Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

If you are driving the superslab from Peoria to Pascagoula, pulling into a truck stop — where your car will be lost among a flotilla of snorting diesels and massive semi-trailers — is a bit like being a spider in the middle of a tarantella festival. But electric cars are beginning to change all that.

According to the New York Times, truck stop operators are spending billions to make them more appealing to regular motorists, particularly those driving electric cars. It says many of those once grimy truck stops are now more like a mini-Walmart, filled with energy drinks, iced coffee, and healthy snacks like sliced fruit and veggies. Many now offer merchandise like purses and puzzles, as well as phone chargers and birdhouses.

The travel plazas are being redesigned to accommodate those who need to stay stationary while their electric cars recharge. Many now have renovated restrooms and showers, quick serve kitchens, and full service and fast food restaurants, as well as dog parks where Fido and Fluffy can stretch their legs and do whatever it is that dogs do.

The changes put truck stops in a better position to serve the growing number of electric cars on the road, said Jim Hurless, a managing director in Dallas for CBRE, a real estate services firm. “Truck stops are trying to get electric car owners to spend as much of that time as possible inside their stores,” he said. “So they’re trying to differentiate themselves by providing amenities that will be more appealing to that consumer.”

America’s Growing Fleet Of Electric Cars

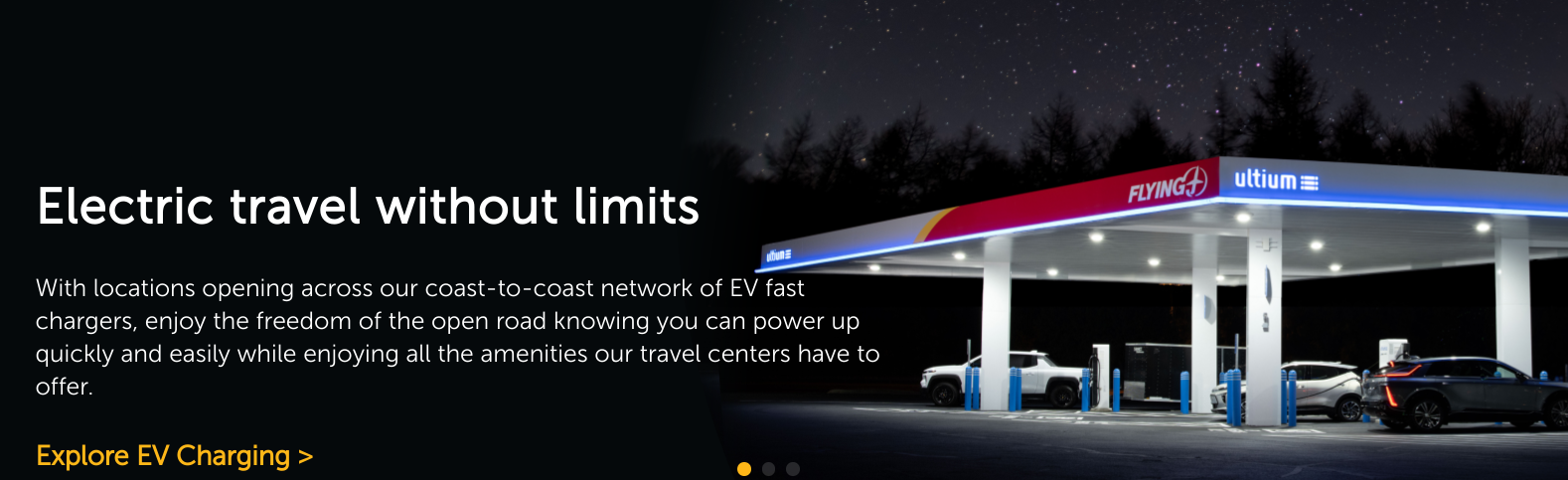

Image courtesy of Pilot Flying J

You wouldn’t know it if you listen to Faux News all day, but 577,000 electric cars and trucks were sold in the United States in the first half of 2023 — a 47% increase over the same period in 2022, according to Cox Automotive. Catering to the needs of those motorists seems like a smart business decision to many truck stop owners and operators.

