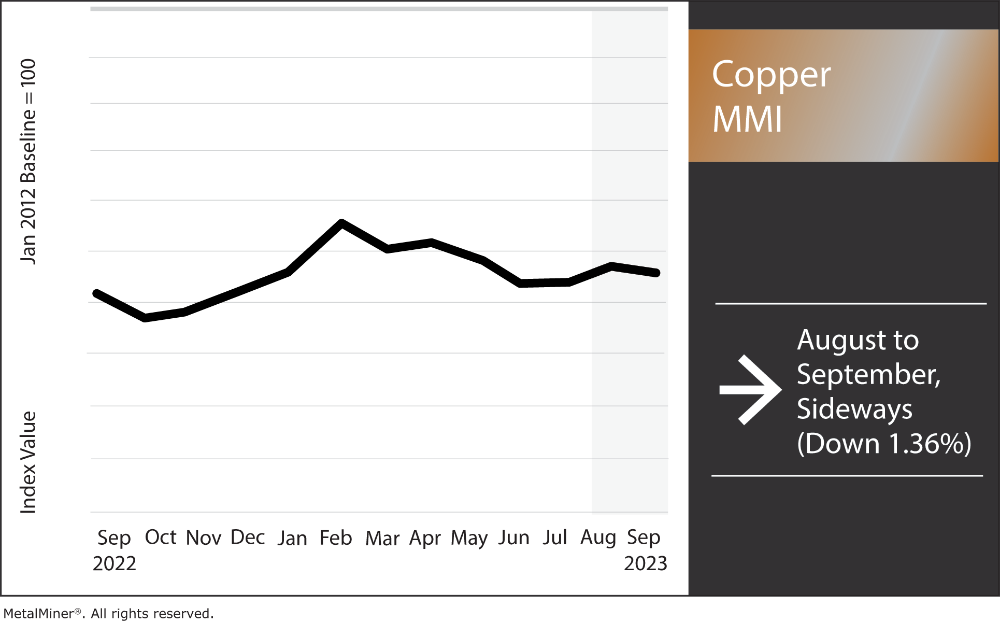

The Copper Monthly Metals Index (MMI) moved sideways from August to September, dropping just 1.36%.

Copper prices continue to trade sideways within a tight range. Amid a lack of bullish or bearish momentum, prices have failed to establish a breakout. Following a 3.34% decline throughout August, prices slid merely 0.53% during the first three weeks of September.

Get all the news on shifts in copper markets and other valuable commodities. Sign up for the free weekly MetalMiner newsletter here.

LME Inventories Tripled Since July, Offer No Support to Copper Prices Today

As copper prices remain trapped within an increasingly narrow range, rising LME inventories offer no support. Indeed, LME inventories have more than tripled since mid-July and now sit at their highest level since May 2022. This is a clear sign that current demand remains lackluster.

Inventories appeared to bottom out on July 13 at 54,225 metric tons. This preceded considerable increases in the ensuing months to where they currently stand at 162,900 metric tons. The rise seemed to pick up during September, as inventories jumped by over 60,000 tons throughout the first three weeks.

The long-awaited copper boom has yet to take hold as supply builds. While China continues to roll out stimulus measures and consumer spending appeared to bounce back in August, its property sector remains within an ongoing slump. Therefore, global copper demand can no longer rely on what was once a leading consumer of the red metal.

Meanwhile, the U.S. continues to await the commencement of its more copper-intrusive infrastructure projects. On top of that, the ongoing contraction of the U.S. manufacturing sector has led to limited demand that has thus far prevented a significant upside breakout for copper prices.

Tired of copper market uncertainty resulting in loss of revenue? The Monthly Metals Outlook report provides both short-term and long-term forecasts, giving you the edge to navigate market volatility. Secure a free sample report and opt into a subscription.

UAW Strike Could Stunt EV Rollout, Copper Demand in the U.S.

Part of the long-term bull narrative for copper relates to the growth of EVs. However, this remains threatened by the ongoing UAW strike. On average, EVs require as much as four times more copper compared to their gasoline-powered counterparts. As China’s property sector declined, experts looked to EVs to replace demand from the once copper-hungry sector.

More than two years ago, the Biden administration announced the ambitious goal of having EVs represent 50% of auto sales by 2030. The ongoing UAW strike, which expanded on Sept. 22, has put green plans from the Big Three automakers, Ford, GM, and Stellantis, on hold. The rising cost of raw materials and higher labor costs, once automakers and the UAW come to an agreement, could substantially derail their abilities to provide consumers with affordable EV options.

Estimates suggest that the Big Three currently spends between $64 to $67 per hour on labor due to their unionized labor forces. Meanwhile, their nonunion competitors spend roughly $55 per hour, and Tesla spends between $45 to $50. On top of already higher labor costs, the average price of an EV sits considerably higher than its gas-power counterpart. According to Cox Automotive, in July 2023, the cost of an EV averaged $53,469, while the gas vehicles averaged $48,334.

It’s true that Federal subsidies have helped close the gap between the two vehicle types substantially in recent years. However, higher labor costs and the rising costs of materials like copper threaten to exacerbate that delta. With the adoption of EVs already facing challenges from battery combustibility to limited driving range between charging stations, this could translate into slower overall growth in the sector, thus limiting its upside pressure on copper prices in the coming years.

Harness copper data to forge a path to success in metal sourcing using MetalMiner Insights’ powerful long-term and short-term forecasting. Ready to learn more?

What Does Steel Scrap Tell Us About Copper Prices?

As copper prices remain directionally uncertain in lieu of a strong up or downtrend, shredded steel scrap prices, which boast a relatively strong correlation, appear to support the ongoing sideways trend.

After shredded scrap prices found a bottom in June, they continued to trade sideways through September. Although scrap prices sit above their historical average range (as do copper prices), this appears indicative of the larger sideways trend among base metals.

Scrap prices see impacts from many of the same market conditions as copper. As a result, since 2012, copper prices have boasted an almost 89% correlation to shredded steel scrap prices. This may suggest that the current sideways trend for copper prices will continue, at least in the short term.

MetalMiner’s MMI report includes 10 metal price reports and can serve as an economic indicator for contracting, price forecasting, and predictive analytics. Sign up here.

Biggest Copper Price Moves

- Korean copper strip prices saw the only, albeit minor, increase within the overall index. Prices rose 0.41% to $10.42 per kilogram as of September 1.

- Meanwhile, Chinese primary cash copper prices fell 2.71% to $9,658 per metric ton.

- LME primary three month copper prices fell 3.34% to $8,381 per metric ton.

- U.S. grade 102 copper producer prices fell 4.18% to $5.04 per pound.

- U.S. grades 110 and 122 copper producer prices fell 4.37% to $4.82 per pound