Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In the past week, I’ve been digging into the underpinnings of a few Canadian cities’ current fixation on wasting serious amounts of taxpayer money on hydrogen buses. I had been ignoring it, more than not, as I’d assessed global hydrogen fleet trials and results along with exorbitant global hydrogen transportation costs, engaged in research related to road transportation decarbonization, and assumed sanity would eventually prevail.

However, someone I have the utmost respect for, Michael Raynor, lives in Mississauga, one of the cities going down this oft-trodden and ill-fated path to economic ruin. I’ve been citing the book he co-authored with Clayton Christensen, The Innovator’s Solution, for two decades, and working to apply its strategic insights in technical and business strategy efforts globally. The book was a sequel to Christensen’s best-selling, deeply influential book on the challenges facing market leaders facing disruptive innovation, The Innovator’s Dilemma.

In 2023, Raynor reached out to me to discuss carbon insets as an abatement mechanism for Scope 3 emissions and an engine of industry transformation in so-called “hard-to-abate” industries; more on that in a different article.

Two weeks ago, however, he reached out to me as a concerned citizen of the Greater Toronto Area (GTA) city who was watching it march headlong into the same trap that had been sprung on transit and fleet operators globally over the past 25 years: hydrogen as an energy carrier. There are so many hydrogen bulls to gore that I’d managed to ignore this one, until he forwarded me some of the collateral being used. Prepared by the Canadian Urban Transit Research and Innovation Consortium (CUTRIC), its content was noteworthy, not least for its seeming ignorance of the long list of failures, globally, and over decades, of hydrogen for transit applications. Further misrepresentations, outright errors, and more, conspired to present hydrogen fuel cell buses and trains in a very positive light, albeit still secondary to the actual solution, battery and grid-tied systems.

That led to an article outlining and citing the global data that’s publicly available on real costs and challenges of hydrogen fleets, including high capital costs, very high operating costs, low reliability of vehicles, low reliability of refueling systems, and much higher greenhouse gas emissions than battery-electric solutions. I followed that with a lightweight version of Professor Bent Flyvbjerg’s reference class forecasting approach, as outlined in both his best selling book co-authored with Dan Gardner How Big Things Get Done, but also in his academic publications, to estimate the costs of four scenarios. I found that using global empirical data, an end-to-end system for hydrogen would be more than double the costs of a battery-electric solution, allowing far more buses to provide far more service for the same cost if hydrogen were avoided.

As often happens, another GTA contact reached out to provide me with a more detailed study that CUTRIC had done for Brampton, as well as the city’s general manager of transit’s memo supporting its conclusions that a mix of 724 electric buses to 408 hydrogen buses would be cheapest and the best alternative. I did an in-depth review of the assumptions and results, and found the non-material 0.1% difference in cost between the blended fleet and the battery-only fleet would be well over $350 million in favor of a battery-only fleet if appropriate assumptions were used. (All figures in Canadian dollars unless explicitly stated otherwise.) The costs of hydrogen, hydrogen refueling systems, and hydrogen bus maintenance were lowballed, and the costs of electric bus maintenance were overstated. Further, carbon pricing on the gray hydrogen that would dominate energy supplies for the hydrogen buses were ignored.

I provided the CUTRIC and Brampton material along with my results to Raynor, and his different perspective, shaped by his Harvard doctorate of business administration, global business strategy career with Deloitte, and four books on strategy and innovation, caught additional points. What follows is a blend of his insights and my extensions in a couple of places.

Good Scenarios Model Uncertainty

Raynor’s first point is that any good scenario modeling, especially one projecting a couple of decades into the future, respects and represents uncertainty ranges. A professional scenario projection or estimation would quantify and characterize the uncertainty. I do projections decade by decade of climate challenges and solution sets in areas like aviation, steel, and hydrogen, and I’m always careful to state that I don’t think I’m right, I just think I’m less wrong than most, and that the error bars are big.

As the global data shows, everything we know about hydrogen for transit applications is bad. Any predictions that anything about hydrogen will get better should be viewed as highly suspect. Similarly, everything we know about battery-electric and grid-tied transit is good, and we have strong reasons to believe that predictions for further improvements along multiple dimensions are credible.

