Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Another day, another review of a major hydrogen for energy report which doesn’t stand up to the slightest scrutiny. Unfortunately, this one is from the EU’s Joint Research Centre (JRC), its science and knowledge service which employs scientists to carry out research in order to provide independent scientific advice and support to European Union policy.

Policymakers who read the splash page or policy brief would be left with the impression that green hydrogen could be manufactured and piped from Ukraine or northern Africa for a combined cost per kilogram of perhaps €3. A close read, the use of realistic assumptions, and comparisons to much more credible reports makes it clear that industrial hydrogen delivery would cost closer to €8 / kg before taxes or profits and transportation hydrogen would cost around €14 / kg before taxes or profits. The report’s summaries present only the rosiest portions of a study which intentionally reduced primary cost assumptions to arrive at cheap imported hydrogen.

This report was a deep disservice to policy discussions in Europe and clearly not aligned with the JRC’s mission.

How Does The JRC Compare To Other Research Organizations With Bad Hydrogen Studies?

The JRC is not an organization like DNV, where the European pipeline operator association can pay them off to produce a terrible report showing that green hydrogen manufactured offshore and piped into the industrial sectors of Europe would be the cheapest way to get hydrogen, a report I tore apart a few months ago.

It’s not the Rocky Mountain Institute, which while historically very influential and does good work today, does not peer review its publications and is not a governmental institution with expectations of the highest quality and discipline. I recently published a broad assessment of that organization’s recent failures on hydrogen for energy vectors, finding assumption after assumption that was not supportable by empirical reality. RMI, while influential, isn’t an arm of government or an academic organization.

It’s not the International Council on Clean Transportation, an organization founded to figure out what would work and what wouldn’t, but which became pot-committed to hydrogen for transportation in the past few years and warped reality to try to make the economics work when they don’t, committing obvious error after error. I started looking at them due to an obviously fatally flawed trucking total cost of ownership report which they’ve subsequently quietly completely changed. Then I looked and published on their equally flawed and error filled publications on maritime shipping and aviation. That organization is an NGO funded by well meaning and rich donors in the USA and also doesn’t do external peer review. And it’s not providing direct policy guidance to the US Congress.

The JRC is much more like the PIK Potsdam Institute for Climate Impact Research, which was funded decades ago by two levels of German government to figure out what was going on and what to do about it, has about 400 staff, maintains two major models, REMIND and LIME-EU, which it and others use to model alternatives for energy and decarbonization in Europe, and publishes peer-reviewed material in good journals. Unfortunately, their most recent publication managed to get through all of the quality filters with glaring errors in the underlying assumptions. LIMES-EU has €1.67 per kilogram green hydrogen end consumer prices for energy generators baked in. REMIND has €2 per kilogram green hydrogen end consumer prices for industry and €3.50 for transportation and business end use cases.

These are empirically and theoretically unsupportable prices. There is no way for end consumer prices of hydrogen to be that low after manufacturing, storage, compression / liquification, distribution, pumping, and profits along the value chain. Assumptions claimed by the paper of 75% of average EU industrial prices for electricity alone would have resulted in €8.80 per kilogram just for electricity costs, with nothing else included. I published my assessment of that study recently as well and have recommended that PIK fix the underlying hydrogen cost numbers, rerun the model, and retract the recent report. Further, this calls into question the quality of all recent PIK publications which depend on LIMES-EU and REMIND model outputs and compare hydrogen to other energy pathways.

After publication of the PIK study assessment, a Swedish researcher whose study on total cost of ownership of European road freight trucking decarbonization I’m assisting with, asked my opinion of the JRC’s 2022 publication, Assessment of hydrogen delivery options. I dug through that this morning, and I’m deeply dismayed at what I found in the underpinnings. This study is as problematic as the PIK’s, and both are governmentally funded, independent, academically rigorous research organizations whose output is treated as authoritative gold in Europe.

What Was The JRC Study About?

Let’s frame the study.

