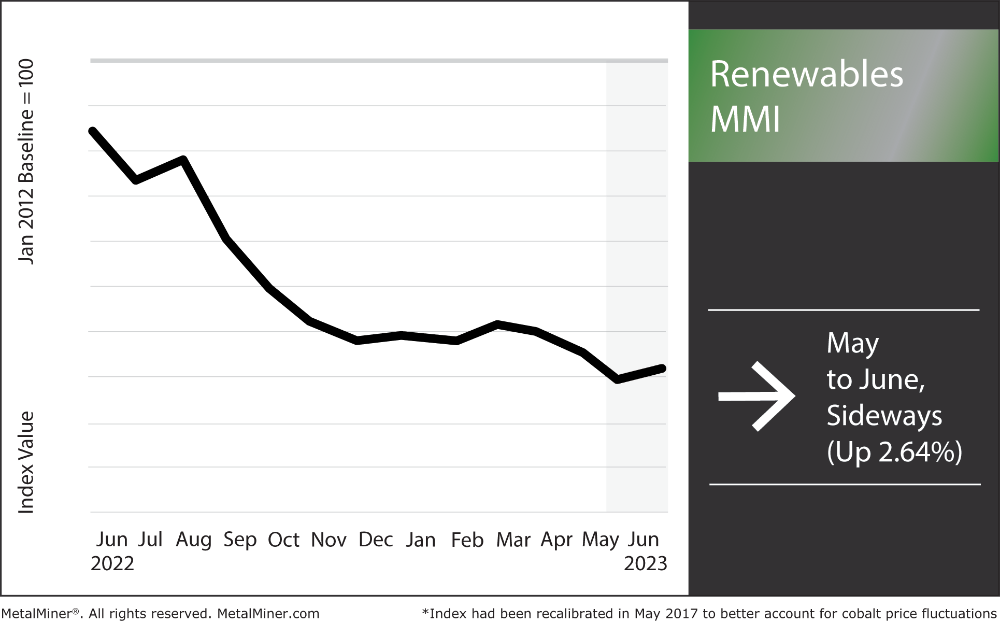

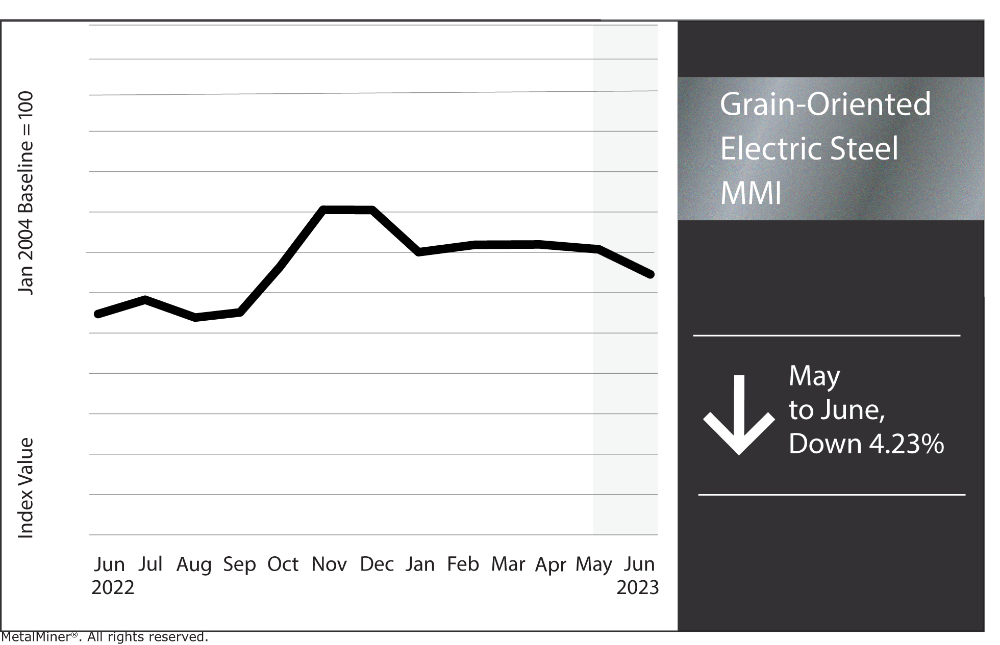

The Renewables MMI (Monthly Metals Index) continued to edge sideways, this time rising by just 2.64%. Cobalt and neodymium rising in price contributed the most to the index’s upward movement. This occurred despite massive oversupplies of cobalt, which is crucial to utilizing renewable energy sources like EV batteries. Meanwhile, grain-oriented electrical steel dropped month-over-month, with the steel plate components of the index either moving sideways or dropping slightly.