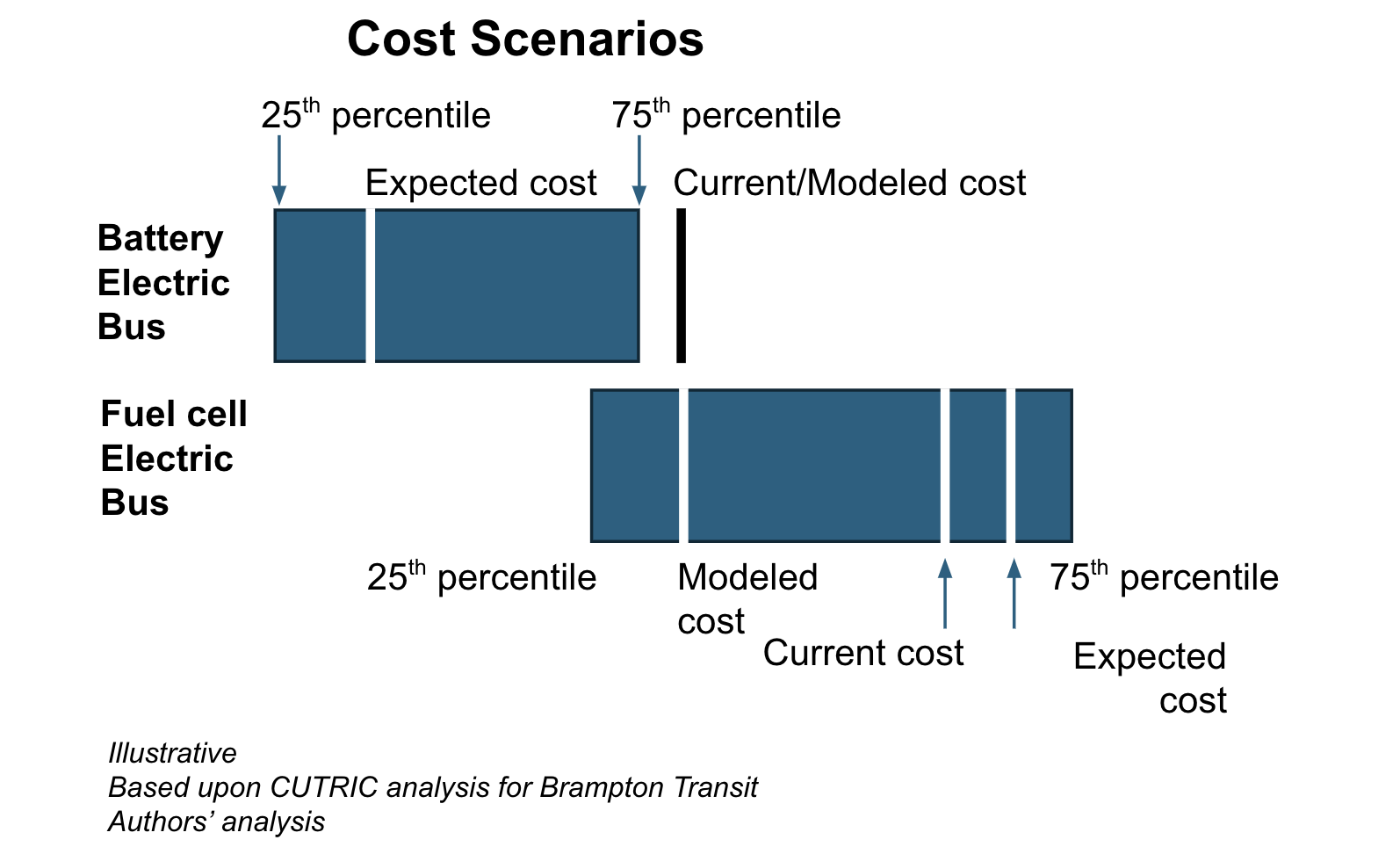

While battery-electric buses show relatively stable costs, with current prices near the upper end of projections (75th percentile), fuel cell buses exhibit wider cost variability, with current costs exceeding modeled expectations. The findings suggest that battery-electric buses are closer to achieving cost targets, whereas fuel cell buses face higher uncertainty and financial hurdles, something that must be taken into account during scenario assessments and decision making.

Include that in the analysis, and you’ll get an expected case and a range of outcomes that look very different, something like the representation in the rough chart above.

His experience and mine, as well as global project datasets like Flyvbjerg’s 16,000+ infrastructure megaprojects material and software projects dataset COCOMO II, all support a wide distribution of outcomes. In a big project that includes immature technologies, we know that the outcomes almost always skew high, so anything that includes hydrogen in the solution is likely to be underestimated.

To extend that point, hydrogen vehicles and fuel cells do not have the criteria for the radical reductions in cost and parallel increases in quality and reliability that we’ve seen globally with battery-electric vehicles and batteries.

Batteries, like solar panels, have followed Wright’s Law for decades, with a 20%-27% cost reduction for each doubling of cumulative production, while quality is maintained or increased. New production capacity is still being added at a rate that is material compared to installed capacity, so cumulative production still doubles rapidly, implying continued significant cost declines.

