Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A closer look at the best-selling automotive groups for plugin electric vehicles — part 3 of 4.

This is the third edition of a series looking at the OEMs with the most EV sales. To have a look at the first and second parts, please check them out here and here.

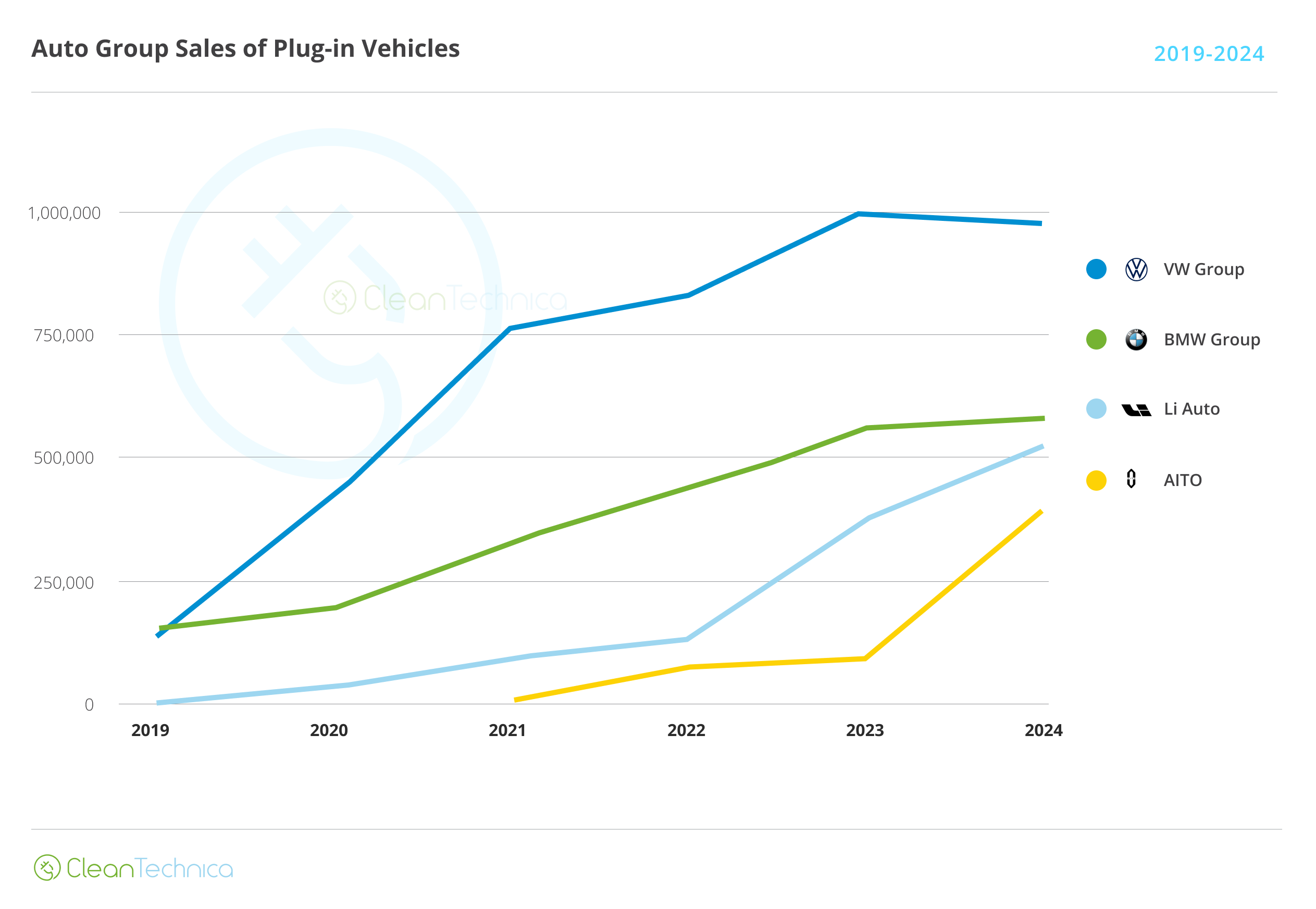

In this third one, we have a look at Volkswagen Group, Li Auto, AITO, and BMW Group.

