Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

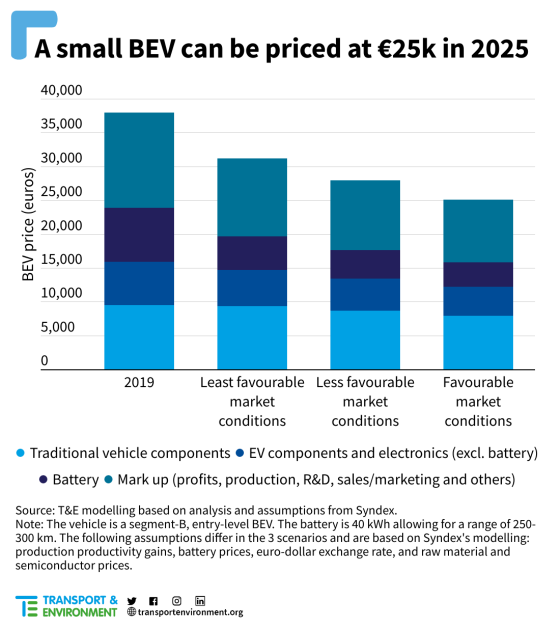

Carmakers can sell small electric cars made in Europe for €25,000 while making a profit, new research shows. Falling production costs and battery prices would make mass market B-segment vehicles feasible to electrify by 2025, according to the study by Transport & Environment (T&E) based on analysis by the Syndex consultancy. T&E said the availability of smaller, more affordable EVs could be a game changer for mass adoption of electric cars and will be crucial if European carmakers are to hold off the challenge of Chinese companies surging into Europe.

European manufacturers can make a reasonable 4% profit margin on a small battery electric vehicle produced in Europe in 2025, according to the report’s “favourable market conditions” scenario. This would see battery costs fall to $100 per kWh, in line with forecasts by BloombergNEF and others. The report factors in other direct cost reductions while keeping broad industry expectations around indirect costs and mark-ups. The B-segment vehicle would have a 40 kWh LFP battery and a range of 250-300 km.

Julia Poliscanova, senior director for vehicles and emobility supply chains at T&E, said: “Survey after survey has shown prices are one of the biggest barriers to drivers going electric. The €25k small BEV will be a game changer for public adoption of electric cars. Bringing those models to market quickly and in volumes is crucial for European manufacturers to compete with Chinese rivals which are already offering cheap, small electric cars here.”

The arrival of more affordable, small electric cars would hasten the uptake of zero-emission cars in Europe, a new survey shows. One-quarter (25%) of new car buyers already intend to buy an electric car in the next year, according to a YouGov poll for T&E in France, Germany, Italy, Spain, Poland and the UK. [1] But when given the option of a small €25,000 electric car, the share of new car buyers willing to buy a battery electric model increases to 35%. [2] This would equate to an additional 1 million EVs being sold in Europe annually, replacing combustion equivalents.

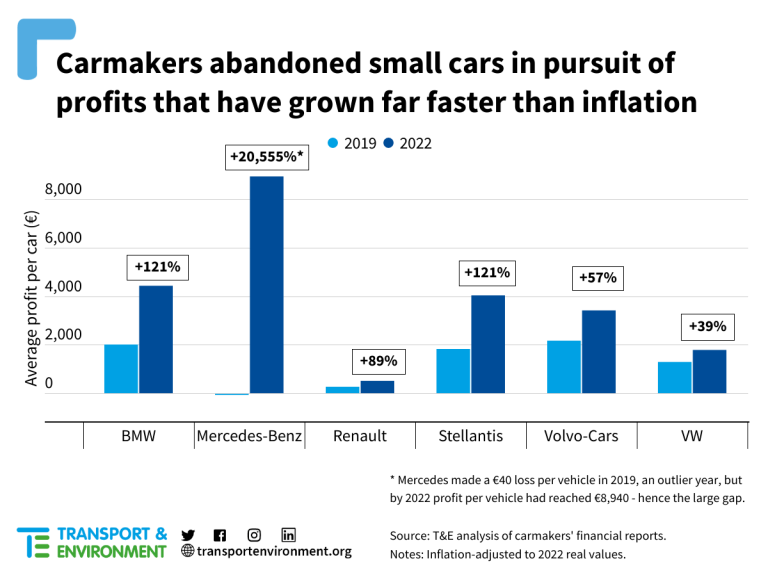

However, the big six European carmakers [3] have abandoned small affordable cars in pursuit of profits that have grown far faster than inflation. Between 2019 and 2022 their net profit per vehicle jumped from between -€40 to €1,920 to €510 to €8,940, adjusted for inflation, the report finds. This was delivered by prioritising sales of larger, more lucrative SUVs which today account for over half (53%) of all vehicles sold in Europe. Electric SUVs, which consume more electricity and raw materials, accounted for 51% of electric car sales in 2022.

T&E said lawmakers need to create the conditions for car companies to prioritise small electric cars, which are better for the environment, low-income households and the competitiveness of the European auto industry. It called for a joined-up strategy of EV efficiency rules at EU level, vehicle taxes and subsidies at national level that penalise weight, and higher parking charges for SUVs at local level.

Julia Poliscanova said: “More car buyers will go electric if small affordable BEVs are available. But right now carmakers are happy to cream the profits off large SUVs which are too expensive for many low-income households. Lawmakers need to step in with efficiency standards, taxes, reform of subsidies and other measures that tip the balance in favour of small, affordable electric cars and ordinary people.”

Courtesy of Transport & Environment.

[1] All figures, unless otherwise stated, are from YouGov Plc. Total sample size in six markets was 3,031 adults. Fieldwork was undertaken between 3rd – 8th August 2023. The survey was carried out online. The figures for each country have been weighted and are representative of all adults (aged 18+) in that respective country.

[2] Of those surveyed who intend to buy a new car in the next 12 months in France, Germany, Italy, Spain, Poland and the UK, 25% said they would most likely buy an electric one. Of those who said they would most likely buy a combustion engine, 13% said they would switch to electric if a €25k/£21k/ PLN 110k small BEV model was on the market. Of those who didn’t know, 21% said they would go electric when presented with the option of the small, cheap model. If these intentions were replicated in the car market, the advent of affordable small BEVs would bring the sales share of fully electric cars to 35%.

[3] T&E calculated the net profits per car of BMW, Mercedes, Renault, Stellantis, Volvo Cars and Volkswagen.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.