Further, another regular contact, Professor David Cebon, founder and director of the Centre for Sustainable Road Freight at Oxford, points out that light road vehicles — by far the biggest market for alternative energy for transportation — have firmly chosen batteries instead of fuel cells. As a result, that enormous demand volume will lead to Wright’s Law efficiencies for electric vehicle batteries, but not for fuel cells.

Hydrogen buses contain a single fuel cell, a much more complex assembled electrochemical product than a battery, and with limited markets globally. The conditions for fuel cells themselves to decrease in cost are much lower than for batteries.

As noted in the earlier assessment, CUTRIC’s study makes inaccurate assumptions about both prices of both gray hydrogen and batteries. They use a figure of $8 delivered for gray hydrogen, which is roughly half of global benchmarks, including those by the US Department of Energy for trucked-in hydrogen. For batteries, they appear to be using older data for battery pack costs and assume that the prices aren’t going to decline over the next 20 years, despite very significant declines that are very well documented and more room with Wright’s Law for reductions. Also as noted, fuel cells and their attendant balance of plant inside the bus and out, will not see nearly as much price reduction from the experience curve, as volumes will be much lower.

In other words, the Brampton analysis is estimating a total cost for battery-electric buses that is essentially their current cost. That’s perhaps defensible in the interests of conservatism, but based on what we know about battery technology, it is also deliberately and unnecessarily inaccurate, especially for battery pack replacements in the 2030s. In contrast, the modeled full lifecycle cost for hydrogen fuel cell electric buses is significantly lower than current costs, when there is little reason to believe costs will drop materially. In reality, decarbonizing hydrogen further will lead to increases in costs.

While the modeled cost for fuel cell buses are still above those for battery-electric ones full lifecycle in the report, they are much closer in the model than in reality. Each is reasonably characterized by very different distributions of realized average cost over the period of the project. Batteries are very likely to come down, a lot. Hydrogen is likely to cost much more and to increase in costs. To the extent those claims are found compelling, the conclusions of the CUTRIC report are suspect.

Complexity Is Ignored As A Factor

There’s another condition for decreased cost and increased reliability, which is the complexity of the end system into which the batteries or fuel cells are installed. A battery-electric bus has the battery packs with their thermal management, wiring, and monitoring systems, mostly solid-state with no moving parts except in the thermal management. It has a power control system, again solid-state, to manage the power delivery from the battery to the motor and back again in the case of regenerative braking. It has an electric motor with a single moving part. Achieving reliability with a system dominated by solid-state components where the only things in and out are electrons is relatively simple.

A hydrogen bus, by contrast, has everything just described for an electric bus as well as all of the components for the hydrogen energy system. That’s because all hydrogen buses are actually hybrid hydrogen-battery buses. They have a single, complex, fuel cell with connectors for hydrogen, electricity, and water. They have very high pressure hydrogen tanks with pressure and thermal management systems for the variable pressure, variable temperature hydrogen to get it into fuel cells at the specific temperature they require. They have surgical-suite grade air filtration, humidity, and temperature controls because the fuel cell requires pure air of a specific humidity range in a relatively small range of temperatures. They have water emissions thermal management and pumping systems so that it doesn’t freeze inside the vehicle in the winter time, as happened regularly in Whistler, BC’s four-year trial starting with the Winter Olympics of 2010. They have hydrogen sensors inside the drivetrain and passenger compartments along with alarms to detect hydrogen leaks and prevent passenger, driver, and maintenance staff injuries, as hydrogen is an escape artist of a molecule.

The low global volume of fuel cells, even if they somehow became the energy source of choice for large trucks, buses, ships, and aircraft — which they won’t, in my professional opinion — means limited economies of scale from manufacturing them. The complexity of the surrounding gas and liquid management systems means more failures in assembly, more maintenance of the finished bus and more failures of buses. The combination means that hydrogen fuel cell buses will remain much more expensive even as the battery inside of them gets cheaper.

But that’s just the complexity of the vehicle itself. Raynor also observed that there is a very real reason to doubt that a mixed fleet solution will be lower cost. There’s no way introducing more complexity and lower scale reduces cost — quite the opposite.

The mixed fleet will have substantially more technologies. Diesel fueling and servicing facilities will be maintained until all diesel buses are replaced with alternative energy buses regardless, so that set of infrastructure, staff, and materials will be maintained but used at a declining rate over time, leading to higher costs. That’s inevitable for any solution.

Adding battery-electric buses adds a limited set of maintenance requirements for them due to the extreme simplicity of their drivetrain. Global experiences are that the biggest maintenance efforts for them almost entirely exist on diesel buses as well, such as jamming doors, broken indicator lights, passenger climate control systems, and the like. However, the solution does require adding charging systems. These are almost entirely solid-state, with very limited and simple moving parts and have proven highly reliable globally, more reliable than diesel gas pumps. There is a greater requirement for electrical engineers and qualified electrician trades than with diesel buses.