To implement the European Hydrogen Strategy it is important to understand whether the transport of hydrogen is cost effective, or whether hydrogen should be produced where it is used. If transporting hydrogen makes sense, a second open question is how long the transport route should be for the cost of the hydrogen to still be competitive with locally produced hydrogen.

So far, so good. The first question is a good one. Can green hydrogen be made in northern Africa or Ukraine and be transported to western Europe economically? And then, if so, which transportation pathways are most economical?

If the report had answered the first question honestly, I wouldn’t be writing this assessment. Unfortunately, the authors cooked the books to arrive at cheap delivered hydrogen. Having reviewed their academic and professional backgrounds, I can see no way in which they didn’t know that they were creating deeply unrealistic results. Why they did so is unclear to me as I don’t know them and I don’t know the JRC, so it’s entirely possible that they were highly pressured to get positive results for delivery of hydrogen, and so changed underlying assumptions until the end price points were adequate. Or it’s possible that, like the ICCT researchers, they fell into a bubble of internal bias echoing until they really believed what they professionally are qualified to know is nonsense seemed realistic.

I make no judgements except that the final report is fatally flawed and that no policies or strategies should be based on it.

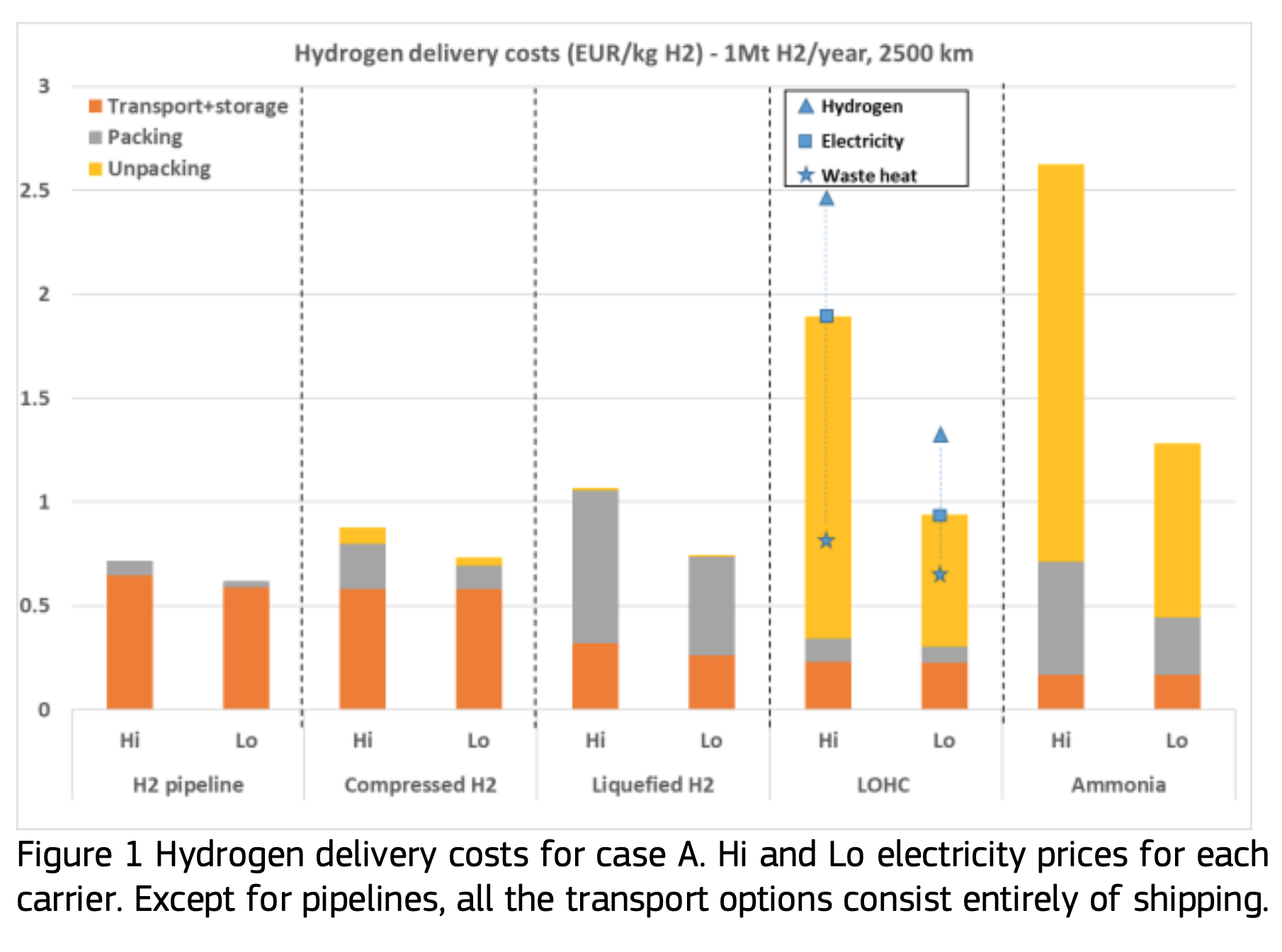

So, what did the authors do right? First, they did create a cost model for two major scenarios and four major delivery options. Scenario A was delivery of hydrogen by transmission pipeline or ship 2,500 kilometers to major industrial consumers. Scenario B was to take the hydrogen from the end of the pipeline and to distribute it to 270 hydrogen refueling stations across Europe.

They created low and high costs scenarios and the summary was where my radar started sending off alarms.

(1) Low price (Lo), with a production site electricity cost of EUR 10/MWh and a consumption site electricity cost of EUR 50/MWh; (2) High price (Hi), with a production site electricity cost of EUR 50/MWh and a consumption site electricity cost of EUR 130/MWh. For case A (industrial use of hydrogen), waste heat at 300°C is also assumed to be available, at a cost of EUR 20/MWh. […]

For Lo the estimated hydrogen cost is EUR 1.5/kg H2, while in Hi it is EUR 3.5/kg H2