For more information on these and other OEMs, don’t forget to check out the top selling brands for EV sales in October.

Volkswagen Group

Volkswagen AG, as it is officially known, is a German automotive group based in Wolfsburg, Germany.

It was founded in 1937, but only really started making cars in significant numbers after the end of World War II, in 1945.

It is the second largest automotive group globally, only behind Toyota, with a production output of 9.2 million units in 2023. It is currently the owner of the following passenger car brands:

- Volkswagen — Mainstream brand, with ICE, PHEV and BEV lineups;

- Audi — Premium brand, with ICE, PHEV and BEV lineups;

- Bentley — Luxury brand, with ICE and PHEV models;

- Cupra — Sporty mainstream brand, with ICE, PHEV and BEV lineups;

- Jetta — China-based value-for-money brand, ICE only;

- Lamborghini — High-end sports brand, with ICE and PHEV models;

- Porsche — Sports brand, with ICE, PHEV and BEV lineups;

- Scout — US-based brand, will make BEV and EREV SUVs and pickup Trucks;

- SEAT — Low-cost brand, with ICE and PHEV models;

- Skoda — Value for money brand, with BEV, PHEV and ICE lineups.

Besides this, it also has the motorcycle brand Ducati, the Volkswagen Commercial Vehicles LCV division, and the heavy-duty vehicle Traton subsidiary, which in turn owns truck companies like, MAN, Scania, among others.

On top of this, the German OEM also has three joint ventures in China: FAW-VW, where it has a 40% stake; SAIC-VW (50% stake); and Volkswagen Anhui, with VW having a 75% share in this last JV, and the remaining 25% belonging to JAC.

Finally, it recently bought a 5% stake in the Chinese startup XPeng, and through Porsche, Volkswagen Group also has a 45% stake in the high-end sports company Bugatti Rimac.

Within all these brands, Volkswagen is the best-selling one, representing roughly half of all of the OEM’s EV sales, followed by Audi, with about 26% of those sales, while the remaining is split among all the other makes.

Looking at individual models, the OEM has a balanced lineup, with all of the top sellers coming from the dedicated MEB platform. The VW ID.4 crossover represents 18% of all of the OEM’s EV sales this year, while its hatchback sibling, the VW ID.3, is second, with 16% of sales, followed by the premium-class cousin Audi Q4 e-tron, with 11% of sales. The value-for-money Skoda Enyaq is fourth, with 8% of the group’s EV sales.

When it comes to China, this market represents a significant slice of the OEM’s global EV sales, representing 23% of all of the OEM’s plugin sales. Counting all powertrains, sales in China represent 35% of Volkswagen Group’s total sales. While a 12 percentage point difference in share between overall and EV sales may not seem like much, in the case of a future EV-based Chinese market, that would represent a 1.1 million unit loss for the conglomerate, so it is critical for the German OEM that their sales and production output remain relevant in China.

Much of the future of the OEM is on the line in the largest global automotive market.

Li Auto

This is the most successful of all the China-based EV startups. It is based in Beijing, it was founded in 2015, and it started making vehicles at the end of 2019, with its production output having already surpassed the one-million unit score a few months ago, less than five years after the start of production.

Having started with just one model, called One, the startup hit gold without really presenting groundbreaking technology, but by providing Chinese buyers with what they wanted: Big, comfy SUVs with all the benefits of the EREV technology (long EV range, immediate response of the electric motor), without the setbacks of BEVs (limited range, charging limitations, high price).

After the success of its initial model, the startup replicated its success formula in several sizes: L6 (midsize), L7 & L8 (full-size), and L9 (XXL).

Having seen its sales almost triple in 2023, to some 376,000 units, it was time for the difficult second album.