Hydrogen buses bring a completely new set of complexity. The outline of the complexity of the drivetrain components requires maintenance facilities and workers competent to work with a very high pressure gas that’s highly explosive. They require skills and certification not just in basic climate control for the passengers and driver, but the much more specific thermal and air quality systems for the hydrogen, air, and water. Significant new safety procedures are required, far more than for battery-electric buses. The hydrogen storage and refueling system at facilities itself is much more sophisticated than diesel tanks, having its own set of more industrial-scale thermal and pressure management components and compressors, all of which have their very tight mechanical tolerances and rapidly degrading seals.

These are not insurmountable problems taken one by one, but adding two sets of additional complexity to a system, especially one with the safety and mechanical characteristics of hydrogen, and limiting the number of buses that unique resources can work on, adds significant costs and risks in and of itself.

All of this complexity means that the variance of estimation for hydrogen buses is much higher than for battery-electric buses, and further, that the variance of estimation for the blended fleet model is much higher than for the battery-electric only option. Wise city and transit managers will ensure that they apply very significant contingency factors to the more complex options to account for the complete lack of addressing them in the CUTRIC material.

Transformation Roadmap Is Flawed

Raynor’s 2007 book The Strategy Paradox deals explicitly with scenario modeling for strategic assessments. His career has been filled with top-level engagements with leading firms around the world on scenario development for decision making. In his professional opinion, the CUTRIC report is really bad scenario-based planning. If it were handed in by a group of students in one of the MBA courses he has taught in the past, it would rate a failing grade, not merely a low grade.