The low price scenario assumes electricity will be available for €0.01 per kWh from renewables in Africa or Ukraine and European consumers will get industrial rates of electricity at €0.05 per kW. Neither of these numbers is remotely credible. The high cost numbers for hydrogen production in remote areas of €0.05 per kW is a credible number, but the €0.13 per kW is again not credible. The average price of industrial electricity in Europe is €0.21 to €0.24, as I found when looking at the ICCT material in late 2023.

The researchers assert that they are using Germany’s industrial electricity rates, but Statista makes clear that Germany hasn’t had rates that low since 2010. In other words, even the high price scenario is making unsupportable cost claims, and the low price scenario is assuming that the laws of physics and economics no longer apply.

A book I’ve been recommending is Escape from Model Land: How Mathematical Models Can Lead Us Astray and What We Can Do About It by Erica Thomson. These results smell like a pattern Thomson describes, “We have to achieve this price point, so what unrealistic assumptions are required in the model to deliver that” without intervention of human judgement about realistic results. This is different than what appears to be the case with the PIK researchers, where reverence of a trusted model precluded skepticism of validation of results, again a failure of human judgement and professionalism.

But that was only the summary and one clear indicator of a problem. The meat of the problems surfaces in the detailed report and its assumptions.

Hydrogen Will Be Much More Expensive To Manufacture Than JRC Asserts

Let’s pull apart the assumptions underlying the study, all from the long report which most policymakers will not read and even fewer have the competence to judge.

The electrolysers are assumed to be operating at 35% capacity

That’s realistic in a remote area where wind or solar dedicated to hydrogen generation are constructed, but they assert that they are going to be running alkaline electrolyzers like that, when alkaline electrolyzers just don’t turn off and on easily or well. Even PEM electrolyzers are finding it very difficult to deal with intermittency in the real world as opposed to Model Land.

They take the cheaper alkaline and more expensive PEM electrolyzers and average the cost of manufacturing, even though their assumptions preclude the use of alkaline electrolyzers. That’s another thumb on the scale of low costs. Given the long background of the study authors in hydrogen, this is hard to ascribe to a simple mistake.

