Nickel and Critical Metals

Critical minerals, often overlooked in daily conversations, have become the linchpins of the evolving green and digital economy. Their significance can’t be overstated. Every cornerstone of the modern sustainable infrastructure—whether it’s the batteries that power our devices, electric cars transforming transportation, wind turbines harnessing nature’s energy, or the solar panels capturing the sun’s rays—relies heavily on these minerals.

The world is racing to discover these minerals, and the United States intends to increase its stake by implementing the Inflation Reduction Act. This isn’t merely a policy decision; it’s a visionary commitment to fortifying the nation’s foundation for the imminent energy transition. By increasing the domestic supply of vital minerals like lithium, nickel, manganese, and graphite, the U.S. isn’t just ensuring its energy security but also positioning itself as a dominant player in the global green energy arena.

But what does this mean for the business landscape, especially for those in North America? The implications are profound. The burgeoning demand for green technology, particularly electric vehicles, is a testament to the world’s shifting priorities. With EV registrations witnessing a staggering 60 percent surge year-on-year in just the first quarter of 2022, the trajectory is clear. Moreover, the market anticipates the EV market’s valuation to leap from a substantial $24 billion in 2020 to a whopping $137.43 billion by 2028.

For companies in North America, this isn’t just a trend; it’s a long-term opportunity. As nations worldwide accelerate their shift towards sustainability, those that harness the power of critical minerals now, will undoubtedly lead the charge in reshaping the world’s energy and economic landscape.

Power Nickel (PNPN.V): The Undiscovered Gem of the Metals Sector?

In the dynamic arena of mineral exploration, Power Nickel, a Canadian junior exploration entity, stands out with its strategic focus on the future. Concentrating its efforts on high-potential prospects of not just nickel but also copper, gold, and other pivotal battery metals, the company casts a wide net, spanning from the vast terrains of Canada to the mineral-rich expanses of Chile.

While the market has its competitors, it’s possible to recognize that Power Nickel’s valuation appears curiously conservative. Trading at a notable discount compared to its industry peers, its current price on the TSXV hovers around the $0.24 mark under the ticker PNPN.V. This subdued valuation is further underscored by its market capitalization, which rests at approximately 31 million – a figure that seems modest when one considers the company’s potential and assets.

Power Nickel’s main asset is the Nisk project, an asset located in Quebec, a region of Canada known for its rich mining history and geology. This project has a historical resource of 3.1 million tonnes of about 1.6% nickel equivalent grade. While a full-fledged nickel-producing sulphide mine demands about 8-10 million tons, the company’s ambition and timeline are clear, and could be gearing up to reach commercial phase of tonnage discovered by the first half of 2024.

To put that into perspective, Panoramic Resources Limited (PAN.AX) has a resource estimate of over 13 million tonnes of nickel graded at 1.52%. The market cap of PAN.AX currently sits around 113 million, 3.6 times that of Power Nickels. As Power Nickel continues to unveil the potential of the Nisk project, this comparison helps paint a picture of its future.

Delving further into the insider holdings of Power Nickel, it’s clear they have trust in the company’s future success. Power Nickel is heavily backed by its officials and management, with around 19% of its shares held by insiders. This is often a testament to the leadership’s confidence in the company’s projects, growth trajectory, and potential. To understand further why Power Nickel is potentially undervalued, we have to delve further into its Nisk project.

Unraveling the Potential of the Nisk Project

Nestled in the mineral-rich terrains of Quebec, Canada, Power Nickel’s crown jewel – the Nisk project – stands as a testament to nature’s bounty. This region, historically known for its vast mineral resources, is uniquely poised to be a leading player in the green energy transition, and the Nisk project is right at the heart of it.

As mentioned, Nisk has a historical resource of 3.1 million tonnes of about 1.6% nickel equivalent grade. The Nisk project has further showcased itself as a reservoir of high-grade class-1 nickel, evidenced by intercepts showcasing 18.5 meters of 2.00% nickel equivalent and 26.6 meters at 1.98%!

Benefiting immensely from the supportive stance of both the Quebec and Canadian governments, Power Nickel has a financial advantage that can’t be understated. With tax credits in the area covering 50% of exploration costs, the company enjoys the leeway to invest aggressively in exploration. To put it in perspective, for every dollar Power Nickel pours into the project, it gets the worth of two in exploration – a tremendous boost to its operational capabilities when compared with companies in other jurisdictions.

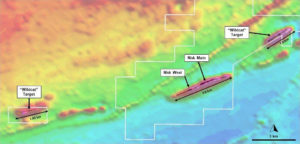

The Nisk property also spans a grand scale, stretching across two extensive blocks, encapsulating 90 claims. This covers an impressive area of 45.9 km^2 with a linear expanse exceeding 20 kilometers. Currently boasting four distinct target areas, extending over a 7-kilometer strike length. The primary focus has been the Nisk Main target, but when looking at historical patterns, nickel sulphide deposits often manifest in multiple pods. Given the trajectory and the evidence at hand, there’s a strong possibility that Nisk might unveil even more of these pods as exploration continues.

Unveiling more of the project’s promise in May, Power Nickel announced exciting news highlighting the discovery of a high-grade Cu-PGE mineralized zone, now identified as the “Wildcat” target. Situated 5km northeast of the Nisk main deposit, what makes the Wildcat discovery even more compelling is that this specific target area had never been subjected to drilling before. Teeming with potential, this hints at the possibility that with more intensive exploration, a network of veins might be unveiled, traversing the expanse of this region.

