while BYD new registrations in Europe were up 359 percent in the same period. Much of that increase can be attributed to the wide ranging variety of models, both electric and PHEV, that BYD offers to its customers, but growth in its battery electric vehicles alone reached 159 percent. JATO says, “BYD’s rapid expansion has already pushed it ahead of established European car brands. It is outselling Fiat, Dacia, and Seat in the UK; Fiat and Seat in France; Seat in Italy; and Fiat in Spain. This growth comes even before production begins at its new plant in Hungary.”

And as we learned recently, a BYD factory is planned in Turkey as well. The cars produced in Hungary and Turkey will avoid the import tariffs on Chinese made cars imposed by the EU last year, and that will make BYD products even more competitive on the Continent. Here is the April 2025 sales report for the EU from JATO Dynamics:

Overall, 17 percent of all new registrations in the EU in April 2025 were fully electric, compared to 13.4 percent in April 2024. Plug-in hybrids also increased, from 6.9 percent to 9 percent, which brings the percentage of cars with a plug sold in the EU last month to 26 percent, according to a report by Electrive. Plug-in hybrid cars are subject to much lower import restrictions, which has led some Chinese automakers to prioritize PHEV models over battery electric models.

Northvolt Suspends Operations At Main Battery Factory

While the electric car news from the EU shows sales are up noticeably compared to a year ago, one supplier is not doing well. Sweden’s Northvolt went into bankruptcy last year. It was trying to keep its core business going so it could retain some of its workers and pay creditors while it worked to restructure its debt, but now Reuters reports the company is discontinuing production at its main factory in Skellefteå, Sweden, entirely. That factory has been manufacturing battery cells for just one customer — truck manufacturer Scania. The final day of production is scheduled to take place on June 30, at which time the 900 people still working at that factory will be out of a job.

Mikael Kubu, the trustee in bankruptcy, has announced that the search for a buyer for the factory, known as Northvolt Ett, is ongoing, but there are no prospects on the horizon who could actually take over production in the near future. A spokesperson for Scania told Swedish news channel SVT, “Unfortunately, this is no longer financially viable for Scania,” which loosely translated means the battery cells being made by Northvolt Ett had become too expensive during the course of the bankruptcy proceedings.

The spokesperson did not want to say so directly, but the import of his remarks was that Scania would look to CATL to supply it with battery cells going forward. “Today Northvolt and the bankruptcy trustee are announcing that they are discontinuing production. Then we shouldn’t be standing here talking about other suppliers.” Nevertheless, there are no other battery suppliers in Europe who could fill the void left by the closure of Northvolt Ett.

Volkswagen Group is the parent company of Scania and is also a major shareholder in Northvolt. It is building its own battery cell factories in Salzgitter, Germany; Sagunto, Spain; and St. Thomas, Canada under the name of PowerCo. None of those factories is in a position to replace the supply of battery cells from Northvolt, according to Electrive. which reports that the fate of a Northvolt factory in Heide, Germany, is far from clear at this point.

According to German TV station NDR, site preparation work, including the installation of power lines, is continuing but there is no actual construction for the factory building itself taking place. Northvolt Germany is a separate company and according to a spokesperson, the proceedings in Sweden should have no impact on the planned factory in Heide. However, Electrive says, it is unlikely that factory could be viable without a fresh infusion of capital by a new investor or investors. No one seems to be rushing forward to invest, so far as anyone knows.

German taxpayers have already put up €600 million for the Northvolt project in Heide. Now the issue has become politically explosive. The German Federal Audit Office is now investigating the situation and a committee of inquiry may be convened in the state parliament of Schleswig-Holstein where Heide is located.

The troubles for Northvolt began almost as soon as the company began operations, but the first the world at large knew of its difficulties was when BMW pulled out of a deal worth billions of euros that would have provided Northvolt battery cells for its Neue Klasse electric cars. The situation may also have serious repercussions for future Porsche and Audi electric models that are well along in the development process, such as the battery electric versions of the Porsche Boxster and Cayman.

Porsche placed all its bets on Northvolt for the batteries for those cars because they have less room for battery packs than a sedan or SUV. Northvolt promised its cells would have a higher energy density, which would allow Porsche to use fewer of them to power those models.

What the ultimate fate of Northvolt may be is hard to predict at this time, but if you said it may just quietly disappear from public view, you are probably not far wrong. RIP, Northvolt.

Whether you have solar power or not, please complete our latest solar power survey.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy