Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

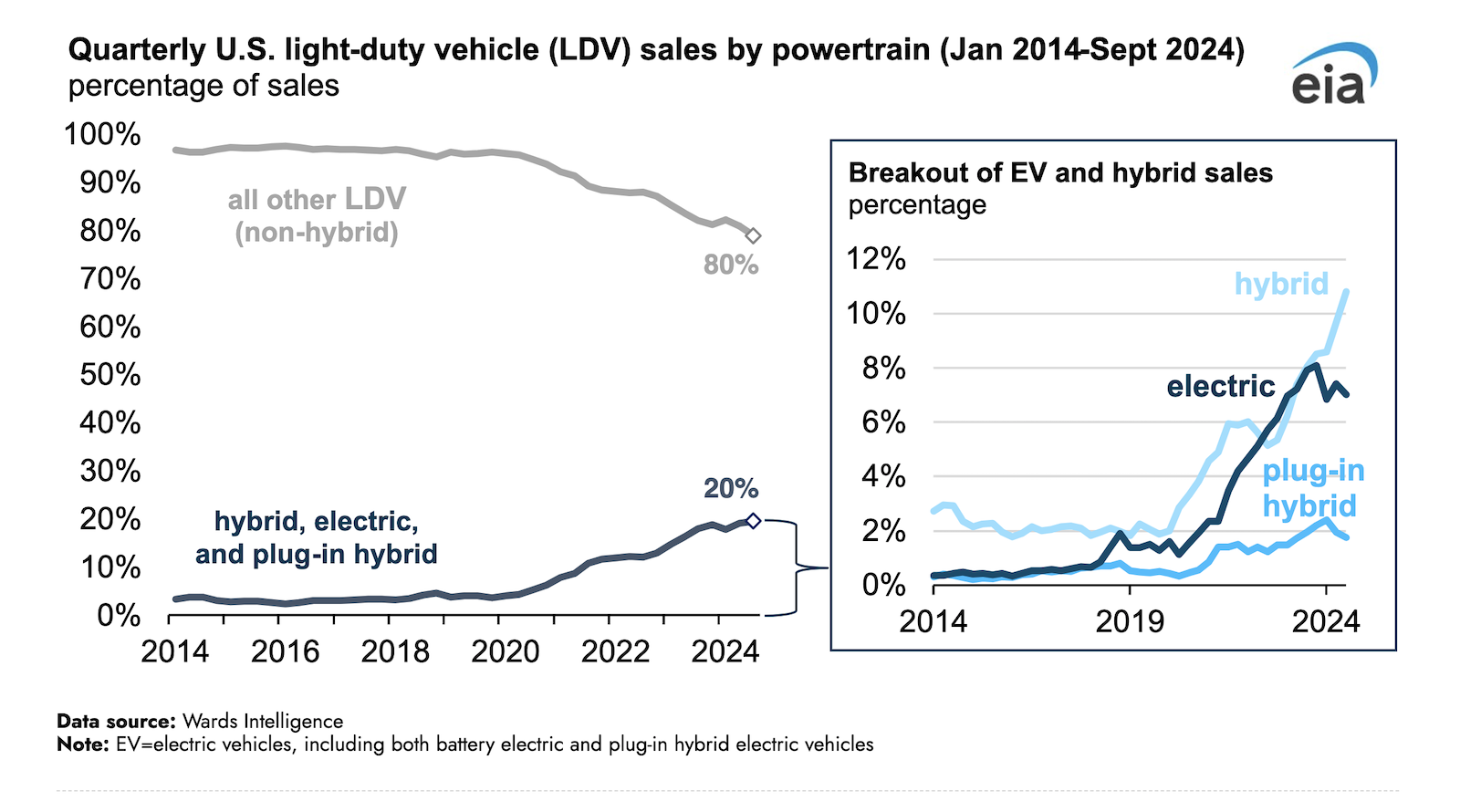

The US Energy Information Administration points out that combined sales of electric and hybrid vehicles reached a record high share of the US auto market in the 3rd quarter. All together, they accounted for 19.6% share of 3rd quarter US auto sales, half a percentage point above their 19.1% share of the auto market in the 2nd quarter.

As the Energy Information Administration (EIA) notes, the record high share is thanks to growth in hybrid sales, as full electric vehicle (BEV) sales dropped in Q3 compared to Q2. BEVs accounted for 7.0% of auto sales in Q3 compared to 7.4% in Q2. Conventional hybrid sales accounted for 10.8% of sales in Q3.

However, notably, electric vehicles are going after certain segments of the market before others. They already accounted for 35.8% luxury vehicle sales (in Q3). Clearly, that is far above BEV share of the overall auto market. However, the good news is BEVs are gaining a presence in the non-luxury market as well. As the EIA notes, “luxury BEVs as a share of total BEV sales have been decreasing as sales outside the luxury market have increased, falling to the lowest share since 2Q17.”

In the third quarter, a whopping 70.7% of BEV sales were luxury BEV sales. In contrast, only 10.3% of hybrid sales were luxury vehicle sales. Furthermore, “According to Cox Automotive, the average transaction price for a new BEV before accounting for any consumer or government incentives was $56,351 at the end of 3Q24, about 16% higher than the overall industry average price.”

A big part of that is the fact that Tesla still dominates the US EV market. While Tesla finally dropped below 50% market share in the 2nd quarter, it still accounted for 48.8% of BEV sales in the 3rd quarter.

Of course, we cover all of these EV market trends ourselves. However, the EIA pulled in another matter and more data in this analysis. It highlighted that 78.9% of BEVs sold in the 3rd quarter were also produced in North America. Another 7.3% were produced in South Korea, and 5.3% were produced in Germany.

It will be interesting to see how those percentages change if the Inflation Reduction Act, or at least EV tax credit portions of it, is killed by the next administration. That said, there were already nuances and loopholes in the law that perhaps made it less influential than initially planned. “To qualify for the clean vehicle tax credits in the Inflation Reduction Act, manufacturers must comply with domestic content requirements for final assembly, battery components, and critical mineral inputs that extend beyond simply manufacturing in North America. Therefore, not all vehicles classified as manufactured in North America will qualify for this credit. These requirements, while applicable to EV purchases, are less stringent for EV leases. Many EV purchases that do not qualify for the incentives under the clean vehicle tax credit will qualify for the tax credit when leased under the commercial clean vehicle credit, providing consumers with a wider variety of eligible EV models,” the EIA writes. Anyway, we’ll see where things go in terms of BEV production location.

Thanks to Monica Abboud for this US BEV and hybrid update.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy