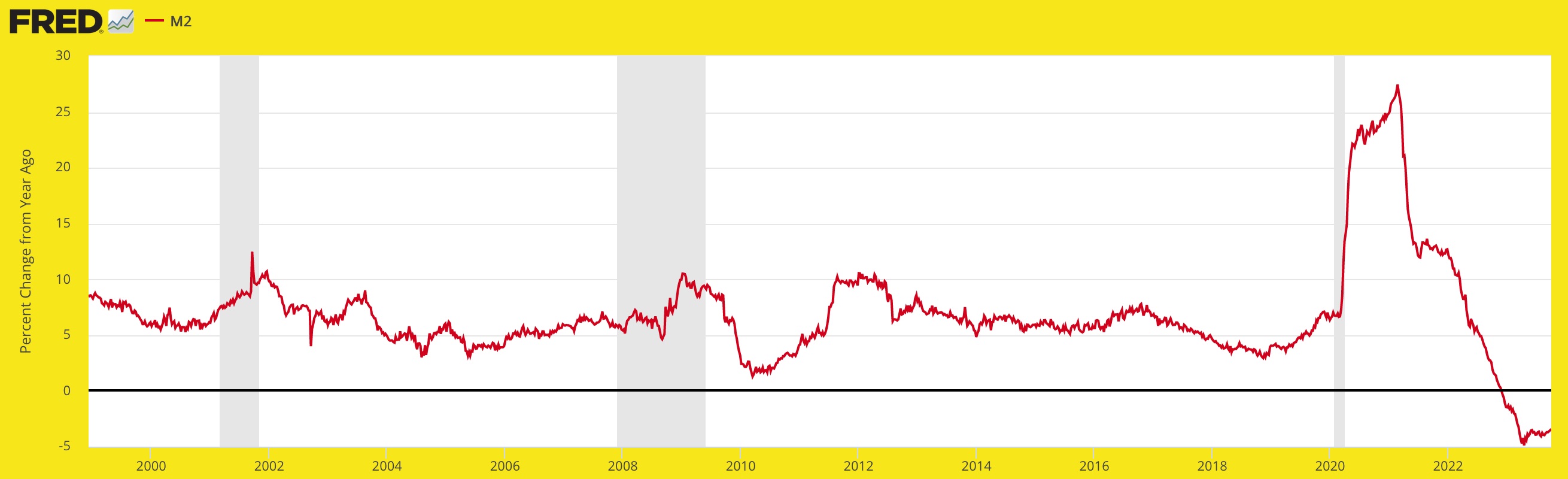

If rapid M2 percentage growth forecast an inflation problem back in 2020, why would it not be forecasting deflationary pressure now?

As far back April, 2020 NFTRH was forecasting a whopper of an inflation situation to come. Why? Guru (aka professional guesser)? No. Follower of logical progressions by important indicators? Oh yes.

In Q1, 2020 the various means of monetary and fiscal inflation promoted by the Federal Reserve and US government (not to mention much of the rest of the world) ramped the rate of M2 growth to extreme, beyond extreme, levels. Sublime levels. The logical progression of all that funny munny sloshing around the system was for asset prices to rise, and the asset prices that rose best were of course stocks. Paper certificate calls on the productivity and performance of public companies.

Fiscally, the government aimed at said companies with debt-spending/bailouts and monetarily, the Fed aimed at the whole shootin’ match with bond market manipulation in service to money printing. More dollars printed out of nowhere vs. finite assets (stocks, commodities, other assets) = price increases of said assets or what the public thinks of as “inflation”.

The. Inflation. Happened. In Q1-H1, 2020.

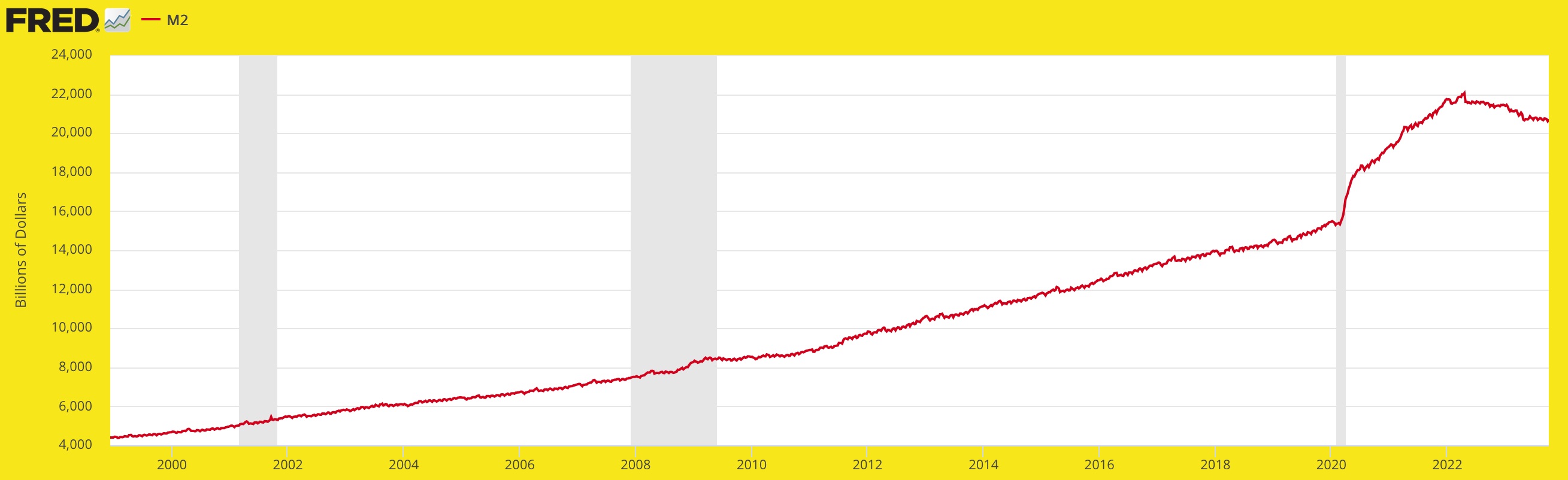

Today the rate of change in M2, the birther of what may be the final leg of the stock market bull, is opposite to 2020. Not yet opposite to the extreme degree of 2020, but it is working on remedying the gross distortion of 2020. The M2 growth rate has plummeted, while…

…the actual reading continues to roll over from extreme and damaging levels. So nominally, there is still a lot of funny munny sloshing around the system. But it is seed corn of illegitimate origin and it is being eaten slowly but surely. With the Fed boxed by the bond market, there is no immediate help indicated to be on the way when things get really dicey, which they will eventually.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

**********