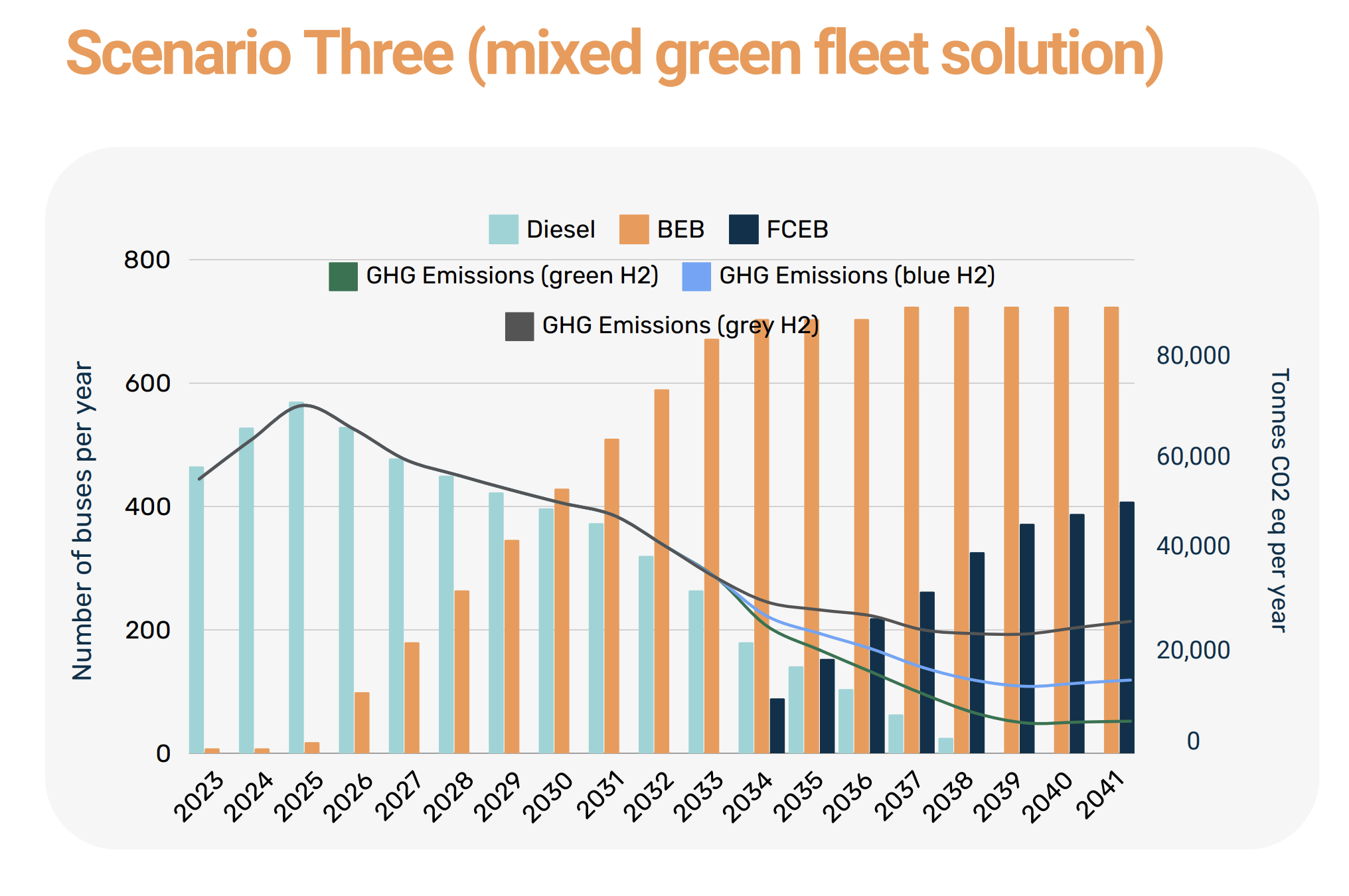

Ultimately, when it comes to the relative costs of battery-electric vs. fuel cell buses, there are three options: battery-electric buses are more expensive, less expensive, or the same. For the reasons adduced above, the only defensible conclusion is that the battery-electric buses are cheaper and that the gap will widen. The CUTRIC report agrees with the first half of that conclusion, proposing a mixed fleet for Brampton, with a gradual phase-in, first of battery-electric buses, then of fuel cell buses, per the diagram below.

That’s a complex transition plan, and if battery-electric buses are cheaper, why include fuel cell buses at all? We’ve been around this space enough to know that the hydrogen lobby makes the claim that fuel cell buses are better suited to longer-haul routes thanks to purportedly faster refueling times and greater ranges. Those claims are more than a little questionable given that transit agencies in the geographically and climatically diverse China overwhelmingly choose solely battery-electric buses, roughly 600,000 to date, as is the case globally. But to someone who believed them, it could make sense to phase in battery-electric buses for shorter routes, and keeping diesels on the road, while Bramptons waits (almost certainly in vain) for the cost of fuel cell buses to come down, and then phasing in the fuel cell buses on the remaining diesel routes. Alternatively, waiting for battery energy densities to continue to improve as costs continue to decline and megawatt-scale charging becomes faster — exactly what has been happening for a couple of decades and exactly what is happening still this year — and then phase in longer range battery-electric buses on the remaining diesel routes.

Phasing in the buses over 15 years has a dramatic impact on the expected costs of the transition. Raynor points out that this risks dramatically underestimating the costs of complexity arising from the diminishing percentage of the fleet on diesel and the small initial numbers of buses that are either battery-electric or fuel cell. It simply has to be the case that when an entirely different technology constitutes a small fraction of the total fleet (regardless of technology) the per-bus cost of maintaining those buses will skyrocket. In other words, there’s a cost-optimizing minimum efficient scale for each technology that any smooth linear change-over necessarily ignores.

Challenges With Bus Electrification In North America

So, why introduce the buses so gradually? To this I have at least a partial answer, and it’s unfortunately a systemic problem with geopolitics and vendor lock-in. I ran into it first when consulting with BC’s TransLink on its planned electrification before COVID, and it’s only become worse. However, there is hope with insight and action.

At the time, I asked the TransLink staffer in charge of the project when they were going to China to get their input on leading practices for bus fleet electrification. Shenzhen already had 16,000 electric buses on its roads and had found and resolved all practical issues with large-scale deployment at speed. This is part of China’s rapid deployment since 2010 of roughly 600,000 electric buses, part of their drive to both clean up city air and reduce health impacts, but also part of their focused electrification of everything in their economy.

I looked at North America’s leading provider of transit buses, New Flyer. It had a peak annual delivery of only 6,500 buses in its history. It was exploring both hydrogen and battery-electric buses, with all of the complexities and schedule and budget impacts that Raynor’s point on systemic complexity brings. It has the disadvantage, from transit authorities’ perspective, of being able to charge them more for all of that extra cost and complexity. Perversely, New Flyer is rewarded for doing exactly the wrong thing.

TransLink by itself operates 2,100 buses, in one small market in one corner of North America. There are 10,000 transit buses in California across its 200 transit authorities. New York has 5,800 by itself. The United States has about 72,000 transit buses on its roads. Just satisfying the United States’ market for transit would take New Flyer churning out more battery-electric buses than it did in its peak year, every year for the next decade. This is deeply unlikely.

It was clear to me that if transit buses were to be decarbonized rapidly in North America, the obvious strategy was to invite Chinese electric bus manufacturers such as Yutong and BYD to establish manufacturing in North America, perhaps in a joint venture with New Flyer, which could provide the shells and seats. This is what Europe is doing now, with a third of its electric buses in 2023 having Chinese drivetrains or full manufacturing in China.