Then the real meat starts to arrive in Annex 2 p 101 of the long report. They assert electrolyzer costs for PEM at €500 per kW of electrolyzer capacity when 2024 costs are US$800 per kW per per the International Energy Agency’s recent e-fuels report. Alkaline is at €400 which is close enough to the IEA’s US$400. So once again, much cheaper electrolyzers of the specific type actually required for the intermittency. They assert that these are 2030 prices and so are asserting almost 40% cost takeout in only eight years on a product which has been manufactured for decades.

Artificially cheap electrolyzers is another thumb on the scale for hydrogen.

But there’s no balance of plant. Historically, I have tended to use 1:1 for electrolyzer and balance of plant components for water management, dehumidification, purification, and the like, for example in my cost work-up of the abandoned Norwegian Equinor-Air Liquide liquid hydrogen shipping fuel plant. Paul Martin, a professional chemical engineer who has worked with hydrogen for decades, a designer of modular chemical engineering plants and a co-founder of the Hydrogen Science Coalition has historically used 1:1 costs as well.

As electrolyzers have dropped in price, balance of plant has not and won’t. The other 27 or so components in an industrial hydrogen manufacturing facility are commoditized industrial units that are already at the flat bottom of the experience curve sigmoid. As a result, the recent IEA report puts PEM at $2,000 with balance of plant and alkaline at $1,700 with balance of plant. This is three to four times more capital expenditure than the JRC report assumes, and that capital expenditure must be amortized across every kilogram of hydrogen.

A utilization factor of 35% for $2,000 per kW balance of plant for the required PEM electrolysis means that they are understating capital costs per kg by more than a factor of four.

Further, they assert an amortization period of 20 years. However, electrolyzers only last a decade before requiring replacement, so this amortization period is unsupportable in reality. That’s another factor of two reduction on the capital costs side per kilogram of hydrogen. I used the 10-year figure in my assessment of an absolute best case hydrogen manufacturing opportunity, in Quebec in Canada using their low industrial rates for power and demand with 95% utilization and alkaline electrolyzers to arrive at hydrogen numbers that would permit economically viable manufacturing of green ammonia for fertilizer. Even that required kicking cryptocurrency miners off of the grid to free up their power demand, as new electricity supplies are double the cost of existing supply.

And then there are their assumptions in Annex 2 on p 102 about compressors. They are asserting capex of €170 to 250 million for case A for compressors and maintenance costs of €1,900 to 2,700 thousand for annual maintenance. That’s 1% of capex for annual maintenance of the compressors. For Case B, the numbers are €17 to 25 million capex and €200 to 280 maintenance, again a ratio of 1%.

However, compressors are the single leading failing components in hydrogen energy pathways. As part of the Swedish study I’m assisting with, I looked at the maintenance history of California’s hydrogen refueling stations. I took the last six months of the six years, post-COVID, when utilization was highest, after lemons would have been removed and when maintenance would be expected to be optimized.

The statistics showed that maintenance costs were 30% of capex annually if extrapolated to target kilograms per day, that hydrogen refueling stations were being fixed 20% more hours than they were actually pumping hydrogen, and that compressors were the cause of over 50% of all maintenance issues. I published my assessment of this a few weeks ago, but the data was available before the JRC report was published.

Further, discussions with a professional who has been engaged in both compressed natural gas and hydrogen ventures confirmed that compressor failures are the biggest problem across the space. This 2016 US National Renewable Energy Lab study found a mean time between failures of only 49 days for a 400 bar compressor.

Total cost of ownership assessments for hydrogen refueling stations have tended to use unrealistically low 3% to 4% of capex as the maintenance cost per year for the stations and compressors are the dominant source of failure. A professional contact shared with me that a credible refueling vendor for 350 bar refueling systems told him to use 10% of capex as the annual cost in business cases, a major reason why he didn’t proceed with hydrogen vehicles for the application in question.

There is zero empirical evidence which supports a 1% of capex maintenance rate. At minimum, a 10% of capex for maintenance annual cost is defensible and only just. This is an order of magnitude out in terms of low-balling costs.