MetalMiner just released its Annual Outlook quarterly update. Read where industrial metal prices are projected to go in 2023, get expert sourcing and purchasing advise and understand market trends in order to save money. Learn more and see a sample copy.

U.S. Infrastructure Racing to Get Where EV Demand Sits

EV demand grew by 14% in 2022, and experts project an additional 18% growth by the end of 2023. In fact, global EV battery demand alone expanded by a whopping 65% in 2022. However, finding charging stations continues to present a problem. While the number of charging stations for EVs continues to grow, there’s only about one EV charging station for every gas station in the U.S., with each gas station averaging 4-8 pumps. This means only 1 EV charging station exists for every 4-8 gas pumps, which is a 1:4 ratio, at best.

EV and EV battery demand continue to outpace the infrastructure necessary to keep them charged. For instance, only 6% of charging stations lie along the interstate highway system, the center of the national road network. Moreover, around 8% of the U.S. population lives more than 10 kilometers away from a public charging station. To reduce this percentage to less than 5% would require an additional 1,185 stations while reducing it to zero would require around 5,000 more. Of course, connecting all of these charging stations to renewable energy sources as some suggest would also be a monumental undertaking.

To accommodate the demand for electric cars, experts project that more than a million new public EV charging stations will be required in the U.S. by 2030. According to a recent S&P Global Mobility assessment, the U.S. must triple its charging infrastructure by 2025, an x8 increase over the country’s current charging capacities.

MetalMiner’s free weekly newsletter provides up-to-date information on multiple metal types as well as other valuable commodity and macroeconomic information.

Renewable Energy Sources: Cobalt and Silicon Still in Oversupply

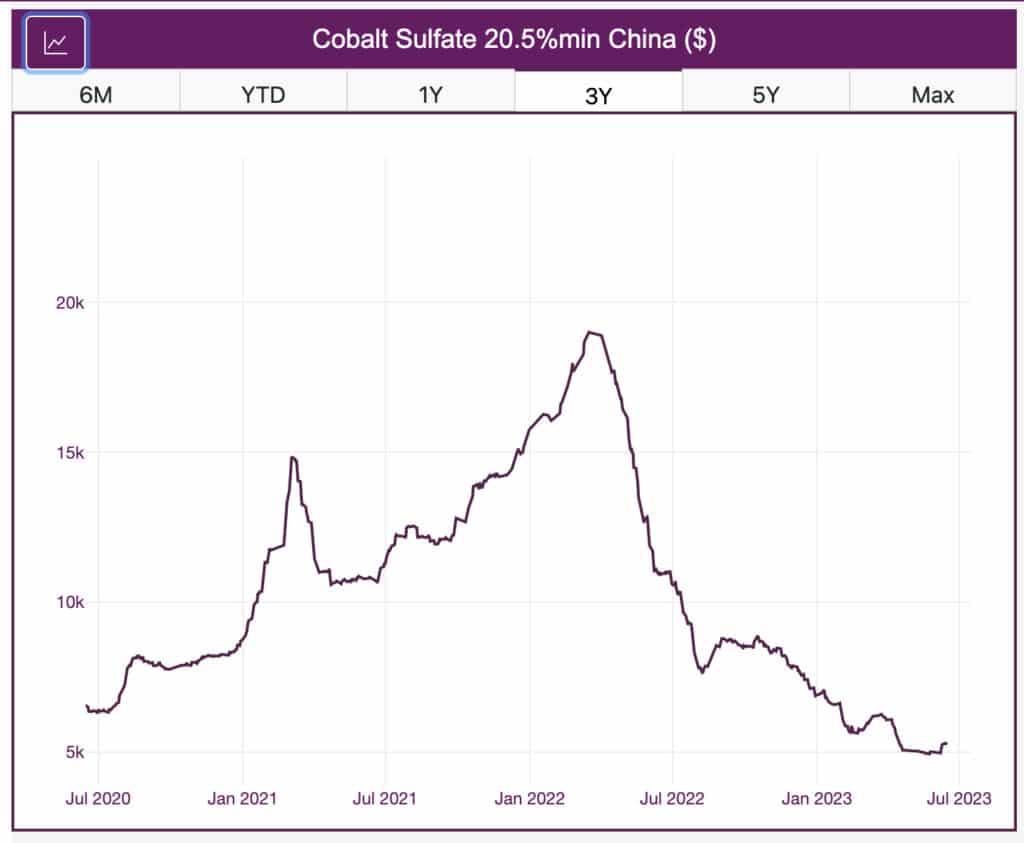

Both cobalt and silicon prices face bearish pressure due to oversupply. Though the price of silicon seems temporarily stable, some traders and experts remain pessimistic. Meanwhile, cobalt prices remain close to historically low levels without much price movement.