The transit agency staffer’s response was fascinating. They had no intention of talking with Chinese transit operators to gain leading practices, and hadn’t even considered the idea. Crossing the Pacific to work with experts and look at solutions in person was certainly not on the table. Further, they said that Canadian customers had higher standards and Chinese buses wouldn’t satisfy them, indicating that they had no idea what modern Chinese cities and citizens were like. Finally, it was completely above their pay grade and imagination to consider assisting in the creation of a joint venture in Canada to satisfy Canadian transit needs, and so they were just assuming business as usual acquisition from New Flyer.

This is not their fault or an aspersion on them at all. They were a relatively low-level employee being put in a position where they did not have the experience or competence to recognize, never mind create, the conditions for success. As I noted at the time, North American transit firms and utilities are excellent operational organizations, with deep skills at delivering the same service over and over and over again to high levels of quality, with significant resource constraints. What they do is amazing.

What decarbonization requires them to do is to maintain that level of service while undergoing a rapid and complex transformation. They did not, and most do not, have the skills and experience necessary even to articulate what a successful transformation program requires, never mind execute one. This is true from the CEOs down. Unfortunately, despite my diagnosis and the clear solution of having major global consulting firms step into the breach and assist with the transformation, I’ve been completely unsuccessful at getting any of the firms I’ve discussed this with to establish even a Canadian or US practice devoted to it.

Now we are post-COVID and full into acceding to the USA’s existential dread of China’s emergence as an economic superpower, one which is creating alternative global systems that displace the post-WWII systems the USA set up to ensure that they served its interest, even as they also served to bring affluence globally. The bipartisan consensus in Washington is ugly, Sinophobic, and irrational. It has led to deeply counterproductive 100% tariffs on Chinese electric vehicles, 25% tariffs on Chinese batteries, and the new ban on Chinese software in imported automobiles. I explored the reasons why the tariffs are so wrong-headed at length recently, pointing out that Biden’s 100% China EV Tariff Fails History 101.

And so the reality is that New Flyer and some other also-rans with limited conditions for success for scaling battery bus manufacturing are what Canada and the USA are currently left with. Further, New Flyer is wasting inordinate amounts of time on the dead end of hydrogen for buses instead of focusing on building as many battery-electric buses as rapidly as possible.

That does mean that it’s going to take longer to electrify bus fleets in North America than seems reasonable, and accelerating transition should have been a key topic. (More on this later.)

Discounting Games Maximize Fuel Cell Buses

Another good question the roll out plan raises is the following: if fuel cell buses have merit, why wait a decade to start introducing them?

Raynor pointed out a — perhaps unintended, perhaps not — implication of this phased approach. By pushing the start of hydrogen bus deployment out by ten years, the 3.5% annual discounting rate reduces their net present costs by 40%. In other words, not only does CUTRIC embed a very optimistic drop in real costs, it further discounts the cost of fuel cell buses by delaying the roll-out. This means that the much more expensive hydrogen fuel and hydrogen fuel cell buses are made to appear artificially inexpensive, while the less expensive electric buses and electricity are more dominant in the cost case.

Taking the full fuel cell bus business case and the ratio of costs associated with the 408 fuel cell buses in the blended case, delaying the fuel cell bus rollout appears to have removed $1.1 billion from the blended case. This factor dwarfs the $10 million advantage claimed for the mixed fleet, and indeed the more than $350 million in cost swings in favor of battery-electric from correcting bad assumptions with global empirical data. If they are worth doing at all, why aren’t they worth doing for ten years, if not to game the scenarios to support hydrogen?

Perhaps, Raynor mused, the hydrogen lobby realizes that fuel cell buses lose the arm-wrestle today (something we hope Mississauga and Brampton realize) and so the best it can hope for is to keep hydrogen in the mix by pushing out the deployment based on unreasonable assumptions about declining costs amplified by the power of discounting. He does see the upside that by 2034 battery-electric buses will so clearly be superior in all respects that the hydrogen sideline will be abandoned, but not before a lot of time and decarbonization opportunity cycles are wasted.

As Raynor notes, the design of the modeling appears to be too focused on maximizing the number of fuel cell buses in the mixed fleet, not actual cost or emissions savings.

