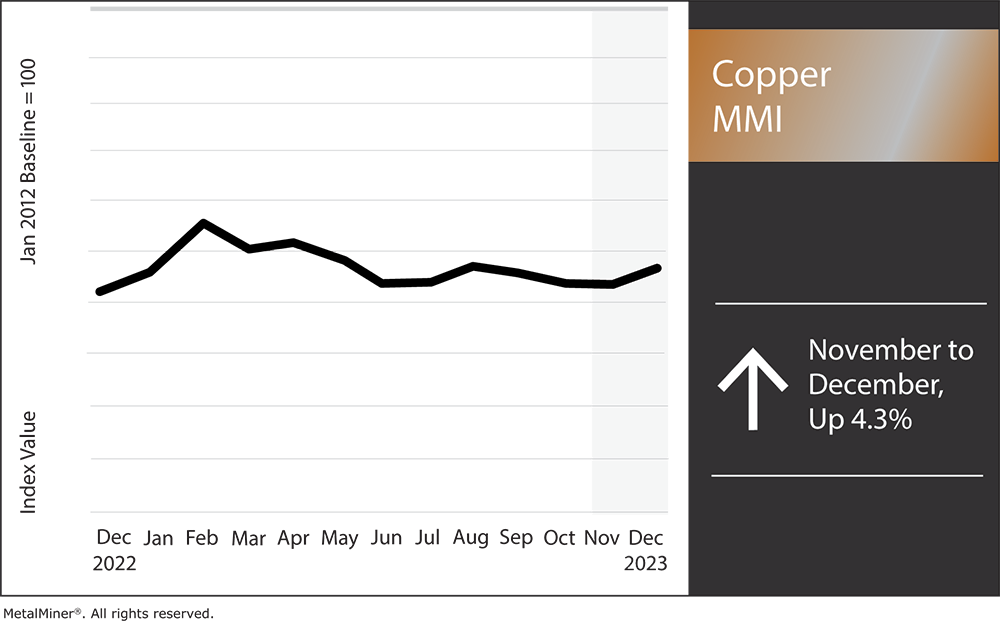

Still short of a breakout, current copper prices lifted off their October lows during November and have yet to see a major downside correction. Nonetheless, copper prices remain sideways and sit only 1.5% above where they stood at the start of 2023. An increase among all of its components helped the Copper Monthly Metals Index (MMI) invert to the upside, with a 4.3% increase from November to December.

Receive weekly updates and market intelligence on copper, helping your company adapt and thrive in the face of changing demand dynamics. Opt into MetalMiner’s free weekly newsletter.

Panama’s Mine Closure Hits Copper Market

By late November, Panama’s president ordered the shutdown of First Quantam’s Cobre Mine, which accounts for an estimated 1% of global copper supply, after it was deemed unconstitutional by Panama’s Supreme Court. Following growing protests sparked by environmental concerns and contention over First Quantum’s contract with the government, the mine was idled and international arbitration initiated. The contract in question gave the miner 20-year rights for the price of $375 million annually.

While estimates and forecasts have fluctuated throughout the year, by late November, the International Copper Study Group noted a narrow apparent surplus of 17,000 tons during the first 9 months of the year. Throughout 2024, the group also forecasted a surplus of roughly 467,000 tons, something seemingly in limbo should mining disruptions persist.

While since-resolved, the closure came alongside protests at Peru’s Las Bambas mine responsible for roughly 2% of global copper output. The mine is also the second-largest copper mine in the world. Although currently operational, the mine stands as a flashpoint for protesters in Peru concerned over its environmental impacts. Furthermore, lack of support to local communities continues to exasperate the issue. Las Bambas possesses a storied history of protests over recent years, which while quiet at the moment, remain a ongoing risk for mining supply.

MetalMiner Insights covers current copper prices, correlation charts and price forecasting for a full suite of industrial and precious metals. See our full metals catalog.

Copper Supply Outlook Remains Uncertain Ahead of Elections

While shuttered at the moment, the fate the Cobre Panama mine appears uncertain. There are three potential outcomes to its future:

- The mine remains permanently closed

- It becomes nationalized

- A new contract, likely more favorable to Panama, is negotiated with First Quantum

The mine accounts for roughly 5% of Panama’s GDP, which suggests that a permanent closure would come at great expense to Panama’s economic outlook. Panama also faced obstacles throughout the year with the Panama Canal. Low water levels forced the country to restrict shipping traffic to under 60% of normal capacity. The combination of the two events forced Panama to lower its 2024 growth projection to 2.5% from 5%. It’s not yet known how badly this will impact current copper prices.

Current Copper Prices Hang in the Balance

Much could change by H2, however. A presidential election looms in May, with copper mining at the heart of debates. Among the front runners, former President Ricardo Martinelli proposed a renegotiation with First Quantum with higher royalties, while another former President and current candidate Martin Torrijos firmly stated, “Panama said no to metal mining.”

Considering the economic implications of a mining halt, even if a candidate like Torrijos secures the presidency, they would certainly not be the first politician to mysteriously shift views following an election. Something similar occurred in China in the Fall of 2022, where ahead of Xi Jinping’s fifth term, he remained in staunch support of zero-COVID, a policy that quickly unraveled by the start of 2023.

Nonetheless, the closure is estimated to have cut copper mine supply by around 40,000 tons in 2023. If it remains closed through May, 2024 would see supply cut by an additional 160,000 tons. While that alone is not enough to shift the market from surplus to deficit, tighter supply, especially ahead of projected supply deficits in the coming years, would offer support to copper prices.

Investment Funds Stand Increasingly Net Long, As Markets Watch the Fed

Positioning among investment funds appears to reflect the evolving outlook for the copper market. By late October, positioning stood steeply net short, suggesting an overall expectation of lower copper prices. Funds began to unravel those positions, as they returned net long during November, however, and continued to expand that delta through December.

In spite of this, total fund positions declined over recent months, which leaves many opting to sit out of the still uncertain market. While mine supply remains in limbo, the global economic outlook does as well. Key sectors, like EVs, which underpinned many demand forecasts in the coming years, face considerable setbacks.

Meanwhile, as current copper prices inch closer toward the top of their currently sideways range, markets await the next moves from the Fed. The prospect of unraveling interest rates in 2024 has already placed downside pressure on the U.S. dollar index, which trades inversely to commodity prices. While it also remains sideways, the U.S. dollar index has started to near its support level. The index currently sits just beneath the 102 mark, similar to where it stood in August. Should the Fed begin to pivot, a falling dollar could likely offer support to copper prices and potentially translate to a breakout of their current range.

Current Copper Prices: Biggest Shifts

Read what’s next for copper prices in this month’s Monthly Metals Outlook. The report provides both short-term and long-term forecasts plus buying strategies, giving you the edge to navigate market volatility. Get a free sample report and opt into a subscription.

- Chinese primary cash copper prices saw the largest increase of the overall index, with a 5.73% rise to $9,779 per metric ton as of December 1.

- Chinese copper bar prices rose 5.55% to $9,718 per metric ton.

- Chinese copper wire prices increased by 5.51% to $9,710 per metric ton.

- U.S. producer prices for copper grade 122 rose 3.82% to $4.89 per pound.

- U.S. producer prices for copper grade 102 saw a 3.63% increase to $5.14 per pound.