One cause for the cobalt overstock is a rise in output from the Democratic Republic of the Congo, the world’s largest producer. This production increase is the main factor behind the market’s cobalt glut as well as plummeting prices. Likewise, the current silicon overstock is also the result of increased manufacturing capacity causing an excess of supply. This is especially true within China, where the over-availability of cobalt and silicon continues to impact global prices.

MetalMiner Insights covers a full suite of battery metals. Get information on where prices are projected to fall in 2023, adjust your procurement strategy accordingly and get expert advice about how to optimize sourcing. Learn more.

GOES MMI

Month-on-month, the GOES MMI dropped by 4.23%. The index suffered its lowest drop since December of 2022.

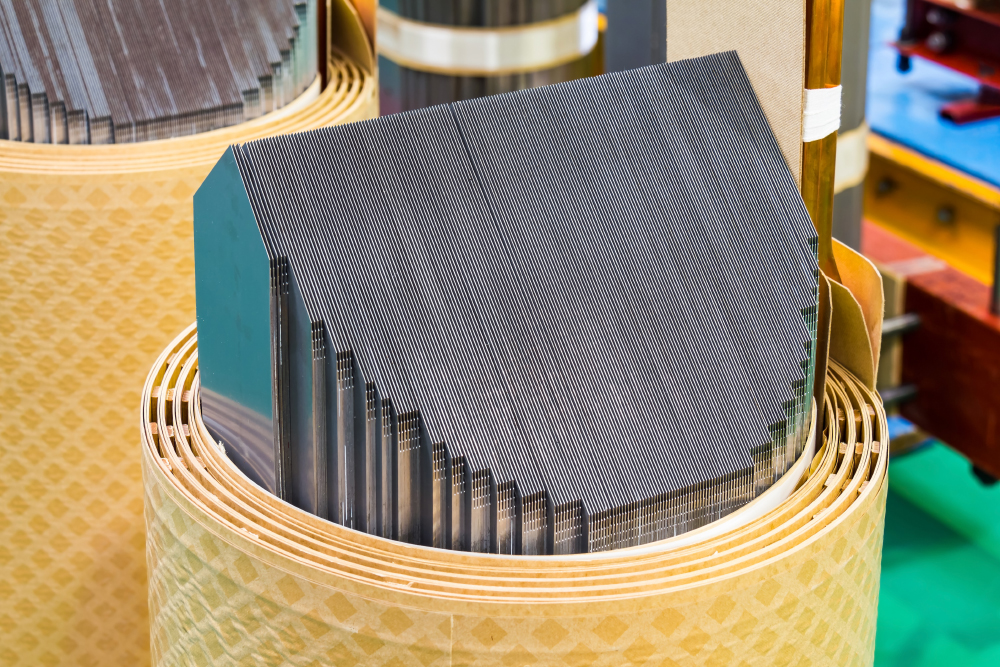

GOES Increasingly Difficult to Source. Renewable Energy Sources Could Suffer

Grain-oriented electrical steel is becoming increasingly difficult to find and source. One of the primary factors is rising demand in the power sector, which continues to leave GOES in short supply. Another problem is the difficulty of manufacturing grain-oriented electrical steel. Indeed, the process necessitates a high degree of metallurgical understanding and skill. This means there are fewer qualified candidates for these jobs, and salary expectations are higher due to it being such a specialized field.

The shortage is significant because it impacts the ability to ensure universal access to affordable, reliable, and modern energy services. To some, the scarcity of transformers is one of the top problems for public utilities nationwide. Earlier this year, about 80% of American Public Power Association members reported having less equipment on hand than in 2018. That was before the pandemic disrupted supply chains and before the latest rise in demand for renewable energy sources. With hurricane season coming and summer storms beginning to fire up across the Midwest, the problem of too few transformers and too little grain-oriented electrical steel comes at worse time.

Solutions For GOES Shortages

One solution to the problem is to increase domestic output. After all, the U.S. can improve its ability to produce GOES by developing and constructing new construction stations. Furthermore, the United States can engage in research and development to increase the efficiency of grain-oriented electrical steel manufacturing. This takes place through the development of innovative technologies and procedures that minimize energy usage and waste. Finally, the U.S. might consider purchasing grain-oriented electrical steel from other countries. However, this technique may not prove viable in the long run due to the danger of supply chain interruptions and trade conflicts.

Discover what’s impacting the shift to renewable energy sources and generate hard savings on your metal buys all year. Trial MetalMiner’s monthly outlook report.

Renewables/GOES MMI: Notable Price Trends

- Grain-oriented electrical steel fell by 4.23%, leaving prices at $4,530 per metric ton.

- Chinese silicon dropped by a stark 14.39%, which brought prices to $1875.38 per metric ton.

- Finally, Chinese cobalt moved sideways and trended up by 1.29%, leaving prices at $39,389.46 per metric ton.