China’s announced restriction on the export of gallium and germanium goes into effect in August. Both of these elements are vital to the microchip industry. Many worry that the move will lead to another major semiconductor shortage. As per the new rule, export of these strategic metals now requires Beijing’s permission. Exporters violating the rule could face possible penalties or charges.

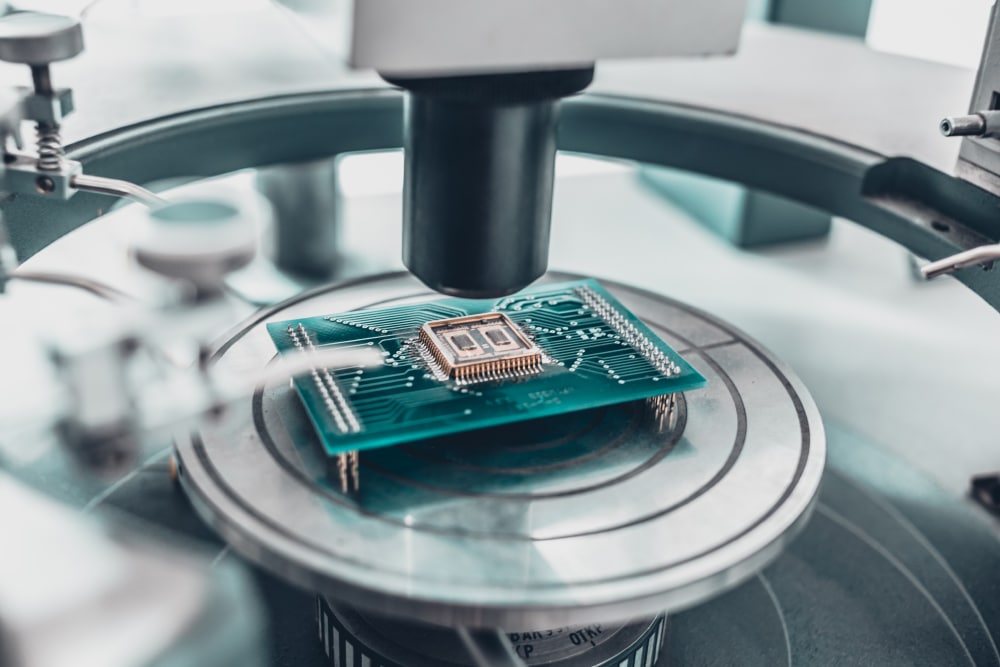

Manufacturers often use germanium and gallium in modern-tech devices, including smartphones, laptops, solar panels, medical equipment, radars, etc. The two elements also possess unique properties that are challenging to replicate, making them well-suited for niche applications. Though silicon is the most used material in semiconductors, germanium and gallium are far more sought after by many industries, including the defense and auto sectors.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today.

Many See the Move as Both Pragmatic and Retaliatory

While announcing tighter export controls, China’s Ministry of Commerce emphasized the dual-use nature of germanium and gallium products. Specifically, the organization underscored their relevance in both military and civilian applications.

China’s move smacked of retaliatory measures. Beijing claims it wants to assert greater control over the export of these strategic metals to prevent potential misuse or diversion for military purposes. According to this report, by requiring permission for their export, China seeks to have better oversight of the destination and end-use of these materials.

However, the U.S. previously blacklisted several Chinese companies, aiming to limit their access to American chips and advanced technologies due to national security concerns. According to Chinese state media, the new restriction on the export of gallium and germanium was a “symbolic warning” to the U.S.

MetalMiner’s weekly newsletter provides updates on metal market price shifts and market trends, as well as other valuable commodity news. Sign up here.

Semiconductor Shortage Not a Foregone Conclusion

Despite China’s efforts to hurt the U.S., experts predict the new rule will have minimal impact on the Pentagon’s supply chain. This applies to gallium, in particular, which is a crucial component in U.S. military radars. In fact, the U.S. is already reportedly looking to alternative sources to ensure a steady supply of the element.

Gallium sees extensive use in advanced microelectronics, including semiconductors and LEDs. This makes it a critical material within the U.S. advanced defense systems and military supply chain. Specifically, it plays a key role in high-energy radars like the U.S. Navy’s AN/SPY-6 and the Marine Corps’ AN/TPS-80 G/ATOR radars.

Currently, China dominates the production of gallium and germanium, accounting for 80% and 60% of global output, respectively. Meanwhile, the main importers of germanium products are Japan, France, Germany, and the U.S. By restricting the export of these rare elements, China seeks to exert pressure on the U.S. during the ongoing semiconductor shortage and the so-called “chip war.”

Reports indicate that the auto industry is also following the developments closely. Indeed, it is still recovering from the global semiconductor shortage caused by the COVID pandemic, which forced automakers to halt production of certain models and sometimes leave unfinished vehicles waiting for a single chip.

Go into your 2024 metal contract negotiations with confidence. Watch MetalMiner’s August fireside chat: 2024 Annual Budgeting & Forecasting Workshop.