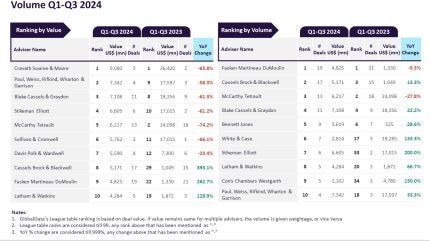

Cravath Swaine & Moore and Fasken Martineau DuMoulin have topped the mergers and acquisitions legal advisers rankings in the metals and mining sector for the first three quarters of 2024, according to the latest financial advisers league table by GlobalData.

According to GlobalData’s league tables, Cravath Swaine & Moore led by deal value, while Fasken Martineau DuMoulin topped by deal volume.

Aurojyoti Bose, lead analyst at GlobalData, commented: “Cravath Swaine & Moore and Fasken Martineau DuMoulin were the top advisers by value and volume during Q1–Q3 2023 and managed to retain their respective top positions during Q1–Q3 2024 as well.

“Despite both the firms registering decline in total value and volume, respectively, during Q1–Q3 2024 compared with Q1-Q3 2023, they managed to maintain their top ranking.”

Cravath Swaine & Moore advised on transactions worth $9bn while Fasken Martineau DuMoulin advised on 19 deals.

In the valuation rankings, Paul, Weiss, Rifkind, Wharton & Garrison held second place with advised deals amounting to $7.3bn. It was followed by Blake Cassels & Graydon at $7.1bn, Stikeman Elliott at $6.6bn and McCarthy Tetrault at $6.2bn.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Regarding deal volume, Cassels Brock & Blackwell came in second with 17 deals. McCarthy Tetrault was involved in 13 transactions, while Blake Cassels & Graydon advised on 11 deals. Bennett Jones rounded out the top five with nine deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks deal submissions from leading advisers.