And once again, the researchers working on this study were long term hydrogen professionals and in one case had been responsible in the past for operation, maintenance and evaluation of hydrogen production, storage and end-use systems. It is inconceivable that they thought 1% of capex for maintenance was a credible number.

With the 10% of capex maintenance figures to replace especially seals, the compressors are expected to have 20-year life spans as the JRC study assumes, but it’s unclear if this is an empirically supportable number. It is more supportable than compressors, so I’ll consider it at least defensible, unlike the other assumptions.

Are they referencing external data and studies which support these very, very low cost choices? No, the tables are rife with “Own assumption,” “Own calculation,” or no comments or sources at all.

A much more realistic hydrogen manufacturing and transportation study was performed in 2022, Determining the Production and Transport Cost for H2 on a Global Scale, by researchers at Technische Universität Berlin, Berlin, Germany. What did they conclude for northern Africa production costs?

The production cost ranges from 6.7—11.4 €/kg H2 (average standard deviation 0.37 €/kg H2), with the lowest cost areas being northern Africa and the Middle East (7.0—7.5 €/kg)

Note the ranges and error assertions, things completely missing from the JRC study which makes it appear that dirt cheap hydrogen is guaranteed.

When I asserted at the beginning of this piece that the authors of the study cooked the books, it’s clearly apparent from both the deeply unrealistic results, but also the clear low-balling of cost point after cost point when industry data and professional experience should have made it obvious that the results and costs were unsupportable.

This is clearly a case where the researchers or their organization needed to arrive at a specific price point for delivered hydrogen, created what appears to be an almost complete and useful model, and then adjusted assumed costs downward time after time until they arrived at what they felt were acceptable costs.

There is no world in which green hydrogen will cost €1.5 /kg H2 to manufacture. The €3.5/kg H2 is not supportable either, as to get costs down to this level with 35% utilization they had to eliminate balance of plant, make PEM electrolyzers much less expensive, average the cost across alkaline electrolyzers which could not be used, amortize the electrolyzers over double their lifespan, and then slash compressor annual maintenance costs by a factor of ten.

Transportation Costs Are Much Lower Than IEA & DOE Studies

Is there anything else? Yes, to make any of this work they had to assume that salt caverns could be constructed both at the point of manufacturing the hydrogen and at the end of the pipeline in Europe. They admit that this might not be actually possible given the basics of geography where massive salt deposits aren’t uniformly distributed, but they once again made the cheapest possible choice for hydrogen and used that in all of their end results.

For trucks, they assumed 500 bar compression, double the normal US limit of liquid hydrogen. Exceptions are permitted at up to 500 bar, but not as the standard for all trucks. But even at these levels, the US DOE finds that trucking either liquid or compressed hydrogen is very expensive.

For liquid tanker-based stations, delivery costs are calculated to be approximately $11/kg at 450 kg/day and projected to be roughly $8/kg at 1,000 kg/day stations. For tube-trailer gaseous stations, delivery costs are projected to be $9.50/kg and $8/kg at 450 kg/day and 1,000 kg/day stations, respectively (2016$)

At no point anywhere in the JRC report did the authors spell out the cost of trucking hydrogen to hydrogen refueling stations in €/kg delivered, one of the key transport scenarios in the study. This might be an oversight, but given the massive thumbs on the scales for hydrogen discovered so far, it might very well have been intentionally removed or never added because it would call into question the entire premise of the study.

Their pipeline assumptions are questionable as well.

For newly built pipelines, depending on size and the scenario considered, they range from 1.4 to 3.4 M€/km. If natural gas pipelines are repurposed, the costs can drop down to between 0.2 and 0.6 M€/km

This doesn’t align with recent German studies that show that while natural gas pipelines can be repurposed, they must be run at considerably lower pressures and volumes to avoid issues. Paul Martin called that out in an assessment which showed clearly that the report’s summaries were equally cooked to show very positive results.

And the pipelines results don’t align with IEA studies on pipeline costs, something the JCR researchers said themselves.

