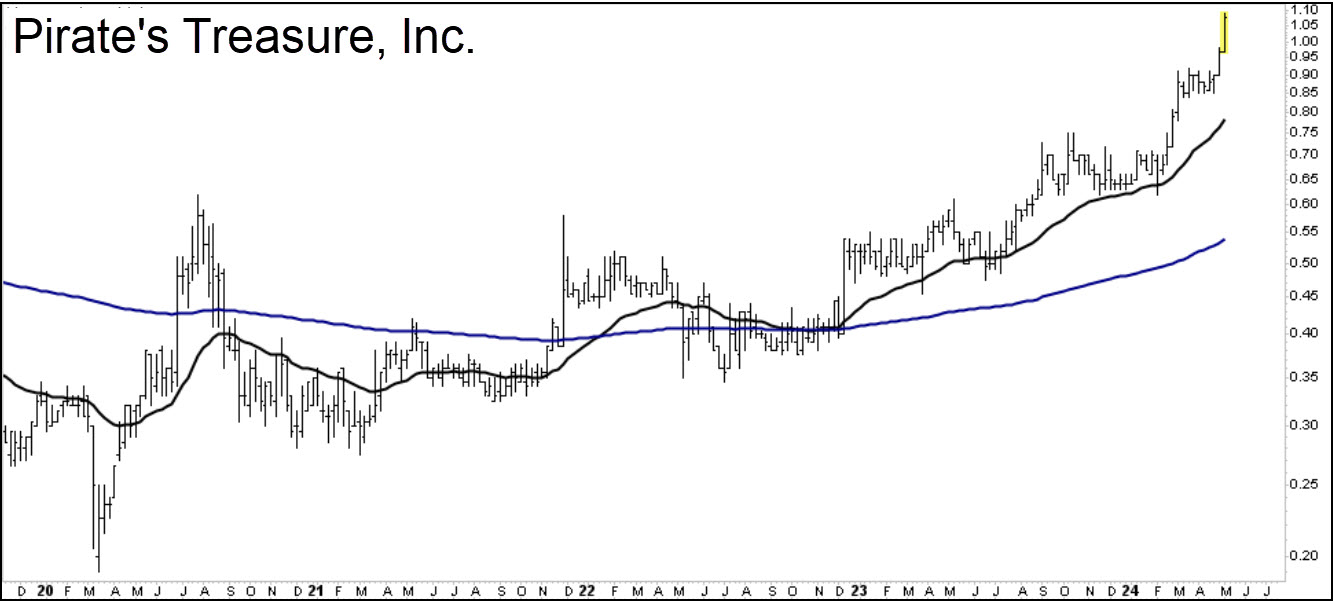

Although there is no publicly traded company called Pirate’s Treasure, the impressive price history displayed in the chart above is real enough. The Canadian company holds royalties to five gold mines that could conceivably rank among the largest in the world someday, according to ‘Spartacus’, a Rick’s Picks regular known for his street savvy, his encyclopedic knowledge of the mining world, and his insightful posts in the chat room. The stock is a classic ‘be right, sit tight’ winner, he says, and enviable profits will be made by investors patient enough to play the waiting game.

If you want to find out the real name of ‘Pirate’s Treasure’, and of similarly promising stocks that are routinely discussed in the chat room, click here. This will give you free access to all the features and amenities of Rick’s Picks, including provocative commentary and actionable ‘touts’ for such popular vehicles as the E-Mini S&Ps, crude oil, gold and silver futures, the Dollar Index, TLT, bitcoin, Microsoft and Apple. Put and call options are a specialty, with occasional ‘Friday jackpot bets’ intended to at least double or quadruple one’s stake in an hour or less. (Certain caveats apply, as noted in the disclaimer below.) There are also two chat rooms that draw some of the best traders in the blogosphere. One of them is devoted mainly to timely trading ideas; the other, a ‘coffee house’, to more freewheeling discussion.

Fahrenheit 430.58

Technical forecasts in the touts section are often precise-to-the-penny, but also intuitive. There is MSFT, for instance, which has served lately as our #1 bellwether for the bull market. We predicted in a headline last year that a 430.58 high in the stock could signal the end of the grandaddy of all bull markets. This forecast is still viable and could prove prescient, since MSFT topped at exactly 430.82 seven weeks ago and has yet to exceed that number, a major ‘Hidden Pivot resistance’.

The current topic du jour is the newly resurgent bull market in bullion. Unsurprisingly, some of the biggest skeptics are gold bugs who have grown used to having their hopes crushed by ‘Mr. Slammy’ whenever gold and silver stage a promising rally. It is predictable nonetheless that bullish sentiment will eventually carry the day, bolstered in no small part by Spartacus and other chat-room stalwarts who recognize the stealth character of the current phase of bullion’s long-term uptrend.

No Second Chances

“Regarding the idea that gold and silver were going to get crushed,” he notes, “I have been saying for two months that the pullbacks would be quick and shallow. That’s just what we have seen. The psychology of market sentiment was revealing the cards for us all to see. I watched a video this weekend of some British guy laying out in great detail the correction going down to $2.000-2,100. That’s just what everyone wants so they can get aboard. Sorry, but Mr. Market is not going to give them a second chance.”

********