Pilot, which operates more than 870 Pilot and Flying J locations in the United States and Canada, started a $1 billion initiative last year to remodel 400 of its travel centers and upgrade others over three years. it represents Pilot’s largest investment in store modernization since its founding in 1958.

“We take care of 1.5 million guests per day, and we realize they all have different tastes and that their needs are changing,” said Allison Cornish, vice president of store modernization for Pilot. “We want to be a place for all travelers”

Love’s Travel Stops, a family-owned business based in Oklahoma City founded in 1964, has built about half of its 640 store network over the last decade and is spending $1 billion to refresh its older stock, president Shane Wharton tells the New York Times. Part of that process has required demolishing old stores and building new ones in their place.

The company is opening 25 locations this year and has received $4.8 million in federal funding for electric vehicle charging stations at eight travel centers in Pennsylvania and Colorado. “From a competitive standpoint, we want a consistency of customer experience,” Wharton said. “When our customers see the Love’s brand, they’ll know what to expect.”

He added, “If you’re filling up with gas or diesel, it might take three to five minutes, but charging electric vehicles today might be 30 minutes. By providing those products and services, whether it’s food, Wi-Fi, a dog park or a shower, we think we’re positioned well when compared to a charger in the middle of a parking lot of some big box retailer.”

Increased Traffic Lures Investors

Traffic at convenience stores is increasing in the US. Foot traffic at convenience stores last year was 15.9% higher than it was in 2019, outpacing grocery stores, fast food chains, coffee chains, conventional gas stations, and other related retail categories, according to Placer.ai, an analytics firm that tracks customer traffic. Much of that increase is attributable to more fresh food, baked goods, and coffee options becoming available at those stores in the past few years.

The changes at truck stops are attracting investors. Early this year, Berkshire Hathaway paid $8.2 billion to increase its ownership of Pilot from 38.6% to 80%. British energy giant BP completed its $1.3 billion acquisition of TravelCenters of America in May.

BP is investing $1 billion in electric vehicle chargers across its U.S. retail businesses, which include Amoco and Thorntons, said Greg Franks, BP’s senior vice president of mobility and convenience for the Americas. The overhaul of travel centers along with the creation of an e-commerce platform is aimed, in part, at strengthening its appeal to passenger traffic, he said.

In 2021, Congress passed the Infrastructure Investment and Jobs Act, which allotted up to $5 billion to build a network of fast chargers all along America’s major transportation routes. That money is parceled out by the states. Pilot has secured $9.6 million from Ohio and $2.3 million from Pennsylvania to fund the installation of fast chargers at 17 locations. The company also has teamed up with General Motors and EVgo to expand its fleet of fast chargers.

Infrastructure Woes

Creating a national fast charging network is easy to say, but not so easy to do. Truck stop operators face a number of challenges in order to meet the growing demand. Byzantine utility rules differ from state to state and getting access to the electricity to power banks of DC fast chargers — some of which can provide up to 350 kilowatts of power — is often an issue.

Aaron Luque, the CEO of EnviroSpark, a designer and installer of electric car charging stations in Atlanta, says many travel center operators are getting blind sided by so-called demand charges imposed by utility companies, Those fees can often triple the price they pay for electricity. “Electric vehicle charging presents a unique set of challenges,” he said. “But what’s encouraging is that traditional fuel providers are coming around.”

“This is such a new business that you’re not only trying to figure out who will show up, but when will they show up — will it be at a time of peak or low electrical demand?” asked Brad Jenkins, president of PFJ Energy, Pilot’s fuel supply division. “We’re working with regulators, utilities and states and others to come up with creative solutions to make this work.”

Electric Cars Spark A Transition

Adding charging equipment for electric cars is a major transformation for truck stops and travel centers, but represents a new business opportunity, says David Fialkov, executive vice president of government affairs at the National Association of Truck Stop Operators.

“Truck stops don’t care what type of fuel people put into their cars, just like they don’t care whether people buy Coke or Pepsi or coffee or cake in their stores,” he said. “But they need to be able to make money selling electricity in the same way they do selling gas to build an ongoing, sustainable market.”

That last part really is the key to any business plan.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.