Yet, amidst this promise of riches, Power Nickel aligns itself with the global shift in perspective. With Class I nickel being the sole grade that meets the rigorous quality and economic benchmarks for EV battery usage, it’s a pressing priority. Moreover, in an age where manufacturers are beholden not just to cost and quality, but also to the environmental and social implications of their supply chains, Nisk’s potential role in this eco-conscious world is not just about mining but mining responsibly.

Pioneering Sustainability with Carbon Neutrality & ESG Initiatives

So, what makes the Nisk Project potentially the world’s first carbon-neutral mine? First, the company aims to leverage carbon capture technology, utilizing the ultramafic tailings discovered at Nisk. The project intends to not only address carbon emissions but has the potential to sequester more carbon than it emits. Historically, mine tailings—waste materials left after extracting the valuable minerals—were seen as a liability. However, Power Nickel’s vision sees these tailings, especially those from ultramafic hosted deposits, as an asset in the fight against carbon emissions.

Ultramafic rock is characterized as an igneous rock predominantly comprised of 90 percent or more of either one or a combination of the following silicate minerals: those rich in iron and magnesium and exhibiting a dark-colored hue. These have been scientifically proven to have significant CO2 absorption capabilities. Studies conducted worldwide affirm that such tailings, like those found in nickel sulfite deposits, can play a pivotal role in achieving net-zero carbon emissions through the process of carbon mineralization. They are even considered a natural carbon capture and storage (CCS) method, where ultramafic rocks actively engage with atmospheric carbon dioxide (CO2) to transform it into a rock-like state, ensuring its secure storage for thousands of years. While this mineralization process typically unfolds slowly through natural weathering, the mining procedure offers a significant accelerant to the capture and conversion of CO2.

Additionally, the strategic location of the project allows for access to inexpensive and abundant hydropower courtesy of a nearby Hydro-Quebec substation. This sustainable power source allows for an easily accessible energy source, while also promoting Power Nickel’s emphasis on eco-friendly energy consumption, further giving it the opportunity to align itself with today’s environmental goals and reduce its impact.

But the company’s dedication doesn’t stop with carbon neutrality. Embracing Environmental, Social, and Governance (ESG) principles, Power Nickel has emphasized its commitment to respecting and considering the CREE Nation Mining policy. This proactive stance ensures that the potential roadblocks and conflicts, which have plagued some mining operations in the past, are preemptively addressed.

This should further position Power Nickel as a leader in the future as industries like electric vehicles look for clean resources. If Power Nickel can ensure the carbon-neutrality of its nickel and other resources, there is a high chance of potential premiums being paid by future buyers.

Power Nickel’s Global Portfolio

Power Nickel’s assets aren’t confined to just one region or mineral; its assets extend both regionally and globally.

Nestled in the heart of British Columbia’s esteemed Golden Triangle region, historically rich in gold deposits, Golden Ivan stands as a beacon of potential wealth, tapping into the region’s storied past filled with significant mining exploits.

However, Power Nickel’s international endeavors are equally noteworthy. Stretching over to South America, the company boasts ownership of five properties that span more than 50,000 acres, all strategically situated in northern Chile’s renowned iron-oxide-copper-gold belt.

Zulema project: Located a mere 30 kilometers from Lundin Mining Corporation’s Candelaria mine, Zulema has similar geography. The project covers 4,300 hectares rooted deep in the Atacama mineral belt’s core.

Palo Negro and Hornitos properties: Both 100% owned by Power Nickel, these two properties collectively occupy over 9,000 hectares in Atacama, further cementing Power Nickel’s presence in Chile.

Tierra De Oro property: another crown jewel in Power Nickel’s assets. Located in Chile’s prolific IOCG belt, which has birthed numerous copper-gold deposits like Mantos Blancos and Manto Verde, Tierra De Oro is in good company.

In essence, Power Nickel’s diversified assets, both domestic and international, underscore its ambitious vision and commitment to tapping into the world’s rich mineral resources.

Looking Forward for the Nisk Project

Moving forward with its flagship project, news can be expected to flow continuously from the company. Power Nickel has identified the path forward and laid the following roadmap:

Q3 2023 – Use Gravity, Seismic, Airborne EM & Ambient Noise Tomography on other Pods

Q3-Q4 2023 – Initiate 15,000 Metre Phase 4 Drill Program

Q3 2023 – Release Metallurgical Study

Q3 2023 – Update NI 43-101

Q2 2024 – Deliver PEA or better

Our 3 Key investment points

- With nickel continuing to increase in demand, the Nisk initiative represents a high-grade nickel sulphide discovery anticipated to be of significant size.

-

- Government tax credits cover 50% of exploration costs

- Easy access to cheap power through the Hydro-Québec substation.

- The North American market is eager for more and prepared to offer subsidies related to the industry.The project is found in one of the best places in the world to build a nickel mine.

- Power Nickel has forged a partnership with CVMR Corporation, a global frontrunner in nickel powder, wire, and anode production.

-

- CVMR will oversee advanced bench scale production, piloting, and engineering evaluations for the Nisk project to assess the project’s viability.

- CVMR is a metal refining technology provider that is also engaged in mining and refining of its own mineral resources in 18 different countries. This collaboration shows the interest and belief others have in this promising project.