My estimation of global official gold reserves hit 38,764 tonnes in Q2 2023, breaking its previous record from 1965. The new high confirms the world has entered a new era of gold. Central banks will continue to accumulate gold and the metal’s role in the international monetary system will increase to the detriment of the US dollar.

The new record in world gold reserves reflects a desire by central banks the world over to diversify away from the US dollar with its ever more evident counterparty risks.

Analysts widely use the International Monetary Fund (IMF) calculation for total official gold holdings, though what is usually overlooked is that this number is an estimate by the Fund. As mentioned in my previous article on the official gold reserves of China, not every central bank is transparent about its gold holdings. The Chinese central bank (PBoC) reports to have 2,113 tonnes, while it’s an open secret in the gold industry the PBoC owns much more than that—about 5,000 tonnes, according to my analysis. Another example, the central bank of Syria stopped reporting its gold holdings in 2011. For its computation of world holdings, the IMF carries forward the last known data point, assuming Syria still holds 26 tonnes.

My personal evaluation of global official gold reserves is largely based on how the IMF compiles its world series, the main difference being “unreported purchases” traced by industry insiders that I include in my data. My approach:

- The base consists of the the last registered volumes from all central banks and monetary authorities, also of the ones that stopped reporting years ago.

- For China I use my own numbers going back to 1995.

- Unreported purchases by central banks other than the PBoC are added, measured by the difference between the World Gold Council’s estimated total purchases based on field research and reported changes by all central banks combined.

- Known reserves by sovereign wealth funds are included*.

- Gold owned by international financial intuitions such as the European Central Bank and West African Economic and Monetary Union is also added.

- Swaps on the balance sheets of the Turkish central bank and Bank for International Settlements (BIS) are subtracted.

Based on my methodology, world official gold holdings reached 38,764 tonnes in June 2023, which is approximately 400 tonnes more than the prior high set in 1965 at 38,347 tonnes.

The new record reflects a desire by central banks the world over to diversify away from the US dollar with its ever more evident counterparty risks. Central banks’ turning point in gold holdings came just after the Great Financial Crisis of 2008, since when they have bought more than 7,000 tonnes.

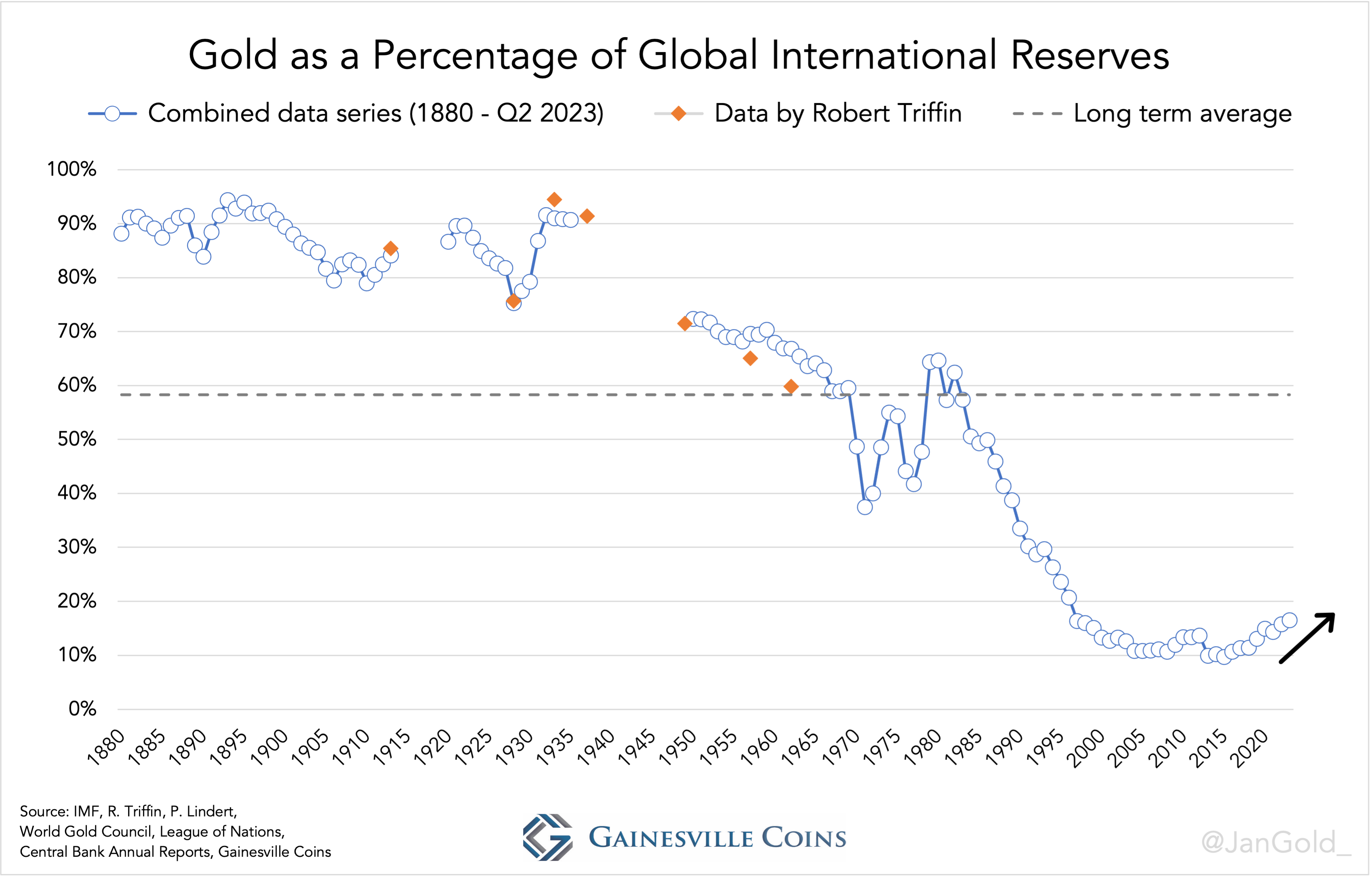

The value of global gold reserves grew by 66% from that moment, while foreign exchange reserves have swelled by 30%. As a result, gold’s share of global international reserves (gold and foreign exchange) is rising from an all-time low in 2015.

There is plenty of upside for the gold price if gold’s share of total reserves (currently 17%) should ever come close to its long-term average (58%). In a previous article I speculated gold could reach $8,000 in the next ten years.

In context of increasing geopolitical tensions, a weaponized dollar, and sky-high debt levels across the globe (historically alleviated through inflation), central banks will continue to buy gold in the foreseeable future.

The new record in gold reserves is mostly a symbolic milestone. Any trends I describe haven’t been altered but reconfirmed by the new high.

Foreign central banks mostly own US government bonds (Treasuries) as dollar assets. As their gold reserves are rising, their nominal holdings of Treasuries have been roughly flat in the past decade. So, against massive increases in US public debt every year, the share of foreign central banks owning that debt is steadily decreasing. This dynamic could lead to a funding crisis in the US, further eroding the dollar’s appeal as a reserve currency.

*It’s unknown how the IMF exactly calculates its world series, but I suspect they don’t include gold owned by sovereign wealth funds. My figures include about 100 tonnes for such funds.

Courtesy of gainesvillecoins.com Article originally published here.

********