Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

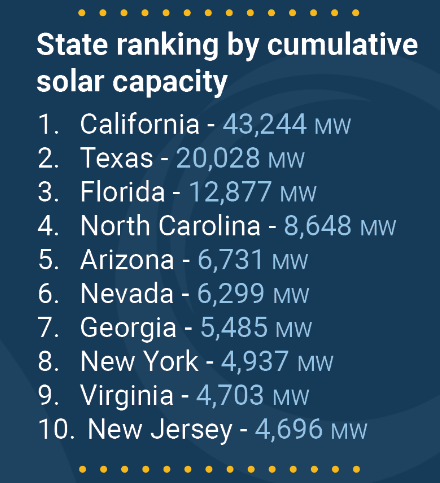

In terms of cumulative solar power capacity, California has more than twice as much installed than #2 Texas — 43,244 MW versus 20,028 MW. Florida then comes in at third with 12,877 MW, North Carolina in fourth with 8,648 MW, and Arizona in fifth with 6,731 MW. As you can see, it’s a pretty steep drop down from #1 to #5 (and beyond).

However, with less “easy fruit” to pick and policy changes over the years, other states are closer to California in terms of new solar power capacity. In the first three quarters of 2023, California still led the country with 3,216 MW of new solar power installed, but #2 Florida and #3 Texas weren’t far behind — with 2,764 MW installed and 2,517 installed, respectively.

California did well to grab another #1 title, but it was given a big boost by a certain policy change and the lingering aftereffects of that. The US Solar Energy Industries Association (SEIA) thinks this California boost will extend through the first quarter of 2024, but then trail off. The SEIA explains further: “The residential segment set another quarterly record at 1.8 GWdc installed across more than 210,000 projects in Q3 2023, reflecting 12% growth over the same quarter last year. This growth is driven by California, where installations had already grown 31% year-over-year in the second quarter and grew another 29% in the third quarter. Installations are surging as backlogs of sales made before the switch to net billing in April are interconnected. […] Some in the industry have been surprised by this delay, but project-level installation data proves there can easily be a 2-3 quarter lag between sales and interconnection. We expect installation volumes to drop off precipitously once this sales pipeline runs out (likely in early to mid-2024).”

Let me clarify a few things, though. The big change concerns excess electricity generated from rooftop solar power systems that is sent back into the grid. The big change is that instead of getting compensated at retail electricity prices for that electricity, homeowners now get compensated at the “value” of that electricity from “avoided costs” at the time it is sent into the grid. That changes from hour to hour. An analysis on what the average compensation rate will be, though, found a 75% drop in the compensation homeowners are getting. Naturally, this change from “net metering” to “net billing” is going to depress the rooftop solar power market in the #1 rooftop solar power state in the country.

So, wait, how is that boosting solar installations in California? I’m glad you asked. The thing is: there was a grandfather clause included that said that anyone who applied before April 14, 2023, for their solar power system to be interconnected to the grid could get the original net metering rate (the retail electricity price). Well, not anyone — the system then has to be installed by April 15, 2026. That’s quite far off, but generally speaking, it doesn’t take a couple of years or more from the time of requesting interconnection to the grid to actually getting interconnected to the grid. As SEIA noted above, it can certainly take 2–3 quarters to get interconnected. However, it shouldn’t take too much longer than that. So, we’re in the middle of a solar boom from people rushing to get solar installed before April 14, 2023, but not yet being interconnected to the grid. Though, that boom won’t last forever. In fact, it will probably be predominantly over a year from now.

The other bad news is that the other top solar power states have been seeing a sales drop, and it’s not clear when that trend will turn around. “Notably, Arizona, Florida, and Texas, three of the largest residential solar markets, experienced quarterly and annual declines in installed capacity in the third quarter. Installers are coping with these challenges as best as possible, focusing more on operational efficiencies or experimenting with pricing and product offering tweaks to survive the slowdown,” SEIA writes. This is reportedly due to not-very-attractive interest rates. If interest rates turn around eventually, though, we should see a boost sales again at that point. The story needs to change, though. “Next year, installation growth in California and the Northeast will no longer offset the impacts of declining residential solar sales volumes, mostly because of the anticipated drop in California. As a result, we expect the residential solar market to decline by 12% in 2024.”

Let’s hope interest rates drop a bit before we see that decline in loan-heavy markets.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.