The [IEA] cost for hydrogen distribution by pipeline was given as USD 2 / kg H2 for a distance of 3 000 km, which is far higher than the costs assumed in our study (< EUR 1/kg H2, see Figure 8).

In fact, their reference price for delivering hydrogen via pipeline was as low as €0.55 per kg, well under a third of the IEA’s calculations. Instead of leaning into this, they explain it away with expected lower costs of things in 2030 and the assertion that unstated low technology readiness level products would come along. A few thousand kilometers of hydrogen pipelines exist, the physics are well understood and the technologies in use aren’t going to leap into the future. This is an unsupportable assertion as well.

This is part of where the compressor maintenance problems come in, as hydrogen pipelines require a lot of them running at much higher pressures than natural gas pipelines 24/7/365. As a reminder, the DOE found that hydrogen compressors fail every 49 days on average.

Given how the study made assumption after assumption in favor of hydrogen, it’s unsurprising that they find that their delivery cost assumptions are radically lower as well.

Back to the other German report from 2022. What does it say for the cost of hydrogen pipelines with realistic assumptions?

the pipeline cost of 1.4/kg H2 to transport H2 from Sharm El-Sheikh to Cologne

Yes, the study found 2.5 times higher costs for pipelines from northern Africa than the JRC study did.

What would the reality of hydrogen manufactured in Africa for delivery by pipeline to Europe be? Optimizing production could bring the price point down to €5 / kg. The IEA and other study pipeline numbers are much more credible than the JRC numbers, so another €1.50 / kg would be required for transmission.

The study also does not provide any costs of transportation of hydrogen by distribution pipeline, just transmission pipeline costs. At the end of the transmission pipeline there’s a massive salt cavern and hydrogen has to be compressed into it. Then it has to be extracted and compressed to the right level for distribution and fed into what would be a set of much smaller pipelines. The study is silent on the cost of this process in any €/kg model. Let’s be generous and assume another €1 / kg.

That would put the more realistic cost of hydrogen delivered to industrial facilities at €7.50 / kg without any profits or cost of capital or in the price range that Boston Consulting Group believes that green hydrogen might be manufactured in Europe with green PPAs that respect additionality, locality, and temporality requirements. If delivered to truck stops, it would cost in the order of €14 / MWh before profits.

This compares to the second German study’s price point of €8.4 /kg for hydrogen transmitted — but not distributed, taxed or profited off — to Cologne.

For liquid organic hydrogen carriers, a contender for longer distance shipping, they also make a startling assumption. To make the cost case work, they assume:

For Case A (industrial use of hydrogen), it is assumed that in the delivery site there is the option to source waste heat at 300°C, since in this type of industrial setting waste heat may be available. Information on the cost of waste heat is not readily available, so the price was set to a value considerably lower than that of heat provided by NG, at a price of EUR 20/MWh.

For those unfamiliar with LOHCs, they release significant heat energy in their manufacturing and require it in extraction of the hydrogen, roughly a third of the energy as in the hydrogen or in the same range as liquification. That heat must be provided and the study did not assume electricity as the source, which will be more expensive than natural gas, but that they would be able to get heat very cheaply at the end.

Yes, they assume 300° C waste heat will be available, that there will be no other economic uses for it and that they’ll be able to get it really, really cheaply, because that’s the assumption that is required to arrive at the per kg hydrogen price point they need for any of this to make sense. That’s not a supportable assumption.

Even so, their unrealistically low number for shipping hydrogen in LOHC form, only €3 per kg, wasn’t the cheapest option and so was ruled out.. As with all of their results, their cost point is just not believable.

For liquified hydrogen, the purported winner of the shipping model for transportation of hydrogen, they make more startling assumptions.

While ideal liquefaction work is below 14.4 MJ/kg H2 [54], the energy requirement of current liquefaction plants is in the order of 36-43 MJ/kg H2 [55]. It is expected that with larger scale plants (>50 tonnes/day), the power requirements could be reduced by up to 50% (18-22 MJ/kg H2) [55]

The world has been liquifying hydrogen for decades for space programs and multiple industrial use cases. Assuming that the energy costs to liquify hydrogen down to a cyrofluid at 20° above absolute zero would drop by 50% by 2030, the timeframe stated in the underlying long report but neither of the two summaries, is a fantastical notion and an unsupportable assumption.