So, when Li Auto launched the much-hyped Mega MPV, expectations were high, not only because of the previous success, but also due to the specs and design of the startup’s first BEV.

But while the first months were still okay, now it seems that demand for the striking MPV has stabilized at below 1,000 units per month, well below expectations.

Better luck next time?

Back to the current models, it is no surprise that the L7 is responsible for 37% of the Chinese make’s sales, despite only starting sales last April — after all, it is the smallest, and above all, the cheapest of Li Auto’s models. And with all L-line models looking the same, and sharing the same basic specs, there is little incentive to go upmarket, aside from the extra space.

The Chinese brand still has a small exposure to exports, with overseas markets representing just 5% of its plugin sales this year, and its main export market being Russia, where big, comfy SUVs are quite popular.

(And if it wasn’t for the current anti-China sentiment in the USA, I could also see Li Auto succeed there. After all, big comfy SUVs are all the rage in that market. Add an EREV powertrain to it, and success would be all but guaranteed.)

AITO

What do Tesla, Huawei, and Chinese EV startups have in common?

AITO. Intrigued? Let’s go, then, through the interesting and winding story of this company.

Standing for “Adding Intelligence to Auto,” AITO is an EV brand belonging to the Seres Group, a Chinese company that makes cars, commercial vehicles, motorcycles, and automotive components, previously known as Sokon Group.

AITO was founded just three years ago, with the launch of the Aito M5, a vehicle based off of the Seres SF5, the first model of the SF/Seres startup, a USA–China company that had a certain Martin Eberhard in its ranks in its early stages.

While the Seres SF5 failed to meet success, its AITO sibling gained enough volume to remain relevant and expand thanks to an important detail that its Seres twin lacked: Huawei’s involvement.

Effectively, AITO was the first brand of the HIMA Alliance, which is led by the Chinese tech giant Huawei and where the tech company cooperates with established automakers by establishing new EV brands.

As such, in 2021, AITO was launched as the child of Sokon, which had Seres in its ranks, and Huawei. The former provided the hardware (the car/platform) and the latter contributed via product planning, design, marketing, quality control, and software.

This cooperation served as template for the other HIMA brands: Luxeed (Chery), Stelato (BAIC), and Maextro (JAC).

Talking about AITO, with the original Seres startup brand dying, at the end of 2023, AITO recovered its name to become its export-led brand. Although the sales share of exports is still marginal (1%), it is expected to grow in 2025, especially if the brand can replicate Li Auto’s success in Russia. (AITO’s success recipe seems quite close to Li’s — big, comfy SUVs with EREV powertrains.)

With sales tripling in 2024, the future seems bright. This is due to the success of its M7 full size SUV, and especially thanks to the launch of its flagship M9 SUV, which recently became the brand’s best seller.

Looking at the best-selling models, the short lineup is visible. The flagship M9 is the second best-seller, with 39% of AITO’s sales, while the M7 represents half of the startup’s volumes.

BMW Group

Bayerische Motoren Werke AG, also known as BMW, it is one of the most famous automotive brands worldwide. It started its life in 1910, as a plane maker. It wasn’t until 1922 that it changed its name from Bayerische Flugzeugwerke AG to Bayerische Motoren Werke (BMW).

After launching its first motorcycle in 1923, in 1928 the Bavarian make expanded to cars with the BMW 3/15, a rebadged Austin Seven. For a proper BMW, kidney grille and all, we had to wait until 1933, the year that the inline six-cylinder engined BMW 303 was launched.

BMW is headquartered in Munich, Germany, and is known as one of the Three German Premium Mary’s (Audi, BMW, and Mercedes), with the OEM making 2.6 million cars in 2023.

The OEM is made of the namesake brand and a number of sub-brands associated with it, like the sports-based BMW M and the sports-tuned Alpina. On top of this, it also owns the luxury brand Rolls-Royce, the MINI brand, which specializes in small, sporty vehicles, and the BMW Motorrad motorcycle division.