Negative Externalities Cannot Be Discounted

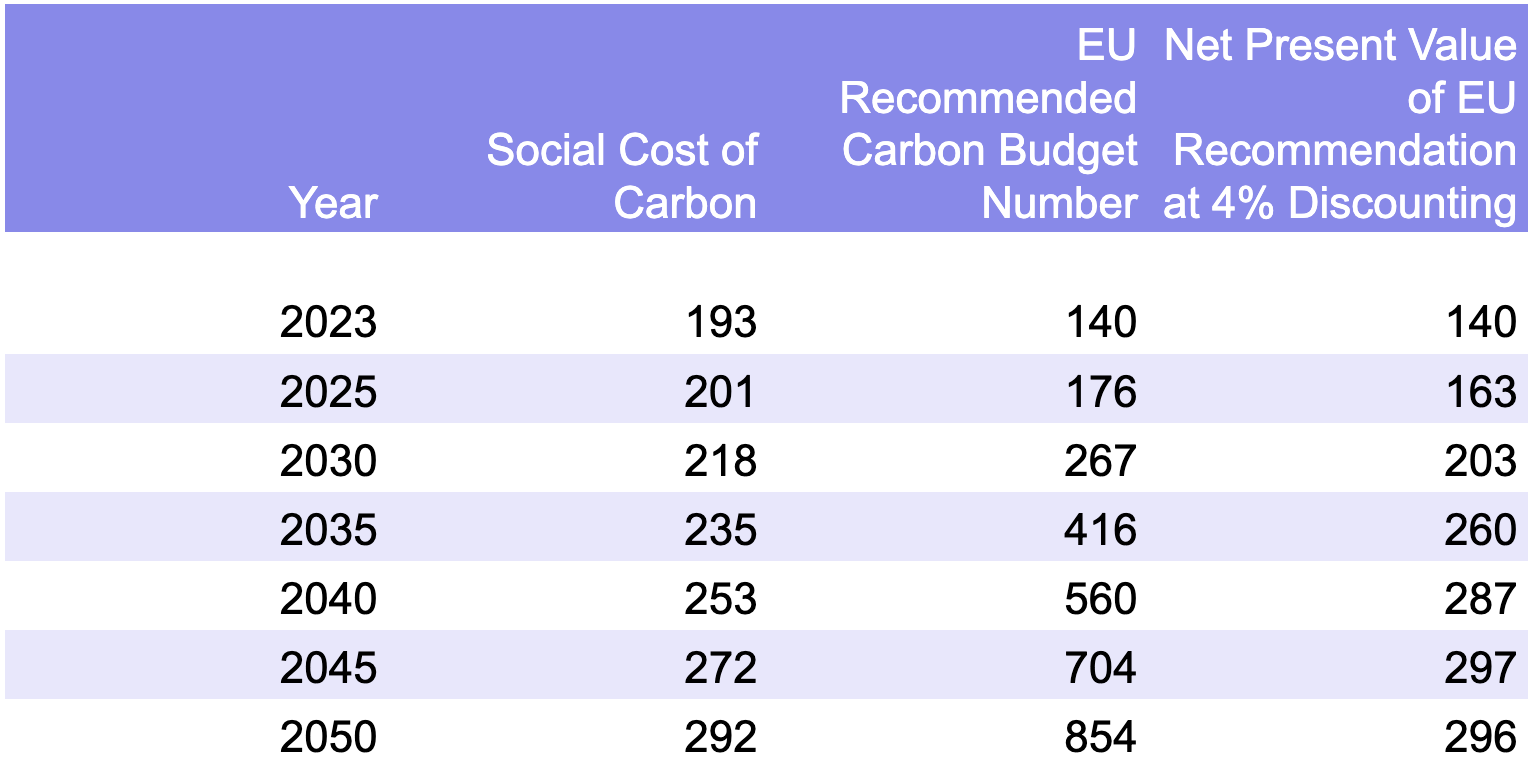

Raynor agrees with me that ignoring carbon pricing in the costing scenarios is clearly a problem, something I documented as having a potential $25 million swing in favor of battery-electric buses by itself. He points out further that negative externalities cannot be discounted.

Finance theory only lets you discount benefits or expenses that accrue to you and you alone. You can’t discount an externality. Even Milton Friedman would tell you that. Why? Two reasons: first, you don’t know what the discount rate is for others affected by your choice. It could be lower, or even negative. You don’t get to choose for them. Second, because the future harms fall on future people, $100 of harm in 10 years to someone ten years from now, is still $100 of harm. It might only be $6 of harm in today’s terms to you, but the harm befalls more than just you, so that $6 isn’t all that matters. You might not even be here in ten years, and worse, there’s every chance that there will be more people affected then and today, and they will all be harmed, so future harms should actually be compounded, not discounted. It gets still more complex than that (e.g., non-linear effects due to system-level collapse, for example) but for now, let’s leave it there.

To add to this point, the European Union understands this very clearly. Its budgetary guidance for projects receiving EU funding requires it to price in the cost of greenhouse gases first and asserts a requirement for a 4% discounting rate, not dissimilar to CUTRIC’s 3.5% rate. Then it intentionally grosses up the future value of the carbon price using the discounting rate and provides that number as the one to be used in business cases. As a result, when discounting is applied, the value of the future emissions of greenhouse gases are not discounted into oblivion, but remain significant in terms of net present costs.