With more realistic but still frankly optimistic assumptions, I worked up a cost case for liquid hydrogen shipping from Namibia in 2022 and found that the most likely cost per unit of energy delivered of liquid hydrogen via shipping would be ten times that of liquid natural gas, the most expensive currently imported form of energy economies use today. That’s the reality of importing liquid hydrogen.

What would a policymaker who read the policy brief assume? That for distance of 10,000 km, it would be possible for end consumers to purchase hydrogen delivered via liquid hydrogen shipping for perhaps €4.50 / kg, assuming that they added up the numbers. As with pipelines, the reality is much higher.

I also did the cost workup for importing ammonia as an energy carrier recently and once again, real costs would be much higher than JRC’s very optimistic ones. Per the analysis for Japan’s intended use to displace coal in thermal generation units, the absolute best possible case scenario with the cheapest possible real world hydrogen would be nine times the cost per kWh of imported coal.

To be clear, in my assessments I am continually giving hydrogen benefits of the doubt as an energy carrier and finding very high costs. For JRC’s report to get under the absolute best case scenarios I’ve worked up, they have to be inventing deeply unrealistic numbers across multiple solution sets.

What Would Policymakers Take Away From The JRC report?

As always, hydrogen can be green but it can’t be cheap, but what would people actually take away from this report?

If they only read the splash page, as most would, they would see zero numbers and clear assertions that transporting hydrogen long distances would be economically viable. This is not good policy guidance.

For distances compatible with the European territory, compressed and liquefied hydrogen solutions, and especially compressed hydrogen pipelines, offer lower costs than chemical carriers do. The repurposing of existing natural gas pipelines for hydrogen use is expected to significantly lower the delivery cost, making the pipeline option even more competitive in the future.

If they only read the Science for Policy Brief, which would be all the vast majority of policymakers would do, they would see some very low numbers in text and in a graph.

For Lo the estimated hydrogen cost is EUR 1.5/kg H2, while in Hi it is EUR 3.5/kg H2.

Most would be left assuming that the low price of around €2 / kg is likely and most would likely think the combined price would be somewhere in the middle, around €3 / kg. Most would be left with the assumption that this was the cost to get hydrogen to end consumers.

Virtually no policymakers will ever look at the long report and its tables and tables of assumptions or have the competence to assess the quality of those assumptions.

The study first radically diminishes the costs of both manufacturing and shipping hydrogen using assumptions with large error bars, presents numbers that are well below realistic numbers without any error bars, then doesn’t tell policymakers that the numbers are incredibly weak based on absurdly optimistic assumptions and disagree completely with publicly available data including the IEA, the US DOE and other credible peer reviewed studies.

The two summaries clearly make it appear as if cheap hydrogen imports from thousands of kilometers away is economically viable. That’s the fundamental message policy makers would be left with.

Let’s Finish On A Funny Note

There was one thing that didn’t depress me about this fatally flawed study. On page 30 of the long report regarding delivering hydrogen by modes other than pipeline they say:

Biodiesel is the fuel choice for ships, diesel trains, and trucks.

They are going to deliver green hydrogen 2,500 km to 270 hydrogen refueling stations to put in heavy goods vehicles because it’s required, but the entire supply chain for delivering it will be biodiesel because that’s a cheap, low cost, low-GHG option. The cognitive dissonance as they wrote this must have split their skulls.

When I read that it was five minutes before I could bring myself to continue my assessment. They literally know and asserted the real answer for transportation that can’t directly electrify, used it in their assumptions, and then pretended it wasn’t relevant to the findings of the report.

Similarly, throughout the report they use electricity for compression, heating, transportation, and everything else, but assert that hydrogen is required for energy in the EU. It’s painful to read, for the most part.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.