With the BMW brand representing 91% of the EV sales of the group, the OEM’s volume output is basically the same as the namesake brand’s.

BMW has a large lineup of EVs, both BEV and PHEV, which means that the two best-selling models, the i4 liftback and the iX1 crossover, have a low share of the group’s EV sales, with each having 14% of sales. On one hand, this means that it is not dependent on the life cycle of one particular model, but on the other, it means that it lacks a star player on the team.

The Neue Klasse models could change this, of course….

The Chinese EV market has significant weight to the total tally of its EV sales, with that market representing 18% of BMW Group’s PEV sales. Counting all powertrains, China’s sales become more significant (29%).

This sales discrepancy in China (18% of EV sales vs. 29% of overall sales) should be one reason for concern for the German make, because BMW could lose some 11% of its total sales, or close to 300,000 sales, in a PEV-based Chinese market. And that scenario is just a few years away….

Looking at the sales of each OEM, one can immediately see the changing trends in the evolution of these OEMs, with the Chinese startups accelerating their growth in the past two years while the German legacy OEMs seem to have stalled in 2024.

Volkswagen Group seems particularly concerning, because from 2022 onwards, things have slowed down significantly.

Uncoincidentally, 2022 was also the year that Herbert Diess was ousted from the CEO position, after taking the OEM out of the Dieselgate mess and preparing an ambitious electrification strategy. Despite all the faults with that (as an example, the VW ID.3 & ID.4 could have a less vanilla-like design…), the strategy provided a much needed jump in EV sales, which had left it in 2nd place globally in 2021, only behind then all-mighty Tesla.

But no, its plans and warnings were too disruptive for the conservative OEM, and Diess was removed from the CEO position. Now, something similar to what he wanted to do is finally being approved … but in the meantime, three years were lost. Talk about being right ahead of time….

Now, the German OEM is only 4th globally, with half of the market share it had in 2021. These are the consequences of trying to slow down the electrification process.

You might slow down, but the others won’t.

And this narrative of years lost should also apply to Stellantis and the removal of Carlos Tavares from the CEO position. While not without faults, Tavares’ strategy offered a path towards electrification, which will now probably be bogged down by his successor, John Elkann. And in a couple of years from now, when the house is on fire, the Stellantis management will secretly regret the ousting of Tavares, even if they will never admit it in public.

But I digress.

Back to the OEMs’ sales behavior, both Li Auto and AITO had a great 2024. What now? To continue growing, they need more models and need to start exporting in large volumes, something that Li Auto seems a bit more ahead on, with its first electric SUV landing in 2025 and unit deployments in Russia, Central Asia, and the Middle East.

The thing is … apart from Russia, where sales are hitting four digits per month, the other markets do not promise to add significant volumes in the near term, and a full size electric SUV, if successful, will cannibalize sales of its EREV models. So, Li Auto’s sales should slow down significantly in 2025.

It’s essentially the same story for AITO. Yes, they will launch the AITO M8 full size SUV, but with two full size SUVs already in the lineup (M7 & M9), one wonders how many sales will be conquest sales and how many will just be diverted from the older M7 and M9 models. And when it comes to export markets, despite the ambitious targets — 200,000 units in 2027, a presence in 60 markets, etc., etc. — it is difficult to see how they will pull it off when other Chinese makes with a greater presence in export markets are still struggling.

Finally, we get to BMW Group. With slow but steady growth at the end of 2024, the next growth stage will bank on the upcoming Neue Klasse models. With promising attractive designs (which is kind of a new thing, considering the last … uh … controversial designs of the brand) and better specs, the questions are more focused on how soon they will land and how fast the ramp-up will go. The new iX3 is said to land in 2025. But … is that mid-2025? Late 2025? That could be the difference between another stagnating year, like 2024, or a growth year — albeit small — while preparing for a great 2026 with a fully ramped up iX3 and the launching of the new i3 sedan, pushing BMW’s EVs firmly into profitability.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy

.jpg)