Sharp eyes will notice I included a column in the comparison table I created for the social cost of carbon, and that it’s reasonably similar to the EU’s budgetary guidance. That social cost of carbon is the harmonized US EPA and Canadian social cost of carbon, and is the price point that should be used for evaluating emissions avoidance benefits as well as potential carbon price points.

There are at least two implications to this. First, the CUTRIC report acknowledges that battery-electric buses have a lower carbon footprint. The indefensible $10 million cost advantage to the mixed fleet scenario emits materially more carbon in perpetuity. Since the harm of those incremental tons can’t be discounted, that $10 million actually abates tens of thousands of tons of emissions, implying an avoidance cost of less than $100/ton, which is pretty cheap for such quality abatement. (The most valuable ton is the ton never emitted).

Second, the slower retirement of diesels is very likely driven by a need to justify the lower costs assumed for future fuel cell buses. But that delays the abatement of the emissions from diesels, ignoring the very real costs of the future harms they create. In short, the design challenge they seem to have adopted is “maximize the number fuel cell buses subject to the constraints of fully electrifying the fleet and appearing cost competitive with a fully battery-electric option.” The real design challenge should be “minimize carbon emissions subject to budgetary constraints.” On that basis, you’ll end up with fully battery-electric buses every time.

However, there’s a kicker with this. Hydrogen’s greenhouse gas emissions are much higher than CUTRIC’s modeling shows. Studies out of California and Europe show that hydrogen leaks from every point in the value chain, and there are seven to eight steps in the value chain for gray hydrogen. A California refueling station was leaking up to a third of all hydrogen, and engineers and technicians only got that down into the 2% to 10% range after significant efforts. In the early 2000s, it was identified that hydrogen had an indirect impact on methane breakdown in the atmosphere, and that’s been quantified in a Nature journal report published in 2022.

Hydrogen is 37 times worse than carbon dioxide over 20 years, and 13 times worse over 100 years. With the gray hydrogen value chain, that means emissions related to hydrogen leakage would be in the same range as those avoided by burning gray hydrogen instead of diesel. As a result, the emissions related to gray and green hydrogen are deeply understated.

As a reminder, the point of transforming bus fleets is actual decarbonization. Leaking a high intensity greenhouse gas that’s hard to contain is not a climate solution.

Opportunities For Lowering The Costs For Battery-Electric Buses Ignored

Raynor also noted that CUTRIC and Brampton don’t address the opportunities to lower the cost of its battery-electric buses by syncing up with Mississauga and Toronto. Integrated procurement and charging infrastructure would be a good idea. They don’t have to think about that with diesels because that’s a mature and entirely modular market, but shifting to a new infrastructure opens up new possibilities that they don’t seem to appreciate. In his professional opinion, getting these transit organizations on the same page with a strategic effort for procurement would accelerate all of the transformations.

Personally, I’m sure that there is room for a Yutong or BYD bus factory in Oshawa, and the transit agencies in Ontario should be pushing the Ford government to get one built. Even if New Flyer is part of the joint venture and provides some of the non-drivetrain elements, it is an obvious strategic move that governments should be looking at. There is nothing in Canada’s acquiescence to the USA’s position that would constrain Canada from quietly having Chinese drivetrains and batteries in their transit fleets.

As noted in the first article in this series, CUTRIC’s membership has grown to include three natural gas distribution utilities — Enbridge, Fortis BC, and Fortis Alberta — and fuel cell industry representative firms. My assumption after extensive analysis of their reports is that CUTRIC, regardless of its intent upon founding, has been captured by lobbyists and is giving deeply misleading, badly modeled guidance to transit agencies as a result.

After reviewing their results, I don’t find CUTRIC to be credible and advise municipalities to downgrade any of their advice during decision making and to stop engaging them for scenario modeling exercises until they’ve resolved their data, governance, and methodology challenges.

Raynor and I agree, in our overlapping professional opinions as transformation and sustainability experts with global careers in those fields, that CUTRIC’s scenarios and modeling are deeply sub-par, that they lack clear components which are required for any good exercise of this nature, and that they are giving their transit clients completely the wrong guidance as a result. The question is, what are the transit agencies and CUTRIC going to do about it?

With Michael Raynor, co-founder/investor of S3 Markets and Canary Medical

Raynor and I reiterate our offers to provide pro bono discussions of the points in the four articles so far on CUTRICs assumptions, scenario modeling and results to ensure that taxpayer money is spent most wisely and transit service quality remains high while carbon emissions drop.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy